Local governments have long been the front line in shaping economic opportunity, public health and safety, and the success of future generations through education and other key services. But public sentiment, along with the views of many local leaders, has been shifting towards a more direct approach for supporting the community – namely, cash for low- and moderate-income families. Cash transfer programs are demonstrated to have positive impacts on both recipients and the broader community.

Refundable tax credits, one form of cash transfers, are linked to increased birth weight, higher educational attainment, improved food access, and fewer evictions. Most states already offer their own Earned Income Tax Credits (EITC), typically matching a certain percentage of residents’ federal EITC, but this is still a rarity among localities.

Three localities — Maryland’s Montgomery County, New York City, and San Francisco — are leading the charge with local refundable EITCs that collectively lift the incomes of approximately 700,000 households each year. Other local leaders should leverage lessons learned from their experiences, highlighted in our new report, and consider adopting them as well.

More than ever, families with modest earnings are feeling the crunch of rising costs of housing, childcare, education, and health care. At the same time, many pandemic-era relief benefits have either expired or are expiring soon.

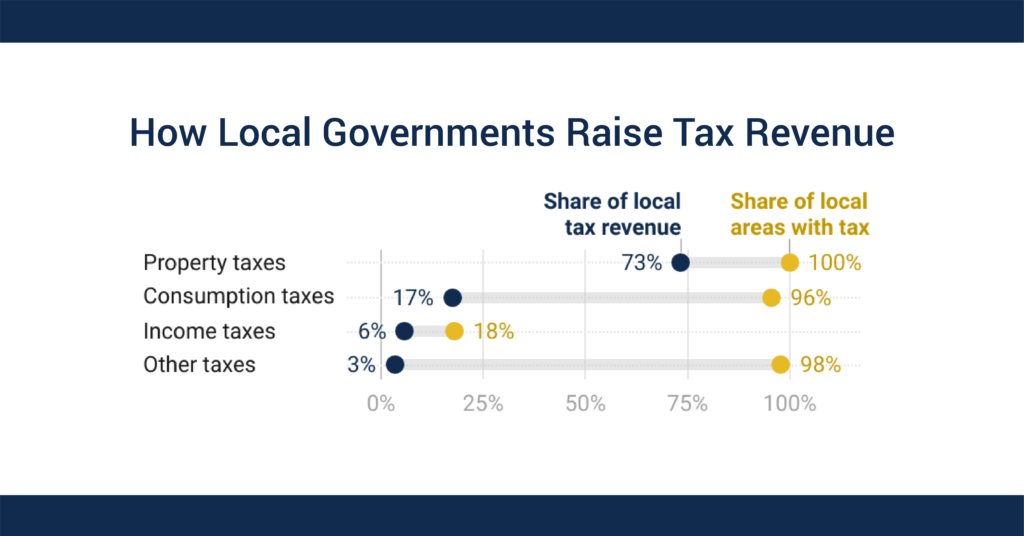

While local governments alone cannot fix these issues or quell poverty, investing in local refundable EITCs and child tax credits (CTCs) can help secure economic stability and offset the regressivity of local tax codes. Property taxes represent the largest local tax revenue source, followed by consumption taxes, while only one in five localities have an income tax. Given that property taxes are usually somewhat regressive and consumption taxes are undoubtedly regressive, low- and middle-income households generally pay a larger share of income in taxes than those at the top. Local refundable EITCs and CTCs can add fairness to revenue systems while improving residents’ well-being.

This is important for all families, but especially for marginalized Black and Hispanic households that disproportionately feel the effects of regressive taxation, inadequate public investment, and a discriminatory labor market. The EITC reaches a larger proportion of Black, Hispanic, and Indigenous households relative to their share of the overall population and provides these households a greater share of the total income boost. Local EITCs and child tax credits that build upon federal and state tax credits promote a more inclusive economy for all.

That said, not all local EITCs have the same impact. Local credits work best when they are refundable, inclusive of the most financially vulnerable households, and administered to facilitate participation. Our latest report shows how these decisions regarding structure, eligibility, accessibility, and sustainability contribute to differences in reach and impact across Montgomery County, New York City, and San Francisco. Lessons from these programs hold relevance for any leader or community member seeking a stronger, fairer, and healthier local community.