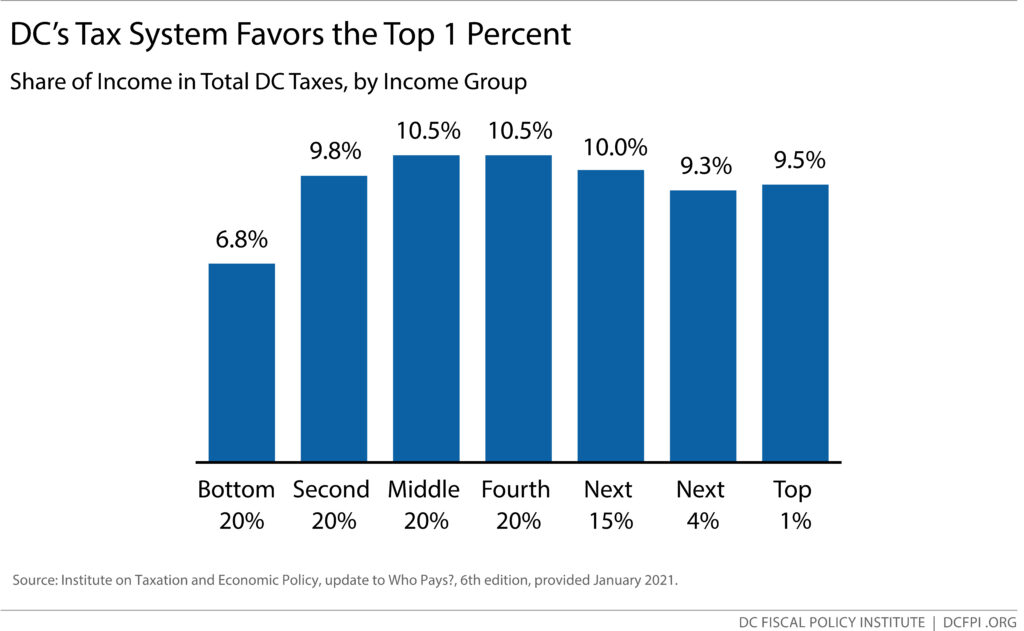

A tax system that adequately advances racial and economic justice must be progressive, requiring the richest people to pay a much higher share of their income in taxes than lower-income families who have little or no wiggle room in their family budget. Yet new findings from the Institute on Taxation and Economic Policy (ITEP), a national nonprofit research group with a sophisticated tax model, show that DC’s richest residents pay a smaller share of their income in taxes, or a tax responsibility level, than most other residents.