President Trump and the Republican majorities in the House and Senate plan to extend the temporary parts of the Trump tax law that will otherwise expire at the end of this year. But they may not extend the one part of the 2017 law that significantly limits tax breaks for the rich: the $10,000 cap on federal income tax deductions for state and local taxes (SALT). And, depending on which proposal they settle on, leaving out the existing cap on SALT deductions could add between $10 billion and over $100 billion each year to the total cost of their tax plan.

The $10,000 cap on SALT deductions should not be seen as a model of sound policymaking. Congressional Republicans who drafted the 2017 law could have limited any number of tax deductions, tax credits, or other types of tax breaks to offset some of the cost of the tax cuts they were determined to enact. But they focused mainly on one deduction – the deduction for state and local taxes – for ideological and political reasons.

The SALT deduction is more important to people who live in states with higher state and local taxes, which are more likely to have Democratic governors and legislators. Drafting tax policy to stick it to “blue states” is not a fair or sound way to write a tax code.

At the same time, removing the cap on SALT deductions could be very costly and mainly benefit the richest taxpayers if it is not replaced with another policy to limit tax breaks for well-off households.

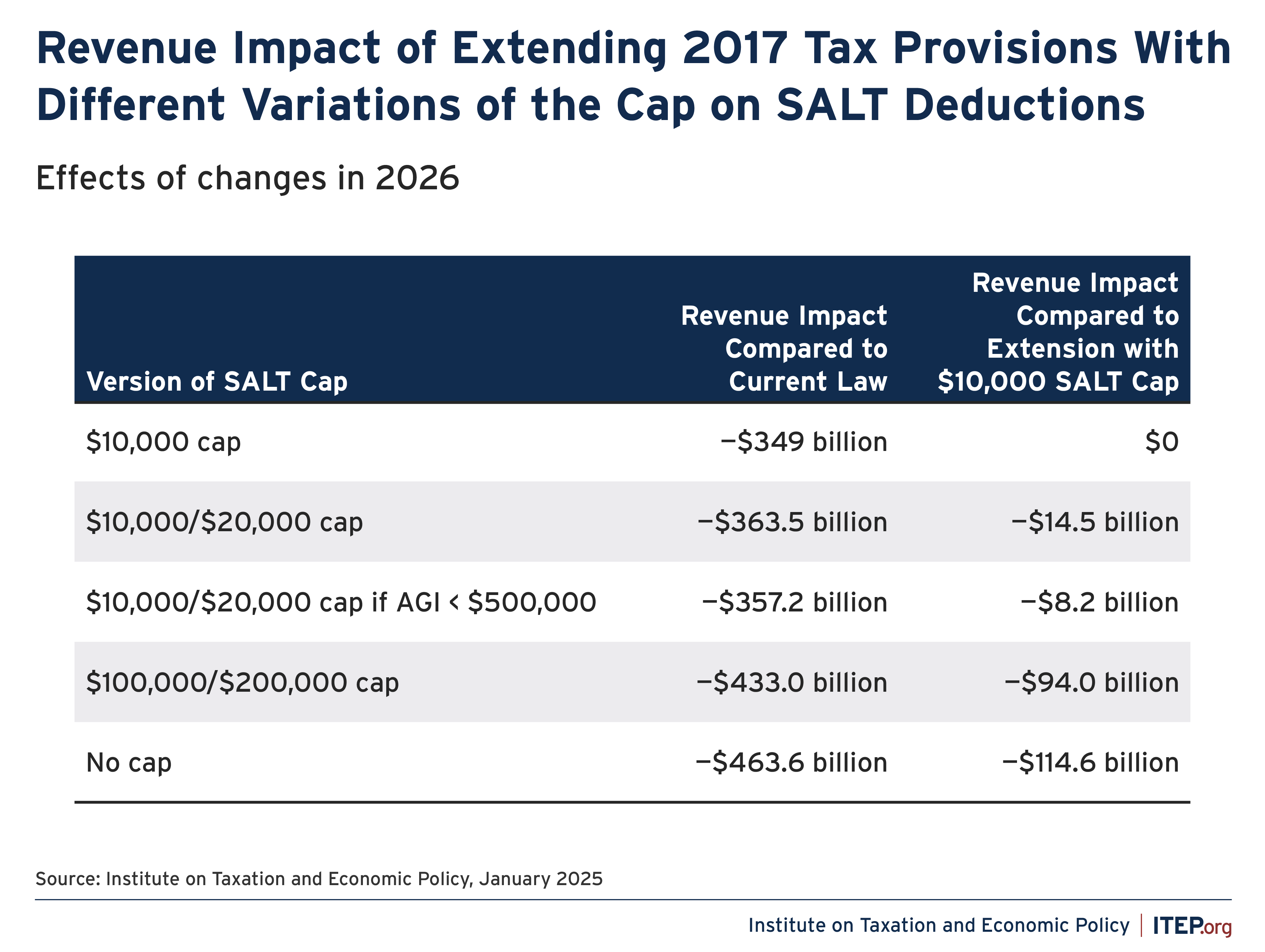

