Minnesota

This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe. There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and […]

Short-sighted tax cuts continue to make their way to Governors’ desks this week. In Florida, Gov. DeSantis signed a $1.3 billion tax cut package with $550 million of the tax cuts from sales tax holidays, alone. The Nebraska legislature also sent $6.4 billion in tax cuts to Gov. Pillen’s desk which includes an enormous personal income tax cut that will reduce taxes on the top 1 percent by tens of thousands of dollars.

State Rundown 5/25: The North Star State Leads the Way on Tax Fairness

May 24, 2023 • By ITEP Staff

As we approach the midpoint of 2023, it’s a good time to look back at the progress states have made in the name of tax fairness and equity...

This past week, in statehouses around the country, tax policy decisions are moving fast as budgets were signed and budget plans were released and passed...

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

State Rundown 5/10: Momentum on State Tax Credits Continues to Build

May 10, 2023 • By ITEP Staff

This week, in states across the country the momentum to center improvements to family economic security remains strong...

Minnesota Poised to Enact Landmark Loophole-Closing Corporate Tax Reforms

May 7, 2023 • By Matthew Gardner

With Minnesota poised to enact worldwide combined reporting of corporate income taxes, business lobbyists are pulling out all the stops to make state lawmakers believe the apocalypse is upon them.

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

While the conversations on the debt ceiling heat up in the nation's capital, debates on state tax policy also continue to unfold in capitol buildings across the nation...

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

State Rundown 4/19: Revenue Discussions Heat Up Like the Temperature

April 19, 2023 • By ITEP Staff

Tax season has ended for most filers, but the topic remains a hot one in states around the country...

Everything! Taxing wealthy people and corporations and using the revenue for paid leave, child care, education, health care and college would transform America for girls and women of every race and family type, in every corner of this country.

Deep Public Investment Changes Lives, Yet Too Many States Continue to Seek Tax Cuts

April 12, 2023 • By Aidan Davis

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

This week, a bill out of Arkansas that would cut the top personal income tax rate and the corporate income tax rate found its way to the governor’s desk...

Minnesota’s Tax Code Should Be Based on Ability to Pay, Not Year of Birth

March 31, 2023 • By Carl Davis, Eli Byerly-Duke

Minnesota lawmakers are considering a carveout that would treat seniors much more favorably than young families. The proposal would fully exempt all Social Security income from state income tax, even for seniors with exceptionally high incomes.

As nature bursts into life and color with the arrival of spring, state tax proposals are doing the same as the legislative seeds planted by lawmakers earlier this year start to grow, blossom, and in some cases rot. However, some governors are not entirely happy with what state lawmakers have produced.

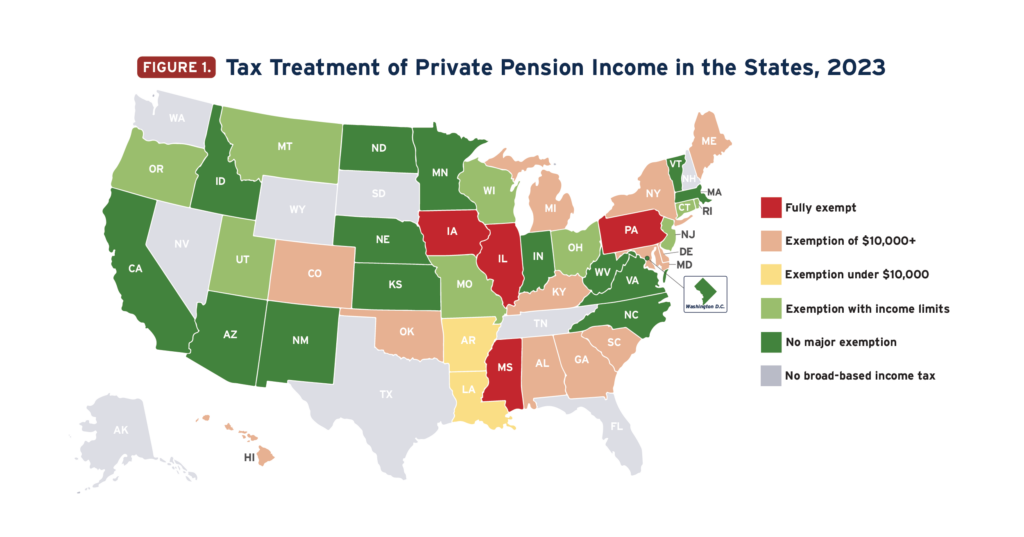

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

State governments provide a wide array of tax subsidies to their older residents. But too many of these carveouts focus on predominately wealthy and white seniors, all while the cost climbs.

Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities

March 22, 2023 • By ITEP Staff

Contact: Jon Whiten – [email protected] Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities State lawmakers should focus on improving overall tax fairness, not creating special carveouts based on age Lawmakers in several states are currently considering tax subsidies for senior citizens, even though these breaks are costly and poorly targeted. […]

This week, several big tax proposals took strides on the march toward becoming law...

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.

Minnesota Budget Project: Governor Walz Releases FY 2024-25 Budget Priorities

February 16, 2023

The Walz administration’s recently released budget proposal names as their priorities making Minnesota the best state for children, investing in the state’s economic future, and promoting the health and safety of Minnesotans. Read more.

State Rundown 1/26: Tax Season Brings With it Reminder of EITC’s Impact

January 26, 2023 • By ITEP Staff

Tax season has officially kicked off and with Earned Income Tax Credit (EITC) Awareness Day right around the corner, it serves as another reminder for how important the EITC is...

State Rundown 1/19: ITEP Provides a Roadmap for Equitable Tax Goals in 2023

January 19, 2023 • By ITEP Staff

State legislatures are buzzing as leaders and lawmakers jockey to advance their 2023 goals...

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.