The nation’s capital has a once-in-a-decade opportunity to advance a stronger and fairer local tax code. New draft recommendations from a key advisory panel will help leaders make the most of the moment.

In a package of 39 draft policy recommendations released this month, the District of Columbia’s Tax Revision Commission laid out reforms that would improve the tax system and foster shared prosperity. The Commission, appointed by the mayor and D.C. council, is currently undertaking its decennial examination of the adequacy, efficiency, and equity of the District’s tax policies. The proceedings will culminate in a slate of proposals presented to public officials later this year. Before that, in the coming days and weeks the panel will review its draft proposals to finalize a consensus set of recommendations.

The Tax Revision Commission’s revenue-neutral draft recommendations include several worthwhile changes. Among the 39 proposals to revamp the tax code are ideas that would lift more residents from poverty, support families with low and moderate incomes, and improve fairness by closing loopholes used by the wealthy to dodge tax obligations.

Especially promising proposals include:

- Creating a Child Tax Credit for D.C. families

- Strengthening the Earned Income Tax Credit for low-paid workers

- Addressing property tax regressivity with a graduated tax on the highest-value homes

- Improving affordability by expanding the property tax circuit breaker credit

- Closing tax loopholes that exacerbate inequality

- Modernizing corporate taxes with a new excise tax on commercial data collection

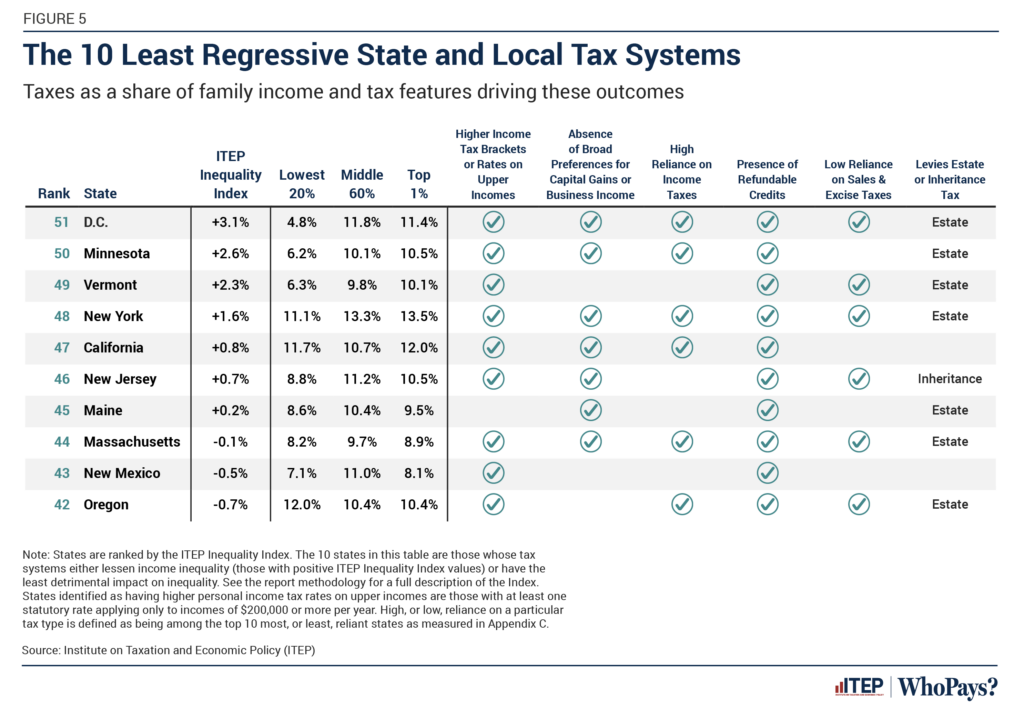

The Commission’s next steps come as a new ITEP study shows the District earning an encouraging distinction: the least-regressive tax code of any state in the nation. The 7th edition of ITEP’s comprehensive Who Pays? analysis finds the District among a select few jurisdictions with tax systems that do not, overall, significantly worsen economic disparities among residents. Improvements in recent years to D.C.’s Earned Income Tax Credit and personal income tax, among other reforms, strengthened the District’s standing. The needle-moving impact of these actions offers a roadmap for addressing remaining obstacles — such as the reality that, despite recent progress, the highest-income five percent of D.C. households continue to pay a lower effective tax rate than middle-income households.