Figure 1 below illustrates the cost of extending the temporary 2017 tax provisions that will otherwise expire at the end of 2025, with different approaches to the cap on SALT deductions. The figures were produced using ITEP’s tax microsimulation model.

FIGURE 1

For example, extending all tax provisions that will otherwise expire at the end of 2025 (including the $10,000 cap on SALT deductions) would cost $349 billion in the first year alone. Extending all the tax provisions EXCEPT the $10,000 SALT cap (and including no cap on SALT deductions at all) would cost $436.6 billion in the first year. That means that not including the SALT cap (and not replacing it with anything) would increase the costs of the extension by $114.6 billion. Other options that include a SALT cap, but a more limited version of it, would add a smaller cost.

One example is the proposal introduced by New York Rep. Michael Lawler during the previous Congress, which would leave the cap in place but would double it from $10,000 to $20,000 for married joint filers. (This is often described as removing the “marriage penalty” in the SALT cap). This would add $14.5 billion to the cost of extending the tax cuts in the first year, as shown above.

Another proposal from Rep. Lawler would do the same thing but only for married joint filers with income of less than $500,000; this would add about $8 billion to the costs of extending the tax cuts in the first year.

A more recent proposal introduced at the start of this Congress by Rep. Lawler would increase the SALT cap much more, to $100,000 for unmarried taxpayers and $200,000 for married taxpayers. This would add $94 billion to the costs in the first year – nearly as much as eliminating the cap entirely.

