The ITEP Guide to State & Local Taxes

Tax Principles

What Principles Should Guide State and Local Tax Policy?

State and local taxes exist primarily to fund schools, roads, health care, and other services needed for communities to thrive. There are multiple ways to achieve this goal, so it can be helpful to evaluate different options based on a few core principles.

How Do State and Local Tax Systems Affect Racial Justice?

State and local tax codes have the potential to either narrow or widen racial inequality created by historical and current injustices in public policy and in broader society. In general, tax codes that are more progressive across the economic spectrum do more to narrow racial inequality, while regressive tax policies exacerbate it.

Do Tax Cuts Fuel Growth?

Tax policy is an important economic tool, but claims that tax changes will affect a state’s economy are often overstated. Such overstated claims are particularly common in discussions of taxes on wealthy individuals and profitable corporations, so careful assessment of such claims is an important part of shaping adequate and equitable revenue streams.

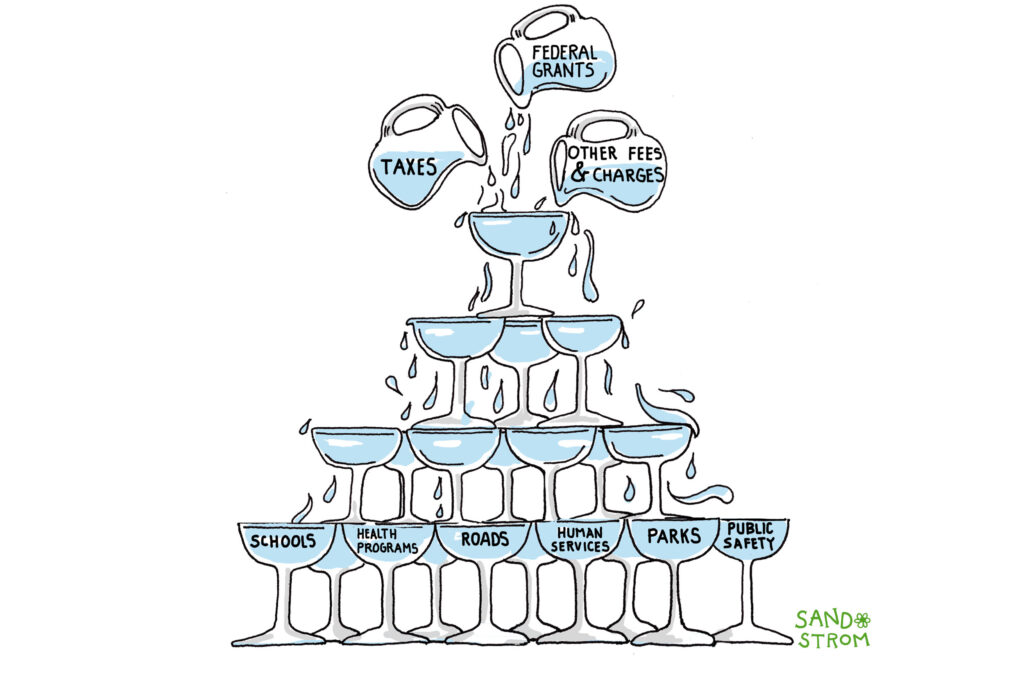

How Do State and Local Governments Raise Funds?

State and local governments play important roles in helping communities thrive. They fund and run schools, roads, parks, health programs, human services, public safety agencies, and other key services. To pay for these services, states and local areas receive money from multiple sources. The main source is taxes, but funds from the federal government and fees people pay to use services are also important contributors.

What Are Tax Bases and Tax Rates?

Taxes are calculated by multiplying a tax rate by a tax base (the things being taxed). Broader tax bases allow for lower tax rates while raising the same amount of revenue. It’s often helpful to differentiate nominal rates (the rate written into law) from effective tax rates (what people actually pay relative to their income).

