Recent Work

2146 items

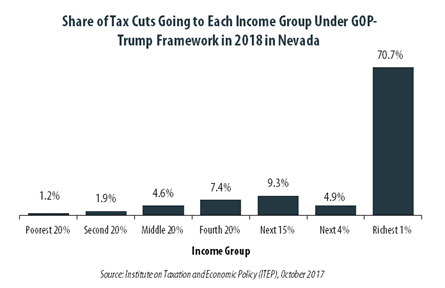

GOP-Trump Tax Framework Would Provide Richest One Percent in Nevada with 70.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Nevada equally. The richest one percent of Nevada residents would receive 70.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $538,200 next year. The framework would provide them an average tax cut of $113,840 in 2018, which would increase their income by an average of 4.5 percent.

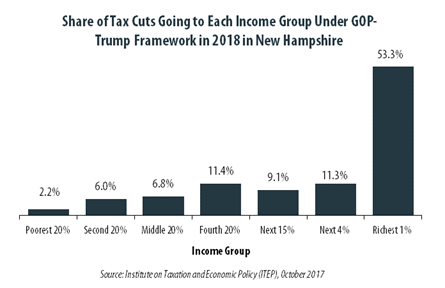

GOP-Trump Tax Framework Would Provide Richest One Percent in New Hampshire with 53.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New Hampshire equally. The richest one percent of New Hampshire residents would receive 53.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $545,600 next year. The framework would provide them an average tax cut of $69,390 in 2018, which would increase their income by an average of 4.2 percent.

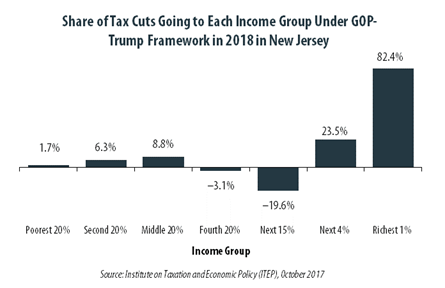

GOP-Trump Tax Framework Would Provide Richest One Percent in New Jersey with 82.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New Jersey equally. The richest one percent of New Jersey residents would receive 82.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $1,105,200 next year. The framework would provide them an average tax cut of $73,950 in 2018, which would increase their income by an average of 2.3 percent.

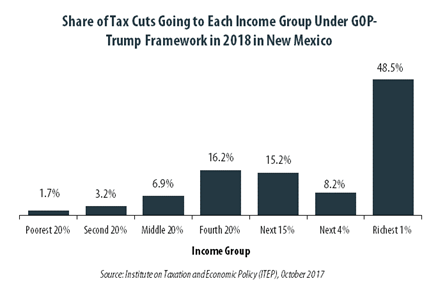

GOP-Trump Tax Framework Would Provide Richest One Percent in New Mexico with 48.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New Mexico equally. The richest one percent of New Mexico residents would receive 48.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $443,700 next year. The framework would provide them an average tax cut of $45,910 in 2018, which would increase their income by an average of 3.6 percent.

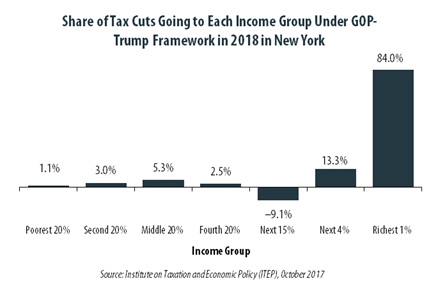

GOP-Trump Tax Framework Would Provide Richest One Percent in New York with 84.0 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in New York equally. The richest one percent of New York residents would receive 84.0 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $872,200 next year. The framework would provide them an average tax cut of $103,660 in 2018, which would increase their income by an average of 3.2 percent.

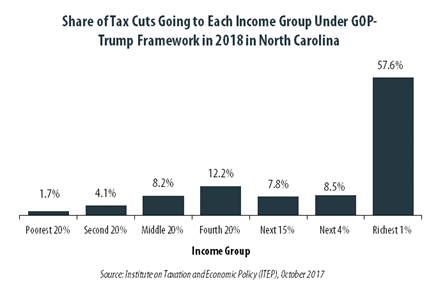

GOP-Trump Tax Framework Would Provide Richest One Percent in North Carolina with 57.6 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in North Carolina equally. The richest one percent of North Carolina residents would receive 57.6 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $512,000 next year. The framework would provide them an average tax cut of $50,440 in 2018, which would increase their income by an average of 3.2 percent.

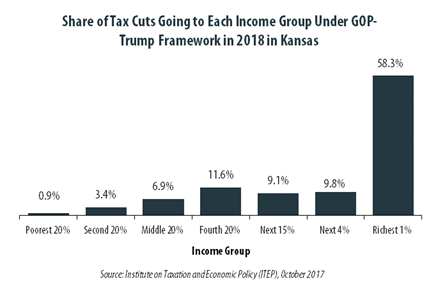

GOP-Trump Tax Framework Would Provide Richest One Percent in Kansas with 58.3 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Kansas equally. The richest one percent of Kansas residents would receive 58.3 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $535,600 next year. The framework would provide them an average tax cut of $84,190 in 2018, which would increase their income by an average of 4.6 percent.

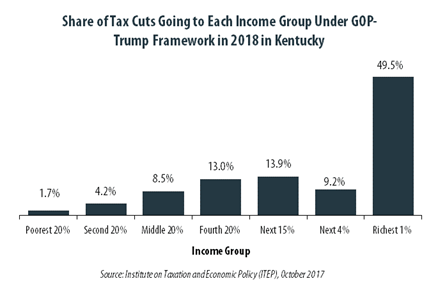

GOP-Trump Tax Framework Would Provide Richest One Percent in Kentucky with 49.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Kentucky equally. The richest one percent of Kentucky residents would receive 49.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $460,800 next year. The framework would provide them an average tax cut of $42,480 in 2018, which would increase their income by an average of 3.2 percent.