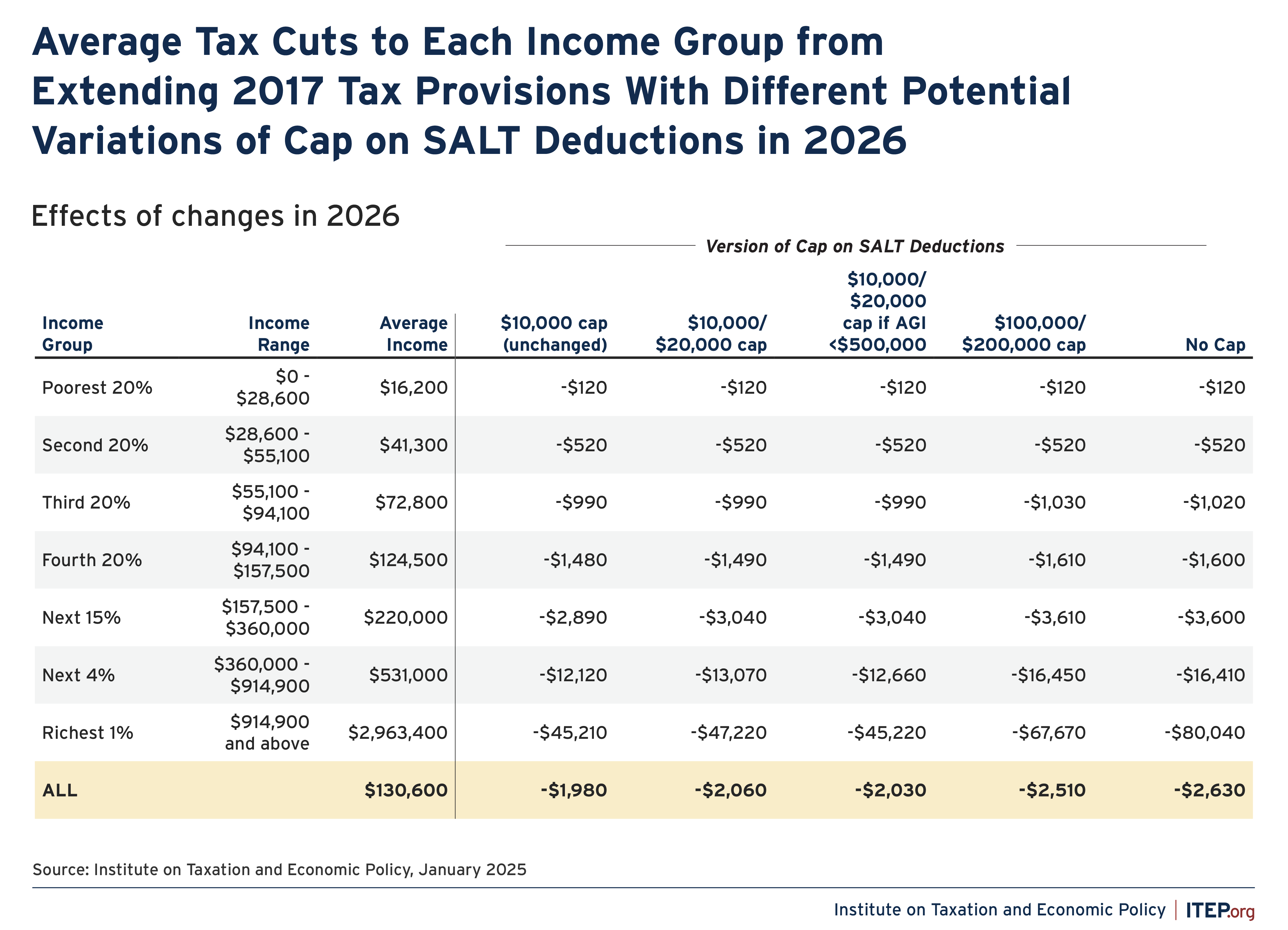

As illustrated in Figures 2 and 3 below, the benefits of changing the SALT cap would be either non-existent or negligible for most taxpayers among the bottom 80 percent of households.

For example, the average tax break for the poorest 20 percent of Americans from extending the temporary tax provisions into 2026 would be $120 (mainly because the Trump tax law increased the standard deduction and the Child Tax Credit). This is the same no matter what approach Congress takes to the SALT cap, which has virtually no impact on the poorest taxpayers.

This is another way of saying that, compared to simply extending all the temporary tax provisions as written, leaving out the SALT cap or limiting the SALT cap provides an additional average tax cut of zero dollars to the poorest fifth of Americans.

But the situation is very different for the rich. The average tax break for the richest 1 percent would be $45,210 if Congress simply extends all the temporary tax provisions as written, including the $10,000 SALT cap. But if Congress extends all the temporary tax provisions except the $10,000 SALT cap, the average tax break for the richest 1 percent would be $80,040. That means leaving out the SALT cap would provide the richest one percent with an additional tax cut of $35,830 on average.

FIGURE 2

FIGURE 3

Of course, none of these proposals would change the fundamental fact that extending all the temporary Trump tax provisions would mainly benefit the rich unless other changes are made to dramatically limit tax breaks for those with the highest incomes.

