Massachusetts

This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe. There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and […]

This past week, in statehouses around the country, tax policy decisions are moving fast as budgets were signed and budget plans were released and passed...

Massachusetts Budget & Policy Center: What’s Race Got to Do With It? Some Tax Proposals Would Widen Racial Inequality, Others Would Advance Equity

May 17, 2023

Lawmakers have proposed a variety of tax cuts, some of which would provide outsize benefits to the most affluent households and widen existing racial and economic disparities. Other proposed tax changes would make the Commonwealth more equitable by targeting benefits to lower-income households who need them the most. Read more.

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

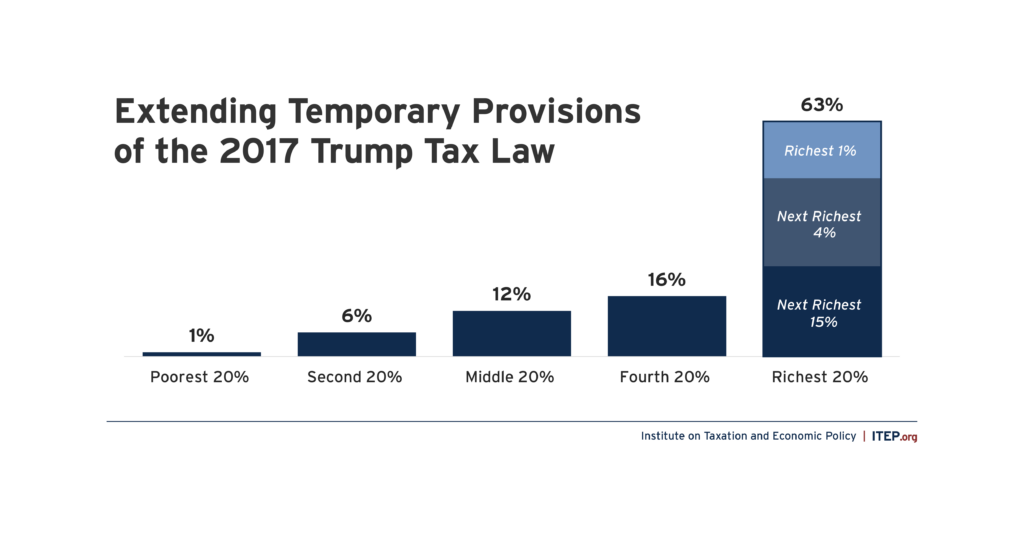

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Racial Justice Requires Tax Justice: Our Analysis Helps Deliver Both

April 24, 2023 • By Amy Hanauer

ITEP’s analytical approach, our comprehensive microsimulation model, and our unique state-level capacities enable us to do pioneering analyses that enrich the debate on racial justice in tax policy that no other entity can do.

Everything! Taxing wealthy people and corporations and using the revenue for paid leave, child care, education, health care and college would transform America for girls and women of every race and family type, in every corner of this country.

State Rundown 4/12: Tax Day 2023 – A Good Reminder of the Impact of Our Collective Investments

April 12, 2023 • By ITEP Staff

With Tax Day quickly approaching it’s worth taking some time to reflect not just on tax forms (though those are important!), but also on the current state of state tax policy...

Testimony of ITEP’s Marco Guzman Before the Nevada Assembly Committee on Revenue

April 10, 2023

For a video of Marco’s testimony, click here. Thank you, Assemblywoman Anderson, and thank you chairman and members of the Assembly for the opportunity to speak on the topic of Nevada’s state tax system. My name is Marco Guzman, and I am a Senior State Policy Analyst with the Institute on Taxation and Economic Policy […]

Over the past week Washington state saw a major victory for tax fairness after the state Supreme Court held the state’s capital gains tax—passed in 2021—constitutional...

Massachussets Budget & Policy Center: Taking Measure of the Governor’s Tax Plan

March 21, 2023

Governor Healey’s tax relief proposal would reduce state revenue available for future investments by $986 million annually. Three proposed tax credits would be progressive, meaning the benefits for lower-income households would be a larger percent of their income than the benefits for higher-income houseolds..1 The Governor also proposes two highly regressive tax cuts, meaning richer, higher-income households would receive […]

This week, several big tax proposals took strides on the march toward becoming law...

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.

Why the States Have a Major Role to Play If We Want Tax Justice

February 9, 2023 • By Amy Hanauer

With fears of gridlock in a divided Washington, tax justice champions are building momentum in other places where there's dire need for better tax policy: the states. We can upgrade communities across the country by making 2023 a year to win tax improvements in statehouses.

