The budget resolution passed by House Republicans yesterday will enrich the richest, blow up the deficit, and decimate vital public services. If adopted by the Senate, this framework will allow lawmakers to move forward on enacting President Trump’s tax plans through “reconciliation” legislation that cannot be filibustered in the Senate and therefore can pass without any Democratic votes. The budget resolution allows Congress to pass reconciliation legislation with $4.5 trillion in tax cuts – or more if Republicans’ spending cuts exceed the targets in the resolution – that would mostly flow to the wealthiest families in the country.

Congressional Republicans have no way to pay for the massive tax cuts promised by President Trump during his campaign other than to dismantle fundamental parts of the government and increase the federal budget deficit.

During his campaign, Trump talked of offsetting some of his proposed tax cuts with tariffs. Congressional Republicans have largely avoided discussing that idea after ITEP and others pointed out that tariffs would have the effect of a huge tax increase that outweighs any tax cuts for all but the richest Americans.

This is why Congressional Republicans have instead fixated on radical cuts in public investments, along with additional federal debt, as a way to pay for Trump’s promised tax cuts, which we estimate would cost well over $650 billion in the first year alone.

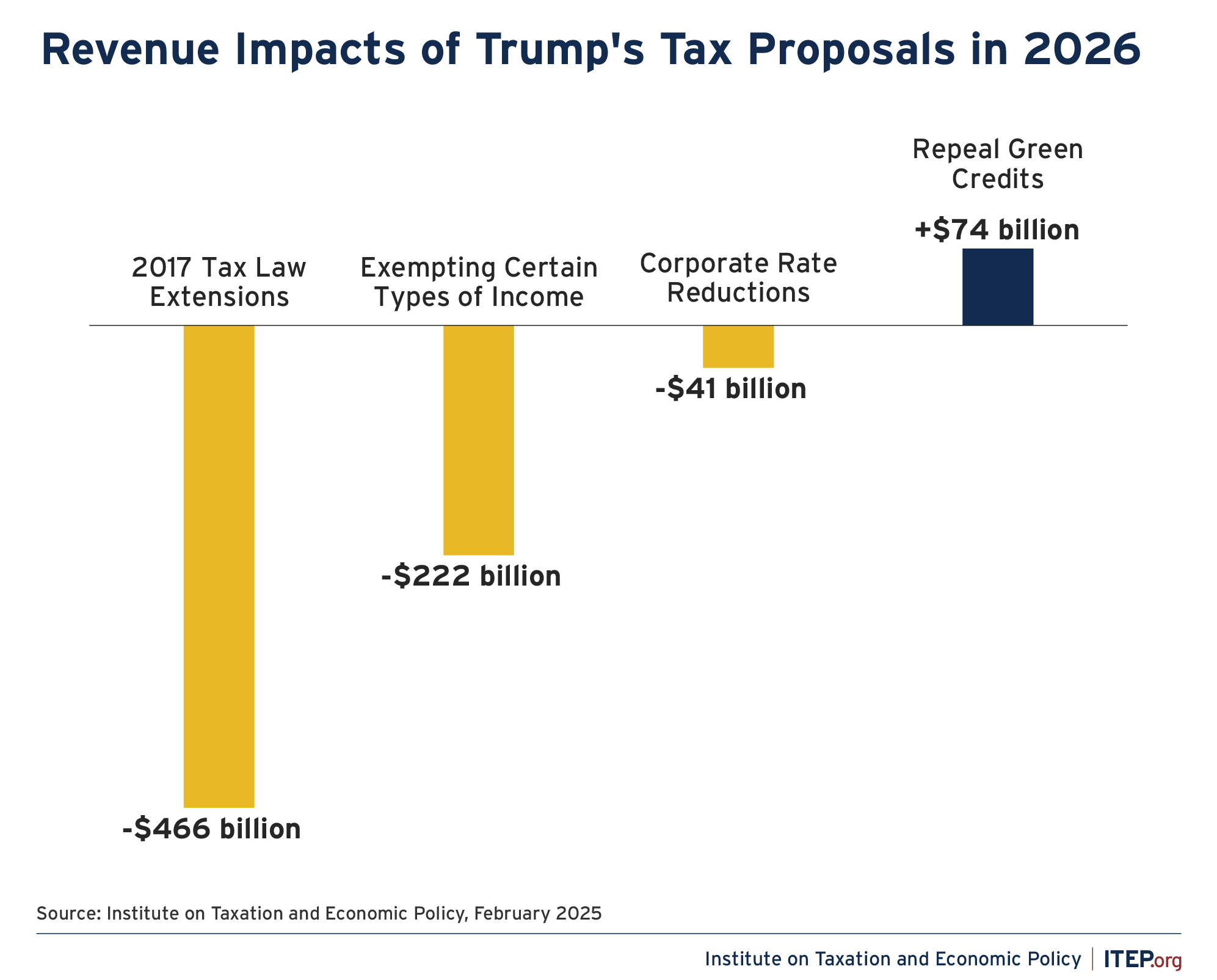

FIGURE 1

The costliest part of Trump’s tax proposals is extending the parts of his 2017 law that would otherwise expire at the end of this year, clocking in at $466 billion in 2026. Next in line is a series of proposals to exempt certain kinds of income (tips, overtime pay, Social Security benefits) from taxes, which would cost $222 billion in 2026. During the campaign Trump also suggested lowering the overall corporate income tax rate from 21 to 20 percent and pairing that with an additional reduction to 15 percent for “companies that make their product in America,” which would cost another $41 billion in 2026. Trump also proposed to offset a tiny fraction of these tax cuts by repealing green energy tax credits, which would raise only $74 billion next year.