The tax revision process presents D.C. leaders with a chance to keep the positive momentum going. It is an opportune moment to redouble efforts against deep-rooted inequities and to take on new and oncoming challenges. The proposed changes highlighted below would begin to do so, contributing to a better tax code that supports residents and provides a solid foundation for the future.

Bolstering Economic Security for Workers and Families

Creating a D.C. Child Tax Credit

One key recommendation before the Tax Revision Commission would see the District embrace a welcome nationwide movement by enacting a refundable D.C. Child Tax Credit. Today more than one in four states provide child tax credits. They are a critical tool that can lift kids out of poverty, boost family economic resiliency, and advance racial equity. The Commission’s draft recommendations set forth a substantial $1,000 per-child credit for D.C. families. The proposed credit would be refundable with a phase-out for higher earners, ensuring families with the least resources see a direct and meaningful boost. It would deliver an estimated $77 million directly into families’ pockets each year.

A refundable credit along these lines would have a powerful impact. A robust Child Tax Credit would help D.C. families provide children with basic necessities, particularly for caregivers earning too little to qualify for the full boost from the federal Child Tax Credit and the federal and D.C. Earned Income Tax Credits. Evidence indicates the investment would improve children’s health and educational and financial success as they grow up. It would go a long way to ensuring children in D.C., no matter their background, can start off on the right foot.

Strengthening the Earned Income Tax Credit

The District’s Earned Income Tax Credit lifts incomes for tens of thousands of workers and their families, reducing poverty and improving tax equity. The credit, presently set to fully match residents’ federal EITC by 2026, would be further strengthened by recommendations in the Tax Review Commission’s draft proposal package. These proposed changes would extend the credit to more low-paid workers without children in the home, a group which includes childless workers, noncustodial parents, and workers with adult children.

A decade ago, D.C. committed to lifting up these workers by increasing their EITC match to 100 percent of the federal credit and expanding income eligibility beyond restrictive federal limits. These changes resulted from proposals endorsed by the 2013 Tax Revision Commission. The latest draft recommendations renew this commitment with two proposed policy changes. The first would expand EITC access to younger workers and older workers without children who are currently excluded from the D.C. and federal credits. For the first time, low-income working adults below the age of 25 and above the age of 64 would be eligible to claim the D.C. EITC. A second adjustment would allow more low-wage workers to marry without losing their boost from the credit.

The recommended changes represent a critical step for residents beginning to secure a foothold in the job market and those working beyond the traditional retirement age. A disproportionately large share of these residents are Black, the Commission estimates, an outcome of historic and continued disparities in income and economic opportunity. Undoing these inequities will take purposeful investments. A strengthened EITC can be part of the solution.

With the proposed adjustments, more than 16,000 workers earning under $28,000 annually would gain access to the District’s EITC, the Commission estimates. Their incomes would be lifted by approximately $7 million altogether, a meaningful advancement for economic and racial equity.

A Progressive Property Tax

Addressing imbalances for very wealthy property owners

The Tax Revision Commission will consider two proposals to strengthen the property tax system by applying a new tax bracket to high-value homes, an approach which would better reflect the lopsided concentration of wealth ownership in D.C. along economic and racial lines.

