Overview

There is significant room for improvement in state and local tax codes. Income tax laws are filled with top-heavy exemptions and deductions. Sales tax bases are too narrow and need updating. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. In this light, the growing interest in tax reform among state lawmakers across the country is welcome news.

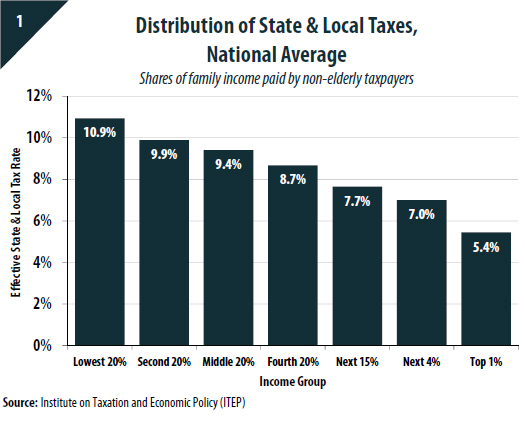

Too often, however, would-be tax reformers have proposed policy changes that would worsen one of the most undesirable features of state and local tax systems: their lopsided impact on taxpayers at varying income levels. Nationwide, the bottom 20 percent of earners pay 10.9 percent of their income in state and local taxes each year. Middle-income families pay a slightly lower 9.4 percent average rate. But the top 1 percent of earners pay just 5.4 percent of their income in such taxes. This is the definition of regressive, upside-down tax policy.

State and local tax systems add to the nation’s growing income inequality problem when they capture a greater share of income from low- or moderate-income taxpayers. Further, state tax systems that ask the most of families with the least are not well-suited to generate the revenues needed to fund schools, health care, infrastructure, and other public services that are crucial to building thriving communities. This problem is particularly acute in the long run since regressive tax systems depend more heavily on low-income families that face stagnating incomes while taxing the superrich, whose wealth and incomes continue to grow, at lower rates.

As the information in this chart book helps illustrate, it does not have to be this way. States vary considerably in the fairness of their tax codes, and pursuing policies adopted by states with the least regressive tax systems is a proven strategy for reducing tax inequity.

States levying robust personal income taxes with graduated tax rates, for example, tend to have overall tax systems that are more reflective of taxpayers’ ability to pay. By contrast, states with flat-rate personal income taxes or no personal income tax at all have among the most regressive tax systems in the nation.

And contrary to claims that everybody pays a “fair share” under sales and excise taxes, states relying heavily on these taxes to fund government tend to fare poorly in terms of the distribution of their tax systems. As this chart book shows, middle- and low-income taxpayers typically pay more tax on what they buy (sales and excise taxes) than on what they earn (income taxes), though many families may fail to notice this fact since the sales taxes they pay are spread out over countless purchases made throughout the year.

When states shy away from personal income taxes in favor of higher sales and excise taxes, high-income taxpayers benefit at the expense of low- and moderate-income families who often face above-average tax rates to pick up the slack. This chart book demonstrates this basic reality by examining the distribution of taxes in states that have pursued these types of policies. Given the detrimental impact that regressive tax policies have on economic opportunity, income inequality, revenue adequacy, and long-run revenue sustainability, tax reform proponents should look to the least regressive, rather than most regressive, states in crafting their proposals.

