Retirement Tax Breaks

Policymakers Could Consider Using Tax and Transfer Policy to Reduce the Racial Retirement Wealth Gap

February 3, 2025 • By Brakeyshia Samms, Carl Davis

As we show in our recent study, this is, in part, due to longstanding discrimination shaping racial differences in economic wellbeing in the U.S. Moreover, aspects of federal and state tax policies have helped create the vast racial retirement wealth gap in place today. For this reason, we evaluate how tax and transfer policy reforms could help shrink racial retirement wealth inequality. To inform lawmakers as they approach the 2025 debates, below we offer several guiding principles.

Tax Policy to Reduce Racial Retirement Wealth Inequality

February 6, 2024 • By Brakeyshia Samms, Carl Davis

Historic and ongoing discrimination have created stark racial disparities in the US, and the racial retirement wealth gap is one such example.

Deep Public Investment Changes Lives, Yet Too Many States Continue to Seek Tax Cuts

April 12, 2023 • By Aidan Davis

When state budgets are strong, lawmakers should put those revenues toward building a stronger and more inclusive society for the long haul. Yet, many state lawmakers have made clear that their top priority is repeatedly cutting taxes for the wealthy.

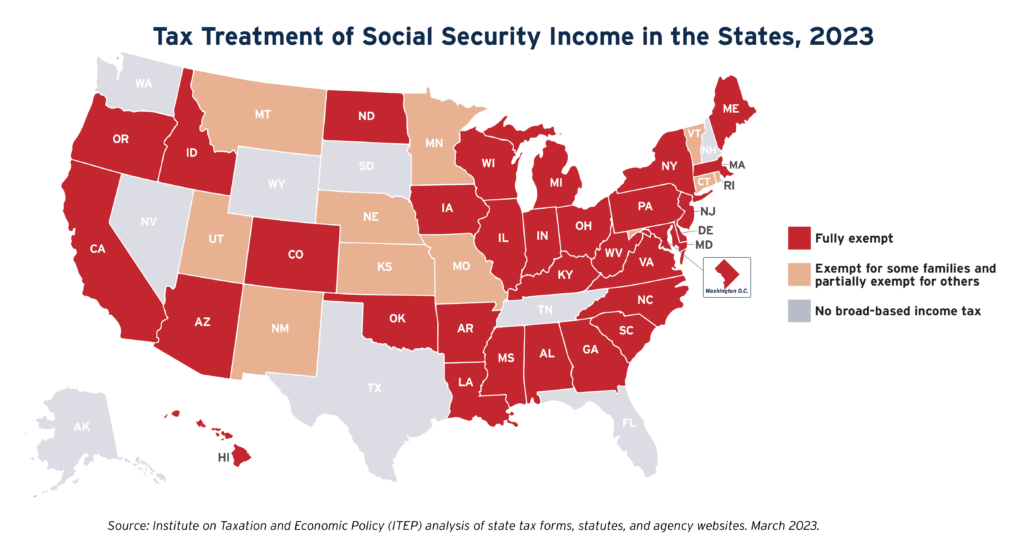

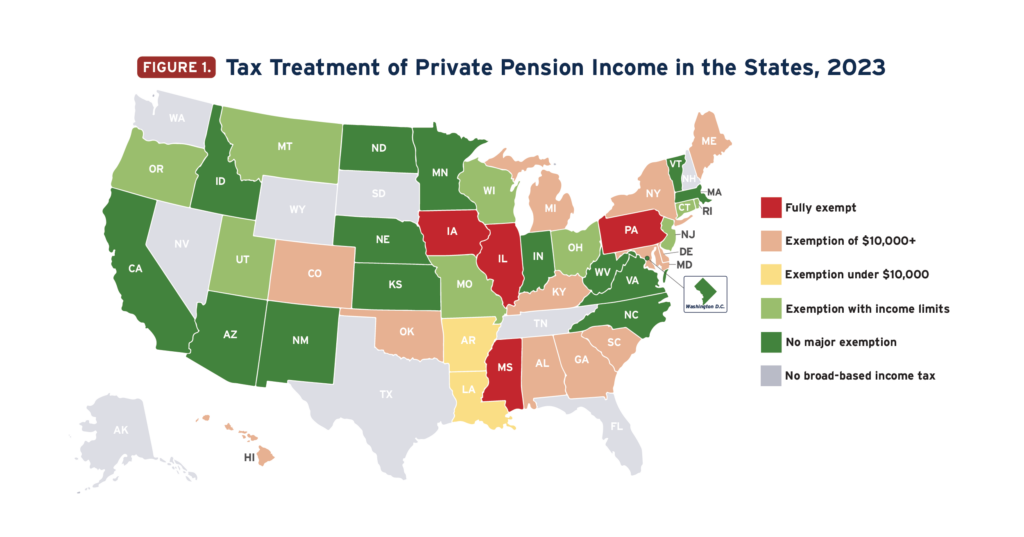

Every state with a personal income tax offers tax subsidies for seniors that are unavailable to younger taxpayers. The best academic research suggests that the median state asks senior citizens to pay about one-third less in personal income tax than younger families with similar incomes. The majority of these subsidies are costly and poorly targeted. […]

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

State governments provide a wide array of tax subsidies to their older residents. But too many of these carveouts focus on predominately wealthy and white seniors, all while the cost climbs.

Bipartisan Retirement Proposals Are Mostly Just More Tax Cuts for the Wealthy

December 5, 2022 • By Steve Wamhoff

The EARN Act and SECURE Act 2.0, two bipartisan retirement bills working their way through Congress, are major disappointments. They would mainly provide more tax breaks for the well-off who will most likely retire comfortably regardless of what policies Congress enacts. The bills would provide modest assistance for those who really need help to save.