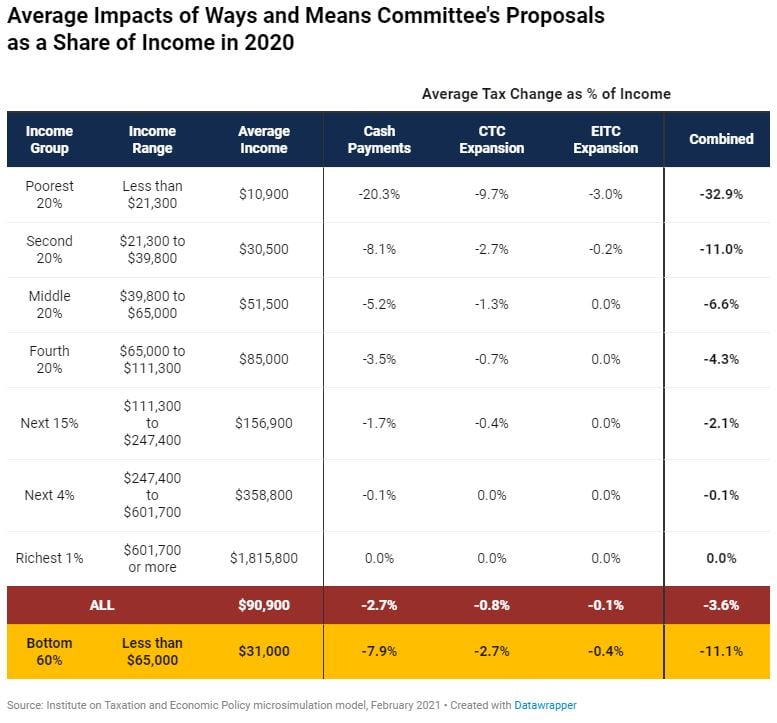

For the bottom 20% of families in terms of income, the proposed expansion of the CTC would increase income by an average of 9.7% — even higher if you only consider tax filers with children, according to the Institute on Taxation and Economic Policy. The proposal would also lift 4.1 million children above the poverty line, cutting the number of children in poverty by more than 40%, the Center on Budget and Policy Priorities found.

Related Reading

February 9, 2021