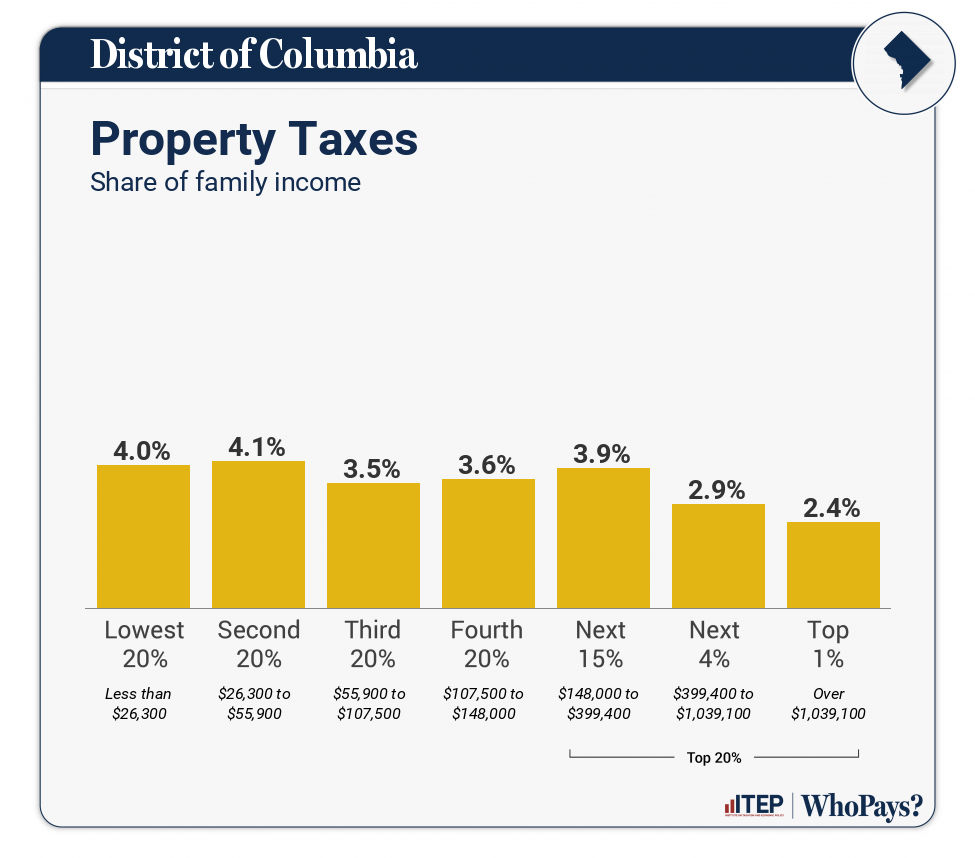

An entrenched legacy of exclusionary policies and practices results in large present-day wealth and homeownership gaps for residents with lower incomes and residents of color, particularly Black residents: The average white household in the D.C. area owns property, including homes and other real estate, worth 81 times that of the average Black household. Yet despite these stark inequalities, households with the most financial means tend to pay the least in D.C. property taxes as a portion of income, as ITEP’s latest Who Pays? report shows. This is a key source of unaddressed inequity in the District’s tax code.

The draft recommendations outline two pathways to achieve a better balance. One would create a new marginal tax bracket on homes worth more than $2 million, affecting owners of the most expensive 5 percent of residences. The new bracket would apply a higher tax rate on the portion of home value that exceeds $2 million. The other would increase the flat-rate property tax alongside an offsetting enlargement of the homestead deduction. Each approach would raise an estimated $42 million per year and contribute to a fairer property tax system that supports more inclusive prosperity in the District.

Boosting property tax affordability by expanding the circuit breaker credit

The draft recommendations improve upon D.C.’s property tax circuit breaker credit, Schedule H, expanding its reach and impact for residents with low and moderate incomes. The proposed changes would enhance the program by broadening income eligibility, lifting the maximum credit households can receive, and allowing all income-eligible residents to receive the same amounts regardless of age.

Schedule H, claimed by tens of thousands of homeowners and renters each year, promotes property tax affordability and keeps housing costs in check by providing a refund when property taxes exceed a certain percentage of income. Circuit breaker credits like Schedule H prevent overloads of property tax liability beyond households’ ability to pay, helping to protect economic security for residents while addressing a driving force of regressivity in the tax code. Recommended changes to the credit would ensure more residents receive support.

