Recent Work

2146 items

Congress Should Raise Taxes on the Rich, But That’s a Totally Separate Issue from the Debt Ceiling

May 9, 2023 • By Steve Wamhoff

Congress absolutely should raise taxes on the rich and on corporations to generate revenue and improve the fairness of our tax code. President Biden has several proposals to do exactly that. But this is an entirely separate question from whether we should raise the debt ceiling to honor the debts the nation has already incurred and avoid an economic apocalypse.

Minnesota Poised to Enact Landmark Loophole-Closing Corporate Tax Reforms

May 7, 2023 • By Matthew Gardner

With Minnesota poised to enact worldwide combined reporting of corporate income taxes, business lobbyists are pulling out all the stops to make state lawmakers believe the apocalypse is upon them.

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

While the conversations on the debt ceiling heat up in the nation's capital, debates on state tax policy also continue to unfold in capitol buildings across the nation...

The GOP is Finally Ready to Raise Taxes. (Or, When a Tax Hike is Not a Tax Hike.)

May 3, 2023 • By Joe Hughes

House Republicans recently voted to rescind the green energy and electric vehicle tax credits that were enacted last Congress as part of the Inflation Reduction Act. This newfound willingness to raise taxes stands in contrast to the recent position of almost the entire House Republican Caucus.

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

A compelling new examination over multiple years and multiple states found that infants are more likely to survive to age one in states that raise more revenue and raise it from those most able to pay. Generating taxes from rich people and corporations can help babies make it to their first birthday.

Kansas Avoids Flat Tax Proposal: Narrow Victory a Cautionary Tale for Other States

April 27, 2023 • By Brakeyshia Samms

Kansas lawmakers failed to override Gov. Laura Kelly’s veto of a damaging flat tax package. In doing so, the state narrowly avoided traveling again down the same disastrous yet well-worn path of deep income tax cuts. States across the country can learn from Kansas’s experience by rethinking tax policy decisions and broader statewide priorities.

This week the importance of state tax policy is center stage once again...

Racial Justice Requires Tax Justice: Our Analysis Helps Deliver Both

April 24, 2023 • By Amy Hanauer

ITEP’s analytical approach, our comprehensive microsimulation model, and our unique state-level capacities enable us to do pioneering analyses that enrich the debate on racial justice in tax policy that no other entity can do.

State Rundown 4/19: Revenue Discussions Heat Up Like the Temperature

April 19, 2023 • By ITEP Staff

Tax season has ended for most filers, but the topic remains a hot one in states around the country...

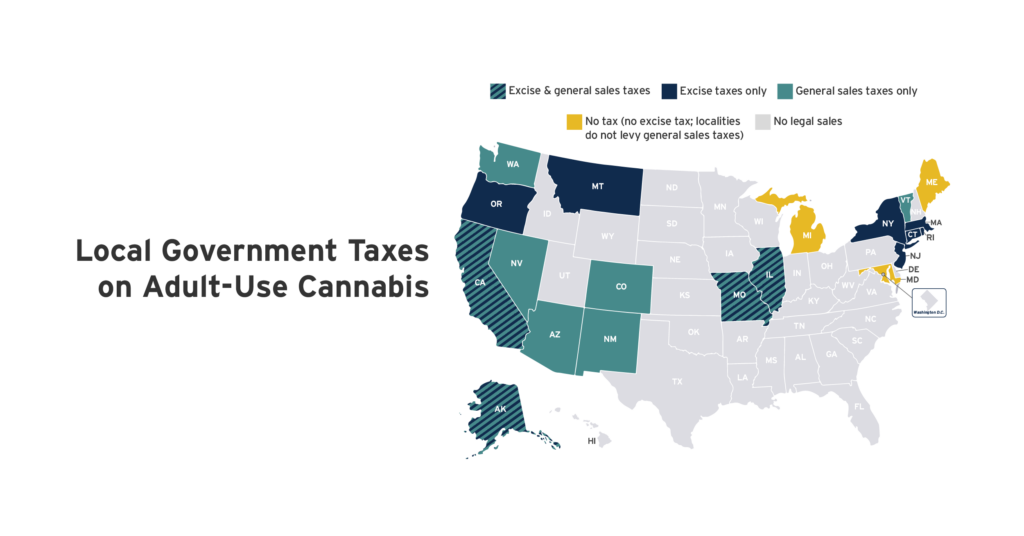

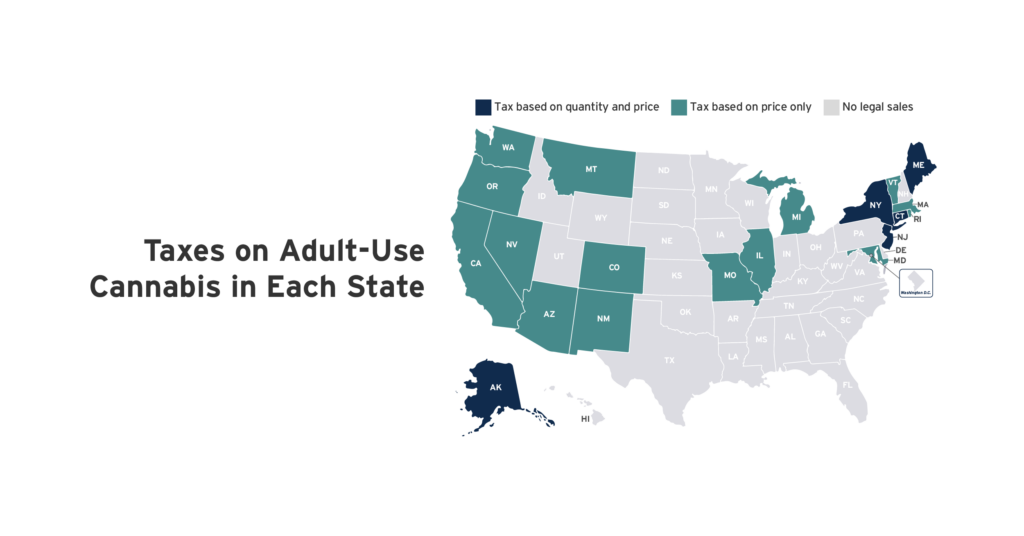

How is Adult-Use Cannabis Taxed by Your Local Government?

April 19, 2023 • By Carl Davis, Eli Byerly-Duke

Twenty states have legalized the sale of cannabis for general adult use. Cannabis taxes vary considerably depending on local authority. Some states allow local governments to levy standalone excise taxes applying narrowly to cannabis purchases. Most local excise taxes on cannabis are levied in states that do not permit local governments to levy general sales taxes.

Twenty states have legalized cannabis sales for general adult use. Every state allowing legal sales applies a cannabis tax based on the product’s quantity, its price, or both. ITEP research indicates that taxes based on quantity will be more sustainable over time because prices are widely expected to fall as the cannabis industry matures.

Why is My Refund So Much Smaller This Year? Only the Good (Tax Credits) Die Young.

April 18, 2023 • By Joe Hughes

This year millions of American families are finding that their refunds are much smaller than last year—or that they even owe taxes back to the government—because of the expiration of the expanded Child Tax Credit and Earned Income Tax Credit that were in effect in 2021. The lapse of the expanded credits affects a majority of the middle class, but lower-income households are particularly likely to feel the sting.

Everything! Taxing wealthy people and corporations and using the revenue for paid leave, child care, education, health care and college would transform America for girls and women of every race and family type, in every corner of this country.