The Cost-of-Living Refund Act would expand the Earned Income Tax Credit (EITC) for low- and moderate-income working people. The maximum EITC would nearly double for working families with children. Working people without children would receive an EITC that is nearly six times the size of the small EITC that they are allowed under current law.

For more information, see the ITEP report, Understanding Five Major Federal Tax Credit Proposals.

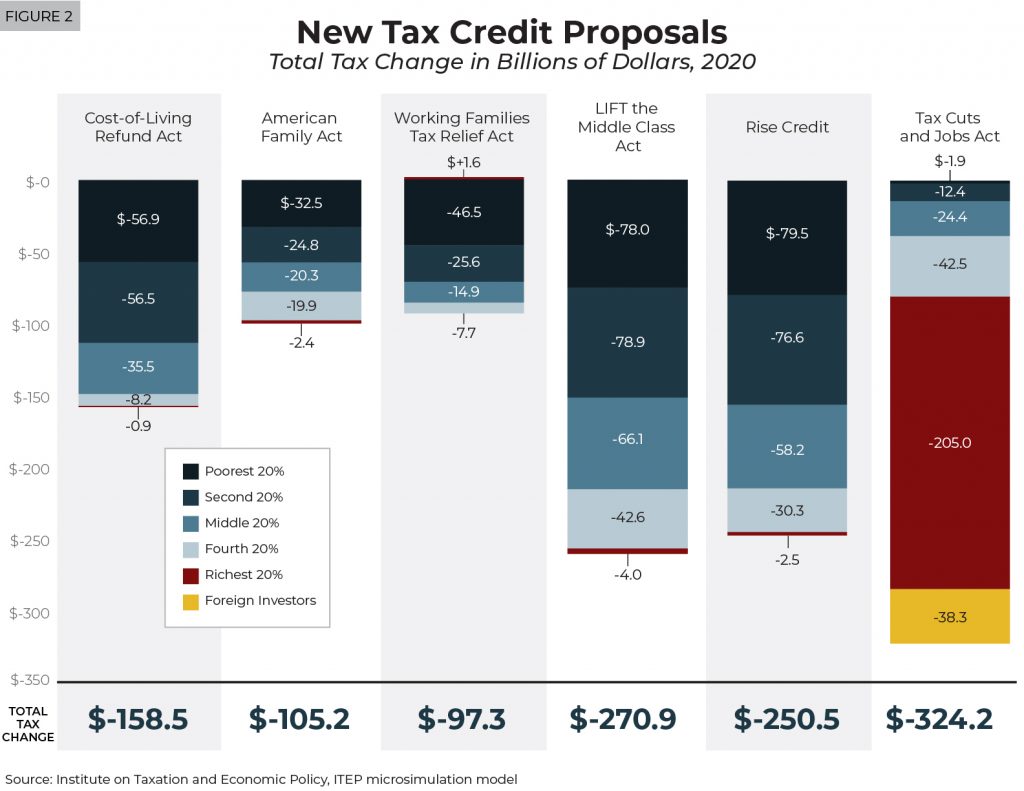

Lead Sponsor/Proponent |

General Explanation |

Share Going to Bottom 60% |

Share Going to Richest 20% |

Total Cost CY 2020 |

| Sen. Sherrod Brown Rep. Ro Khanna |

Major Expansion of EITC | 94% | 1% | $158.5 billion |

State Impact National Impact Who Benefits? Distribution by Race