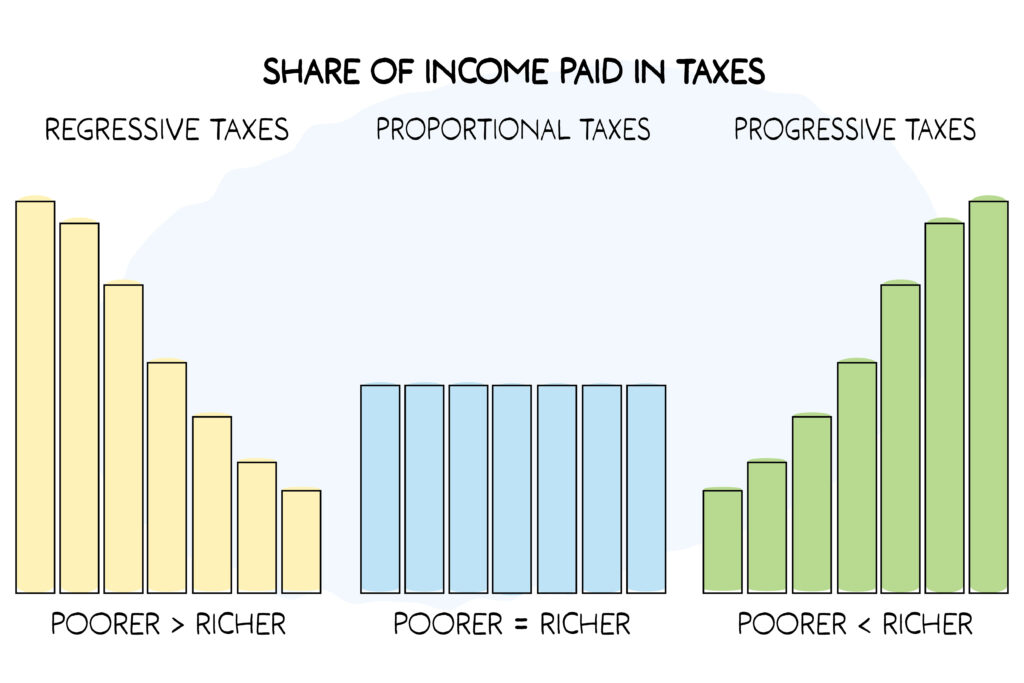

Why Should States and Localities Have Progressive Tax Systems?

A tax system cannot be described as fair unless it is progressive, but that’s not the only reason why states should tax upper-income people at higher rates than those with lower incomes. Progressive state tax codes raise more revenue for public services, improve the government’s relationship with residents, reduce poverty, and advance racial equity.

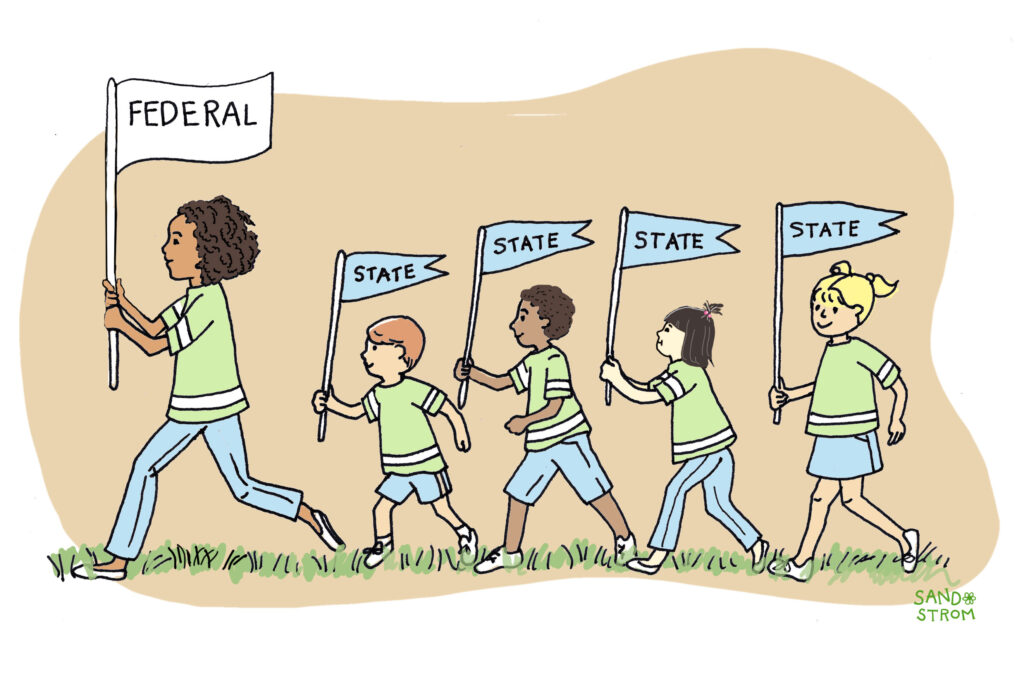

How Does Federal-State Tax Conformity Work?

Most states use the federal tax code as a starting point for their calculations of state personal income taxes, corporate income taxes, and estate taxes. Changes to the federal code and federal tax administration have the potential to affect state tax systems enormously, but to some extent states can pick and choose which of those federal changes to accept.