Index of Charts

Overall State & Local Tax Distribution

Chart 1: Distribution of State & Local Taxes, National Average

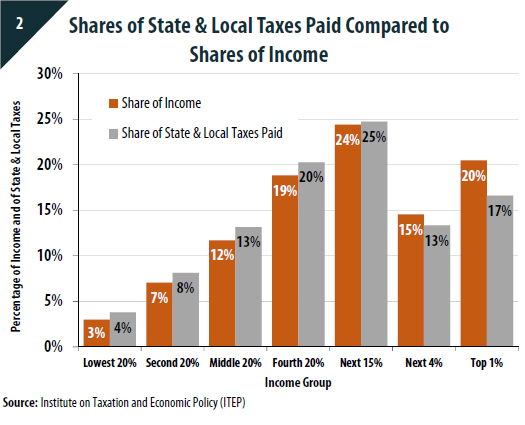

Chart 2: Shares of State and Local Taxes Paid Compare to Shares of Income

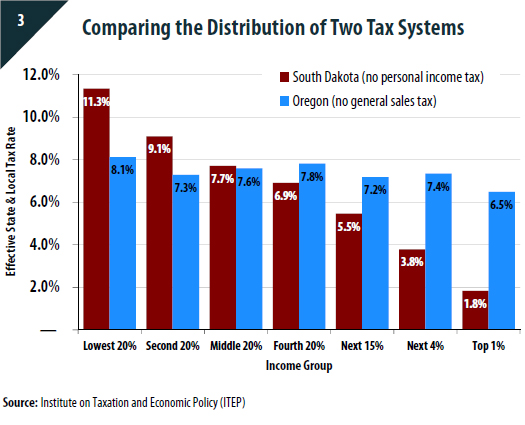

Chart 3: Comparing the Distribution of Two Tax Systems

Income Taxes

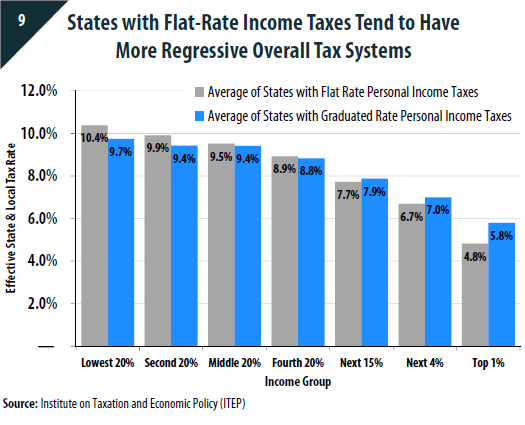

Chart 9: States with Flat-Rate Income Taxes Tend to Have More Regressive Overall Tax Systems

Sales & Excise Taxes

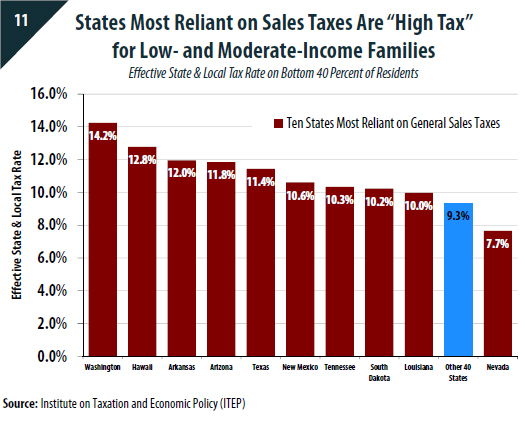

Chart 11: States Most Reliant on Sales Taxes Are “High Tax” for Low- and Moderate-Income Families

Comparing Income and Sales Taxes

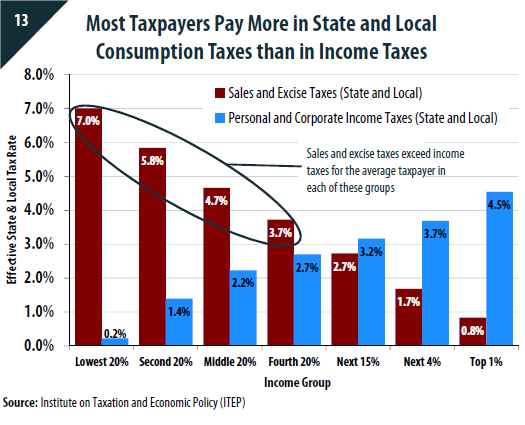

Chart 13: Most Taxpayers Pay More in State and Local Consumption Taxes than in Income Taxes