State Rundown 1/26: Tax Season Brings With it Reminder of EITC’s Impact

January 26, 2023 • By ITEP Staff

Tax season has officially kicked off and with Earned Income Tax Credit (EITC) Awareness Day right around the corner, it serves as another reminder for how important the EITC is...

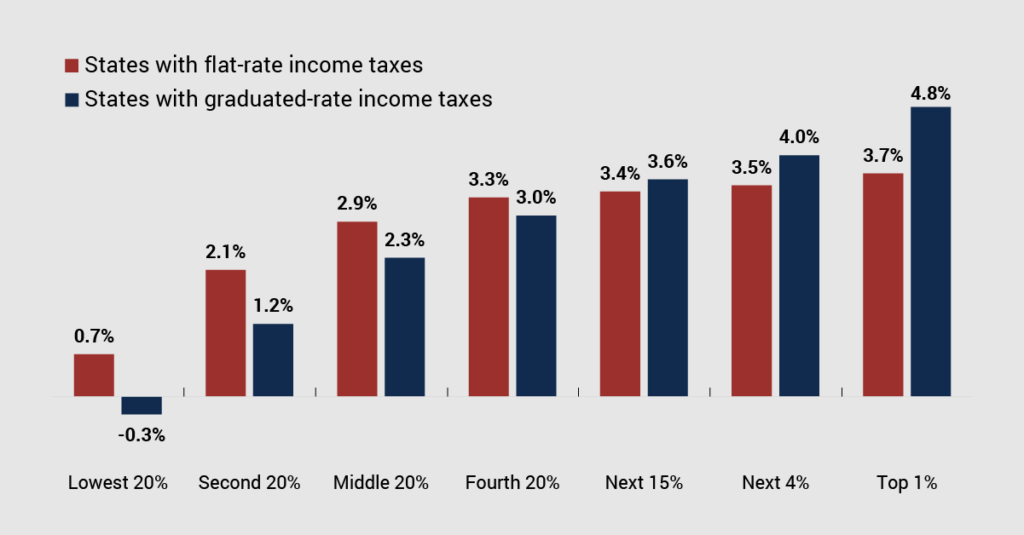

Two-thirds of states with broad-based personal income tax structures have a graduated rate, while one-third have flat taxes.

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.

Momentum Behind State Tax Credits for Workers and Families Continues in 2023

January 18, 2023 • By Miles Trinidad

Refundable tax credits are an important tool for improving family economic security and advancing racial equity, and there is incredible momentum heading into 2023 to boost two key state credits: the Child Tax Credit and the Earned Income Tax Credit.

Flat taxes have some surface appeal but come with significant disadvantages. Critically, a flat tax guarantees that wealthy families’ total state and local tax bill will be a lower share of their income than that paid by families of more modest means.

State Rundown 11/30: ‘Lame Duck’ December Could Have Major Tax Implications

November 30, 2022 • By ITEP Staff

As federal lawmakers begin their lame duck deliberations, the revival of the expanded child tax credit remains a strong possibility...

Jacobin: In Massachusetts, Unions Beat Billionaires to Pass a Tax on the Rich

November 23, 2022

Voters in Massachusetts just ratified the Fair Share Amendment, which taxes income above $1 million to fund public services. A broad coalition of labor and community groups took on billionaire money and won. Read more.

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

As states continue to tally the remaining votes and the news stories roll out at a breakneck pace, the unofficial results of the 2022 midterm elections have brought with it significant changes across the state tax policy landscape...

Election Day in the States: Voters Deliver Important Victories for Tax Justice

November 10, 2022 • By Jon Whiten

Voters in Massachusetts and Colorado raised taxes on their wealthiest residents to fund schools, public transportation and school lunches for kids while making their tax codes more equitable. And voters in West Virginia defeated a proposal to deeply cut taxes, mostly for businesses, and drain the coffers of county and local governments.

Massachusetts Voters Score Win for Tax Fairness with ‘Fair Share Amendment’

November 9, 2022 • By Marco Guzman

In a significant victory for tax fairness, Massachusetts voters approved Question 1—commonly known as the Fair Share Amendment—Tuesday night with 52 percent of the vote. The new constitutional amendment creates a 4 percent surcharge on income over $1 million, and the revenue will specifically fund education and transportation projects in the Bay State.