New Jersey

New Analysis: Congress Considering Creating an Unprecedented Tax Shelter to Steer Billions to Private K-12 School Vouchers and Wealthy Individuals

March 18, 2025 • By ITEP Staff

Contact: Jon Whiten ([email protected]) A bill introduced in Congress would create an unprecedented 100% tax credit for donations to nonprofits that give out private K-12 school vouchers and create a lucrative tax shelter that would further enrich some of America’s wealthiest individuals. If passed, the Educational Choice for Children Act of 2025 (ECCA) would cost […]

A Revenue Impact Analysis of the Educational Choice for Children Act of 2025

March 18, 2025 • By Carl Davis

The Educational Choice for Children Act of 2025 would provide donors to nonprofit groups that distribute private K-12 school vouchers with a dollar-for-dollar federal tax credit in exchange for their contributions. In total, the ECCA would reduce federal and state tax revenues by $10.6 billion in 2026 and by $136.3 billion over the next 10 years. Federal tax revenues would decline by $134 billion over 10 years while state revenues would decline by $2.3 billion.

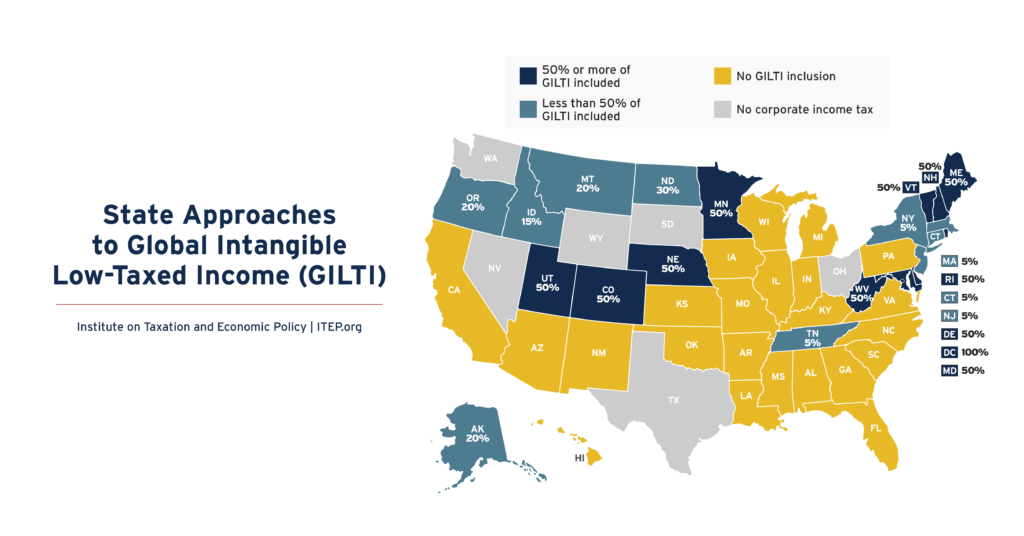

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.

State Rundown 3/6: In the Shadow of Chaotic Federal Policymaking States Seek to Tax the Top, Cut Taxes

March 6, 2025 • By ITEP Staff

Proposals from governors in both New Jersey and Wisconsin include provisions to tax high-income earners. Meanwhile, several major tax proposals are advancing in the great plains, with Iowa considering a major cut to unemployment taxes, North Dakota advancing new benefits for private schools, and Wyoming cutting property taxes. The District of Columbia is facing a more than a $1 billion revenue shortfall over the next three years, compared to previous estimates, and a mild recession due in large part to the layoffs of federal workers.

New Jersey Senator Singleton and Senate President Scutari Resolution Condemning Federal Efforts to Cut Funding

March 4, 2025

In response to the recent passage by the House of Representatives of a budget resolution that seeks to cut hundreds of billions in funding for programs like Medicare, Medicaid, and the Supplemental Nutrition Assistance Program (SNAP), the Senate Health, Human Services, and Senior Citizens Committee has passed a resolution from Senator Troy Singleton and Senate […]

Below is a list of tax expenditure reports published in the states.

Revenue Effect of Mandatory Worldwide Combined Reporting by State

February 21, 2025 • By ITEP Staff

Universal adoption of mandatory worldwide combined reporting (WWCR) in states with corporate income taxes would boost state tax revenue by $18.7 billion per year. The revenue effects of mandatory WWCR would vary across states. We estimate that 38 states and the District of Columbia would experience revenue increases totaling $19.1 billion. The top 10 states […]

States Could Raise $19 Billion a Year with One Policy Change Targeting Corporate Tax Avoidance

February 20, 2025 • By ITEP Staff

Worldwide combined reporting negates the tax benefits of shifting corporate income offshore Public polling has consistently shown for decades that most people believe big multinational corporations are paying too little in taxes. Closing the loopholes these corporations use to avoid taxes is one of the most effective – and popular – solutions to this problem. […]

A Revenue Analysis of Worldwide Combined Reporting in the States

February 20, 2025 • By Carl Davis, Matthew Gardner, Michael Mazerov

Universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion.

Turning IRS Agents to Deportation Will Reduce Public Revenues

February 11, 2025 • By Carl Davis, Jon Whiten

The Trump Administration’s plan to turn IRS agents into deportation agents will result in lower tax collections in addition to the harm done to the families and communities directly affected by deportations.

Local income taxes can be an important progressive revenue raiser, as they ask more of higher-income households and are connected to ability to pay. They can raise substantial revenue to fund key public services to make cities and regions better off.

