Missouri

Tuesday’s elections shook up statehouses, governors’ offices, and tax laws in many states, and in this week’s Rundown we bring you the top 3 election state tax policy stories to emerge. First, voters in Kansas and other states sent a message that regressive tax cuts and supply-side economics have not succeeded and are not welcome among their state fiscal policies. Meanwhile, residents of many other states, including most notably Illinois, voted for representatives who reflect their preference for equitable, sustainable policies to improve their state economies through smart public investments and improve the lives of all residents through progressive tax structures. Lastly, while some states missed…

State Rundown 10/31: Trick or Treat Advice to Savor for Tonight

October 31, 2018 • By ITEP Staff

Look out for potholes if you’re out trick-or-treating in Alabama tonight, where crumbling infrastructure figures to be a dominant debate in the coming legislative session. And be prepared to share the streets with disgruntled teachers if you‘re in Louisiana, where teachers are walking out to protest regressive tax policies that are sucking the lifeblood from the state’s schools. Meanwhile, Wisconsin residents are sharing scary stories of grotesquely large business tax subsidies and the “dark store” tax loophole they’ll be voting on next week. And you better expect the unexpected if you’re in Delaware, where Gov. John Carney shocked everyone by vetoing two broadly supported tax bills last week.

In this special edition of the Rundown we bring you a voters’ guide to help make sense of tax-related ballot questions that will go before voters in many states in November. Interests in Arizona, Florida, North Carolina, Oregon, and Washington state have placed process-related questions on those states’ ballots in attempts to make it even harder to raise revenue or improve progressivity of their state and/or local tax codes. In response to underfunded schools and teacher strikes around the nation, Colorado voters will have a chance to raise revenue for their schools and improve their upside-down tax system at the…

The Columbia Missourian: New Tax on Motor Fuels Would Rev up Road and Bridge Spending

October 25, 2018

As it stands, only Alaska has a lower fuel tax than Missouri. Every neighboring state’s tax is higher. And more than 20 states increased their fuel taxes between 2013 and 2017, according to Institute on Taxation and Economic Policy website. Read more

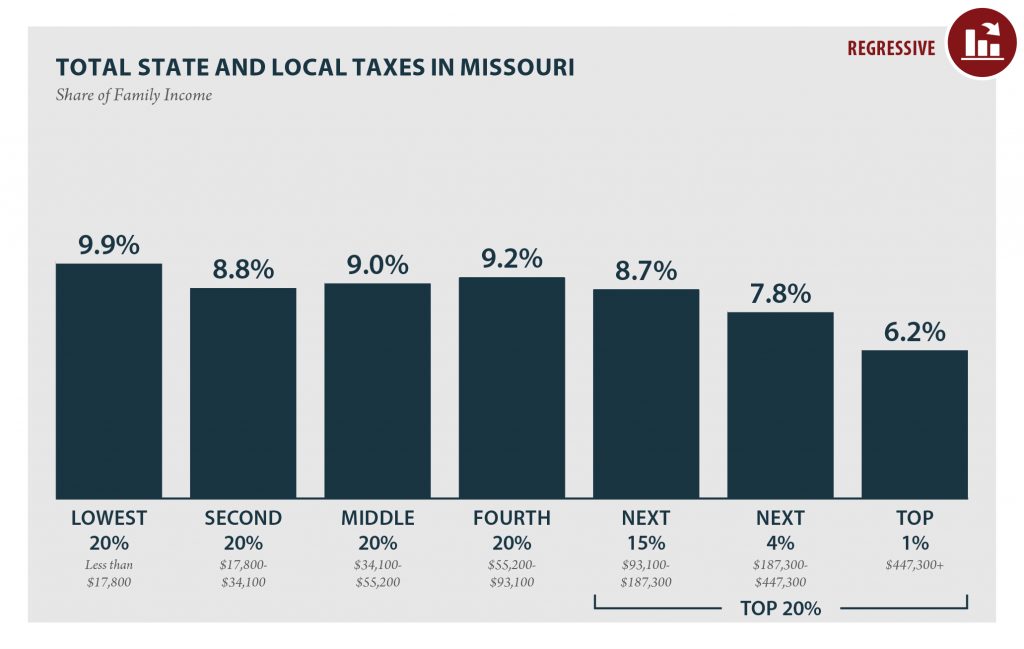

Policymakers and residents in all 50 states and the District of Columbia got new ITEP data this week on how their tax structures and decisions affect their high-, middle-, and low-income residents. As our “Who Pays?” report outlines, most state and local tax codes exacerbate economic inequalities and all states have room to improve. The data can serve as an important informative backdrop to all state and local tax policy debates, such as whether to change the valuation of commercial property in California, how to improve funding for early childhood education in Indiana, and how to evaluate tax-related ballot measures…

