Recent Work

2146 items

State Rundown 12/13: Supermajority Laws Considered in Some States Even as They Confound Others

December 13, 2017 • By ITEP Staff

Supermajority requirements for tax increases are proving a major obstacle to responsible budgeting in Oklahoma, while ballot initiatives are being filed to alter or abolish Oregon‘s similar requirement, but a similar requirement is slowly advancing toward the ballot in Florida nonetheless. Displeasure with agricultural property taxes are spawning both a ballot initiative drive and a […]

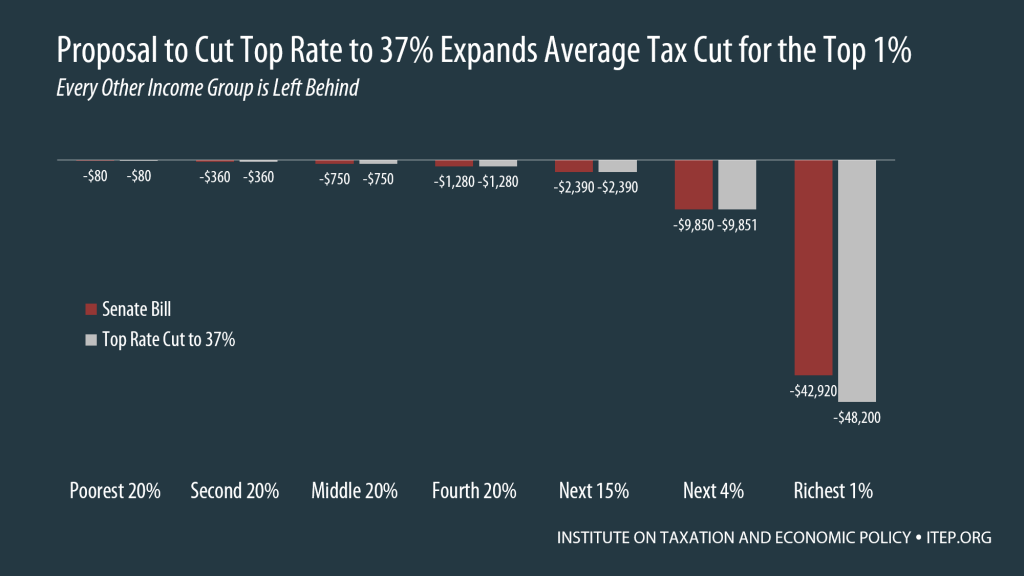

Latest “Compromise” for Tax Plan Is Even Worse than Previous Proposals, Would Reduce the Plans’ “Losers” by Less than 17,000 Taxpayers

December 13, 2017 • By Meg Wiehe, Steve Wamhoff

Earlier this week, ITEP explained that two possible “compromises” to improve the Senate tax bill would accomplish very little other than make the plan more expensive. Incredibly, Republican leaders are now discussing a third possible “compromise” that is even worse — a further reduction in the top personal income tax rate to 37%. This would […]

Parents of College Students: The Tax Plans’ Losers that No One Is Talking About

December 13, 2017 • By Steve Wamhoff

Parents of college students or kids in their last years of high school are more likely to face a tax hike than others under the tax legislation moving through Congress. Higher education has entered the tax debate because the House bill (but not the Senate bill) would repeal several provisions that make college and graduate education more accessible. But little thought has been given to how the tax bills would affect the parents of college students in more direct ways and make it difficult for them to finance college for their kids. If tax legislation were allowed a reasonable number…

As 2017 draws to close, Congress has yet to take legislative action to protect Dreamers. The young undocumented immigrants who were brought to the United States as children, and are largely working or in school, were protected by President Obama’s 2012 executive action, Deferred Action for Childhood Arrivals (DACA). But in September, President Trump announced that he would end DACA in March 2018. Instead of honoring the work authorizations and protection from deportation that currently shields more than 685,000 young people, President Trump punted their lives and livelihood to a woefully divided Congress which is expected to take up legislation…

Updated Tax Contributions of Young Undocumented Immigrants

December 13, 2017 • By ITEP Staff

In September 2017, US Citizenship and Immigration Services released updated enrollment data for the program Deferred Action for Childhood Arrivals (DACA). The updated data included estimates of the number of former DACA enrollees that were now legal permanent residents and those that failed to reapply or their reapplication was denied. The table below provides updated estimates of their tax contributions.

