Recent Work by ITEP

State Rundown 11/8: Election Results Bring Victories, Opportunities for More Common-Sense Tax Reform

November 8, 2023 • By ITEP Staff

Voters had the chance to impact tax policy across the country on election day, and some chose to enact common-sense reforms to raise revenue...

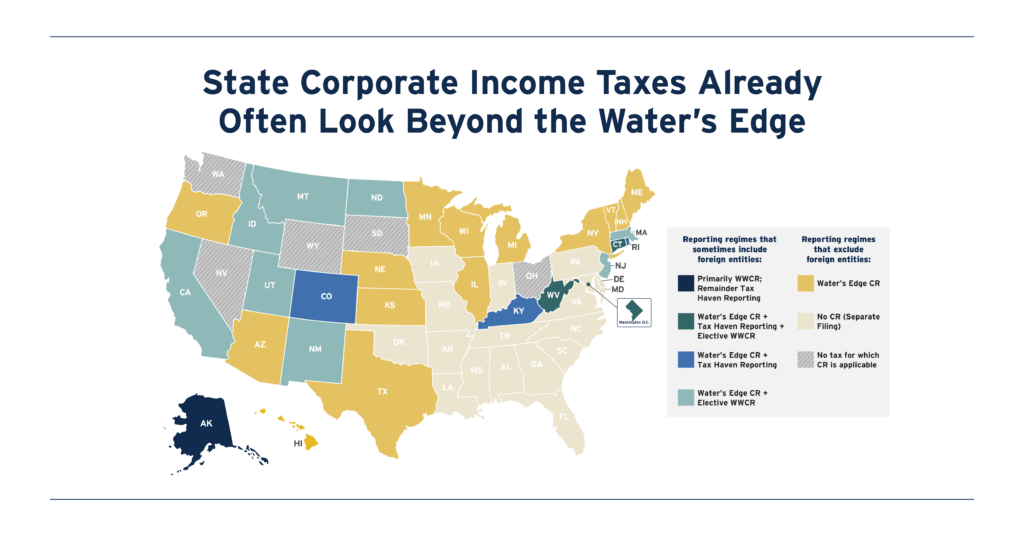

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

America Used to Have a Wealth Tax: The Forgotten History of the General Property Tax

November 2, 2023 • By Carl Davis, Eli Byerly-Duke

Over time, broad wealth taxes were whittled away to become the narrower property taxes we have today. These selective wealth taxes apply to the kinds of wealth that make up a large share of middle-class families’ net worth (like homes and cars), but usually exempt most of the net worth of the wealthy (like business equity, bonds, and pooled investment funds).The rationale for this pared-back approach to wealth taxation has grown weaker in recent decades as inequality has worsened, the share of wealth held outside of real estate has increased, and the tools needed to administer a broad wealth tax…

Workers of all races and ethnicities are confronting a tax code that puts them at a disadvantage relative to those with immense wealth, and people of color and women are among those most likely to be negatively impacted by this injustice.

Free Tax Filing Option from the IRS Would Benefit People of Color, Contrary to Corporate Warnings

October 30, 2023 • By Brakeyshia Samms

There's a patchwork of programs and preparers for people of color to turn to when filing taxes, and most come from corporations that profit from providing a service that the government could provide more effectively and efficiently for free. The Direct File program can change that and is a great step forward in the IRS’ work addressing racism in the tax code.

Three Localities are Boosting Communities with Refundable EITCs; Others Should Follow Suit

October 30, 2023 • By Kamolika Das

Most states already offer their own Earned Income Tax Credits, typically matching a certain percentage of residents’ federal EITC, but this is still a rarity among localities.

Local Earned Income Tax Credits: How Localities Are Boosting Economic Security and Advancing Equity with EITCs

October 30, 2023 • By Andrew Boardman, Galen Hendricks, Kamolika Das

Leading localities are using refundable EITCs to boost incomes and reduce taxes for workers and families with low and moderate incomes. These local credits build on the success of EITCs at the federal and state levels, reduce economic hardship and improve the fairness of the tax code.

State Rundown 10/26: Off-Year Ballot Measures and State & Local Tax Policy

October 26, 2023 • By ITEP Staff

November elections are creeping closer and closer and while that typically means a new batch of lawmakers are elected, it also means voters have another chance to help shape state and local tax policy...

On Corporate Tax Avoidance, Critics Take Aim at ITEP – and Miss

October 25, 2023 • By Matthew Gardner, Steve Wamhoff

In identifying companies that avoid taxes, ITEP presented evidence that our federal corporate income tax was not working the way most Americans think it should work. The public and lawmakers paid attention, including President Biden who then made the case that this demonstrated the need for reform. As a result, Congress enacted the corporate minimum tax, to make the tax system a bit closer to what most Americans want it to be. If you look closely at this, you might just see an example of democracy working.

Intuit Receives Millions in Federal Subsidies While Arguing IRS Direct File Would Be Too Costly

October 24, 2023 • By Joe Hughes, Spandan Marasini

The tax preparation industry has for years lobbied to prevent the IRS from providing a tool that would allow Americans to file their taxes online for free. Recent public disclosures from Intuit, the maker of TurboTax and the leader of the pack, show that tax breaks the company claims for doing “research” might be larger […]