Tax policy is an important economic tool, but claims that tax changes will affect a state’s economy are often overstated.

Such overstated claims are particularly common in discussions of taxes on wealthy individuals and profitable corporations, so careful assessment of such claims is an important part of shaping adequate and equitable revenue streams.

A major concern of state policymakers is how to lure jobs to their state and improve the prosperity of residents. Too often, policymakers assume that tax cuts make the best bait. It’s not hard to understand why they might believe this. Tax-cut advocates frequently assert that cutting tax rates or handing out tax incentives will spur economic growth by attracting more jobs, more workers, and more employers to the state. They are sometimes backed up by businesses and high-profile individuals that threaten publicly to relocate to other jurisdictions if state governments won’t pony up lavish tax breaks.

Aggressive lobbying and campaign contributions from corporate interests or other moneyed interests can push policymakers to support tax breaks even if they have doubts about whether they are good policy. Cold evidence and common sense, however, show that tax cuts and incentives are an ineffective growth strategy for states.

Simply put, lower taxes are not a very good way to produce better economic outcomes. Advocates for lower taxes often cherry-pick academic studies that fit their preferred narrative, but the body of academic evidence on this question is at best mixed, suggesting that tax cuts are an underwhelming tool for economic development. While some studies suggest lower taxes are connected to state-level growth, others emphasize that more robust investments, funded with tax dollars, are equally if not more important.

Other Factors Are More Important Than Taxes

One reason state tax cuts don’t work is that state and local taxes are a small part of the overall cost of doing business. Taxes typically represent around 2 percent to 4 percent of a business’s total costs. As a result, even very large and costly tax cuts barely move the needle when viewed from the perspective of most businesses’ overall costs. Other factors like the cost of transportation, real estate costs, and the availability of skilled labor make a much bigger difference to location.

Another reason to be skeptical of tax cuts is that, given the interconnected nature of the U.S. and global economies, it can be hard for states to target their tax cutting toward exclusively in-state economic activities. Many capital gains and business tax cuts, for example, end up subsidizing investments made elsewhere—either in another state or on the other side of the world.

Tax Cuts Can Be Counterproductive for Growth

Yet another reason tax cuts don’t work is that every dollar lost to tax cuts is a dollar that can’t be used to fund education, transportation, and other public services. High-quality public services are important to residents, businesses, and the economy. Investing in public infrastructure such as schools, roads, and hospitals can be at least as good an approach as tax cuts to encouraging economic development – often better.

In other words, far from impeding economic growth, taxes fund the public services that make a state more attractive to businesses. Good roads and bridges, a well-educated workforce, and other government services are essential to business productivity and profitability.

Of course, there are real differences from state to state in rates of economic growth and interstate migration. But these differences tend to be driven by factors other than taxes, including regional and national economic factors, housing costs, demographic shifts, and even the weather. Individuals also tend to live where they have family and community ties or based on quality-of-life factors that are mostly unrelated to taxes.

Sometimes, rather than enacting broad tax cuts, policymakers enact narrow tax cuts aimed at specific firms or specific industries. Those efforts often fail as well. One big reason is that policymakers don’t fully account for alternative scenarios. Subsidizing one company, one industry, or one type of investment means that other companies or industries are less likely to invest and thrive. Such narrow subsidies also contribute to an overall sense of unfairness in the tax system.

Usually, the decision on where to locate is based on more important economic factors than taxes, such as proximity to suppliers and markets, and the availability of skilled workers. That’s why heads of major corporations will candidly admit that taxes are not very important in their location decisions. As Paul O’Neill, a former executive at Alcoa and President George W. Bush’s Treasury Secretary put it: “I never made an investment decision based on the tax code…If you are giving money away I will take it. If you want to give me inducements for something I am going to do anyway, I will take it. But good business people do not do things because of inducements.”

Related Entries

How Do State Corporate Income Taxes Work?

A robust corporate income tax ensures that profitable corporations help fund the public services they benefit from, just as working people do. It’s one of the few progressive taxes available to state policymakers.

How Do State Estate and Inheritance Taxes Work?

Estate and inheritance taxes are taxes on wealth passed on after someone’s death. They are a common way for states to tax the inheritances of wealthy individuals. These taxes ensure that those very large estates help pay for public services like schools, hospitals, and parks.

How Do States Tax Investment Income?