Missouri: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

MISSOURI Read as PDF MISSOURI STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,800 $17,800 to $34,100 $34,100 to $55,200 $55,200 to $93,100 $93,100 to $187,300 $187,300 to $447,300 over $447,300 […]

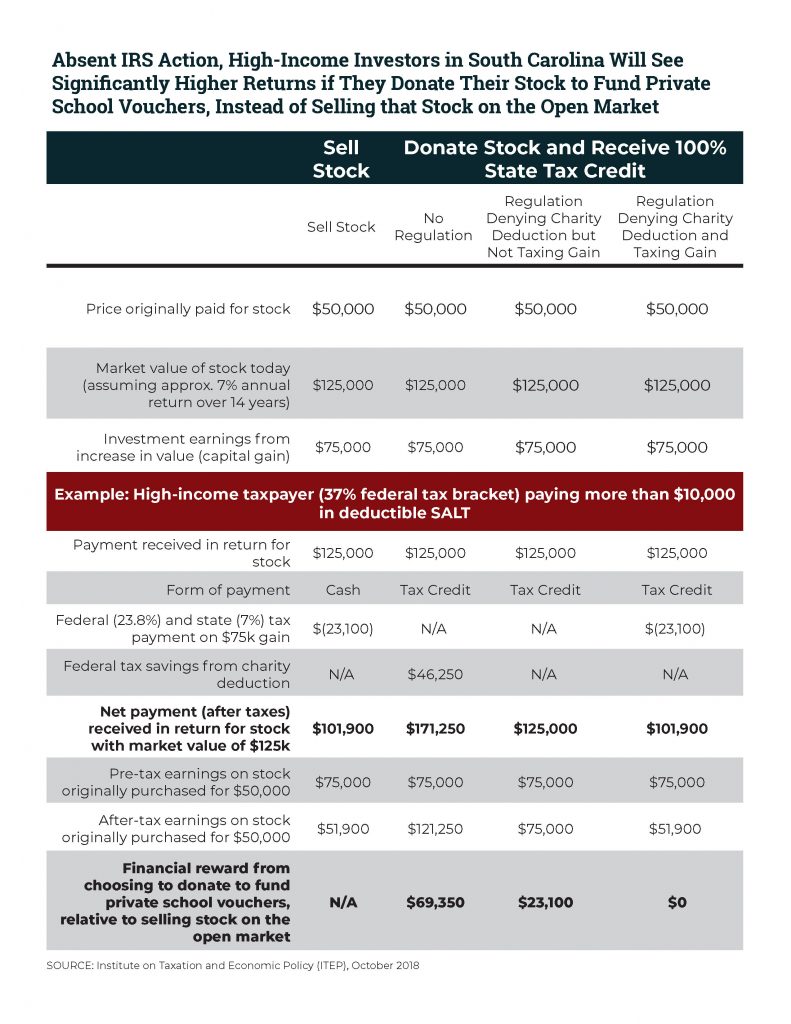

ITEP Comments and Recommendations on Proposed Section 170 Regulation (REG-112176-18)

October 11, 2018 • By Carl Davis

The IRS recently proposed a commonsense improvement to the federal charitable deduction. If finalized, the regulation would prevent not just the newest workarounds to the $10,000 deduction for state and local taxes (SALT), but also a longer-running tax shelter abused by wealthy donors to private K-12 school voucher programs. ITEP has submitted official comments outlining four key recommendations related to the proposed regulation.

Tax Cuts 2.0 – Missouri

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

The Rundown is back after a few-week hiatus, with lots of state fiscal news and quality research to share! Maine lawmakers found agreement on a response to the federal tax-cut bill, states continue to sort out how they’ll collect online sales taxes in the wake of the Wayfair decision, and policymakers in several states have been working on summer tax studies and other preparations for 2019 legislative sessions. Meanwhile, work on ballot measures and candidate tax plans to go before voters in November has been even more active, particularly in Arizona, California, Florida, Hawaii, and Missouri. Our “What We’re Reading” section has lots of great research and reading on inequalities, cities turning…