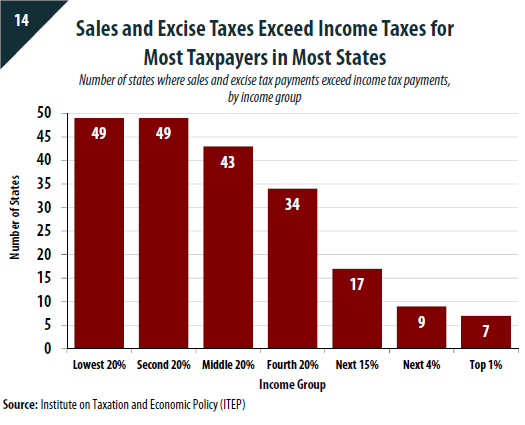

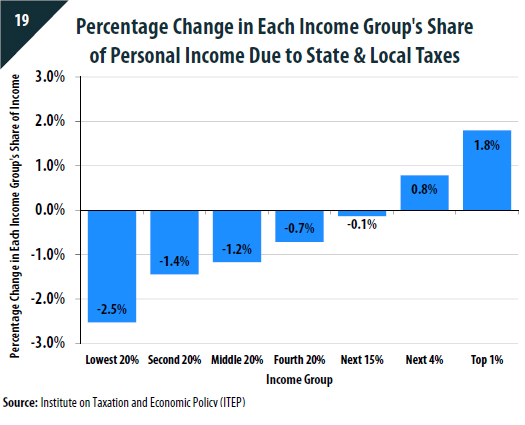

Chart 14: Sales and Excise Taxes Exceed Income Taxes for Most Taxpayers in Most States

Tax Fairness and Income Inequality

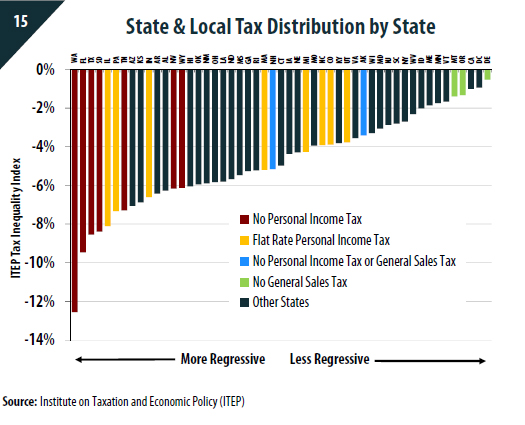

Chart 15: State & Local Tax Distribution by State (Chart)

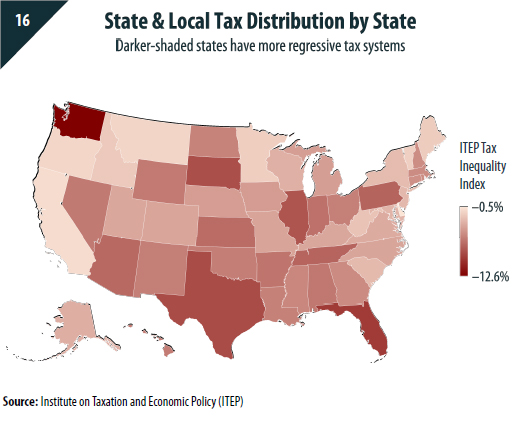

Chart 16: State & Local Tax Distribution by State (Map)

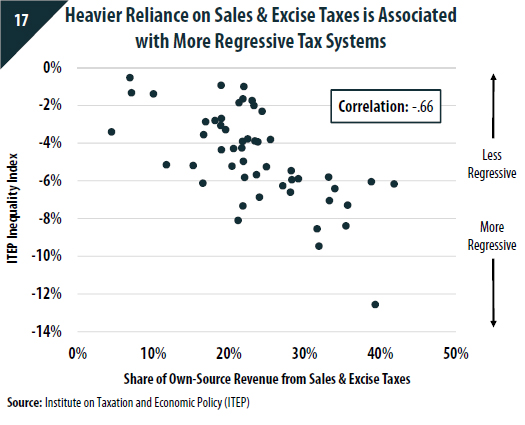

Chart 17: Heavier Reliance on Sales & Excise Taxes is Associated with More Regressive Tax Systems

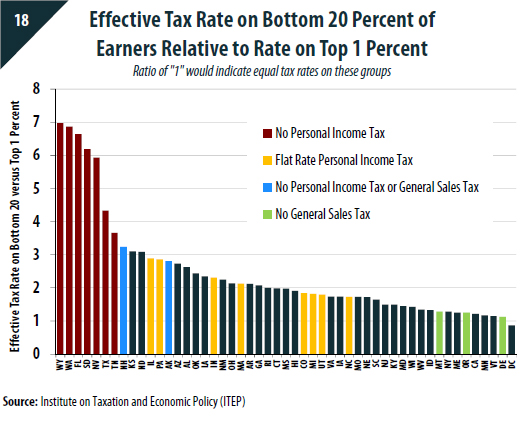

Chart 18: Effective Tax Rate on Bottom 20 Percent of Earners Relative to Rate on Top 1 Percent

|

State and local tax systems are upside-down, levying the highest effective tax rates on the lowest-income taxpayers