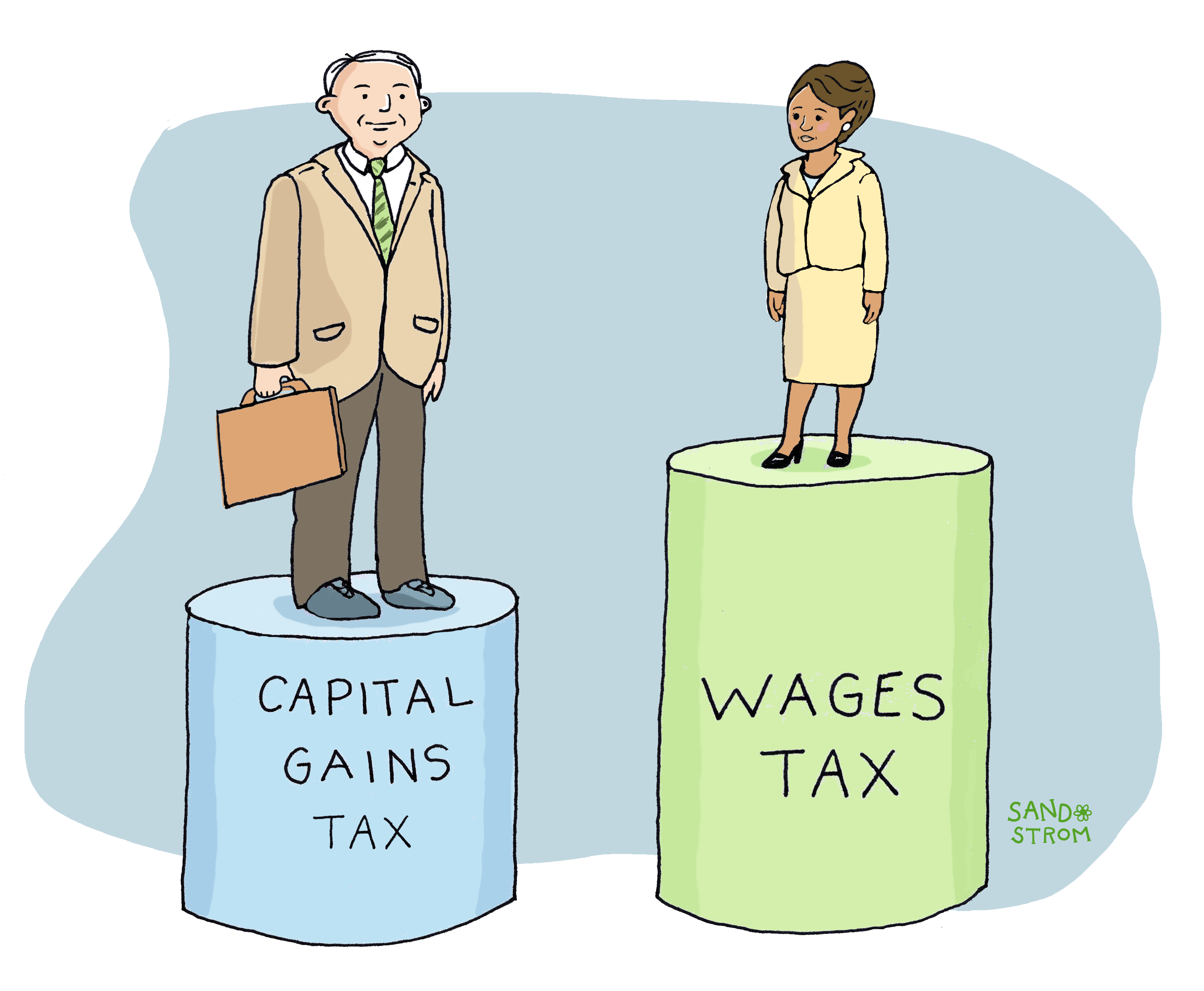

State personal income taxes apply not just to wages and salaries but also earnings on investments, like stocks and bonds. Most investments are held by wealthy people, so when states tax investment income at a lower rate than wages, high-income households pay tax at lower rates than middle-income households. By contrast, states that strengthen taxation of investment income can raise substantial revenue while improving economic and racial equity of their tax code.

Learn More

- Bartik, Timothy J. (2019). Making Sense of Incentives: Taming Business Incentives to Promote Prosperity. W.E. Upjohn Institute for Employment Research,.

- Davis, Carl (2013). “Tax Incentives: Costly for States, Drag on the Nation.” Institute on Taxation and Economic Policy, 2013.

- Davis, Carl (2020). “Another Reason to Tax the Rich? States with High Top Tax Rates Doing as Well, if Not Better, than States Without Income Taxes.” ITEP.

- Gale, William G., Aaron Krupkin, and Kim Reuben (2015). “The Relationship Between Taxes and Growth at the State Level: New Evidence.” National Tax Journal.

- Good Jobs First. “A Beginner’s Guide to Economic Development.” Accessed 2025.

- Lynch, Robert G. (2004). Rethinking Growth Strategies: How State and Local Taxes and Services Affect Economic Development. Economic Policy Institute.

- Mazerov, Michael (2013). “Academic Research Lacks Consensus on the Impact of State Tax Cuts on Economic Growth.” Center on Budget and Policy Priorities.

- Mazerov, Michael (2018). “Kansas Provides Compelling Evidence of Failure of ‘Supply Side’ Tax Cuts.”

- Mazerov, Michael (2023). “State Taxes Have a Minimal Impact on People’s Interstate Moves.” Center on Budget and Policy Priorities.

- Mazerov, Michael and Michael Leachman (2016). “State Job Creation Strategies Often Off Base.” Center on Budget and Policy Priorities.

- Young, Cristobal (2017). The Myth of Millionaire Tax Flight: How Place Still Matters for the Rich. Stanford University Press.