What Are Local Governments’ Taxing Authorities?

Tens of thousands of local governments in the United States, from big cities like Los Angeles and New York to rural counties, school districts, and small towns, operate schools, roads, parks, public safety, and other services. To pay for it, they collect roughly $1 trillion in taxes annually and receive another $800 billion in grants from states. But states, not just localities, set many of the rules for local taxes, and sometimes use that authority to undermine local democracy.

How Do State Tax and Expenditure Limits Work?

A Tax and Expenditure Limit (TEL) is a formula written into state law or into a state constitution that constrains government revenue and spending. These measures can undermine governmental accountability, degrade essential public services like health care and education, and create inequitable tax burdens.

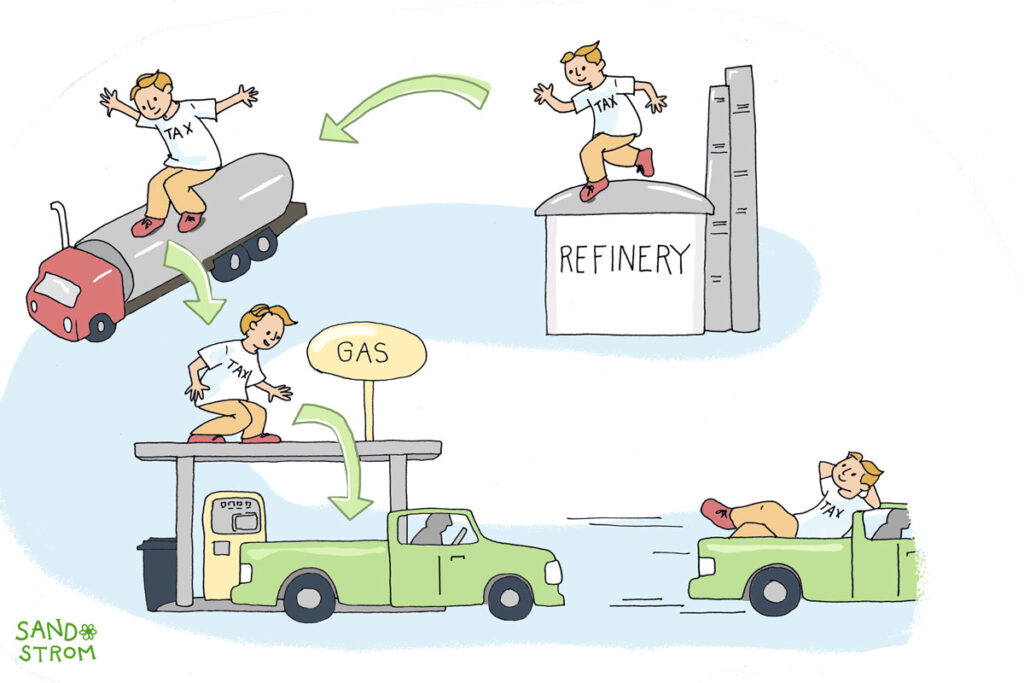

Why Does Tax Incidence Matter and How Do We Measure It?

Tax incidence shows who pays taxes and how much they pay. In studying tax fairness, tax incidence specifically looks at how much people at different income levels pay. Tax incidence analysis is a critical tool for assessing the fairness of tax systems and in showing the equity or inequity of tax policy proposals.