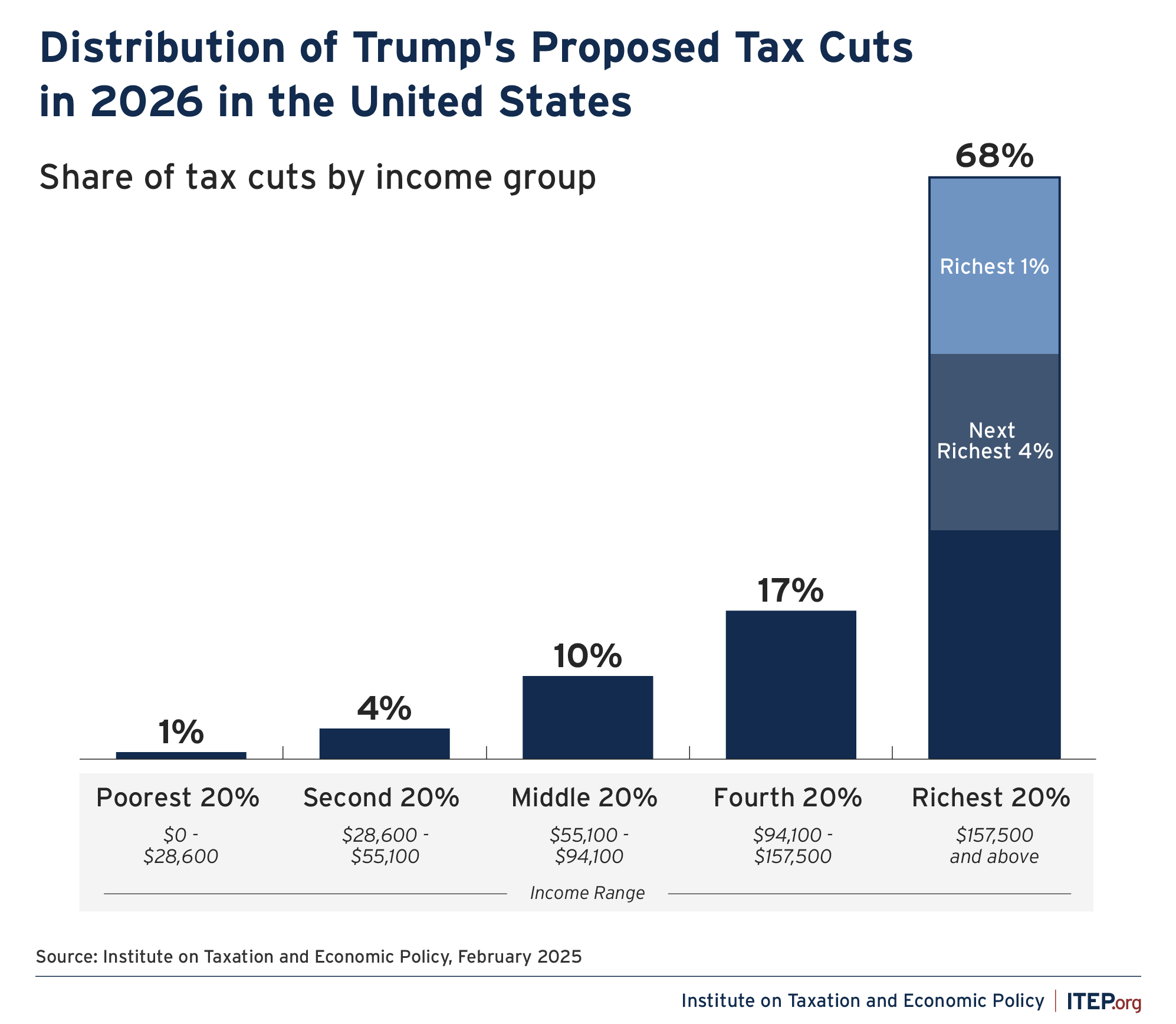

FIGURE 2

More than two-thirds of the benefits of these changes would go the richest fifth of Americans, with 21 percent of the benefits flowing to the richest 1 percent alone. Meanwhile, the middle fifth (20 percent) of Americans would get just 10 percent of the benefits and the poorest fifth of Americans would receive 1 percent.

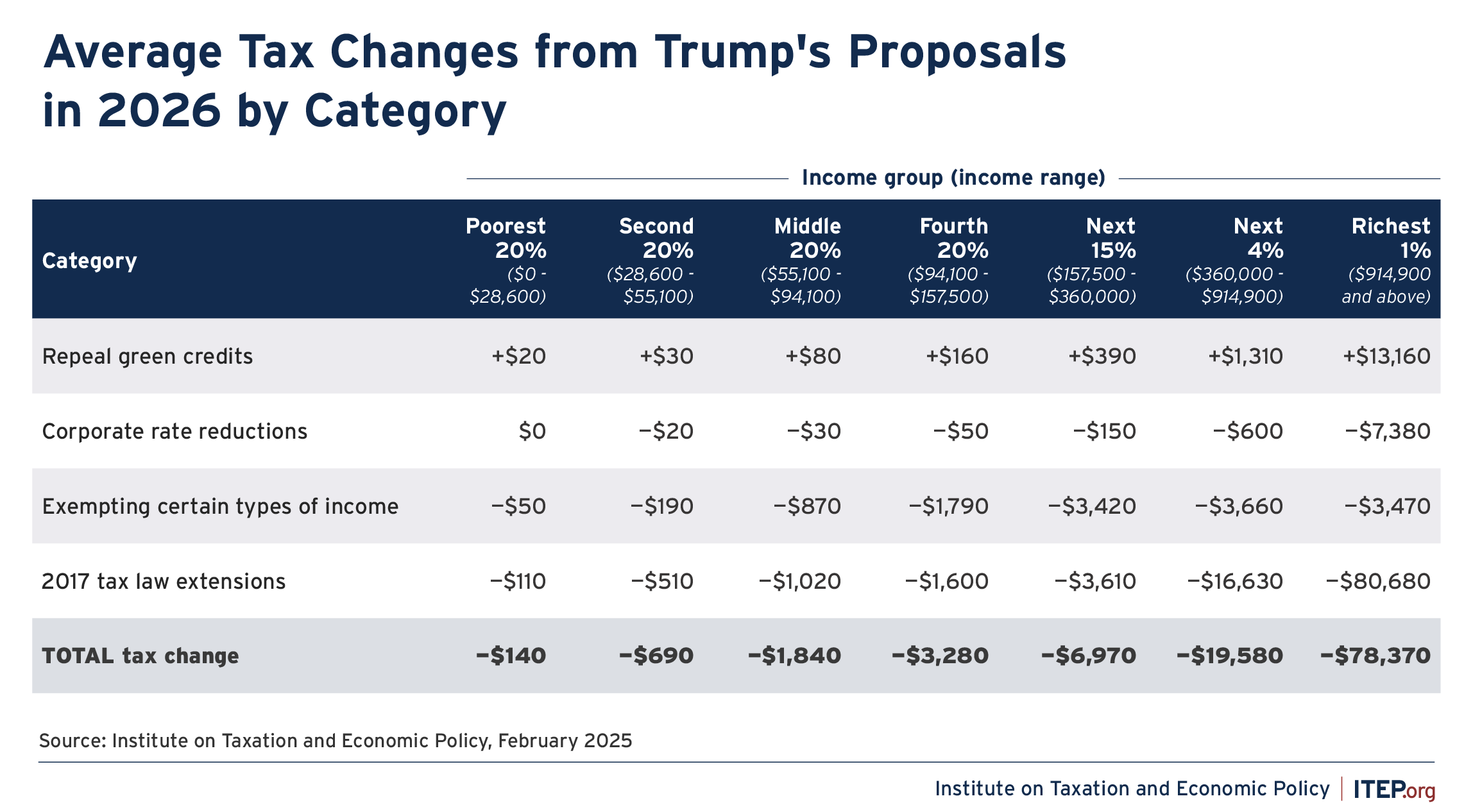

FIGURE 3

The richest 1 percent would particularly benefit from the extension of Trump’s 2017 tax law, which would provide taxpayers in this group an average tax cut of more than $80,000 in 2026 alone. These figures assume that Congressional Republicans would not extend the one 2017 provision that limited tax breaks for the rich (the cap on deductions for state and local taxes, or SALT) in keeping with Trump’s statements during the campaign, but lawmakers could ultimately take a different approach.