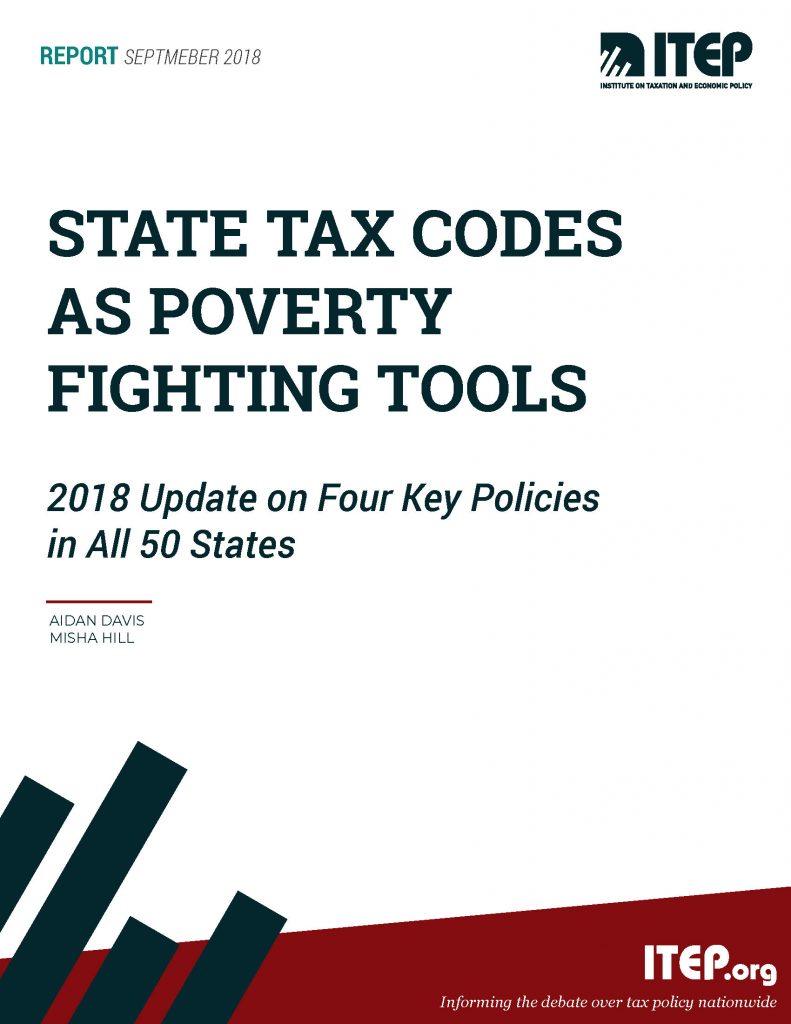

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

State Rundown 8/22: Wayfair Fallout Could Hit the Pavement Soon

August 22, 2018 • By ITEP Staff

Arizona voters learned this week that they will have an opportunity this fall to restore school funding through a progressive tax measure. The effects of the Supreme Court’s Wayfair decision could soon be seen on Michigan and Mississippi roads, as leaders in both states have proposed devoting new online sales tax revenues to infrastructure needs. And new research highlighted in our “What We’re Reading” section discredits one-size-fits-all prescriptions for state economic growth such as supply-side tax-cut orthodoxy, advocating instead for more nuanced and state-specific policymaking.

State Rundown 8/16: November Ballots and 2019 Debates Coming into Focus

August 16, 2018 • By ITEP Staff

Even as the haze from western wildfires reduced visibility across the nation this week, voters got more clarity on what to expect to see on their ballots this fall, particularly in California (commercial property taxes and corporate surcharges), Colorado (income taxes for education), Missouri (gas tax update), and North Dakota (recreational cannabis). Meanwhile, although Virginia lawmakers won’t return until 2019, they got a preview of a clear-headed federal conformity plan they should strongly consider. And look to our “What We’re Reading“ section for further enlightenment from researchers on the [in]effectiveness of charitable contribution credits, the [lack of] wage growth for…

State Rundown 8/8: States Setting Rules for Upcoming Tax Decisions

August 8, 2018 • By ITEP Staff

August is often a season for states to define the parameters of tax debates to come, and that is true this week in several states: a tax task force in Arkansas is nearing its final recommendations; residents of Missouri, Montana, and North Carolina await results of court challenges that will decide whether tax measures will show up on their ballots this fall; and Michigan and South Dakota are taking different approaches to making sure they’re ready to collect online sales taxes next year.

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.

Although most state legislatures are out of session during the summer, the pursuit of better fiscal policy has no "off-season." Here at ITEP, we've been revamping the State Rundown to bring you your favorite summary of state budget and tax news in the new-and-improved format you see here. Meanwhile, leaders in Massachusetts and New Jersey have been hard at work in recent weeks and are already looking ahead their next round of budget and tax debates. Lawmakers in many states are using their summer break to prepare for next year's discussions over how to implement online sales tax legislation. And…

State Rundown 7/19: Wayfair Fallout and Ballot Preparation Dominate State Tax Talk

