New Jersey

Hidden in Plain Sight: Race and Tax Policy in 2023 State Legislative Sessions

November 21, 2023 • By Brakeyshia Samms

Race was front and center in a lot of state policy debates this year, from battles over what’s being taught in schools to disagreements over new voting laws. Less visible, but also extremely important, were the racial implications of tax policy changes. What states accomplished this year – both good and bad – will acutely affect people and families of color.

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

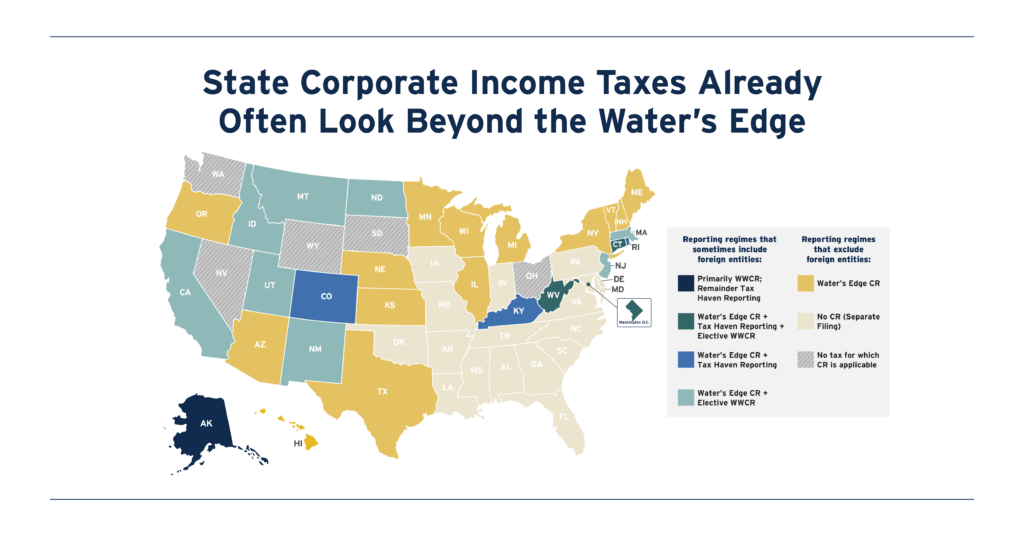

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

States are Boosting Economic Security with Child Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Fourteen states now provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states created new Child Tax Credits while lawmakers in seven states expanded existing credits. To maximize impact, lawmakers should consider making their credits fully refundable, not including an earnings requirement, setting a maximum amount per child instead of per household, setting state-specific phase-out ranges that target low- and middle-income families, indexing to inflation, and offering the option of advanced payments.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

Editorial: Back-to-School Sales Tax Holiday is Mostly Hype

August 15, 2023

It’s just about back-to-school time, and Gov. Phil Murphy and other Democratic state leaders are showing their love for New Jersey families by offering this special giveaway: 20 cents in sales tax savings off a $3 notebook. Or 13 cents off $2 box of pencils. Wow, right? Read more.

Gimmicky Sales Tax Holidays to Cost States & Localities $1.6 Billion This Year

August 3, 2023 • By ITEP Staff

Sales tax holidays are bad policies that have too often been used as a substitute for more meaningful, permanent reform.

The Dog Days of summer are upon us, and with most states out of session and extreme heat waves making their way across the country, it’s a perfect time to sit back and catch up on all your favorite state tax happenings (ideally with a cool drink in hand)...

States and Localities are Making Progress on Curbing Unjust Fees and Fines

July 18, 2023 • By Andrew Boardman

Too many state and local governments tap legal-system collections, rather than adequate tax systems, to fund shared essentials like public safety and education. But a growing number of states and localities are choosing a better approach. Momentum for change has continued to build in 2023, with no fewer than seven states enacting substantial improvements.

State lawmakers continue to make groundbreaking progress on state tax credits, with 17 states creating or enhancing Child Tax Credits or Earned Income Tax Credits so far this year. These policies have the potential to boost family economic security and dramatically reduce the number of children living below the poverty line.

State Rundown 7/6: Tax Policy Keeping Governors Busy from Coast to Coast

July 6, 2023 • By ITEP Staff

From coast to coast, state governors have been busy inking their signature on a growing list of consequential budget and tax bills...

State Rundown 6/28: Movement on Refundable Credits Remains Hot Topic in 2023

June 28, 2023 • By ITEP Staff

The trend of state lawmakers taking big steps on important tax credits like the Child Tax Credit and Earned Income Tax Credit is coming out in full force this week...

New Jersey Policy Perspective: StayNJ 2.0: Senior Tax Cut Still 2 Regressive and 2 Expensive

June 28, 2023

Updated StayNJ senior tax cut proposal would still send the biggest benefits to already-wealthy households. Read more.

Summer is here and many states nearing the end of their legislative sessions. Temperatures are rising in more ways than one in some state legislatures while others seem to be cooling off.

As the sweet days of summer pass, the scent of jasmine isn't the only thing blowing through the minds of state lawmakers, as tax policy discussions remain at the forefront...

New Jersey Policy Perspective: Stay Away from StayNJ: Proposal Cuts Taxes for the Rich, Leaves Low-Income Seniors Behind

June 9, 2023

Housing affordability is one of the most pressing challenges facing New Jersey, but not all policies aimed at making the state affordable are equally effective, efficient, or equitable. When evaluating new proposals and changes to the tax code, it’s critical to consider who stands to benefit, by how much, and who is left behind. In […]

Across the country, the marathon budget season has held pace, with a steady stream of bills continuing to cross the finish line...

Short-sighted tax cuts continue to make their way to Governors’ desks this week. In Florida, Gov. DeSantis signed a $1.3 billion tax cut package with $550 million of the tax cuts from sales tax holidays, alone. The Nebraska legislature also sent $6.4 billion in tax cuts to Gov. Pillen’s desk which includes an enormous personal income tax cut that will reduce taxes on the top 1 percent by tens of thousands of dollars.

State Rundown 5/25: The North Star State Leads the Way on Tax Fairness

May 24, 2023 • By ITEP Staff

As we approach the midpoint of 2023, it’s a good time to look back at the progress states have made in the name of tax fairness and equity...

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Testimony of ITEP’s Amy Hanauer Before the D.C. Tax Revision Commission

May 3, 2023

The written testimony of ITEP Executive Director Amy Hanauer is below the embedded video of the hearing. Dear D.C. Tax Revision Commission, Thank you for inviting me to testify last week on the research of my colleagues at the Institute on Taxation and Economic Policy. We’re grateful to have our perspective included and as a […]

This week, several big tax proposals took strides on the march toward becoming law...

New Jersey, New York, and Connecticut Should Keep Corporate Taxes Strong, Extend Surcharges

February 28, 2023 • By Marco Guzman

At a time when corporations are seeing record profits while not paying their fair share of federal taxes, state corporate income taxes can and should play a role in raising sustainable revenue and adding progressivity to state tax codes. Right now, lawmakers in New Jersey, New York, and Connecticut have a unique opportunity to extend targeted tax changes that have raised billions of dollars from profitable corporations for meaningful public investments.

Wall Street Journal: New Jersey Is Latest State to Push Tax Relief Despite Economic Uncertainty

February 28, 2023

New Jersey Gov. Phil Murphy on Tuesday will propose another $2 billion in property-tax rebate checks as part of a $53 billion state budget, a state treasury official said, making it the latest state to push ahead with tax-relief proposals despite recession concerns. Measures under discussion in more than a dozen states vary widely but the trend cuts […]