Virtually every state tax system is fundamentally unfair, taking a much greater share of income from low- and middle-income families than from high-income families. On average, the poorest 20 percent of taxpayers spend 10.9 percent of their income on state and local taxes, which is double the 5.4 percent average effective rate for the top 1 percent. While the reasons for this disparity vary by state, an overreliance on regressive consumption taxes and the lack of a sufficiently robust personal income taxare two of the most common features of state and local tax codes. Note: These figures are a national average of total state and local tax payments over total income, grouped according to the nationwide distribution of income. They include the impact of the federal deduction for state and local taxes paid. |

|

Unlike every other income group, the top 5 percent of earners pay a smaller share of state and local taxes than their share of income

The nation’s income is concentrated at the top. For example, the top 1 percent alone have a combined income that exceeds the bottom half of individuals and families. Despite this imbalance, state and local tax systems typically ask less of high-income families than of families of more modest means. The top 5 percent of earners pay a smaller share of state and local taxes than their share of income. The remaining 95 percent of families, by contrast, pay a larger share of state and local taxes than the share of income they earn. Note: These figures are based on a national average of total state and local tax payments over total income, grouped according to the nationwide distribution of income. They do not include the impact of the federal deduction for state and local taxes paid. |

|

The mix of taxes levied has major implications for the fairness of state tax systems

A comparison of tax systems in South Dakota and Oregon illustrates how the presence, or absence, of different types of taxes affects the fairness of state and local tax codes. South Dakota lawmakers’ decision not to levy a personal income tax is a major factor in the state having the fourth most regressive tax system in the nation, as determined by ITEP. The bottom 20 percent of South Dakotans face an effective tax rate (11.3 percent) more than six times as high as the rate paid by the top 1 percent of earners (1.8 percent). In Oregon, by contrast, heavier reliance on personal income taxes and the lack of a sales tax contributes to the state having one of the least regressive tax codes in the nation. While middle-income families in both states devote a similar share of their incomes to state and local taxes, South Dakota’s tax system asks far more of the poor while allowing high-income taxpayers to pay very low effective tax rates. Notably, Oregon’s less regressive tax code also raises significantly more revenue per person than South Dakota’s, in part because taxes levied on families with large incomes tend to generate more revenue than taxes levied on families without much income to tax. |

|

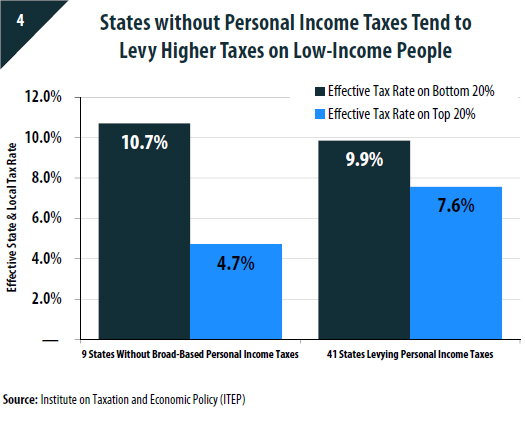

Not levying a personal income tax requires tradeoffs that are often detrimental to tax fairness

It is a common misconception that states without personal income taxes are “low tax.” In reality, to compensate for lack of income tax revenues these state governments often rely more heavily on sales and excise taxes that disproportionately impact lower-income families. As a result, while the nine states without broad-based personal income taxes are universally “low tax” for households earning large incomes, these states tend to be higher tax for the poor. Note: The nine states without broad-based personal income taxes are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. |

