The Child Tax Credit (CTC) is a proven way to dramatically reduce the number of children and families living below the poverty line. For the third year in a row, new Census data shows that by not extending the 2021 temporary CTC expansion, federal lawmakers have allowed the number of children and families in poverty to increase and remain unnecessarily high.

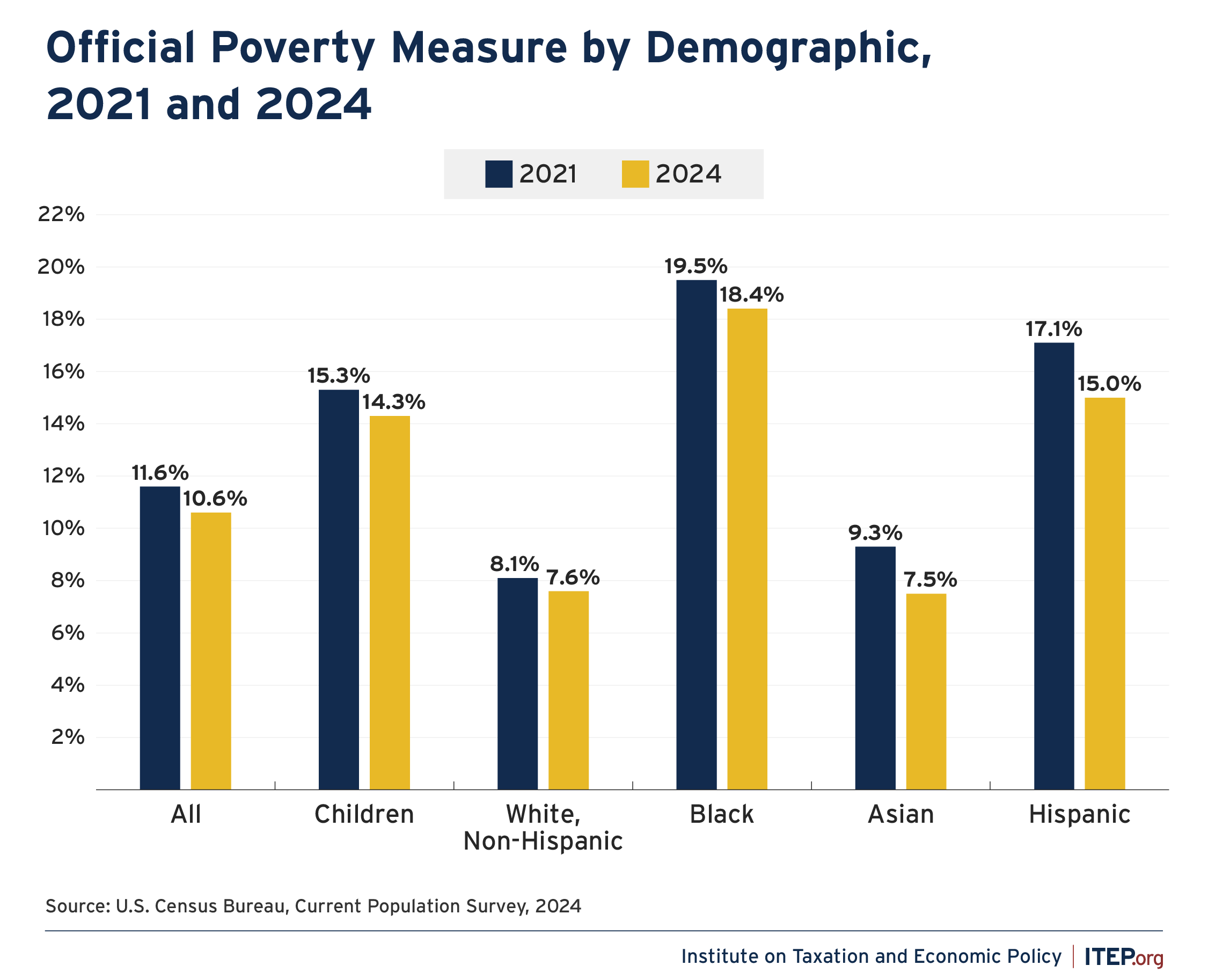

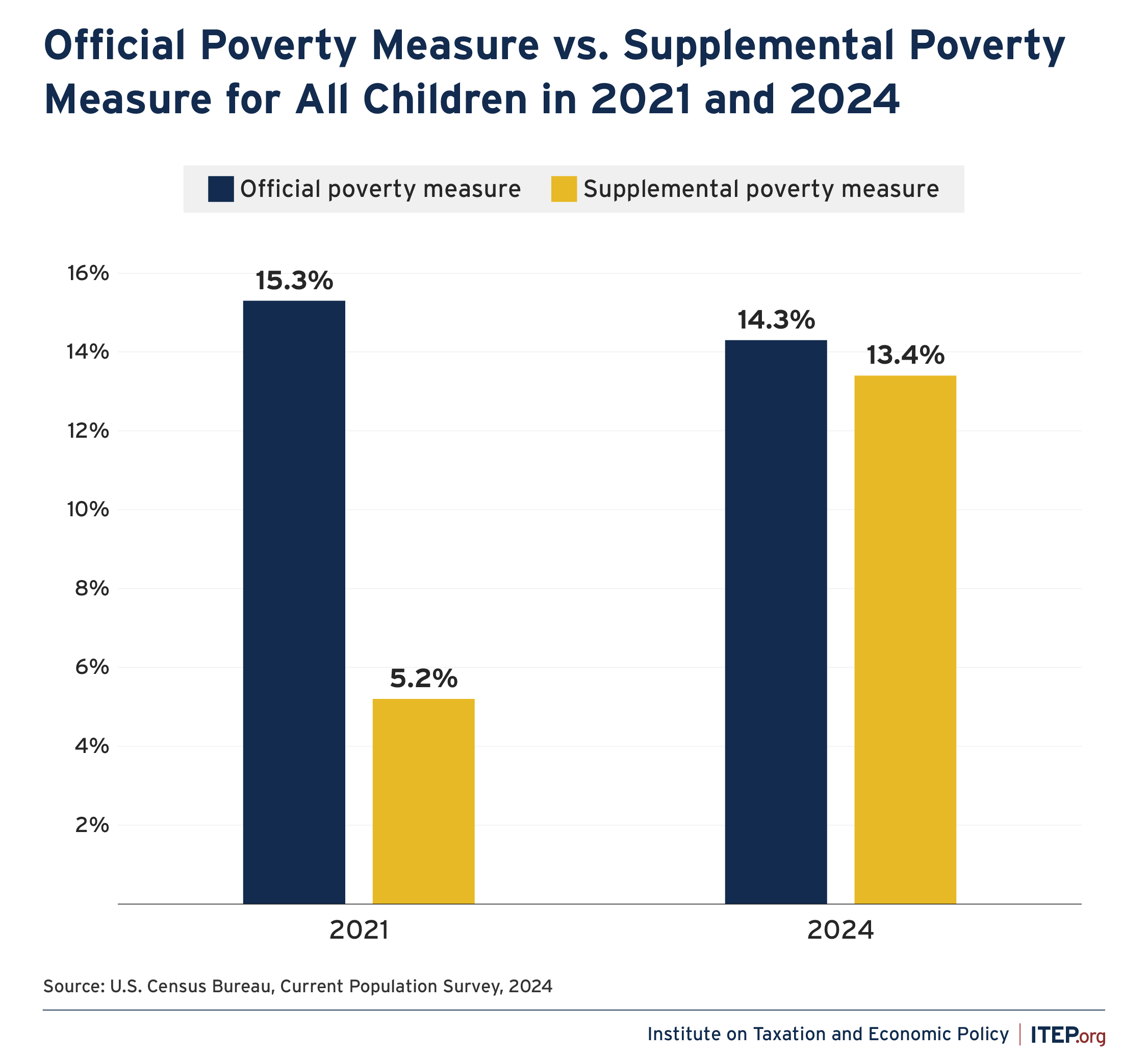

While the official 2024 poverty measure shows 14.3 percent of children, and 10.6 percent of all Americans, living below the official poverty line of $31,200 in annual earnings for a family of 4, the more comprehensive Supplemental Poverty Measure shows 12.9 percent of all Americans and 13.4 percent of children living in poverty, a stark contrast to lower rates seen during 2021

What the Census Data Tell Us About Poverty in the U.S.

