Recent Work

2146 items

Proposed Tax Deal Would Help Millions of Kids with Child Tax Credit Expansion While Extending Damaging Corporate Tax Breaks

January 16, 2024 • By Joe Hughes

On January 16, Congressional tax writers officially announced the details of a tax policy agreement. The deal includes expansions of the Child Tax Credit (CTC) to improve access for low- and middle-income families as well as expansions of the 2017 Trump tax cuts for businesses. The agreement also includes bipartisan tax priorities tax provisions for […]

State Rundown 1/11: Sounding the Alarm on Regressive State & Local Tax Codes

January 11, 2024 • By ITEP Staff

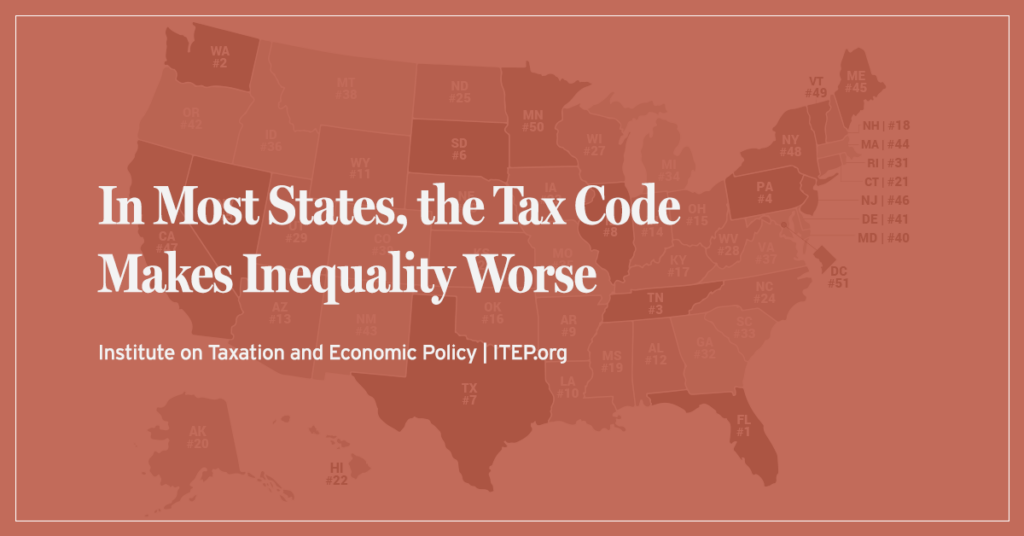

States got a wake-up call this week as ITEP released the latest edition of our flagship Who Pays? report...

The vast majority of state and local tax systems are upside-down, with the wealthy paying a far lesser share of their income in taxes than low- and middle-income families. Yet a few states have made strides to buck that trend and have tax codes that are somewhat progressive and therefore do not worsen inequality.

U.S. Average: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

U. S. Average Download PDF All figures and charts show 2024 state and local tax law, presented at 2023 income levels. These figures depict taxes paid by residents to their home states. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.7 percent) state and local tax revenue collected […]

Utah: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Utah Download PDF All figures and charts show 2024 tax law in Utah, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.5 percent) state and local tax revenue collected in Utah. State and local tax shares of family income Top 20% Income Group […]

Wyoming: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Wyoming Download PDF All figures and charts show 2024 tax law in Wyoming, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.8 percent) state and local tax revenue collected in Wyoming. State and local tax shares of family income Top 20% Income Group […]

Wisconsin: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Wisconsin Download PDF All figures and charts show 2024 tax law in Wisconsin, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.4 percent) state and local tax revenue collected in Wisconsin. State and local tax shares of family income Top 20% Income Group […]

West Virginia: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

West Virginia Download PDF All figures and charts show 2024 tax law in West Virginia, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.3 percent) state and local tax revenue collected in West Virginia. These figures depict West Virginia’s personal income tax at […]

Virginia: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Virginia Download PDF All figures and charts show 2024 tax law in Virginia, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (98.8 percent) state and local tax revenue collected in Virginia. These figures depict Virginia’s standard deduction at its 2024 levels of $8,500 […]

Washington: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Washington Download PDF All figures and charts show 2024 tax law in Washington, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.3 percent) state and local tax revenue collected in Washington. As seen in Appendix D, the state’s new Working Families Tax Credit […]

Vermont: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Vermont Download PDF All figures and charts show 2024 tax law in Vermont, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.7 percent) state and local tax revenue collected in Vermont. State and local tax shares of family income Top 20% Income Group […]

Tennessee: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Tennessee Download PDF All figures and charts show 2024 tax law in Tennessee, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.3 percent) state and local tax revenue collected in Tennessee. State and local tax shares of family income Top 20% Income Group […]

Texas: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Texas Download PDF All figures and charts show 2024 tax law in Texas, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.5 percent) state and local tax revenue collected in Texas. State and local tax shares of family income Top 20% Income Group […]

South Dakota: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

South Dakota Download PDF All figures and charts show 2024 tax law in South Dakota, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.6 percent) state and local tax revenue collected in South Dakota. State and local tax shares of family income Top […]

Rhode Island: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Rhode Island Download PDF All figures and charts show 2024 tax law in Rhode Island, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly 100 percent of state and local tax revenue collected in Rhode Island. State and local tax shares of family income Top […]