Maryland Gov. Wes Moore put forward a tax reform plan that would make the tax system fairer, simpler, and better able to meet the state’s needs.

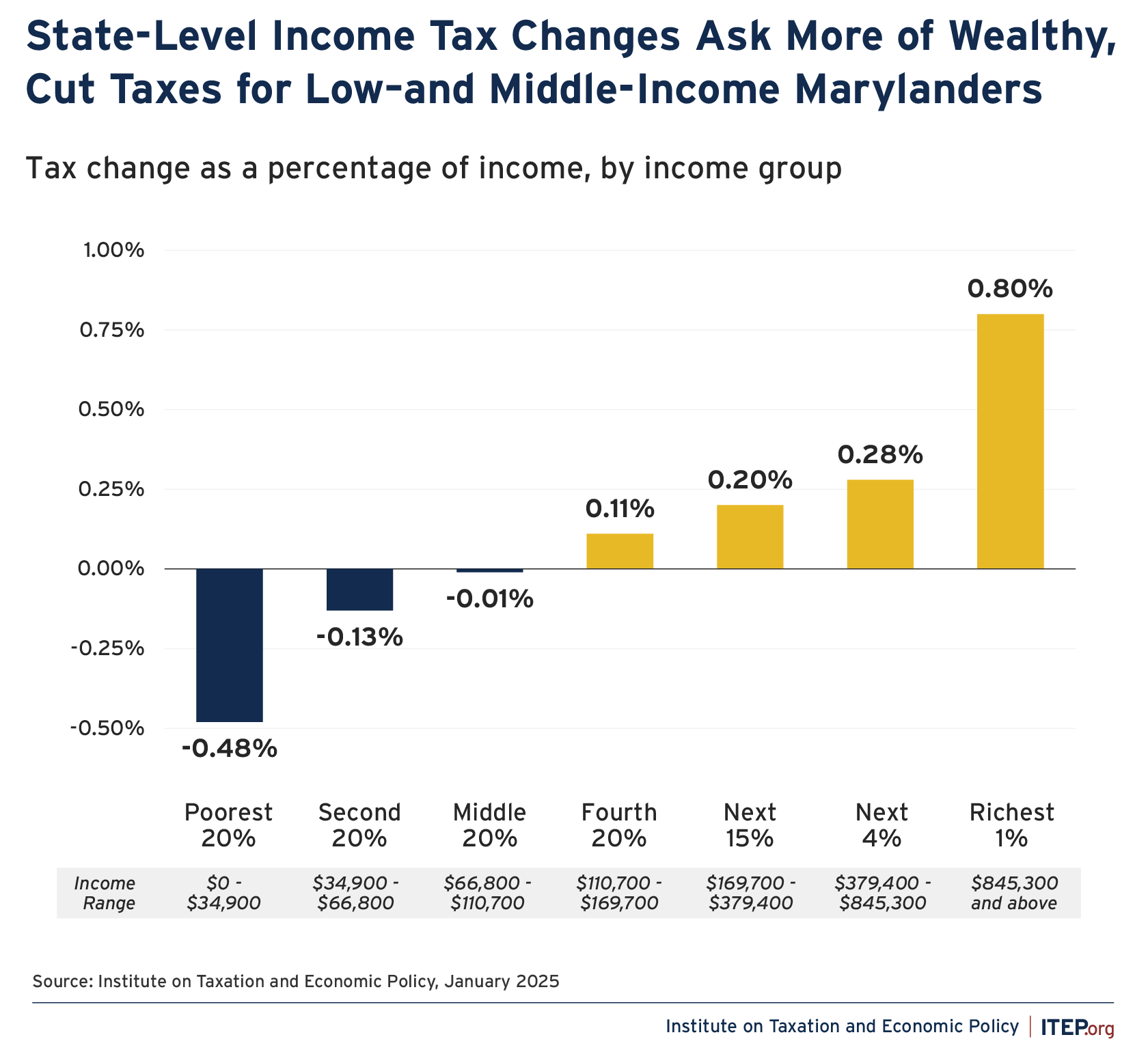

The proposed changes to the income tax ask more of those at the top and provide an average tax cut for those earning less. Our analysis shows that more than three-fourths of the new revenue would come from the wealthiest 20 percent of households. And 80 percent of the revenue from the rate, bracket, and capital gains changes would come from the top 1 percent of households, those earning, on average, more than $2 million annually.

