Updated July 7, 2025

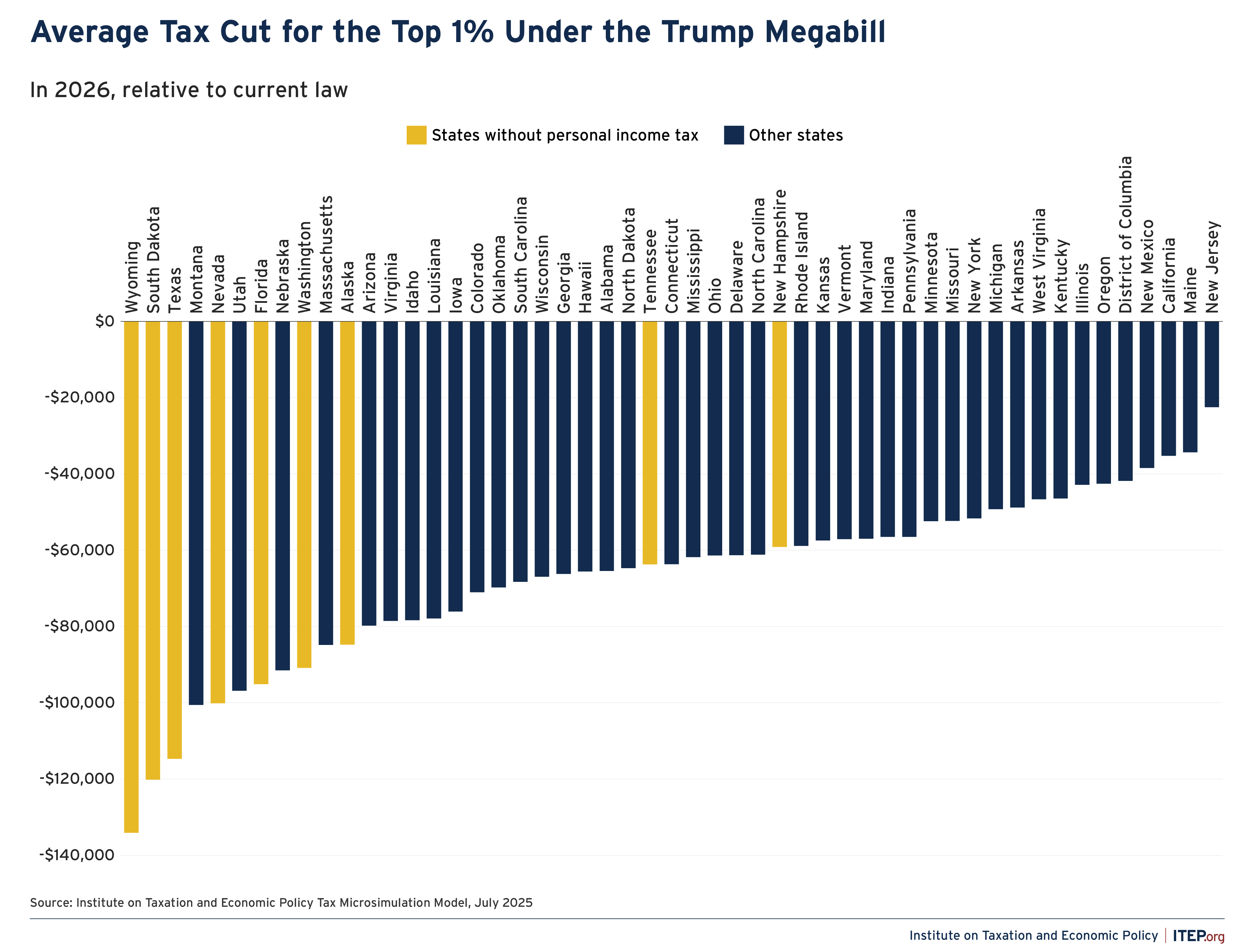

The tax and spending bill signed into law by President Trump on July 4 will bring very large tax cuts to very high-income people. In total, the richest 1 percent would receive $117 billion in tax cuts next year alone. That will amount to $66,000 for each of these affluent households.

Rich families in every state will fare well under the Senate plan because it would slash top tax rates, permanently enshrine tax carveouts for wealthy business owners, and exempt many large fortunes from the estate tax. In some states, though, the wealthy will fare particularly well because they would be unscathed by the bill’s cap on deductions for state and local taxes paid, or SALT. Extending the temporary SALT deduction cap first approved by Republicans in 2017 is one of the chief tools—along with rolling back public investments in health, food assistance, and the climate—that proponents would use to partly curb the very high price tag of the bill.

According to ITEP’s analysis, the richest 1 percent in five states will see tax cuts averaging more than $100,000 per year: Wyoming, South Dakota, Texas, Montana, and Nevada. Four of these five states do not levy personal income taxes and therefore have among the lowest state-level taxes on the rich in the nation. Rich Texans, for example, will receive all the upside of business carveouts and estate tax cuts with almost none of the downside of a SALT deduction cap, because they are paying very little in state taxes anyway.

By now it is widely understood that the centerpiece of the megabill is an enormous windfall to the wealthy. If an asterisk must be attached to that point, it’s that the windfall will be particularly immense for wealthy families in more conservative-leaning states with light taxes on the rich.

| State | Average tax cut for top 1% in 2026 |

|---|---|

| Wyoming | $134,080 |

| South Dakota | $120,130 |

| Texas | $114,680 |

| Montana | $100,580 |

| Nevada | $100,110 |

| Utah | $96,850 |

| Florida | $95,110 |

| Nebraska | $91,480 |

| Washington | $90,850 |

| Massachusetts | $84,800 |

| Alaska | $84,760 |

| Arizona | $79,750 |

| Virginia | $78,530 |

| Idaho | $78,320 |

| Louisiana | $77,880 |

| Iowa | $76,100 |

| Colorado | $71,020 |

| Oklahoma | $69,750 |

| South Carolina | $68,260 |

| Wisconsin | $66,950 |

| Georgia | $66,240 |

| Hawaii | $65,580 |

| Alabama | $65,430 |

| North Dakota | $64,710 |

| Tennessee | $63,730 |

| Connecticut | $63,660 |

| Mississippi | $61,810 |

| Ohio | $61,340 |

| Delaware | $61,290 |

| North Carolina | $61,150 |

| New Hampshire | $59,170 |

| Rhode Island | $58,840 |

| Kansas | $57,440 |

| Vermont | $57,080 |

| Maryland | $56,980 |

| Indiana | $56,520 |

| Pennsylvania | $56,510 |

| Minnesota | $52,370 |

| Missouri | $52,340 |

| New York | $51,630 |

| Michigan | $49,220 |

| Arkansas | $48,810 |

| West Virginia | $46,640 |

| Kentucky | $46,420 |

| Illinois | $42,850 |

| Oregon | $42,580 |

| District of Columbia | $41,840 |

| New Mexico | $38,450 |

| Maine | $34,340 |

| California | $35,260 |

| New Jersey | $22,490 |

|

ITEP.org

|

|