Recent Work

2162 items

As many of you may know, we love taxes, along with the many great things they provide for our communities...

State Rundown 2/8: Flowers, Chocolates, and Tax Cuts for the Wealthy?

February 8, 2024 • By ITEP Staff

While we were hoping to get progressive tax policy wins for Valentine’s Day, many state lawmakers have another idea in mind...

Tax Policy to Reduce Racial Retirement Wealth Inequality

February 6, 2024 • By Brakeyshia Samms, Carl Davis

Historic and ongoing discrimination have created stark racial disparities in the US, and the racial retirement wealth gap is one such example.

House SALT Proposal is Expensive, Unneeded, and Poorly Designed

February 2, 2024 • By Joe Hughes

The SALT Marriage Penalty Elimination Act passed by the House Rules Committee on February 1 is costly, decreasing tax revenue by about $8 billion in 2023. It also mostly only helps taxpayers who are already well off.

Impacts of the Tax Relief for American Families and Workers Act

February 2, 2024 • By Joe Hughes, Steve Wamhoff

The Tax Relief for American Families and Workers Act passed by the House of Representatives on January 31 is a compromise between lawmakers who want to address child poverty and lawmakers who want to expand the Trump tax cuts for corporations and therefore includes provisions that do both. It also offsets the costs of those […]

State Rundown 2/1: Black History Month Begins as Tax Debates Heat Up Nationwide

February 1, 2024 • By ITEP Staff

This week the showdown between the Kansas legislature and governor continued as Gov. Kelly vetoed the legislature’s latest attempt to pass a flat personal income tax. Elsewhere, the focus is on doing more for working families through proposals to expand refundable credits in Maryland and adding a millionaire tax bracket in Rhode Island. Meanwhile, there’s […]

It doesn’t matter if someone with a family income of $800,000 per year thinks they aren’t rich because they can’t quit their jobs and retire to a luxury home on the beach in Malibu. They can call themselves what they want. The point is that they are richer than 99 percent of the population and can afford to pay more.

The IRS Direct File pilot is currently open to eligible taxpayers here. Millions of American families have now received their W-2s for 2023, signaling the start to a new tax filing season. The IRS has set January 29 as the first date that people can file their tax returns for the previous year, and the […]

State Rundown 1/26: Wealth Taxes Drawing Interest Early in Legislative Sessions

January 26, 2024 • By ITEP Staff

Bills are moving and state legislative sessions are picking up across the country, giving elected officials the opportunity to consider two distinct paths when it comes to tax policy...

New Mexico Making Tremendous Progress Making Taxes Less Regressive

January 24, 2024 • By Carl Davis

Recent tax reforms have helped to bring greater balance to New Mexico's tax code. A new in-depth look at taxes in all 50 states finds New Mexico is an emerging leader, though there’s still plenty of room for improvement.

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

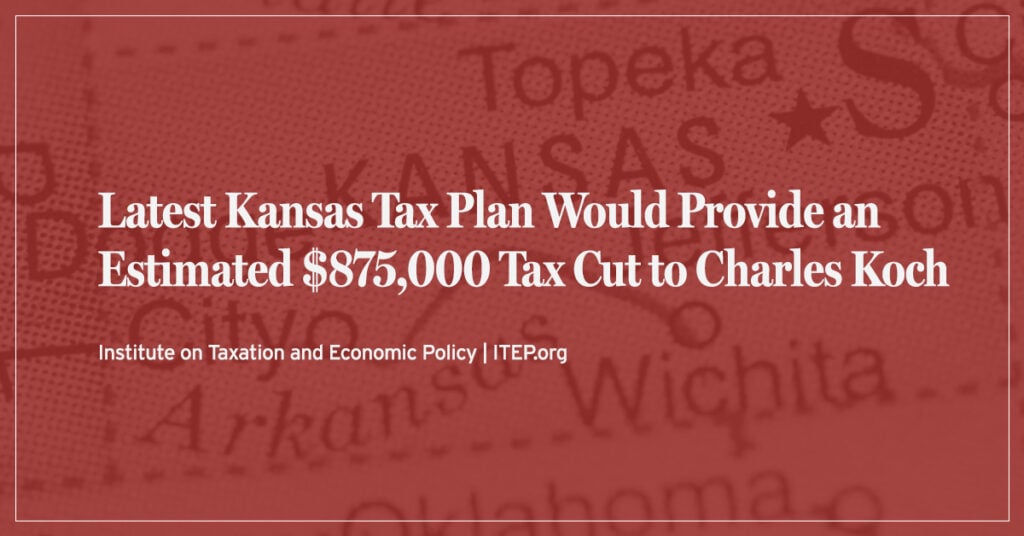

Latest Kansas Tax Plan Would Provide an Estimated $875,000 Tax Cut to Charles Koch

January 22, 2024 • By Carl Davis, Neva Butkus

Last week, both houses of the Kansas legislature approved a significant tax cut centered around replacing the state’s graduated rate income tax structure with a flat tax instead. The bulk of this would flow to upper-income families, mostly through lowering the state’s top income tax rate from 5.7 to 5.25 percent. This tax cut would […]

The findings of Who Pays? go a long way toward explaining why so many states are failing to raise the amount of revenue needed to provide full and robust support for our public schools.

Tax policy themes have begun to crop up in states as governors give their yearly addresses and legislators lay out their plans for the 2024 legislative season...

Worthwhile Ideas for a Stronger and Fairer D.C. Tax Code

January 17, 2024 • By Andrew Boardman, Kamolika Das, Marco Guzman

The nation’s capital has a once-in-a-decade opportunity to advance a stronger and fairer local tax code. New draft recommendations from a key advisory panel will help leaders make the most of the moment.