|

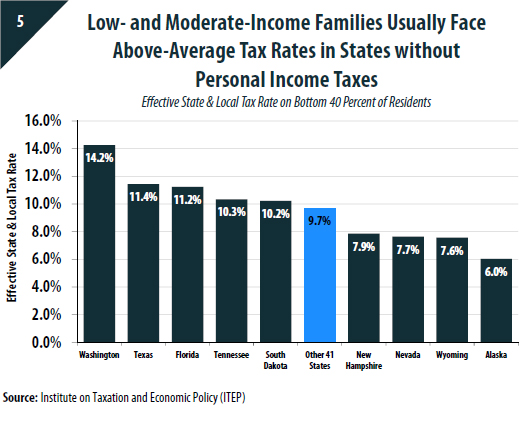

States without personal income taxes are not necessarily “low tax” for everyone

Five of the nine states without broad-based personal income taxes require their low- and moderate-income taxpayers (those in the bottom 40 percent of the income distribution) to pay more than 10 percent of their income in state and local taxes each year. Among states that levy personal income taxes, the average effective tax rate for this group is 9.7 percent. Of the four non-income-tax states with lower tax rates on low- and moderate-income families, three (Alaska, Nevada, and Wyoming) have sizeable mining and tourism sectors that allow them to collect significant tax revenues from non-residents. Additionally, two of these four states (Alaska and New Hampshire) lack a statewide general sales tax. States that compensate for the lack of a personal income tax by levying higher taxes on consumption tend to be “high tax” states for low- and moderate-income families. |

|

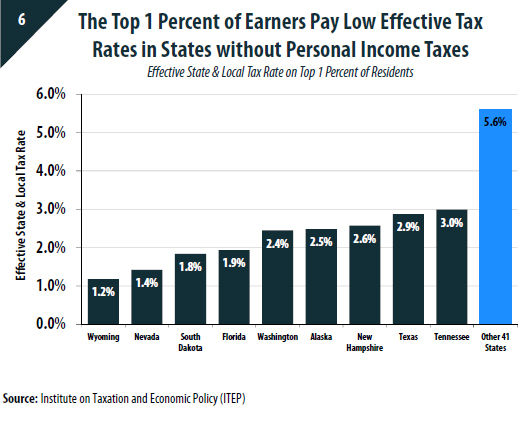

The nine states with the lowest overall tax rates on the wealthy all lack a broad-based personal income tax

Without exception, the lowest state and local tax rates in the nation are confined to nine states that do not levy personal income taxes. Among the 41 states that levy personal income taxes, the overall state and local tax rate (including income, sales, excise, and property taxes) applied to the top 1 percent of earners averages 5.6 percent. In states without personal income taxes, this rate is 3 percent or less. Wyoming, which lacks both a personal and corporate income tax, is the lowest-tax state in the nation for high-income taxpayers. States in this group with somewhat higher taxes on high-income earners often levy limited taxes on investment income (New Hampshire and Tennessee), significantly higher-than-average property taxes (New Hampshire and Texas), or notable corporate income taxes (Alaska, New Hampshire, and Tennessee). |

|

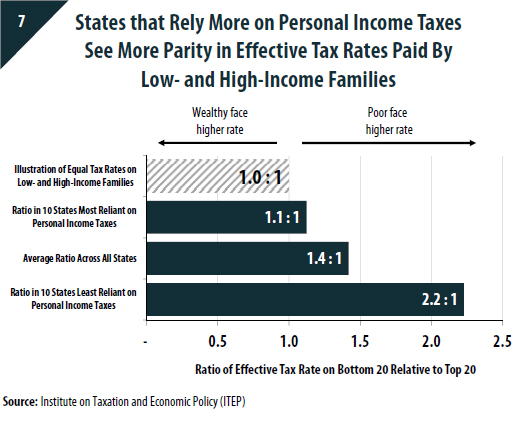

While the poor almost always face higher tax rates than the wealthy, the gap is narrowest in states with robust personal income taxes

Progressive personal income taxes provide an important counterbalance to other state and local taxes that often fall more heavily on low- and moderate-income families. The 10 states relying most on personal income taxes to fund government come closest to parity in tax rates across the income scale. States with little or no personal income tax, by contrast, charge the poorest 20 percent of taxpayers an average effective tax rate more than twice as high as the rate they charge their top 20 percent of taxpayers. Note: Reliance on personal income taxes is measured relative to state and local own-source revenue in Fiscal Year 2013, as reported by the U.S. Census Bureau. The ten most reliant states are Maryland, Massachusetts, Connecticut, Oregon, New York, California, Kentucky, Minnesota, the District of Columbia, and Virginia. The ten least reliant states are Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, Tennessee, New Hampshire, and North Dakota. |

|

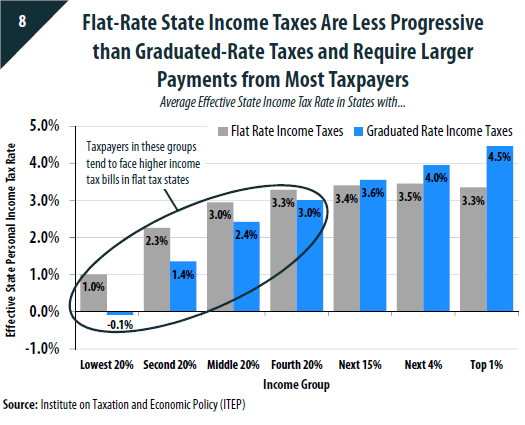

To compensate for less revenue from the wealthy, flat taxes often require higher payments by low- and middle-income families