New Jersey Policy Perspective: Extending Trump Tax Cuts Would Benefit the Wealthiest New Jerseyans

February 3, 2025

Fair tax policy depends on prioritizing the well-being of all households, not just the wealthiest. New Jersey, and the nation as a whole, cannot afford to hand special tax breaks to the most affluent residents by slashing essential services such as health insurance for working families. New analysis of the Trump administration’s plan to make tax breaks from the 2017 tax law permanent shows that the proposal would do just that. It would make the wealthiest New Jerseyans even richer while cutting programs and support for families who need help affording basic necessities like food and health care.

Maryland’s Tax Reform Likely Won’t Cause Millionaire Migration

January 30, 2025 • By Nick Johnson

The moment Gov. Wes Moore announced his proposal to reform Maryland’s tax system, in part, by raising income tax rates on high-income households, opponents began predicting that wealthy people would respond by leaving. Experience from other states says that’s not the case.

State Rundown 1/22: Tax Policy, Affordability, and Where It Misses the Mark

January 22, 2025 • By ITEP Staff

As state legislative sessions ramp up many lawmakers discuss their prioritization of affordability of necessities like food and housing as they craft their legislative agendas. Arkansas, Mississippi and Utah are looking to reduce or fully exempt groceries from their state sales taxes. Meanwhile, multiple proposals to reduce property taxes are making their way around state […]

Trump’s Plan to Extend His 2017 Tax Provisions: Updated National and State-by-State Estimates

January 8, 2025 • By Steve Wamhoff

Trump’s plan to make most of the temporary provisions of his 2017 tax law permanent would disproportionately benefit the richest Americans. This includes all major provisions except the $10,000 cap on deductions for state and local taxes (SALT) paid.

New Jersey Policy Perspective: Fair and Square: Changing New Jersey’s Tax Code to Promote Equity and Fiscal Responsibility

November 14, 2024

Reforming New Jersey's tax system would reduce income inequality and provide revenues needed for public investments to make the state more affordable.

Extending Temporary Provisions of the 2017 Trump Tax Law: Updated National and State-by-State Estimates

September 13, 2024 • By Steve Wamhoff

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans. Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s […]

State Earned Income Tax Credits Support Families and Workers in 2024

September 12, 2024 • By Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit. These credits boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

State Child Tax Credits Boosted Financial Security for Families and Children in 2024

September 12, 2024 • By Neva Butkus

Fifteen states plus the District of Columbia provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states – Colorado, New York, and Utah – expanded their Child Tax Credits while lawmakers in the District of Columbia created a new credit that will take effect in 2025.

New Jersey Policy Perspective: Taxing “Super Luxury” Home Sales Could Make New Jersey Affordable for More Residents

September 10, 2024

As the cost of housing in New Jersey continues to soar, making it increasingly unaffordable for many residents, the market for “super luxury” homes – properties with exceptionally high price tags – continues to rise at a faster rate than all other homes. Applying a higher fee to the sale of these expensive homes could generate hundreds of millions in revenue, helping to make the state more affordable for low-income and middle-class residents. Crucially, this tax would be targeted exclusively to the wealthiest households.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

August 6, 2024 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2024. These suspensions combined will cost states and localities over $1.3 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system.

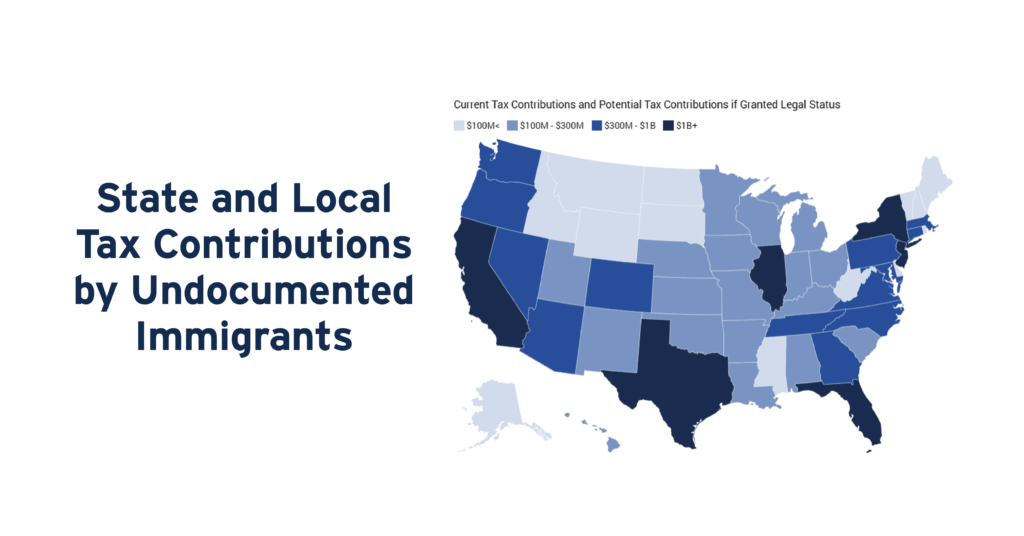

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

Study: Undocumented Immigrants Contribute Nearly $100 Billion in Taxes a Year

July 30, 2024 • By ITEP Staff

Contact: Jon Whiten ([email protected]) Immigration policies have taken center stage in public debates this year, but much of the conversation has been driven by emotion, not data. A new in-depth study from the Institute on Taxation and Economic Policy aims to help change that by quantifying how much undocumented immigrants pay in taxes – both […]

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.