Conformity

Most states use the federal tax code as a starting point for their calculations of state personal income taxes, corporate income taxes, and estate taxes.

Testimony: ITEP’s Miles Trinidad on Decoupling from the QSBS Exclusion Before the Maryland House Ways and Means Committee

February 27, 2026

This testimony was delivered to the Maryland House Ways and Means Committee on February 26, 2026. Chair, Vice-Chair, and Members of the Committee, Thank you for the opportunity to provide testimony in support of House Bill 801. My name is Miles Trinidad, and I am an analyst at the Institute on Taxation and Economic Policy […]

Testimony: ITEP’s Marco Guzman Details a Package of Tax Bills for the Connecticut General Assembly Finance Committee

February 27, 2026

This testimony was delivered to the Connecticut General Assembly Finance Committee on February 26, 2026. My name is Marco Guzman, and I am a Senior Analyst at the Institute on Taxation and Economic Policy (ITEP). ITEP is a non-profit, non-partisan tax policy organization, conducting rigorous analyses of tax and economic proposals and providing data-driven recommendations […]

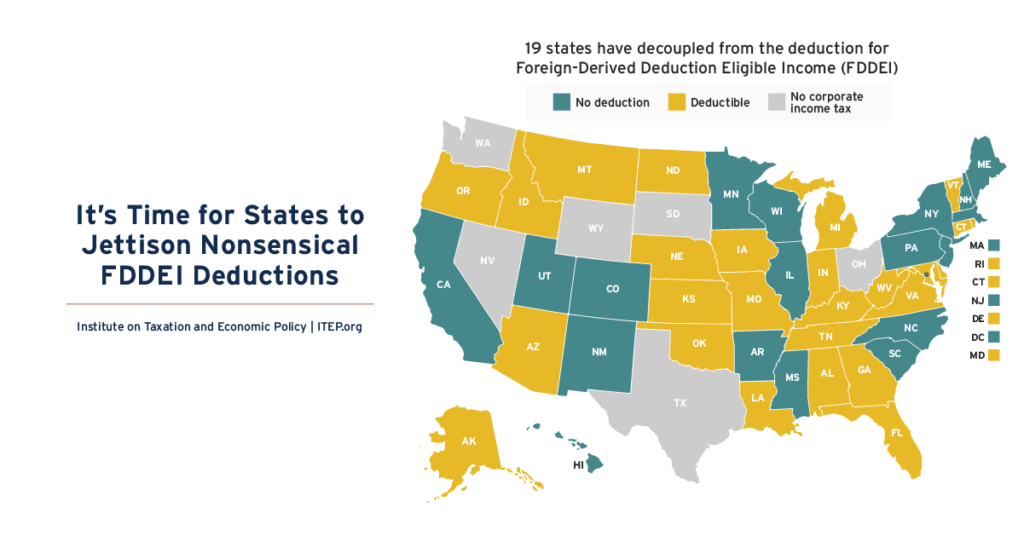

It’s Time for States to Jettison Nonsensical FDDEI Deductions

February 19, 2026 • By Carl Davis

FDDEI deductions should be repealed for policy reasons alone as they do not serve a legitimate purpose at the state level.

NCTI is an Important Part of the Federal Corporate Tax. States Should Adopt It Too.

February 12, 2026 • By Carl Davis

Including NCTI in state corporate tax law is an effective way to neutralize much of the tax avoidance that occurs when multinational companies artificially shift their profits into overseas tax havens.

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

D.C.’s Fiscal Autonomy is at Stake, District’s Conformity Decisions Should Stand

February 6, 2026 • By Kamolika Das

Federal lawmakers passed a bill along party lines that would force the District of Columbia to override the decision of local elected officials and implement all of the costly and inequitable federal tax cuts passed under the “One Big Beautiful Bill Act” (OBBBA).

Testimony: ITEP’s Carl Davis on Federal/State Tax Conformity at Pair of Vermont Committee Hearings

February 3, 2026

ITEP Research Director Carl Davis testified on the impact of the 2025 tax law on Vermont on January 15, 2026 at the Vermont House Ways & Means Committee and the Vermont Senate Committee on Finance. See the slide deck here Watch the videos here (House) and here (Senate) See all of our resources on conformity […]

Testimony: ITEP’s Sarah Austin Urges Washington House Finance Committee to Decouple from Venture Capital Tax Break

January 28, 2026

The prepared testimony below was delivered by ITEP Senior Analyst Sarah Austin to the Washington House Finance Committee on January 27, 2026. For more on the tax break in question, check out our October 2025 brief. Chair Berg, Vice Chair Street, and members of the House Finance Committee, My name is Sarah Austin, I’m a […]

States Can Push Back Against Reckless Federal Tax Policy. Here’s How.