States taxing personal income take one of two general approaches: a flat rate applied to all taxable income or a graduated system in which tax rates rise on larger incomes. Graduated-rate income taxes tend to be more progressive than flat-rate taxes. Because they allow states to collect more revenues from high-income taxpayers, graduated-rate taxes also typically allow for lower tax bills for low- and middle-income families. The middle 20 percent of individuals and families in states with flat-rate taxes, for example, tend to pay 3.0 percent of what they earn in income taxes. In states with graduated-rate taxes, by contrast, that figure is just 2.4 percent. Note: These figures do not include the impact of the federal deduction for state income taxes paid. Of the 41 states with broad-based state personal income taxes, eight levy flat-rate taxes and thirty-three (plus the District of Columbia) levy taxes with a graduated rate structure. The states with flat-rate taxes are Colorado, Illinois, Indiana, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah. |

|

Flat-rate income taxes are less effective at mitigating the regressive nature of other state and local taxes

Flat-rate income taxes apply one consistent rate to most taxpayers. But when other, often regressive, taxes are taken into account states with flat taxes tend to have significantly more lopsided tax codes than states with graduated-rate taxes. Low- and middle-income families generally pay more in flat tax states while high-income taxpayers pay substantially less in those states on average. Note: Of the 41 states with broad-based state personal income taxes, eight levy flat-rate taxes and thirty-three (plus the District of Columbia) levy taxes with a graduated rate structure. The states with flat-rate taxes are Colorado, Illinois, Indiana, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah. |

|

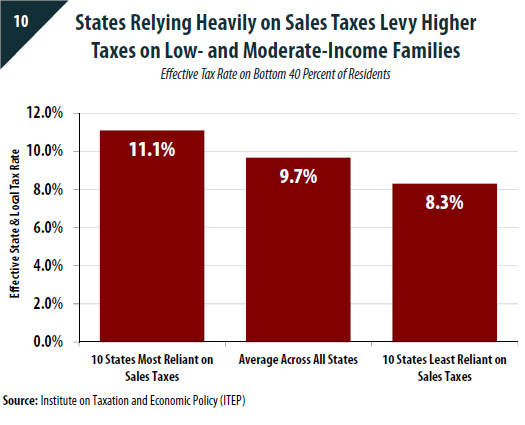

Sales taxes require low- and moderate-income families to pay far more of their income in tax

For individuals and families in the bottom 40 percent of the income distribution, lawmakers’ decisions to fund government primarily through sales and excise taxes, or through some other means, are particularly consequential. Among the 10 states most reliant on sales and excise tax revenues, the bottom 40 percent of earners face an overall effective state and local tax rate of 11.1 percent. This is 1.4 percentage points higher than the average rate faced by this group across all states and 2.8 percentage points higher than in the states least reliant on sales and excise taxes. Note: Reliance on general sales taxes is measured relative to state and local own-source revenue in Fiscal Year 2013, as reported by the U.S. Census Bureau. . The ten most reliant states are Washington, Hawaii, Arizona, South Dakota, Tennessee, Nevada, Arkansas, Louisiana, New Mexico, and Texas. The ten least reliant states are New Hampshire, Delaware, Oregon, Montana, Alaska, Vermont, Virginia, Maryland, Massachusetts, and Illinois. |

|

Sales taxes often determine if a state is “low tax” or “high tax” for low- and moderate-income families