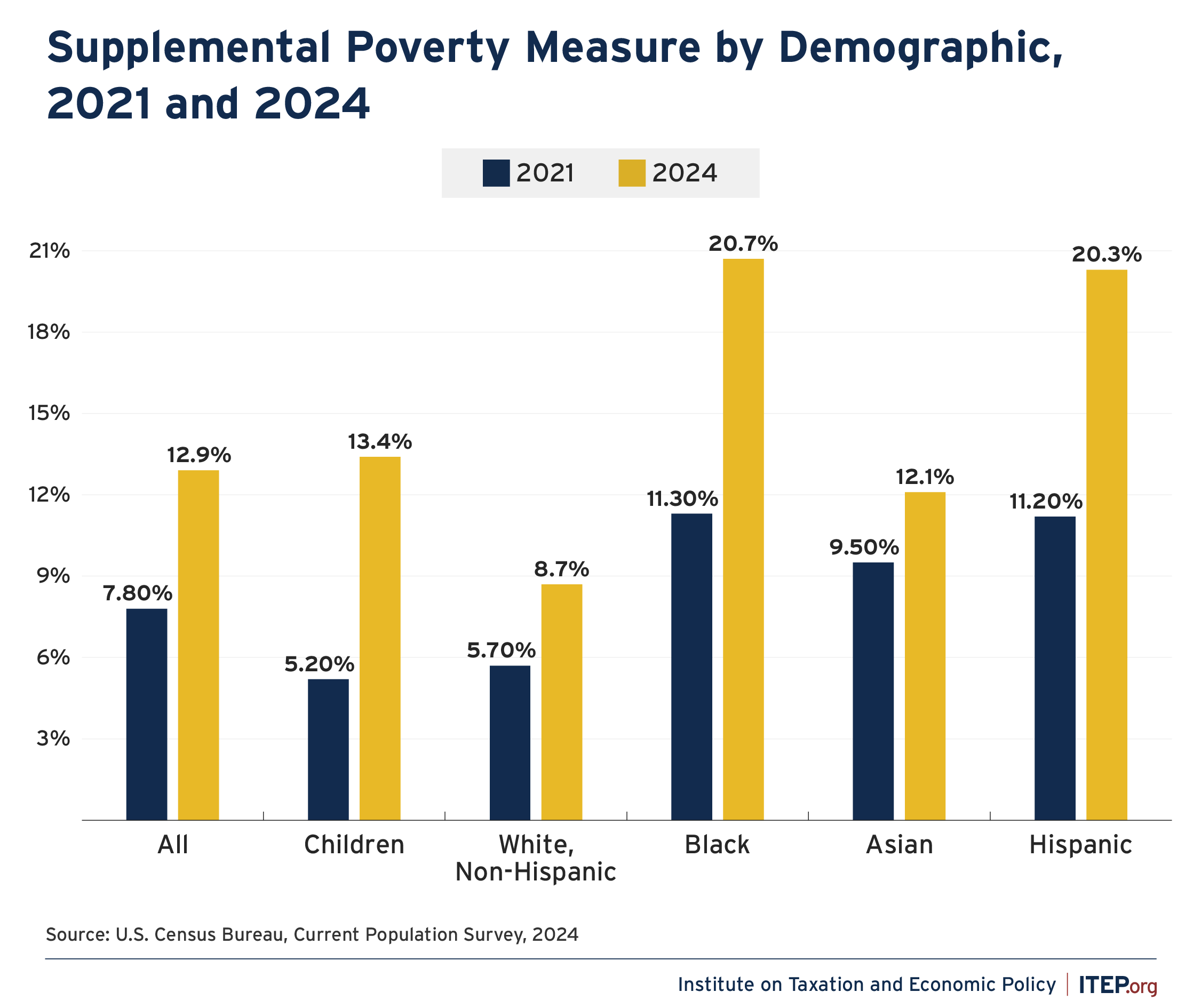

The Census keeps two measures of poverty: the Official Poverty Measure and the Supplemental Poverty Measure. The official rate is calculated by including pre-tax income and Social Security income but excluding most other assistance families receive, while the supplemental rate is based on a family’s after-tax income and includes benefits like tax credits and other safety net programs, thereby doing a good job of capturing how public policy affects hardship. The supplemental measure is adjusted for the cost of living in different geographic areas and is a more comprehensive measure for evaluating the number of people unable to afford basic needs. According to the Supplemental Poverty Measure, 13.4 percent of children and 12.9 percent of all Americans lived below the poverty line in 2024.