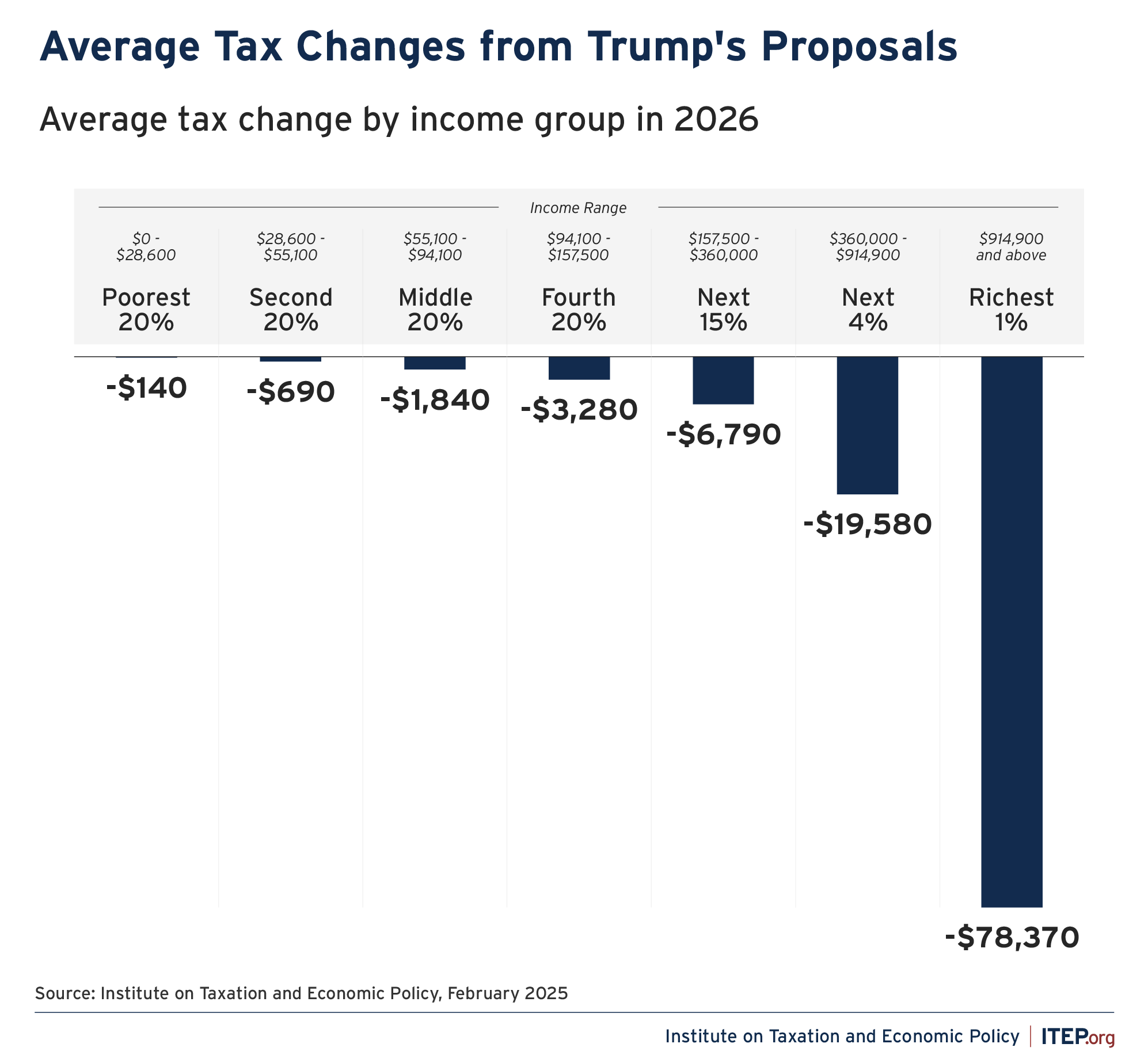

FIGURE 4

Altogether, the richest 1 percent would receive an average tax cut of more than $78,000 in 2026 alone, far outstripping tax cuts to taxpayers in any other income group.

You can find more details in these tables.

For more information, see ITEP’s report on Trump’s tax plan.