Nine of the 10 states most reliant on general sales tax revenue to fund government require the bottom 40 percent of earners to devote 10 percent, or more, of their income to paying state and local taxes each year. Among the other 40 states, state and local taxes average 9.3 percent of income for this group. Choosing to fund government largely through sales taxes affects low- and moderate-income families most since they tend to spend a larger share of their earnings on items subject to sales tax. Note: Reliance on general sales taxes is measured relative to state and local own-source revenue in Fiscal Year 2013, as reported by the U.S. Census Bureau. Note that Louisiana increased its sales tax after the publication of ITEP’s Who Pays? report and that the state’s effective tax rate on the bottom 40 percent of earners would be higher if this increase were included in the data. |

|

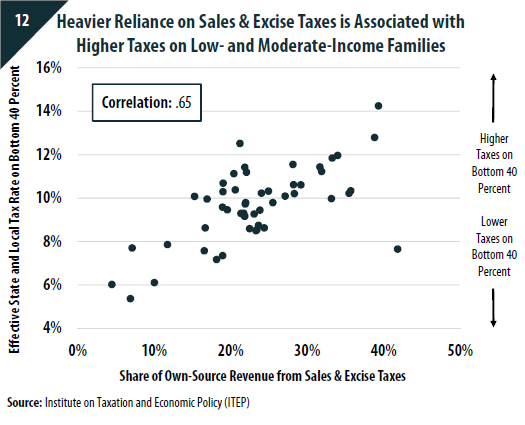

Sales taxes often determine if a state is “low tax” or “high tax” for low- and moderate-income families

While there is no single determinant of whether a state is “low tax” or “high tax” for the bottom 40 percent of earners, the level of reliance on sales and excise taxes has a major impact. In states where sales and excise taxes account for 30 percent or more of state and local revenue, effective tax rates on lower-income people almost always exceed 10 percent. In states deriving 15 percent or less of their revenue from these sources, effective tax rates on this group are 8 percent or less. Note: Reliance on state and local sales and excise taxes is measured relative to state and local own-source revenue in Fiscal Year 2013, as reported by the U.S. Census Bureau. |

|

Most middle-income and low-income taxpayers pay more in sales and excise taxes than in income taxes

Personal income tax returns reveal how much individuals and families pay in income taxes. But most taxpayers cannot measure how much sales and excise tax they pay on the purchases made in a given year. As it turns out, middle- and low-income taxpayers typically pay more taxes to their state and local governments based on what they buy (sales and excise taxes) than on what they earn (income taxes). Proponents of state income tax cuts often overlook this fact, and sometimes even propose policies that would intensify it by swapping lower income taxes for higher sales and excise taxes. Proposals to decrease income taxes that largely impact the wealthy while increasing the less visible sales and excise taxes that impact families of more modest means would exacerbate the upside-down nature of state tax codes. Note: These figures are a national average of total state and local tax payments over total income, grouped according to the nationwide distribution of income. They do not include the impact of the federal deduction for state and local taxes paid—a deduction which primarily reduces the final impact of state income taxes on upper-income taxpayers. |

|

In most states, sales and excise taxes have a larger effect on ordinary taxpayers than income taxes

The outsized impact that sales and excise taxes have relative to income taxes for most taxpayers is remarkably consistent across states. The bottom 40 percent of individuals and families in every state except Oregon, which lacks a general sales tax, pay more in sales and/or excise taxes than in income taxes. Even Delaware and Montana, which levy personal income taxes but not general sales taxes, ultimately collect more in excise taxes than in income taxes from their low- and moderate-income residents. In most states, the bottom 80 percent of earners pay higher taxes on what they buy (sales and excise taxes) than on what they earn (income taxes). Note: “Income taxes” refers to personal and corporate income taxes levied by each state and the localities within that state. The District of Columbia (DC) is excluded from this analysis. In DC, income tax payments exceed consumption tax payments for the bottom two income groups. |

|

The most lopsided state and local tax codes include a flat income tax or no income tax at all

The ITEP Tax Inequality Index measures the effects of each state’s tax system on income inequality. Essentially, it examines whether the gap in families’ shares of income is wider or narrower after state and local taxes are applied. States with regressive tax structures have negative inequality index scores, meaning that incomes are less equal in those states after state and local taxes than before. The farther the score falls below zero, the more regressive the tax code. Of the 15 most regressive state and local tax systems in the nation, 10 exist in states levying either a flat income tax or no personal income tax at all. By contrast, the 15 least regressive states all utilize a graduated-rate personal income tax. Note: An explanation of how the ITEP Tax Inequality Index is calculated is available in Addendum 2 of ITEP’s Who Pays? report. |

|

Lopsided tax codes can be found in every region of the country

While every state’s tax system is regressive, states in the South and Midwest tend to have more lopsided systems than average, asking far more of lower-and middle-income families relative to what is asked of the wealthy. But the relationship between tax fairness and geography is not ironclad. Every major region of the country has states that rank among the most regressive, and least regressive, in the nation. Note: An explanation of how the ITEP Tax Inequality Index is calculated is available in Addendum 2 of ITEP’s Who Pays? report. |

|

States raising more of their revenue with sales and excise taxes tend to have more regressive tax systems

