Local and state governments receive funds from fines and fees paid by people and businesses who have been charged with various offenses. These supplement tax revenues.

Such financial penalties are intended to deter and punish bad behavior. But relying too heavily on fines and fees worsens economic and racial inequality, creates incentives for over-policing, and creates an unstable funding stream for crucial public services.

Local and state governments levy fines for a host of different reasons, whether it’s a $25 speeding ticket, a $500 fine for a misdemeanor violation, a $250-per-day building code or restaurant cleanliness violation, or a six- or seven-figure penalty to a corporation for polluting the air or water. Fine amounts usually reflect the severity of the violation to serve as a deterrent for violating the law again, and they often increase for repeat violations.

Beyond the fines themselves, people who interact with the criminal legal system may have to pay additional fees, sometimes quite out of proportion to the offense. People charged with a relatively minor crime may be required to pay hundreds or even thousands of dollars in additional court filing fees, pre- and post-trial detention fees, and interest on those charges if they cannot pay immediately. Often, these fees apply to all defendants and may not even require a person to be convicted of a crime. Criminal justice fines and fees are used by large and small municipalities alike, totaling $14 billion nationwide in 2022.

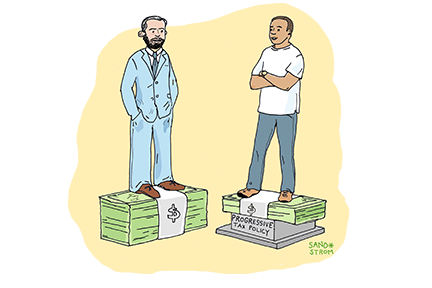

Fines are intended to deter bad behavior, but they are not always effective, and problems arise when governments rely on them too much for revenue. Most obviously, fines and fees are regressive because they are nearly always imposed without acknowledgment of the individual’s ability to pay. While a $50 ticket may be manageable for middle- or high-income individuals, it can be the difference in rent, utilities, or meals on the table for those with low incomes. And if a family needs more time to scrape together enough money to pay, they can face additional penalties that rack up over time. That interest can lead to suspended driver’s licenses and impounded vehicles, making it harder for individuals to get out of debt by limiting their transportation options.

Many state laws include provisions that garnish wages or withhold income tax returns to reimburse local governments who were never paid by violators, which harms families who may rely on income tax returns to pay for essential needs.

While the revenues from fines and fees are small for most communities, budget pressures or other constraints can force some municipalities to become overly reliant on these funds. When policing focuses on extracting revenues instead of keeping communities safe, it has disparate, disproportionate negative effects on Black and Latino communities.

Communities with more residents of color are more likely to use fines and fees to generate revenue, due to a combination of persistent racial profiling issues that result in more police encounters for Black and Latino drivers and residents, low property or sales tax receipts, and reduced political power for Black and Latino residents.

This first came to national attention after a U.S. Department of Justice report detailed the constitutional violations and racial profiling of residents in Ferguson, Missouri. According to that report, the city collected 23 percent of its revenues from fines and fees in 2015. And it’s not just small cities: in 2024, Chicago generated nearly $316 million in revenues from fines and fees – about 7 percent of its general fund. In other cities, like Houston, Los Angeles, and New York City, the share is much lower; nationwide, fines and forfeits were less than 1 percent of state and local revenue in 2023.

The overreliance problem is particularly acute for many courts, prosecutors’ offices, and public defenders’ offices across the country that are still financed primarily through court fees rather than dedicated funding streams. This can drive judges and prosecutors to levy fines and fees just to sustain the legal system. In addition, collection efforts themselves can be costly, with some municipalities spending more money collecting fines and fees than those fines and fees generate in revenue. Poor data collection means many local leaders overstate how much revenue fines and fees actually produce. States who wish to reduce court reliance on fines and fees for revenues should ensure courts are fully funded through broad-based taxes.

Fines and fees should not be a replacement for state and municipal revenues that may be raised more equitably and consistently through broad-based taxes. Many states and cities have made crucial changes to their fines and fees systems to reduce unjust penalties. States and cities can improve fairness and reduce municipal reliance on criminal justice fines and fees by adopting charges tied to ability to pay with higher fines for higher-income violators, payment plans, debt forgiveness programs, and alternatives to cash penalties. In one sign of improvement, the most recent data shows that Ferguson, once the poster child for excessive reliance on this problematic source of funds, in 2024 received less than 1 percent of its revenues from criminal fines and fees.

Related Entries

What Are Local Governments’ Taxing Authorities?

Tens of thousands of local governments in the United States, from big cities like Los Angeles and New York to rural counties, school districts, and small towns, operate schools, roads, parks, public safety, and other services. To pay for it, they collect roughly $1 trillion in taxes annually and receive another $800 billion in grants from states. But states, not just localities, set many of the rules for local taxes, and sometimes use that authority to undermine local democracy.

How Do State and Local Tax Systems Affect Racial Justice?

State and local tax codes have the potential to either narrow or widen racial inequality created by historical and current injustices in public policy and in broader society. In general, tax codes that are more progressive across the economic spectrum do more to narrow racial inequality, while regressive tax policies exacerbate it.

Learn More

- Boardman, Andrew (2023). “States and Localities are Making Progress on Curbing Unjust Fees and Fines.” ITEP.

- Davis, Carl, Misha Hill, and Meg Wiehe (2021). “Taxes and Racial Equity: An Overview of State and Local Policy Impacts.” ITEP.

- “Driven Into Debt: How Tickets Burden the Poor,” published from Feb. 27, 2018 through Jul. 8, 2022. ProPublica series.

- Johnson, Shanelle (2020). “First Steps Toward Equitable Fines and Fees Practices: Policy Guidance on Ability-to-Pay Assessments, Payment Plans, and Community Service.” Fines and Fees Justice Center.

- U.S. Commission on Civil Rights (2017). “Targeted Fines and Fees Against Communities of Color: Civil Rights and Constitutional Implications.”