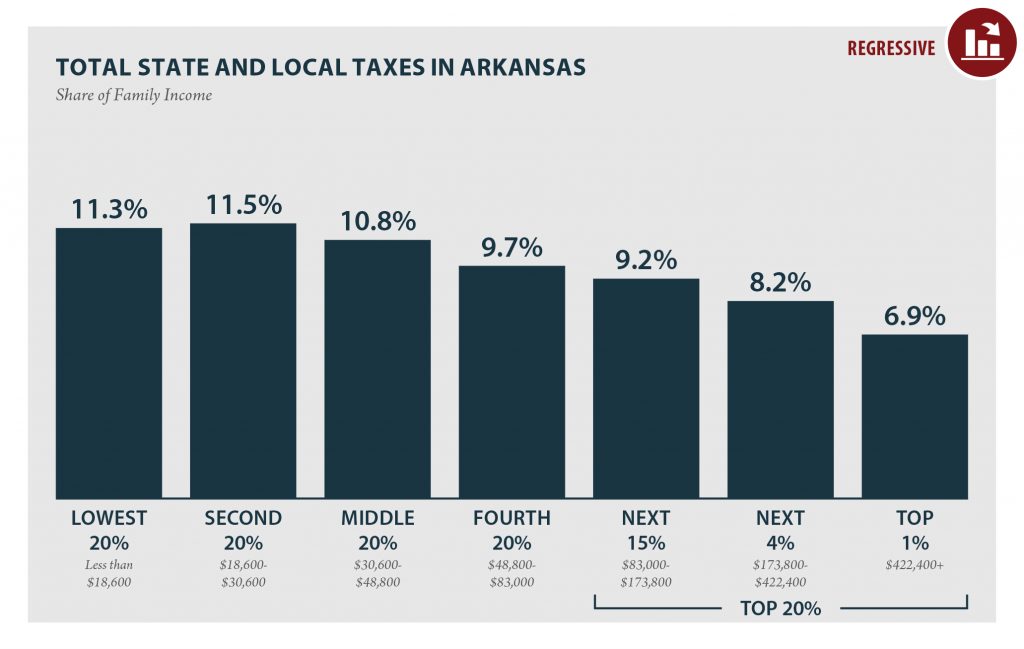

Many people in our state work at low-paying jobs. Arkansans who work hard for little money pay a much higher share of their income to state and local taxes compared to the wealthiest. That’s not the way it should be. Fortunately, there is a great option for Arkansas (just ask the 29 other states that are already using it!) that can help turn things around for working families. That option is a state-level Earned Income Tax Credit (or EITC). At Arkansas Advocates for Children and families, we are so in love with the Earned Income Tax Credit that we decided to sing about it.

Related Reading

October 17, 2018

Arkansas: Who Pays? 6th Edition

February 2, 2026

State Tax Watch 2026

Mentioned Locations

Arkansas