Nearly 65 percent of households would see a tax cut and those cuts would primarily go to middle and low-income households. Just 20 percent of Maryland households would pay more, and most of those earn more than $169,700 a year. And a big chunk of the new revenue (40 percent) would come from the state’s wealthiest 1 percent. When considering the local impacts, the proposal is even more progressive.

FIGURE 1

The wealthiest 1 percent of Maryland taxpayers are currently the least-taxed income group in the state. This plan asks more of those at the top.

Under current law, the top 1 percent of Maryland taxpayers pay 9 percent of their income in total state and local taxes, the lowest of any income group in the state. By comparison, the poorest 20 percent of Maryland taxpayers pay 9.6 percent of their income in total taxes and working-class families in the middle 60 percent pay 11.3 percent.

Under the governor’s plan, the top state income tax rate – now 5.75 percent — would rise to 6.5 percent on household incomes over $1 million (or $1.2 million for married couples), with a smaller increase on incomes over $500,000 ($600,000 for married couples). For incomes over $350,000, an additional 1 percent tax would be levied on profits from the sale of stocks and other assets – a provision that will mostly affect the wealthiest households.

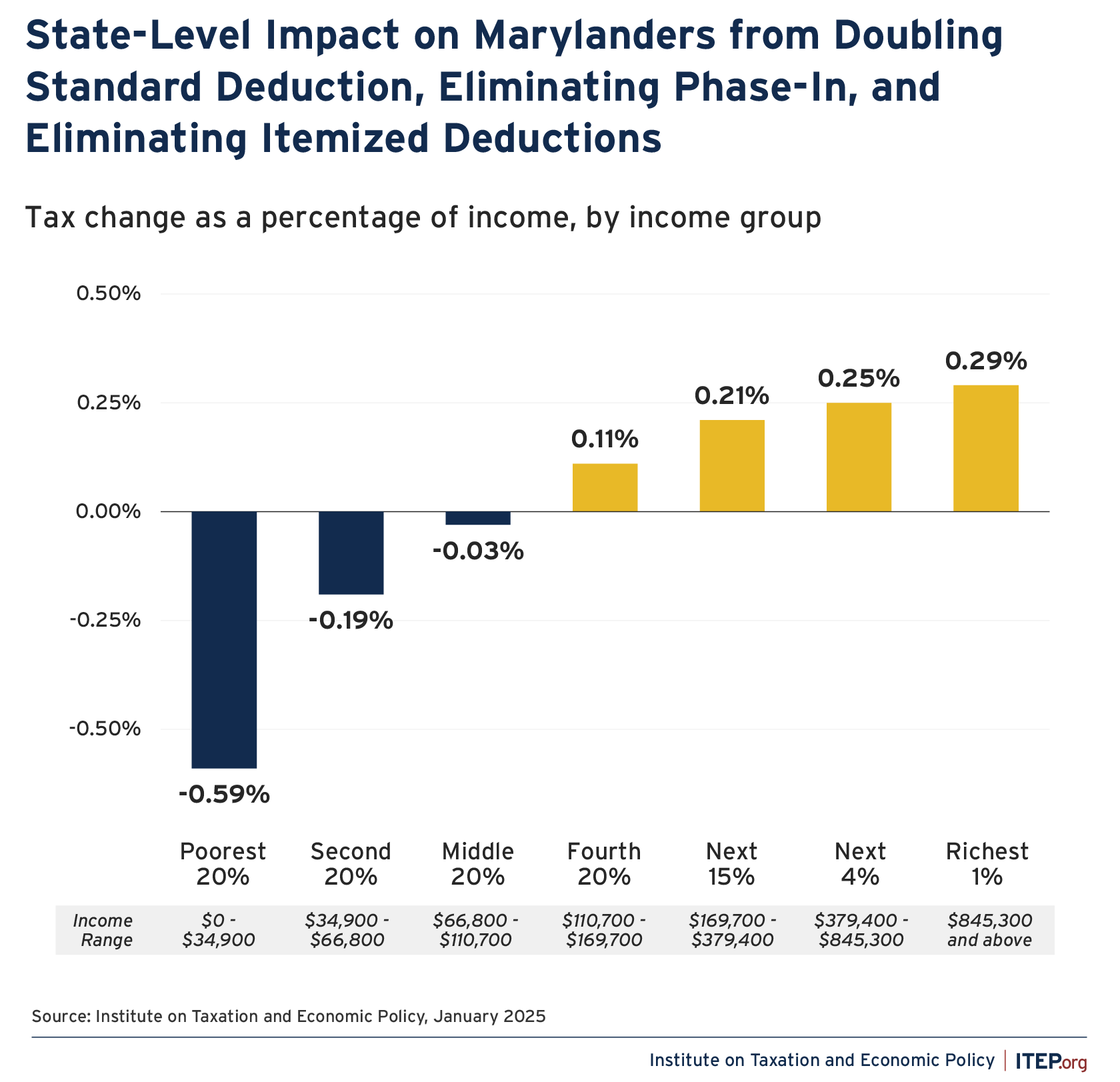

Deductions would be simpler and more favorable for middle- and low-income taxpayers.

Most Maryland taxpayers already use the state’s standard deduction, but it is small and contains a gradual phase-in that reduces the deduction for low-income households. The governor’s proposal doubles the standard deduction and eliminates the phase-in while disallowing Maryland taxpayers from carrying their federal itemized deductions over to their state return.

Itemized deductions at the state level overwhelmingly favor upper-income households, complicate the tax code, and are poorly targeted as our colleagues point out in this report. These changes would provide a net tax cut for most Marylanders: about 65 percent of households would see a cut, and about 78 percent of the decrease will go to the bottom 80 percent of households. The revenue loss would be offset by a tax increase on the wealthiest Marylanders; about 20 percent of households would see an increase, with 71 percent of the increase paid by the top 20 percent of households.