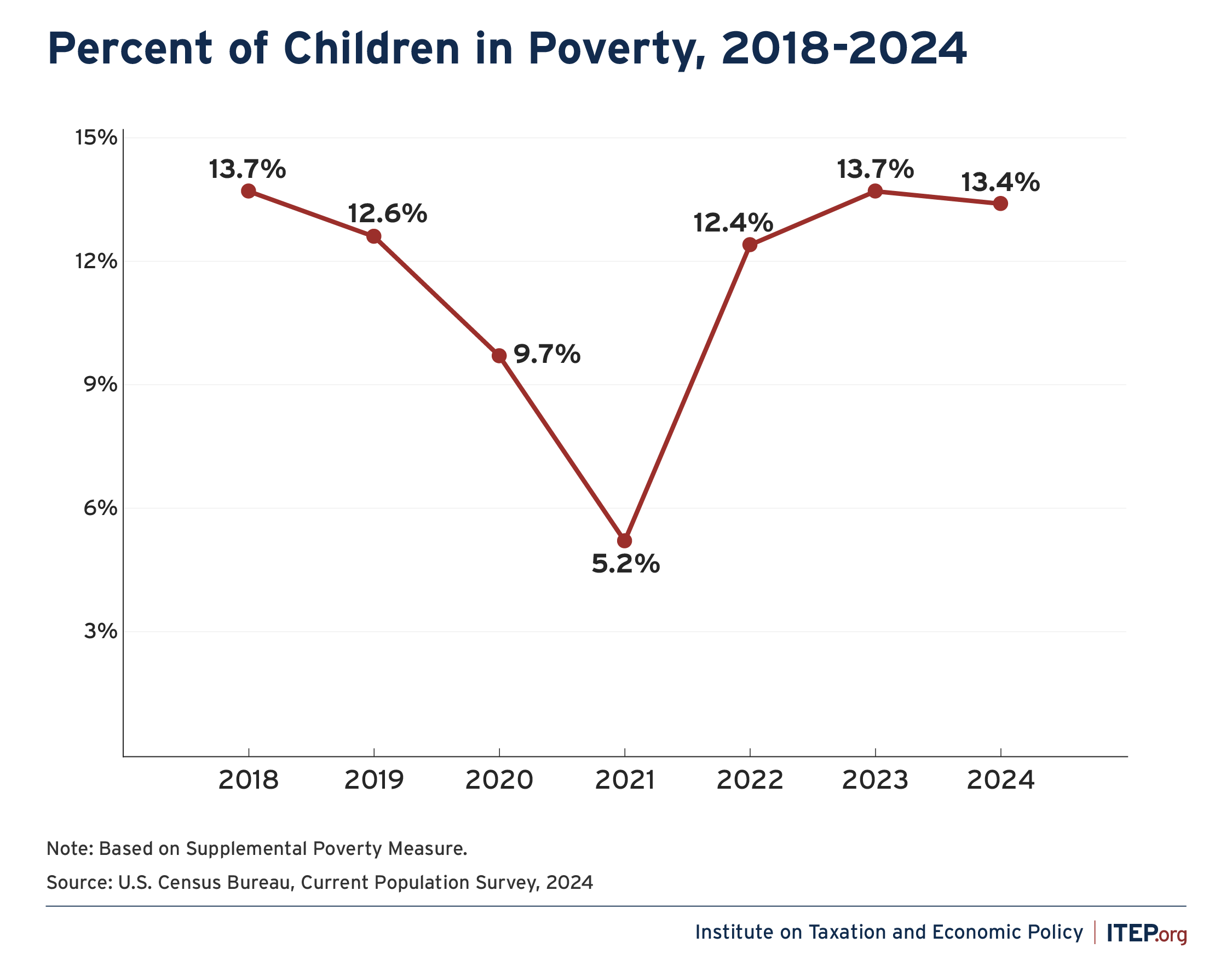

Figure 1

Looking at the simpler measure, poverty dropped last year, from 11.1 percent to 10.6 percent for all Americans. However, measuring poverty this way does not provide as clear a picture of a family’s resources, because programs like the CTC and food assistance can provide substantial assistance. Comparing official poverty rates to supplemental rates provides an approximate effect of anti-poverty programs.

Figure 2

Figure 3

The supplemental measure continues to show unacceptably high poverty rates – after including all a family’s resources. From 2021 to 2024, poverty rose from 7.8 to 12.9 percent, and for children it more than doubled from 5.2 to 13.4 percent. This is the third year in a row that poverty for children has been more than double what was seen in 2021.