January 22, 2026 • By Aidan Davis, Wesley Tharpe

They should take steps to protect and boost their own revenues. And they should take a second look at their own tax cuts.

Curbing Tax Deductions for Executive Pay is a Federal Tax Change States Should Get Behind

January 9, 2026 • By Matthew Gardner

This provision in last summer’s tax law could actually make budget-balancing a little bit easier for states if they follow suit.

From Congressional discussions over the so-called "One Big Beautiful Bill Act" to debates on property taxes, ITEP kept busy this year analyzing tax proposals and showing Americans across the country how tax decisions affect them.

States Can Create or Expand Refundable Credits by Taxing Wealth, Addressing Federal Conformity

December 19, 2025 • By Zachary Sarver

Many states already recognize the potential of these credits to boost low- and moderate-income households. Other states should follow suit.

No, Scott Bessent: States Aren’t Taking Away Anyone’s Tax Cuts

December 11, 2025 • By Nick Johnson

It’s wildly inappropriate for a U.S. Treasury Secretary to lean on states to adopt or not adopt specific federal provisions in their own state tax codes.

Linking to Tipped and Overtime Income Deductions Would Worsen State Shortfalls, Do Little to Help Workers

December 8, 2025 • By Neva Butkus, Galen Hendricks

State deductions for tips and overtime are not only ineffective at supporting working-class people, it will come at a substantial cost to state budgets.

Conforming to the ‘No Tax on Tips’ Gimmick Just Got Riskier and Costlier for States

November 25, 2025 • By Nick Johnson

An unknown number of workers who previously were assumed to be ineligible for the tax break may nonetheless claim it.

Re-Examining 529 Plans: Stopping State Subsidies to Private Schools After New Trump Tax Law

November 20, 2025 • By Miles Trinidad, Nick Johnson

The 2025 federal tax law risks making 529 plans more costly for states by increasing tax avoidance and allowing wealthy families to use these funds for private and religious K-12 schools.

State Tax Dollars Shouldn’t Subsidize Federal Opportunity Zones

November 12, 2025 • By Eli Byerly-Duke

The Opportunity Zones program benefits wealthy investors more than it benefits disadvantaged communities.

States Begin Decoupling from Flawed ‘QSBS’ Tax Break

November 6, 2025 • By Nick Johnson, Sarah Austin

A costly tax break for wealthy venture capitalists is drawing some critical attention from state policymakers.

Why States Shouldn’t Go Along With OBBBA’s Corporate Tax Breaks: A Practical Guide

October 27, 2025 • By Nick Johnson, Michael Mazerov

States should immediately decouple from four costly corporate tax provisions in the new federal tax law.

This webinar focused on the ways the new tax law could impact state revenues by changing policies that state lawmakers will soon consider mirroring in their own income tax codes.

Quite Some BS: Expanded ‘QSBS’ Giveaway in Trump Tax Law Threatens State Revenues and Enriches the Wealthy

October 2, 2025 • By Sarah Austin, Nick Johnson

States should decouple from the federal Qualified Small Business Stock (QSBS) exemption.

Colorado Lawmakers Help Fill Trump-Induced Shortfall by Tackling Offshore Corporate Tax Avoidance

August 26, 2025 • By ITEP Staff

As the Trump megabill blows holes in state budgets, Colorado is leading with reforms to curb offshore tax avoidance and roll back wasteful corporate subsidies.

SALT in the Wound: New Tax Law’s Limit on State Tax Deductions Exempts Some of the Very Wealthiest

August 21, 2025 • By ITEP Staff

The new tax law enacted last month found a temporary compromise on the level of the cap, boosting it to $40,000 through 2029, but failed to fix a loophole that allows some rich taxpayers with good accountants to completely avoid the cap

States Should Move Quickly to Chart Their Own Course on SALT Deductions

July 17, 2025 • By Dylan Grundman O'Neill, Nick Johnson

While a federal SALT cap is hotly debated, capping deductibility at $10,000 was an unambiguously good idea at the state level. States would be smart to stick with the current cap or, better yet, go even farther and repeal SALT deductions outright. Going along with a higher federal SALT cap would double down on a regressive tax cut that will mostly benefit a small number of relatively wealthy state residents and cost states significant revenue.

Trump Megabill’s Deduction for Car Loan Interest Would Not Offset Tariff-Related Auto Price Increases for Most Buyers

June 12, 2025 • By Carl Davis, Sarah Austin

The auto loan interest deduction that recently passed the House is designed, at least in part, to mitigate the impact of tariff-induced price increases on vehicles assembled in America. But the deduction is incapable of offsetting even small-scale price increases, especially for working-class families and others with moderate incomes.