Crucially, the Schedule H credit is the only form of property tax support directly accessible to renters, who assume a share of property tax contributions passed on by landlords, have lower incomes than homeowners on average, and are more likely to be Black and Hispanic. In addition to aiding homeowners, the draft recommendations would expand the number of renters who can claim the credit and increase the amount of support available. With close to half of D.C. renters spending 30 percent or more of their income on housing, these reforms would strengthen an already effective tool to help families make ends meet.

These adjustments to D.C.’s successful circuit breaker credit would grow the amount refunded to households by an estimated $20 million annually, delivering a boost to cost-strained residents.

Closing Loopholes for the Uber-Wealthy and Modernizing Taxes on Corporations

Tackling a common tax shelter

A majority of mega-rich Americans shelter money from taxation using trusts, special entities established to manage and transfer assets between individuals. While trusts can sometimes serve legitimate practical purposes, loose rules can also make them magnets for aggressive tax avoidance. The latter is especially true of “incomplete non-grantor trusts,” or INGs, which allow D.C.’s wealthiest to skirt District taxes. The Commission’s draft recommendations include a straightforward fix to shut down the preferential treatment of these arrangements.

INGs work like this: A wealthy D.C. resident shifts financial assets, such as stock in a company, into a trust nominally set up in a tax-haven jurisdiction such as Wyoming. No taxes are paid on the transfer. The trust becomes an entity separate from the person whose wealth it holds, allowing the wealthy resident to pay no D.C. taxes, and often no taxes to any state at all, as the assets grow in value. The strategy effectively enables the wealthy to pick and choose which tax laws they will abide by, a privilege not afforded to ordinary citizens.

The draft recommendations propose to treat income gains from D.C. residents’ ING trusts for what they are: the income of those residents. This common sense solution has already been adopted in New York and California. The District predicts the reform would stop wealthy residents from dodging over $1 million in D.C. income taxes each year.

Decoupling from a federal capital gains tax break

The federal tax code is full of policies granting sweetheart tax treatment to wealthier Americans’ financial gains. One notable practice allows some investors and employees in startup firms to pay no federal capital gains taxes when they cash out early-issued company shares for profit. This tax break, known as the Qualified Small Business Stock exclusion, has been found to exacerbate income and wealth inequalities by disproportionately favoring well-off investors, founders, and employees.

The District piggybacks on the exclusion, meaning beneficiaries also sidestep paying D.C. income taxes on their gains. The draft recommendations sensibly scale back this loophole, following in the footsteps of California, New Jersey, Pennsylvania, Hawaii, and others. Under the proposed policy, residents would pay District income taxes on stock payoffs from companies that are not D.C.-based. The profits would be regarded the same as other forms of taxable capital gains. Removing D.C.’s tax carveout for these gains would raise an estimated $3 million annually.

Taxing big data collectors

The draft recommendations set forth some constructive ideas to shore up and modernize the tax code for corporations. In one such proposal, companies profiting from their use of D.C. residents’ data would be subject to a new excise tax, calculated at four dollars per individual per year for companies collecting information on more than 50,000 residents. The tax is estimated to raise $7 million annually for the District.

The proposal reflects growing recognition that firms’ accumulation of vast quantities of consumer data — including users’ individual demographics, web history, geolocation, and more — is comparable to the extraction of other valuable resources historically subject to specialized taxation. The idea has parallels in legislation under consideration in New York and Washington.

A Time to Invest

The Tax Revision Commission draft recommendations highlighted here are thoughtful proposals to keep the District and its residents moving in the right direction. These ideas reflect an understanding that D.C. is best primed to grow for the long run when workers and families have ample resources and opportunities to thrive. It’s an approach the Commission, and D.C.’s leaders, ought to apply broadly to meet the challenges of today and tomorrow.

A more robust focus on equitable revenue-raising is one way to better ensure the Commission’s final recommendations meet the moment. This is particularly true as the District — like cities and states across the country — responds to challenges including receding federal support, an evolving economic base, and a need to ensure the continuity of transit and other essential services. A stronger and fairer revenue system can help navigate these challenges while addressing persistent inequities and advancing shared prosperity for D.C. residents. The draft recommendations detailed above form a strong foundation to build upon.