Figure 4

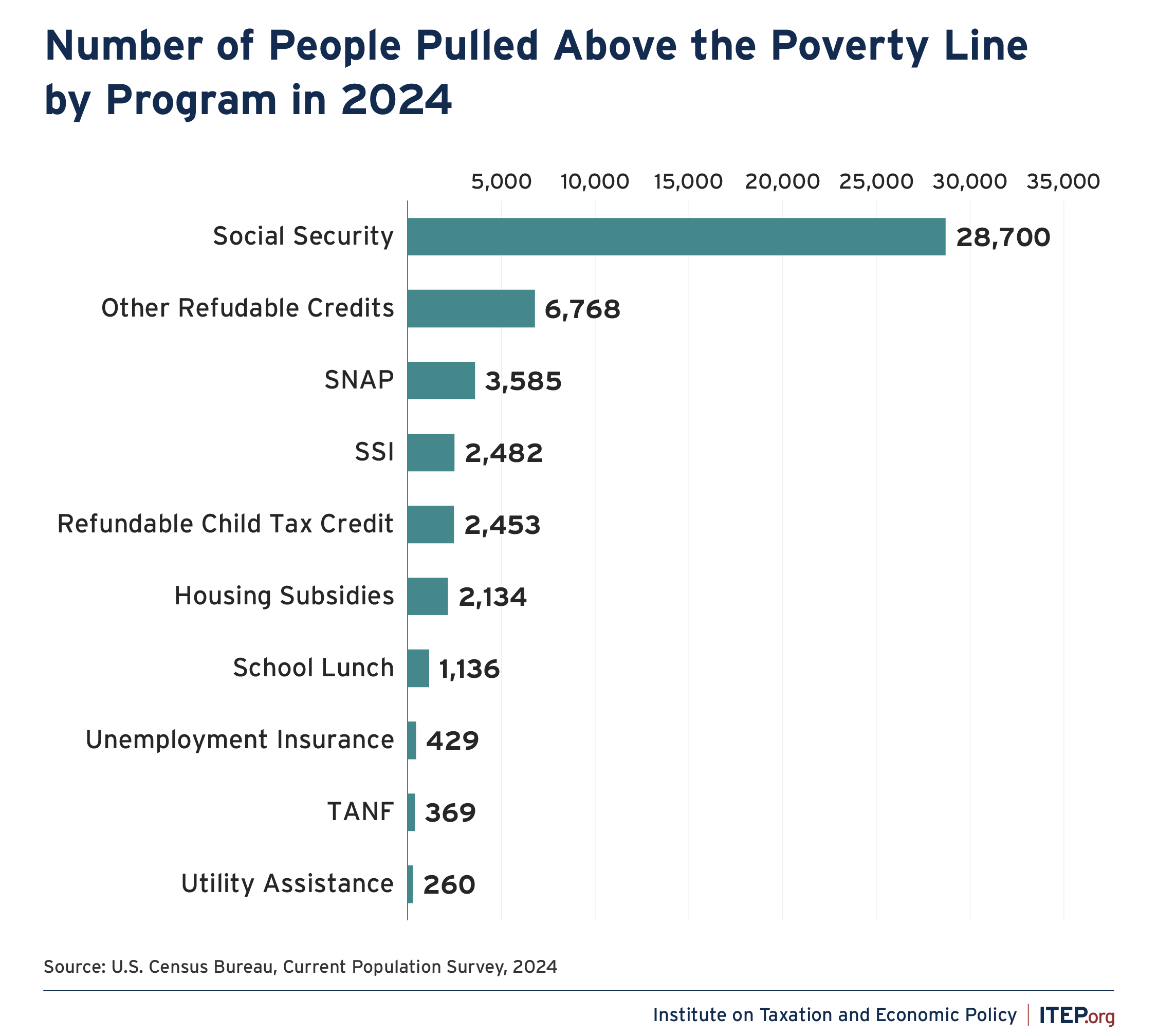

Social Security was the largest anti-poverty program in 2024, lifting 28.7 million people above the poverty line. Every member of Congress should be reminded, as they contemplate cuts to Social Security, that no other program did more last year to pull Americans out of poverty. While Social Security forms the centerpiece of our nation’s safety net, its benefits go mostly to retirees, people 65 and older, and people with disabilities.

Refundable tax credits like the CTC and EITC provide the largest anti-poverty benefit to children, working people, and people under 65 – lifting 6.8 million people above the poverty line in 2024. Food assistance through SNAP, housing subsidies, and other programs also offer essential support to families struggling to make ends meet.

Figure 5

Unnecessary Hardship for Children and Families

It’s clear from recent years of Census data that the 2021 expansion of the Child Tax Credit and Earned Income Tax Credit was transformative in dramatically reducing poverty. This expansion made the CTC fully refundable and boosted the credit amount from $2,000 per child to $3,000 and $3,600 for young children under age six. It also allowed families to take the credit in monthly installments instead of a lump sum when they file their taxes. This policy change cut child poverty in half.

But changes made at the federal level under this year’s tax and spending law go in the opposite direction and will create additional hardship for families. The recent expansion of the federal CTC will boost the credit from $2,000 to $2,200 per child and index it to inflation going forward, but the credit will remain only partially refundable. This means many low-income households will not receive the full $2,200 per child, rendering the policy much less effective at reducing child poverty. In fact, the income threshold to claim the full $2,200 is now higher than it was pre-expansion. The CTC paired with harmful and drastic cuts to important social services like food benefits, health care, and disaster preparedness will solidify the high poverty rates seen in the 2024 Census data.

It’s not a mystery which policy tools lawmakers have to achieve poverty reduction. Any lawmaker serious about helping struggling families should push for the 2021 version of the CTC to be permanent and for further investments in important safety net programs that are proven to reduce poverty among workers, families, and children.