Many features of state and local tax systems contribute to the fairness, or lack thereof, in those systems. One of the most important of such features is how heavily sales and excise taxes are relied upon in funding government. Those states where a significant share of revenue is derived from these taxes on consumption tend to receive lower scores in ITEP’s Tax Inequality Index, meaning that they fall disproportionately on low- and middle-income families rather than on families with large incomes. Note: Reliance on state and local sales and excise taxes is measured relative to state and local own-source revenue in Fiscal Year 2013, as reported by the U.S. Census Bureau. An explanation of how the ITEP Tax Inequality Index is calculated is available in Addendum 2 of ITEP’s Who Pays? report. |

|

Low-income taxpayers often pay state and local taxes at rates many times higher than high-income taxpayers

The gap in tax rates faced by low- and high-income residents varies considerably by state. At one end of the spectrum, states such as Wyoming and Washington tax their low-income residents at rates almost seven-fold higher than the rates charged to their high-income residents. At the other end of the spectrum, California, Delaware, Minnesota, Oregon, Vermont, and the District of Columbia each come close to taxing their highest and lowest-income residents at the same rate. Without exception, the largest disparities exist in states that fail to levy personal income taxes but that do levy general sales taxes. States with smallest gaps, by contrast, levy graduated-rate personal income taxes. |

|

Regressive state and local tax systems widen income inequality

While state and local tax laws are not the primary cause of income inequality, they do play a role in exacerbating existing gaps in income. Because low- and middle-income individuals and families face above-average state and local tax rates, their share of total income falls after state and local taxes are collected. Low-income families, for example, see their share of income fall by 2.5 percent (from 3.0 to 2.9 percent). High-income families, by contrast, experience a 1.8 percent gain in their share of income after these taxes are collected (from 20.5 to 20.8 percent of personal income). In other words, incomes are less equal after state and local taxes are applied than before. Note: These figures are based on a national average of total state and local tax payments over total income, grouped according to the nationwide distribution of income. They do not include the impact of the federal deduction for state and local taxes paid. Note that figures are expressed as percentages rather than percentage point change |

Conclusion

This chart book illustrates that states lacking robust personal income taxes and relying heavily on consumption taxes have some of the most lopsided tax systems in the nation. These states require far higher payments, relative to income, from low- and moderate-income families than from the wealthy. They often levy above-average tax rates on families facing economic hardship and below-average rates on their most affluent residents. In other words, these states are effectively worsening income inequality through their tax policies.

Progressive taxes simply make better economic sense in the short and long term. Higher-income taxpayers are better equipped financially to pay higher rates and, furthermore, income is growing fastest among the wealthiest Americans. If states rely more on progressive taxes they are more likely to experience the revenue growth necessary to adequately fund their schools, infrastructure, and other public services that are essential to building thriving communities.

While there is room for improvement in every state’s tax code, the example set by states that have embraced robust, graduated-rate personal income taxes is a useful one for proponents of tax reform to keep in mind.

About the Institute on Taxation and Economic Policy (ITEP)

The Institute on Taxation and Economic Policy (ITEP) is a non-profit, non-partisan research organization that works on federal, state, and local tax policy issues. ITEP’s mission is to ensure that elected officials, the media, and the general public have access to accurate, timely, and straightforward information that allows them to understand the effects of current and proposed tax policies. ITEP’s work focuses particularly on issues of tax fairness and sustainability.

About the data in this chart book

Most effective tax rates include both state and local taxes, minus the federal deduction for state and local taxes, as reported in ITEP’s report: Who Pays?, A Distributional Analysis of the Tax Systems in All Fifty States, 5th Edition. The report was produced using ITEP’s microsimulation tax model and is available online at www.whopays.org

Unless otherwise noted, any averages reported for groups of states are unweighted. Income group definitions vary by state in accordance with the distribution of income in each state. The District of Columbia is treated as a state in groupings of states.