Refundable Tax Credits

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

D.C.’s Fiscal Autonomy is at Stake, District’s Conformity Decisions Should Stand

February 6, 2026 • By Kamolika Das

Federal lawmakers passed a bill along party lines that would force the District of Columbia to override the decision of local elected officials and implement all of the costly and inequitable federal tax cuts passed under the “One Big Beautiful Bill Act” (OBBBA).

Pennsylvania Just Gave Low-Income Workers a Tax Credit Boost. Now It’s Philadelphia’s Turn.

December 30, 2025 • By Kamolika Das

In the same way states are building upon federal tax credits, localities should consider building on state tax credits.

From Congressional discussions over the so-called "One Big Beautiful Bill Act" to debates on property taxes, ITEP kept busy this year analyzing tax proposals and showing Americans across the country how tax decisions affect them.

States Can Create or Expand Refundable Credits by Taxing Wealth, Addressing Federal Conformity

December 19, 2025 • By Zachary Sarver

Many states already recognize the potential of these credits to boost low- and moderate-income households. Other states should follow suit.

State Earned Income Tax Credits Support Families and Workers in 2025

September 11, 2025 • By Neva Butkus

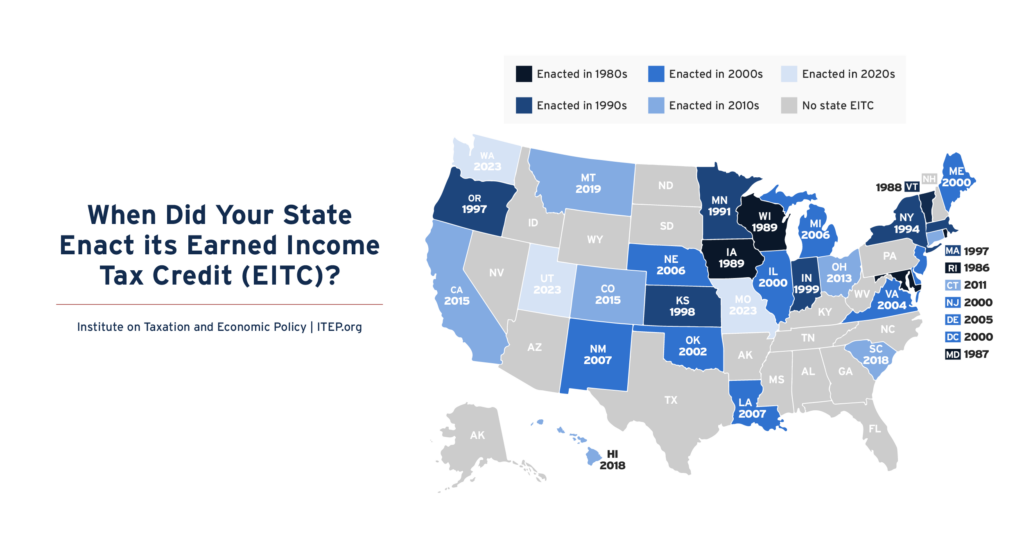

Nearly two-thirds of states now have an Earned Income Tax Credit (EITC). Momentum continues to build on these credits that boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

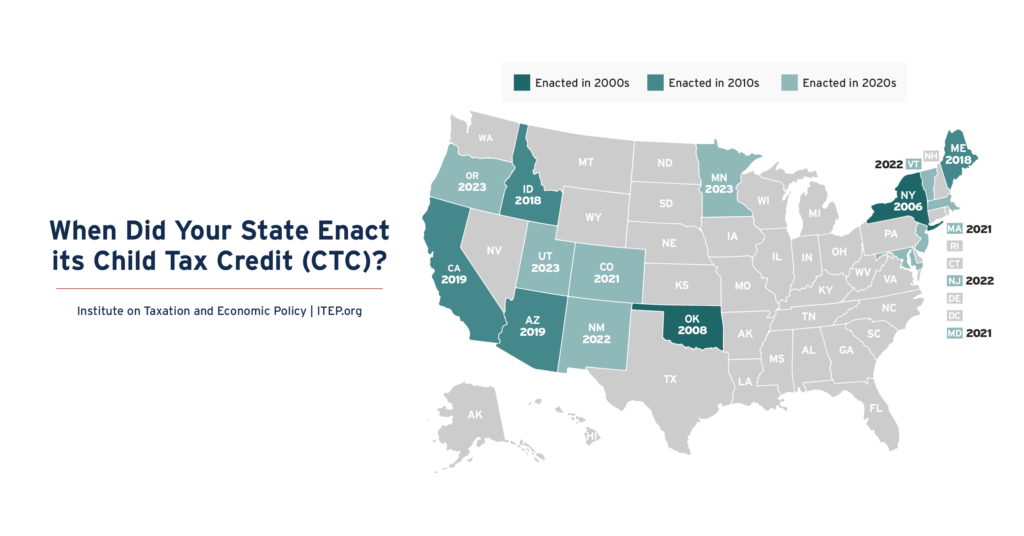

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

Refundable tax credits were a big part of state tax policy conversations this year. In 2025, nine states improved or created Child Tax Credits or Earned Income Tax Credits.

The Earned Income Tax Credit (EITC) supports millions of workers and families and continues to grow in states and localities across the country. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco, where they benefited 700,000 households in 2023.

A Well Targeted Federal Renter Credit Could Help Reduce Wealth Gaps

March 3, 2025 • By Brakeyshia Samms

While lawmakers often speak about income inequality, less attention is paid to wealth inequality. Wealth is distributed even more unequally than income in the U.S. in ways that reinforce racial divides, leave some households with too little to handle unexpected expenses, and enable some households to pass down enormous intergenerational wealth. A renter tax credit is one tool lawmakers can use to reduce wealth inequalities both within racial and ethnic groups and between these groups. As we show in our new analysis, Black and Hispanic households are more likely to be renters and hold less wealth than white households.

High-Rent, Low-Wealth: Addressing the Racial Wealth Gap through a Federal Renter Credit

March 3, 2025 • By Brakeyshia Samms, Emma Sifre, Joe Hughes

While the federal tax code has some policies focused on raising income of low earners, it contains fewer provisions designed specifically to address wealth inequality. A renter tax credit offers a simple, administratively practical means of reaching low-wealth populations through the federal tax code without requiring a comprehensive measurement of every household’s wealth.