FIGURE 2

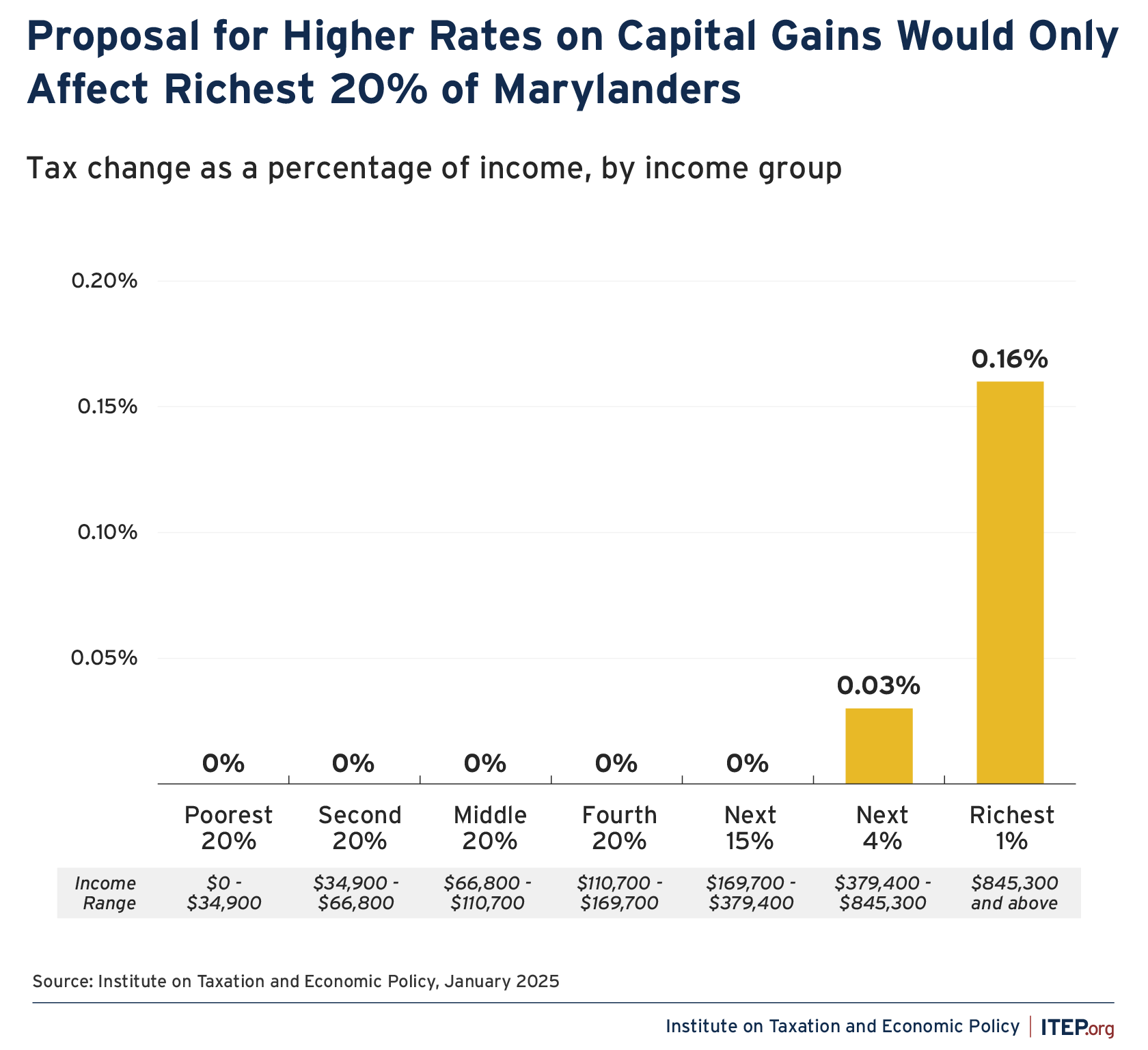

Income from wealth would be taxed with higher rates on capital gains.

The plan would raise taxes on wealthy families by charging higher rates on realized capital gains if the household’s federal adjusted gross income exceeds $350,000. Capital gains income overwhelmingly flows to a small number of wealthy, white families; higher state tax rates on capital gains increase parity in taxation of wealth versus work. All or nearly all of the households who would see an increase are in the top 20 percent, and about 86 percent of the increase would come from those in the top 1 percent.

FIGURE 3

Some families with children would get a new tax break.

State child tax credits help families make ends meet. Maryland’s $500 Child Tax Credit for children under age 6, currently available only to families with incomes below $15,000, would be extended to families with incomes slightly above that threshold, with the amount gradually decreasing as incomes rise.

Other significant changes in the governor’s package include:

- A long-running loophole for corporations would be narrowed. Maryland is now among a minority of states that allow corporations to avoid tax by shifting profits to out-of-state affiliates. The governor’s proposal would have Maryland join 28 other states plus the District of Columbia that require “combined reporting” to require corporations and their affiliates in other states to file a combined return.