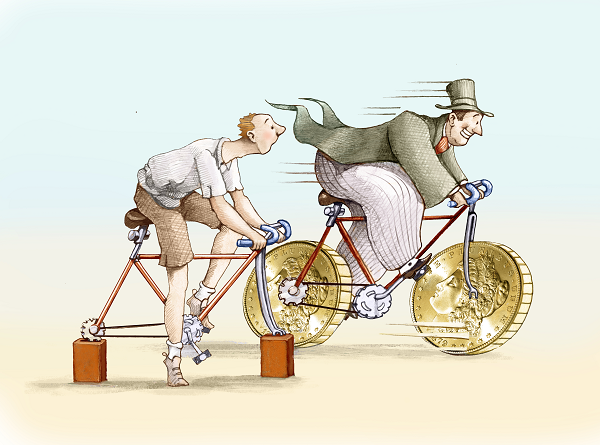

Who Is “America First” Under the Tax Plan? The Rich First, Foreign Investors Second, Then the Rest of Us.

December 12, 2017 • By Steve Wamhoff

In his inaugural speech, President Trump told the world that Washington would be driven by a principle of “America First.” But the tax plans moving through Congress only put the richest Americans first. Everyone else comes after foreign investors.

Treasury’s 1-Page Memo Reasserts False Claims that Tax Cuts Largely Pay for Themselves — But Only When Accompanied by Spending Cuts

December 12, 2017 • By Steve Wamhoff

Treasury Secretary Steven Mnuchin claimed for weeks that his department would release a study showing that the $1.5 trillion tax cut moving through Congress would “pay for itself.” On Monday he released a one-page memo that asserts, without evidence, that economic growth resulting from President Trump’s policies would raise enough revenue to more than offset the costs of the tax cuts.

“Compromises” Under Discussion for the State and Local Tax Deduction Do Not Fix Flawed Tax Bills

December 10, 2017 • By Meg Wiehe, Steve Wamhoff

Republicans in Congress are reported to be considering two versions of a change they claim would “improve” the current bills by making them more generous to residents of higher-taxed states. As illustrated by these estimates, the reality is that these proposals would make little difference on those states and taxpayers hit hardest.

Even with Potential SALT Compromises, Senate Bill Forces California and New York to Shoulder a Larger Share of Federal Taxes While Texas, Florida, and Other States Will Pay Less

December 10, 2017 • By Meg Wiehe, Steve Wamhoff

The Senate tax bill, with or without either of the compromises that could be added to it, would shift personal income taxes away from Florida and Texas to states like California and New York, which are already paying a high share relative to their populations.

State Rundown 12/7: States Try to Plan While Awaiting Federal Tax Decisions

December 7, 2017 • By ITEP Staff

Though most eyes were on Congress rather than states this week, several states have been taking stock of their fiscal situations. Wyoming lawmakers considered ways to resolve budget shortfalls, Kansas and New Mexico legislators got some minor good news about their states' revenues, their counterparts in Minnesota and Vermont grappled with less encouraging revenue news, and those in West Virginia were just happy to hear their revenues had at least met expectations for once.

Charitable, Property Tax, and Mortgage Interest Deductions Would Be Wiped Out for Two-Thirds of Current Claimants Under Congressional Tax Plans

December 7, 2017 • By Carl Davis

In the ongoing debate over major federal tax legislation, there is significant focus on how House and Senate bills would eliminate the deduction for state income tax payments and cap the deduction for property taxes at $10,000 per year. At the same time, tax writers have retained deductions for charitable gifts and mortgage interest with what appear to be comparatively minor changes, at least at first glance.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

They Can’t Help Themselves: GOP Leaders Reveal True Intent Behind Tax Overhaul

December 4, 2017 • By Jenice Robinson

The hand-written scrawls in the margins of the hastily written 500-page Senate tax bill had barely dried when lawmakers began to reveal the true motivation behind their rush to fundamentally overhaul the nation’s tax code.

Senate “Pass-Through” Deduction Threatens to Undermine State Tax Systems

December 1, 2017 • By Carl Davis

The U.S. Senate will soon be voting on a bill that would, among other things, allow so-called “pass-through” businesses to pay significantly lower taxes than their employees...If the Senate “pass-through” deduction is enacted into law, dozens of states will be forced to confront the possibility of reduced revenue collections, more regressive tax codes, and increased tax avoidance.

New ITEP Report Explains How Tax Reform Should Eliminate Breaks for Real Estate Investors Like Trump

December 1, 2017 • By Steve Wamhoff

A new report from ITEP provides more details on the many breaks and loopholes for wealthy real estate investors like Trump and what a true tax reform would do to close them.