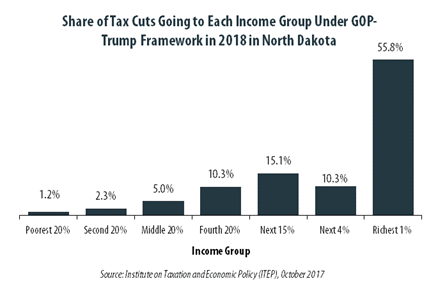

GOP-Trump Tax Framework Would Provide Richest One Percent in North Dakota with 55.8 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in North Dakota equally. The richest one percent of North Dakota residents would receive 55.8 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $693,800 next year. The framework would provide them an average tax cut of $111,620 in 2018, which would increase their income by an average of 6.5 percent.

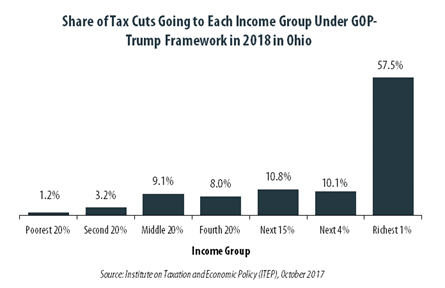

GOP-Trump Tax Framework Would Provide Richest One Percent in Ohio with 57.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Ohio equally. The richest one percent of Ohio residents would receive 57.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $483,100 next year. The framework would provide them an average tax cut of $56,280 in 2018, which would increase their income by an average of 3.7 percent.

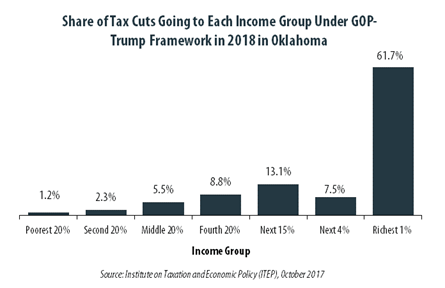

GOP-Trump Tax Framework Would Provide Richest One Percent in Oklahoma with 61.7 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Oklahoma equally. The richest one percent of Oklahoma residents would receive 61.7 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $498,400 next year. The framework would provide them an average tax cut of $72,150 in 2018, which would increase their income by an average of 5.5 percent.

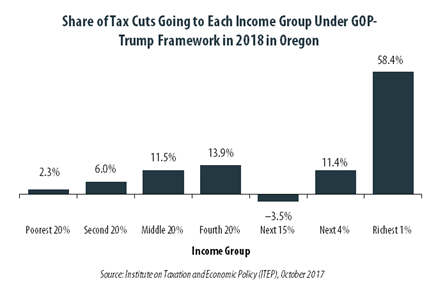

GOP-Trump Tax Framework Would Provide Richest One Percent in Oregon with 58.4 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Oregon equally. The richest one percent of Oregon residents would receive 58.4 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $532,000 next year. The framework would provide them an average tax cut of $42,090 in 2018, which would increase their income by an average of 2.5 percent.

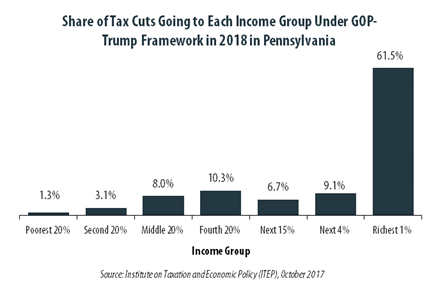

GOP-Trump Tax Framework Would Provide Richest One Percent in Pennsylvania with 61.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Pennsylvania equally. The richest one percent of Pennsylvania residents would receive 61.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $550,200 next year. The framework would provide them an average tax cut of $67,970 in 2018, which would increase their income by an average of 3.8 percent.

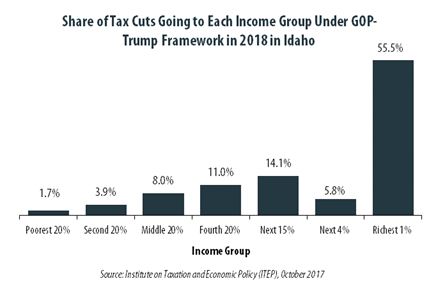

GOP-Trump Tax Framework Would Provide Richest One Percent in Idaho with 55.5 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Idaho equally. The richest one percent of Idaho residents would receive 55.5 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $457,600 next year. The framework would provide them an average tax cut of $52,540 in 2018, which would increase their income by an average of 3.7 percent.

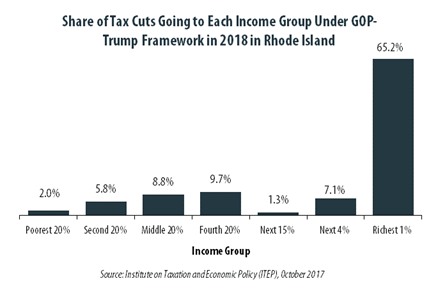

GOP-Trump Tax Framework Would Provide Richest One Percent in Rhode Island with 65.2 Percent of the State’s Tax Cuts

October 4, 2017 • By ITEP Staff

The “tax reform framework” released by the Trump administration and congressional Republican leaders on September 27 would not benefit everyone in Rhode Island equally. The richest one percent of Rhode Island residents would receive 65.2 percent of the tax cuts within the state under the framework in 2018. These households are projected to have an income of at least $528,800 next year. The framework would provide them an average tax cut of $55,510 in 2018, which would increase their income by an average of 3.1 percent.