An updated version of this report was published in April 2019.

Despite Progress, Fixed-Rate Taxes Remain in Thirty States and at Federal Level

The flawed design of federal and state gasoline taxes has made it exceedingly difficult to raise adequate funds to maintain the nation’s transportation infrastructure. Thirty states and the federal government levy fixed-rate gas taxes where the tax rate does not change even when the cost of infrastructure materials rises or when drivers transition toward more fuel-efficient vehicles and pay less in gas tax. The federal government’s 18.4 cent gas tax, for example, has not increased in over twenty-three years. Likewise, nineteen states have waited a decade or more since last raising their own gas tax rates.

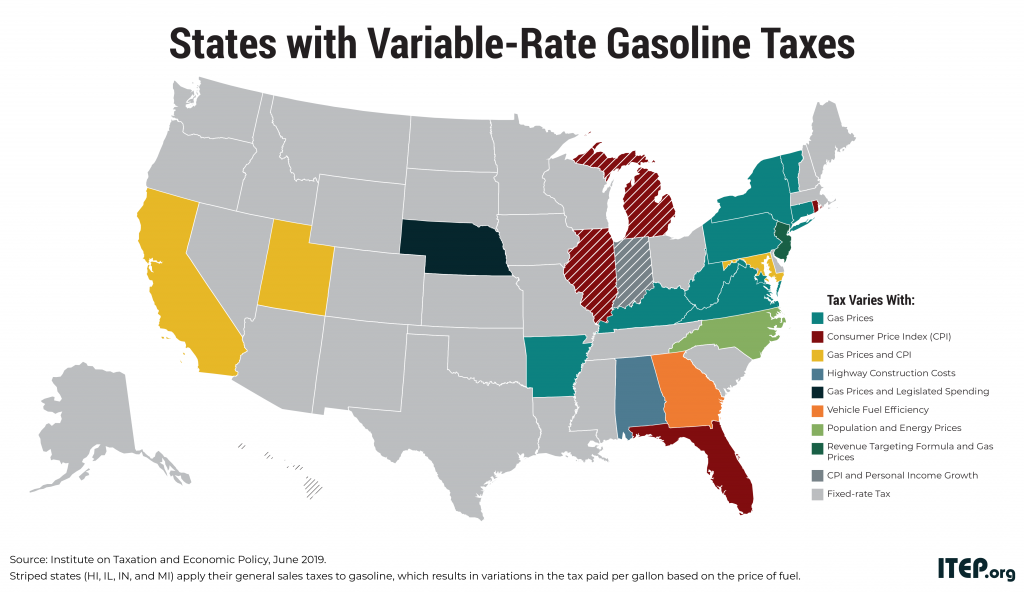

Fortunately, there is a growing recognition of the problems with fixed-rate gas tax designs. Since 2013, six states (Maryland, New Jersey, Pennsylvania, Rhode Island, Utah, and Virginia) as well as the District of Columbia (DC) have abandoned their old gas tax structures in favor of more sustainable, variable-rate designs where the tax rate is allowed to rise alongside gas prices, the general inflation rate in the economy, vehicle fuel-efficiency, or other relevant factors. Over this same period, states such as California, Georgia, Indiana, Michigan, and North Carolina have made significant improvements to their existing variable-rate tax structures. Because of these reforms, a majority (57 percent) of the U.S. population now lives in states where the gas tax rate automatically varies over time.

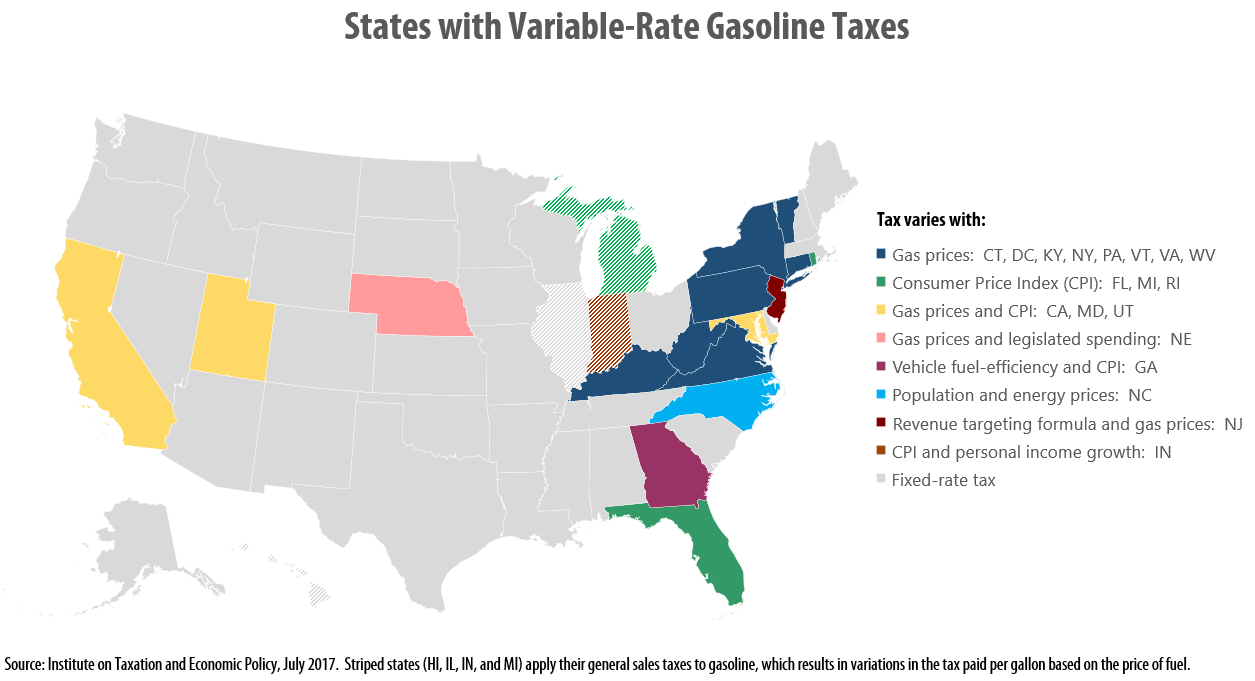

The following map highlights the twenty states that levy variable-rate gas taxes and identifies the type of variable-rate structure used in each of those states. Currently, there are more than half a dozen broad types of economic measures used in variable-rate formulas across the country (i.e. fuel prices, energy prices, inflation, personal income growth, population growth, vehicle fuel-efficiency, revenue targets, and legislative spending decisions). Transitioning toward any of these variable-rate designs at the federal level, and in more states, would put funding for the nation’s infrastructure investments on a more sustainable course.