Kansas

This past week, in statehouses around the country, tax policy decisions are moving fast as budgets were signed and budget plans were released and passed...

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

While the conversations on the debt ceiling heat up in the nation's capital, debates on state tax policy also continue to unfold in capitol buildings across the nation...

Kansas Avoids Flat Tax Proposal: Narrow Victory a Cautionary Tale for Other States

April 27, 2023 • By Brakeyshia Samms

Kansas lawmakers failed to override Gov. Laura Kelly’s veto of a damaging flat tax package. In doing so, the state narrowly avoided traveling again down the same disastrous yet well-worn path of deep income tax cuts. States across the country can learn from Kansas’s experience by rethinking tax policy decisions and broader statewide priorities.

This week the importance of state tax policy is center stage once again...

State Rundown 4/12: Tax Day 2023 – A Good Reminder of the Impact of Our Collective Investments

April 12, 2023 • By ITEP Staff

With Tax Day quickly approaching it’s worth taking some time to reflect not just on tax forms (though those are important!), but also on the current state of state tax policy...

Over the past week Washington state saw a major victory for tax fairness after the state Supreme Court held the state’s capital gains tax—passed in 2021—constitutional...

As nature bursts into life and color with the arrival of spring, state tax proposals are doing the same as the legislative seeds planted by lawmakers earlier this year start to grow, blossom, and in some cases rot. However, some governors are not entirely happy with what state lawmakers have produced.

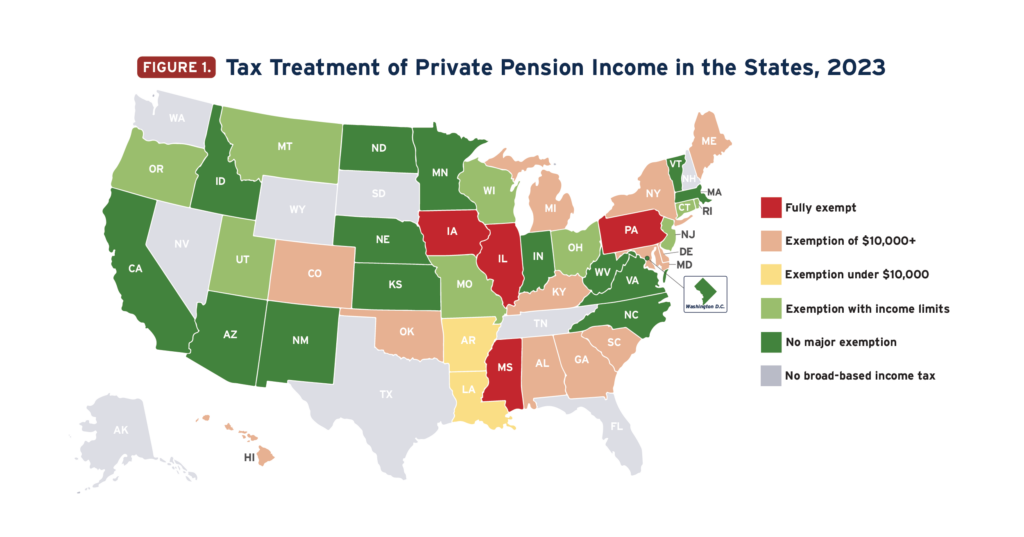

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities

March 22, 2023 • By ITEP Staff

Contact: Jon Whiten – [email protected] Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities State lawmakers should focus on improving overall tax fairness, not creating special carveouts based on age Lawmakers in several states are currently considering tax subsidies for senior citizens, even though these breaks are costly and poorly targeted. […]

It’s March and state lawmakers are showing why the Madness isn’t only reserved for the basketball court...

Kansas Legislators’ War on the Poor Opens Worrisome New Front: School Vouchers and Tax Avoidance

March 13, 2023

Kansas legislative leaders have declared war on the poor. They have pushed bills penalizing those receiving government assistance through the House Welfare Reform Committee. They have advocated a flat tax plan that benefits the wealthy at the expense of everyone else. We have watched these proposals unfold in recent weeks, watched and heard the disdain. Yet the war has […]

Lured by Promises of Financial Gain, Wealthy Families are Flocking to Voucher Tax Shelters and Eroding Public Education in the Process

March 7, 2023 • By ITEP Staff

Contact: Jon Whiten – [email protected] Lawmakers in several states are discussing enacting or expanding school voucher tax credits, which reimburse individuals and businesses for “donations” they make to organizations that give out vouchers for free or reduced tuition at private K-12 schools, as a new brief released today by the Institute on Taxation and Economic […]

Wealthy families are overwhelmingly the ones using school voucher tax credits to opt out of paying for public education and other public services and to redirect their tax dollars to private and religious institutions instead. Most of these credits are being claimed by families with incomes over $200,000.

This week, several big tax proposals took strides on the march toward becoming law...

State Rundown 2/23: Tax Dominos Take Shape, Begin to Fall as Session Heats Up

February 23, 2023 • By ITEP Staff

The 2023 legislative session is in full swing, and dominos continue to be set up as others fall...

Kansas Reflector: Kansas Senate Flat Tax Would Cut $1 for Low-Wage Earners, Hand Windfall to Top 1%

February 22, 2023

A flat tax plan moving through the Senate is structured to provide minimal relief to low-income Kansans while granting a windfall to high wage earners. Read more.

Kansas Action for Children: Flat Tax: Simple Doesn’t Mean Smart

February 16, 2023

The state has seen increased revenue in recent years, with the state budget including millions of dollars in surplus revenue. The temporary, higher receipts have led to several tax cut proposals. Now, some politicians and special business interest groups are proposing to use lingering budget surpluses to tilt the tax code even further in their favor. […]

This week, a fresh bouquet of tax proposals was delivered by state lawmakers, but not all of them have left us with that warm, fuzzy feeling in our stomachs...

State Rundown 2/1: February Brings New (and Some Old) Tax Policy Conversations

February 1, 2023 • By ITEP Staff

Tax bills across the U.S. are winding their way through state legislatures and governors continue to set the tone for this year’s legislative sessions...

Kansas Reflector: Analysis Show Kansas Chamber’s Flat Tax Proposal Costs $1.5B, Favors Top 20% of Wage Earners

January 30, 2023

Assessments by the Kansas budget director and an independent tax policy institute Monday showed the flat tax proposal by the Kansas Chamber would reduce the state budget by $1.5 billion per year and primarily benefit the state’s most affluent wage earners. Read more.

State Rundown 1/26: Tax Season Brings With it Reminder of EITC’s Impact

January 26, 2023 • By ITEP Staff

Tax season has officially kicked off and with Earned Income Tax Credit (EITC) Awareness Day right around the corner, it serves as another reminder for how important the EITC is...

Yahoo News: Flat Income Taxes: Who Are the Biggest Winners and Losers?

January 25, 2023

From Kansas to Wisconsin to Nebraska, the conversation surrounding a flat tax has picked up as of late, with more state legislators pushing for as much. Read more.

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.

State Rundown 1/11: Governors Ready to Talk Tax in 2023 State Addresses

January 11, 2023 • By ITEP Staff

Governors have begun their annual trek to the podium in statehouses across the U.S. to lay out their visions for 2023, and so far, taxes look like they will play a major role in debates throughout state legislative sessions...