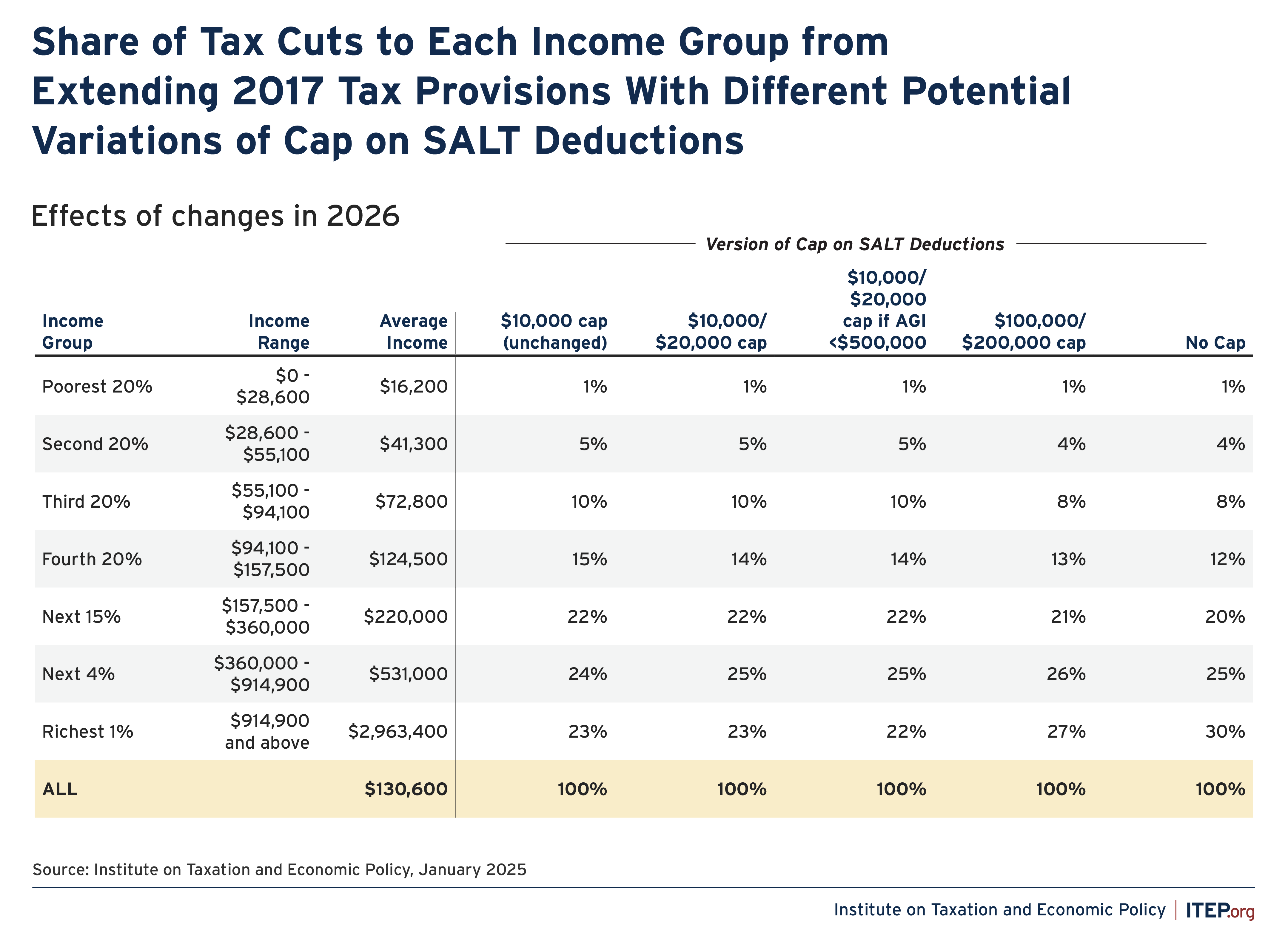

Figure 4 below illustrates the share of benefits going to each income group from extending the temporary tax provisions in 2026 under the different approaches to the SALT cap.

FIGURE 4

Under any of these approaches, about half the benefits or more will flow to the richest 5 percent of taxpayers. Between 22 percent and 30 percent of the benefits will flow to the richest 1 percent alone, depending on which approach is taken. Extending the Trump tax law will make our tax code less fair under any path that Congressional Republicans are considering right now.