National and state-by-state data available for download

The House Ways and Means Committee on Monday published its proposal for the cash payments, tax provisions and other changes that would make up part of the $1.9 trillion COVID relief legislation that President Joe Biden called for a few weeks ago.

The proposal would provide cash payments of $1,400 per person, a Child Tax Credit (CTC) expansion and an Earned Income Tax Credit (EITC) expansion for childless working people who currently receive only a very meager EITC, among other changes. These three parts of the proposal—the new cash payment, the CTC expansion and the EITC expansion—are described more further on.

For simplicity, ITEP estimated these proposals as if they were in effect in 2020 (some of the benefits would be initially calculated based on a family’s income from 2020 or 2019). The table below provides the tax change from these proposals as a share of income.

Figure 1 illustrates the financial impact the proposals could make in people’s lives, particularly for low- and moderate-income families. Generally, everyone in the bottom three quintiles (the bottom 60 percent of tax filers and their families) would receive cash payments of $1,400 per person, but this benefit would be particularly large as a share of income for the poorest quintile. For this group, the cash payment would increase income by an average of 20.3 percent.

For the bottom 20 percent, the proposed expansion of the Child Tax Credit would increase income by an average 9.7 percent. This figure would be much higher if we confined the analysis to tax filers with children. Altogether the three provisions would increase incomes of families in the poorest quintile by around a third on average.

The table below provides the average tax change from these proposals in dollars. The bottom 20 percent of tax filers receive slightly smaller average benefits from the cash payment than the middle 20 percent of tax filers simply because they have smaller households on average. For all three proposals, the benefits are meager or non-existent for most high-income tax filers due to income limits in the proposals, which are described below. Overall, tax filers and their families would receive an average $3,290 combined from the three proposals for the year.

$1,400 Cash Payments

The Ways and Means plan would provide $1,400 to each tax filer, tax filer’s spouse and dependent. A household’s combined cash payments would phase out for those with income between $75,000 and $100,000 for singles, between $112,500 and $150,000 for heads of households (single parents), and between $150,000 and $200,000 for married couples.

The estimates in these tables do not include up to $7.6 billion in cash payments that would go to people who have a Social Security Number (SSN) but live in a family with an adult who files with an Individual Taxpayer Identification Number (ITIN) (who would be ineligible for the payment). Including payments to the family members of ITIN filers, we estimate a total of around $407 billion in cash payments under this proposal.

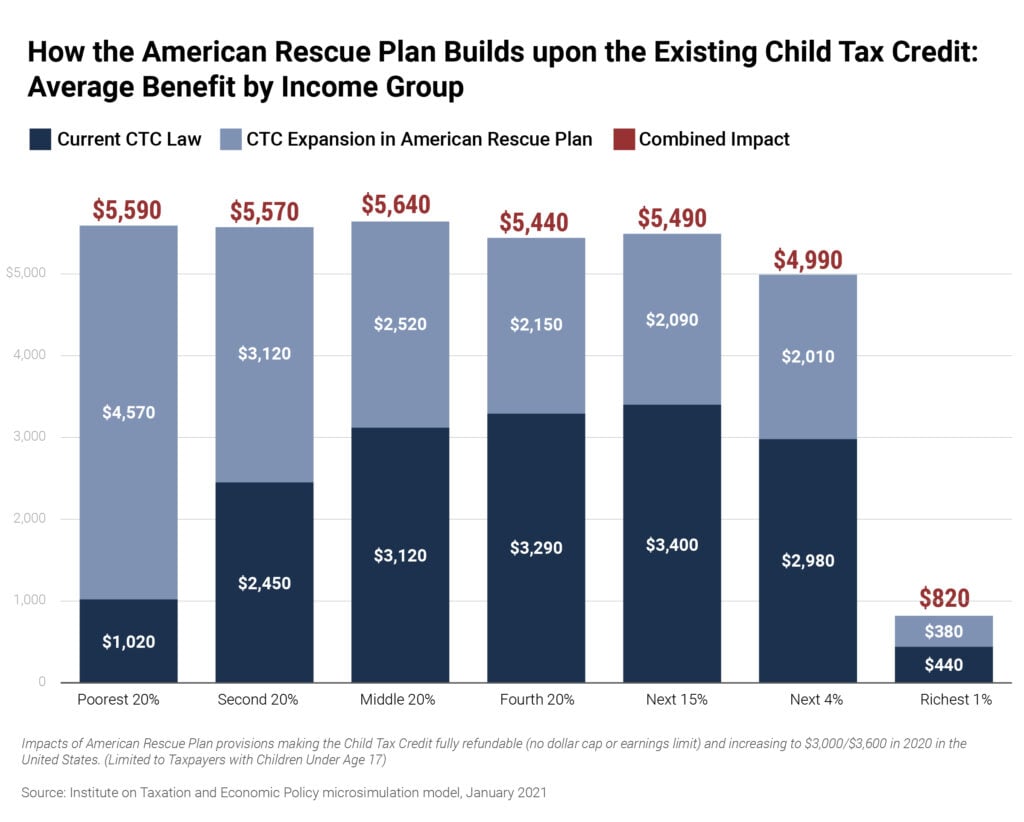

Child Tax Credit Expansion

The Ways and Means proposal would expand the Child Tax Credit (CTC) in two ways. First, it would make the credit fully refundable, removing both the dollar cap and the earnings limit that currently prevents nearly all low-income families with children from receiving the full credit. Second, it would increase the maximum credit from $2,000 per child to $3,000 for each child age 6 and older and $3,600 for each child under age 6. Whereas the current $2,000 credit is phased out for those with relatively high incomes ($400,000 for married parents and $200,000 for other parents) the additional $1,000 and $1,600 provided under this proposal would phase out starting at lower income levels: $150,000 for married couples, $112,500 for heads of households and $75,000 for other parents. ITEP estimates that the CTC changes would provide around $116 billion to families with children for the year. The Ways and Means proposal would also make the credit available for children age 17, which is not included in these estimates.

Earned Income Tax Credit Expansion

Under current law, low-income working people without children living in their home are eligible for a very meager Earned Income Tax Credit (EITC) with a maximum of around $500. The Ways and Means proposal would roughly triple that amount. The proposal would lower the age eligibility for the childless EITC from 25 to 19 and eliminate the upper age limit which currently bars the credit for childless people age 65 and older. The changes described here would provide around $13 billion in additional EITC benefits to childless workers. This does not include the effects of some less significant changes that the plan would make to the EITC.