July 19, 2018 • By ITEP Staff

In the wake of the U.S. Supreme Court's recent Wayfair decision authorizing states to collect taxes owed on online sales, Utah lawmakers held a one-day special session that included (among other tax topics) legislation to ensure the state will be ready to collect those taxes, and a Nebraska lawmaker began pushing for a special session for the same reason. Voters in Colorado and Montana got more clarity on tax-related items they'll see on the ballot in November. And Massachusetts moves closer toward becoming the final state to enact a budget for the new fiscal year that started July 1 in…

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2018 • By Dylan Grundman O'Neill

An updated version of this brief for 2019 is available here. Read this report in PDF. Overview Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and […]

Building on Momentum from Recent Years, 2018 Delivers Strengthened Tax Credits for Workers and Families

July 10, 2018 • By Aidan Davis

Despite some challenging tax policy debates, a number of which hinged on states’ responses to federal conformity, 2018 brought some positive developments for workers and their families. This post updates a mid-session trends piece on this very subject. Here’s what we have been following:

New Jersey avoided a second consecutive shutdown and proved that even against staunch opposition, progressive solutions to states' fiscal issues are attainable, and Arizona voters will likely have a chance to solve their education funding crisis in a similar way. Budget and tax debates remain to be resolved, however, in Maine and Massachusetts. Meanwhile, voters are gaining a clearer picture of what questions they will be asked on ballots this fall as signature drives conclude in several states.

San Jose Mercury News: If California Gas Prices Take Their Seasonal Tumble, Will That Save the Gas Tax?

July 10, 2018

Just so you know, California isn’t the only state raising gasoline taxes. As 2018’s second half starts, drivers in seven states face just-raised taxes on fuel, according to the Institute on Taxation and Economic Policy. In fact, 27 states nationwide have increased gasoline taxes in the past five years – with Missouri voters facing an […]

Orange County Register: California Isn’t the Only State Hiking Gas Taxes

July 6, 2018

Just so you know, California isn’t the only state raising gasoline taxes. As 2018’s second half starts, drivers in seven states face just-raised taxes on fuel, according to the Institute on Taxation and Economic Policy. In fact, 27 states nationwide have increased gasoline taxes in the past five years – with Missouri voters facing an Election […]

24/7 Wall Street: 10 States With the Lowest Gas Prices Get Government Help

July 5, 2018

While oil prices are the major component of gas prices, state taxes are often overlooked. And they are unlikely to change very much. According to the Institute on Taxation and Economic Policy, most increases have been a few pennies, even as the number of states that have bumped them has grown. The organization reports: In […]

With many state fiscal years beginning July 1, most states that will make decisions this year about federal tax conformity have now done so, so it is now time for an update on how well state policymakers have kept to, or veered from, the path we charted out earlier this year. Most states that have enacted laws in response to the federal changes have adhered to some but not all of the principles we laid out, with a few responding rather prudently and a handful charting a much more treacherous course of unfair, unsustainable policy based on unfounded promises of…

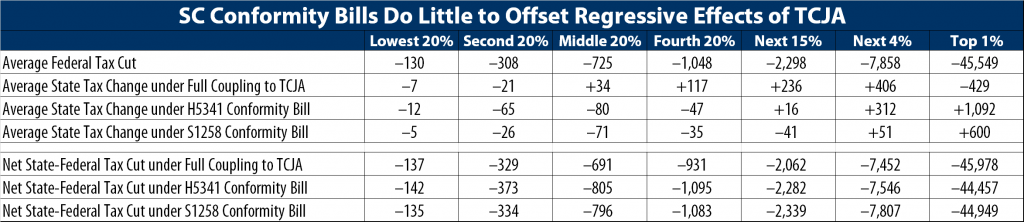

What’s at Stake in South Carolina’s Upcoming Tax Conformity Debate

June 22, 2018 • By Dylan Grundman O'Neill

South Carolina legislators will return next week to try to finalize a few issues before the end of their session and fiscal year on June 30th, including the question of how to respond to the federal Tax Cuts and Jobs Act (TCJA). That's a short timeframe with some important questions at stake, and some misinformation has been spread, so here's a quick guide to the facts, issues, and options.

State Rundown 6/13: Budget Crunch Time Sets in as State Fiscal Years Come to Close

June 13, 2018 • By ITEP Staff

With many state fiscal years ending June 30th, budget negotiations were completed recently in California, Illinois, Michigan, and North Carolina. New Jersey remains a state to watch as a government shutdown looms but leaders continue to disagree about a proposed millionaires tax, corporate taxes, and school funding. In other states looking to wealthy individuals and large corporations for needed revenues, Arizona's teacher pay crisis could be solved with a tax on its highest-income residents and a similar proposal in Massachusetts is polling well, but Seattle's new "head tax" could be on the chopping block.