Iowa taxes its middle- and low-income families more as a share of income than it does wealthy families, a long-term trend worsened by the 2018 tax overhaul.

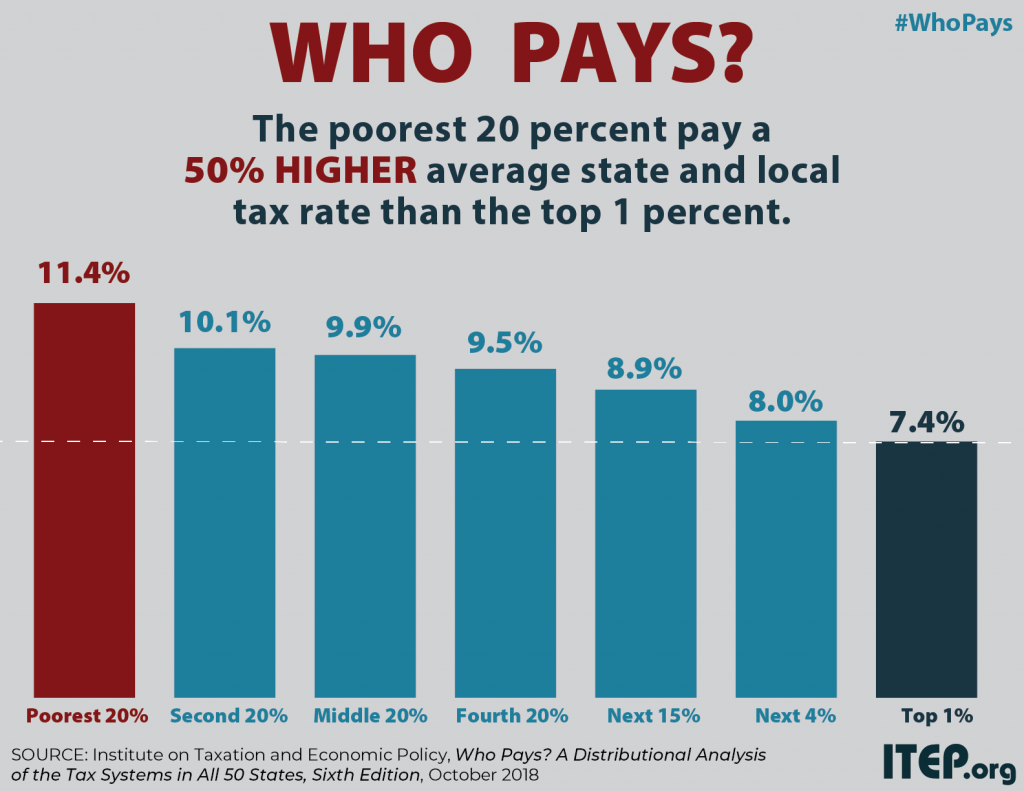

The latest “Who Pays” report by the Washington-based Institute on Taxation and Economic Policy (ITEP), again shows the effect of sales taxes and property taxes on lower-income households tilts Iowa’s overall tax system so the poorest pay the highest percentage in taxes.