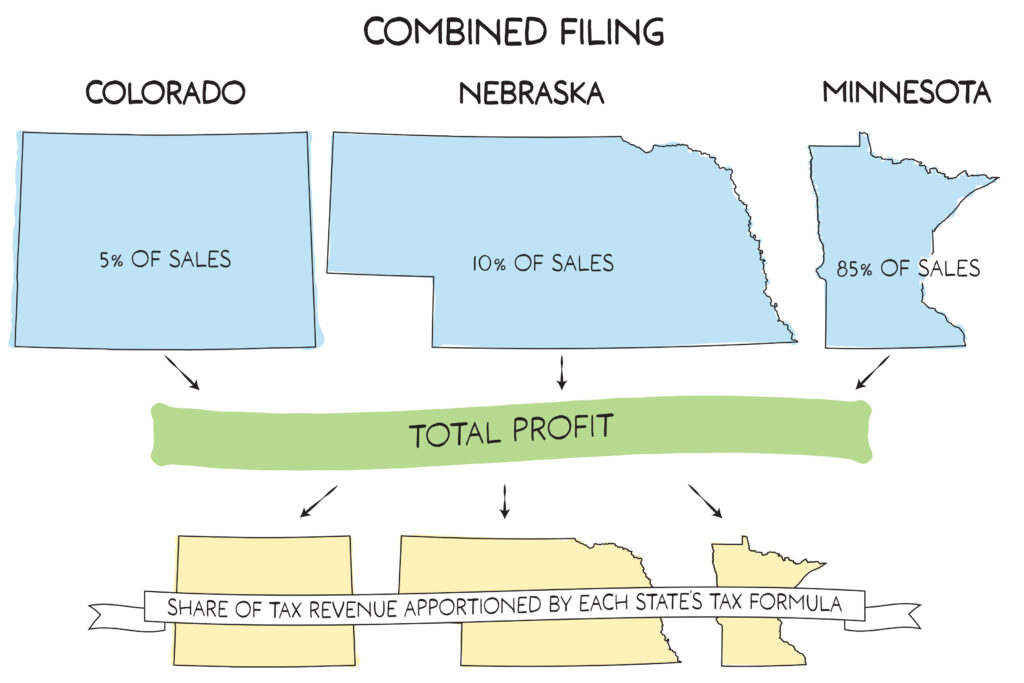

How Do States Use Combined Reporting to Tax Complex Multi-State Corporations?

Combined reporting requires corporations with multistate operations to report all their revenues and expenses together, making it harder for them to avoid state taxes by moving money around. This policy mainly affects very large companies, and it helps those states that use it to collect billions in tax revenue to fund services like education, public safety, and infrastructure that businesses and their employees rely on.

What State and Local Taxes Do Undocumented Immigrants Pay?

Like everyone else in America, immigrants pay taxes, whatever their legal status. The income taxes, property taxes, and sales and excise taxes paid by both documented and undocumented immigrants help sustain American public schools, services, and infrastructure. Undocumented immigrants paid more than $37 billion to states and localities in 2022, and they pay higher effective state and local tax rates as a share of their incomes than our wealthiest citizens.

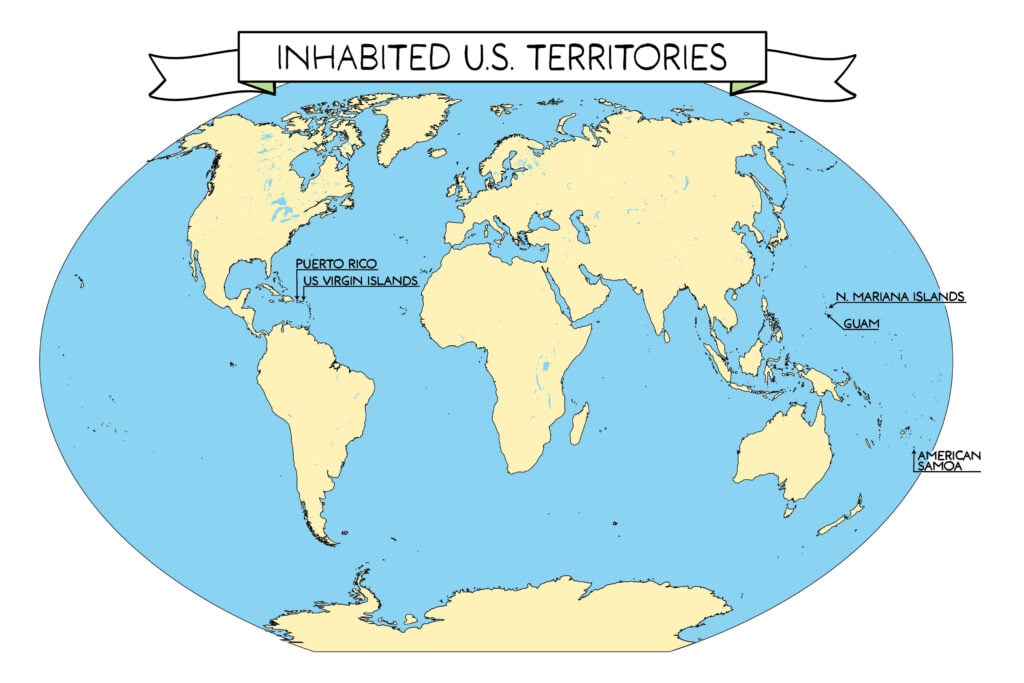

What Taxes Are Paid in Puerto Rico and Other U.S. Territories?

U.S. territories collect taxes to fund schools, roads, health care, and other services, somewhat like states do. They levy income taxes, sales taxes, property taxes, and other typical state and local taxes. These taxes can have important progressive elements, but territorial status poses unique challenges for fair and adequate taxation.