State tax policy can be a contentious topic, but one issue on which lawmakers largely agree is that higher gas tax rates are necessary to keep our nation’s infrastructure operating safely and efficiently. Lawmakers in 27 states have approved gas tax increases since 2013. In many cases, they enacted those increases after decades of inaction, during which time construction costs increased and gas tax revenues fell increasingly short. The states that raised gas taxes over these last few years span from coast-to-coast and were under Democratic, Republican, and/or split party control at the time they voted to boost gas taxes. Now another bipartisan wave of states is looking to play catchup with their own gas tax increases.

In Ohio, for instance, Gov. Mike DeWine is proposing the state’s first gas tax hike in nearly 14 years. Gov. DeWine’s proposal would boost Ohio’s gas tax rate by 18 cents per gallon and would reform the tax so that its rate would grow with inflation in the years ahead. Inflation indexing is an increasingly popular approach that can help ensure gas tax dollars don’t begin falling short as soon as construction costs rise.

Elsewhere, Minnesota Gov. Tim Walz recently proposed a budget containing a 20-cent-per-gallon gas tax increase, and Hawaii Gov. David Ige proposed an increase of 5 cents to 6 cents (the exact amount would vary throughout the state). Alabama Gov. Kay Ivey reportedly supports a 12-cent gas tax increase, which would be the state’s first since the summer of 1992. And Arkansas Gov. Asa Hutchinson supports boosting gas taxes for the first time in nearly 18 years by taxing fuel based partly on its price – a policy change expected to amount to a 3-cent tax increase for gas and 6 cents for diesel.

Wisconsin may be next to join this list, as Gov. Tony Evers has signaled that he may be recommending a gas tax increase soon. Meanwhile, legislators in Arizona, Illinois, Mississippi, New Mexico, and elsewhere are also contemplating gas tax increases.

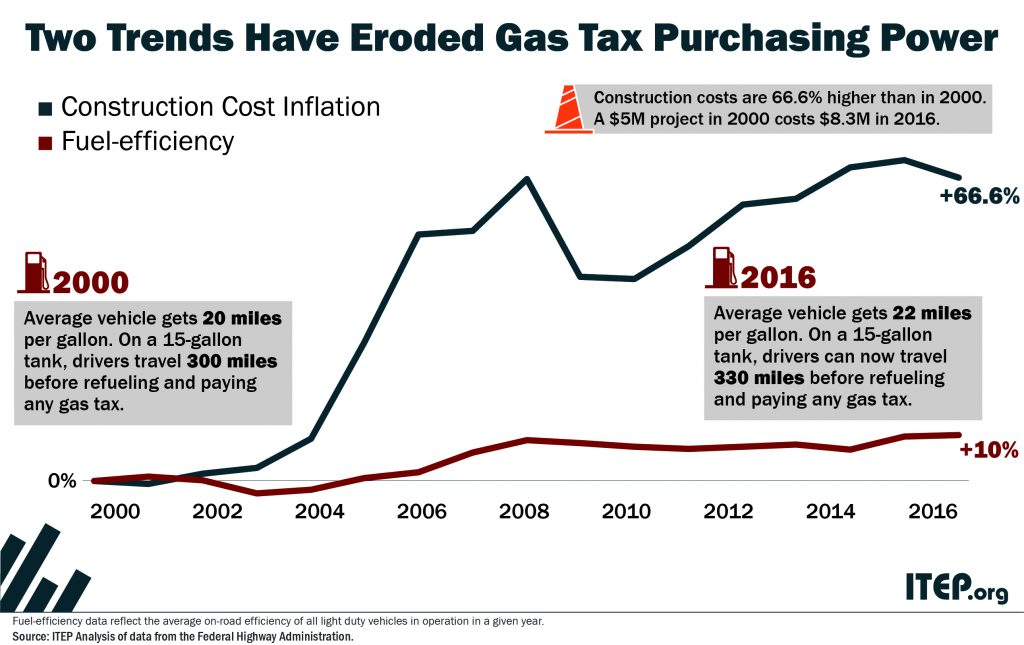

Lawmakers in these states generally recognize that gas tax rates written into law years or even decades ago cannot raise enough funding to maintain a modern infrastructure network. When construction costs rise and fixed-rate gas taxes don’t keep up, an inevitable gap between revenues and expenses begins to emerge. And in recent years, this gap has been widened by fuel-efficiency improvements that allow drivers to travel further on each tank of gas before they need to stop, refuel, and pay the gas tax.

Boosting gas tax rates is a necessary starting point to address funding challenges posed by inflation and fuel-efficiency gains. But thoughtful policymakers have options for going beyond just a one-off gas tax hike. In particular, lawmakers should index their gas tax rates to inflation to insure against inevitable increases in the cost of construction. And lawmakers who are concerned about the impact of a higher gas tax on drivers struggling to make ends meet should push for low-income refundable tax credits that can lessen the impact of the gas tax on people who can least afford to pay.

Read ITEP’s updated brief: How Long Has It Been Since Your State Raised Its Gas Tax?