- Large estates would pay more tax. Estate and inheritance taxes are among the very few tools for states to reduce the concentration of wealth in the hands of a few families over generations. Under current law, the wealthiest Marylanders can pass $5 million to their heirs tax-free before estate tax is owed; the governor’s proposal would reduce the exemption to $2 million.

Key state budget priorities would take less of a hit. The additional revenue from the plan, an estimated $819.5 million according to state estimates, is insufficient to avert spending cuts that the governor has proposed elsewhere in his proposal. But the tax changes would allow the state to make smaller budget cuts than are otherwise needed.

As legislators consider the proposal, they should improve the governor’s plan in several ways to make it more progressive and raise more revenue so that budget cuts don’t have to be so large.

- The General Assembly should set aside the governor’s proposal to reduce the state’s corporate tax rate over time. This approach mostly benefits out-of-state shareholders and does little to bring jobs and investment to Maryland communities.

- The proposal to enact combined reporting should be expanded to encompass not just U.S.-based affiliates but also affiliates in other countries, a practice known as worldwide combined reporting. This policy, which outright stops the incentive for multinational corporations to game revenue departments and shelter their profits in tax havens overseas, is a proven and effective

- Finally, the state should retain its inheritance tax, perhaps using the revenue for further improvements to the state Child Tax Credit, which can be an effective tool to reduce child poverty.