Key findings

• State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

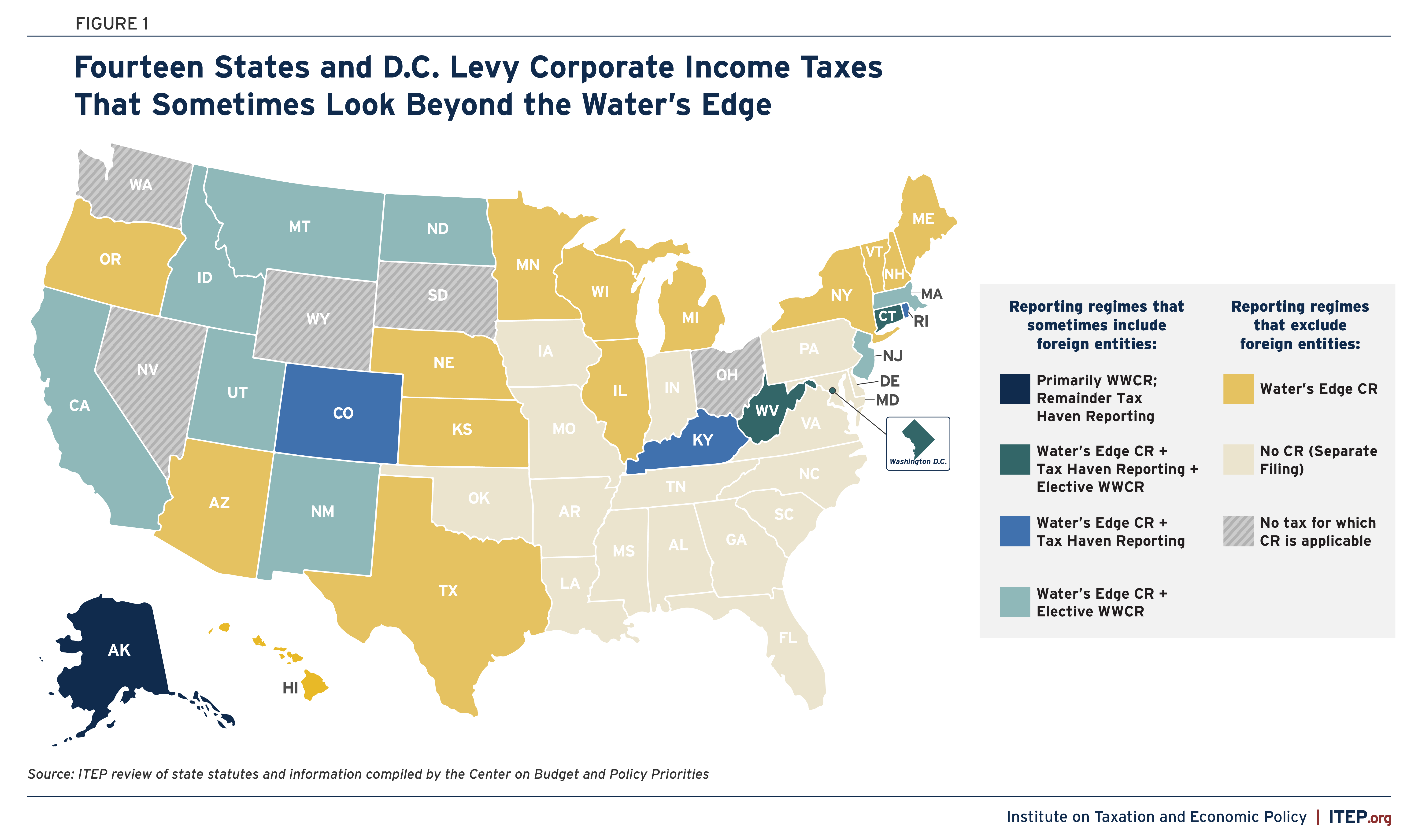

• Worldwide combined reporting would also be a natural extension of features that already exist in state tax law. Fourteen states and the District of Columbia either allow, or require, companies to file returns that include at least some profits booked in foreign countries.

• Ten states and D.C. allow for WWCR on an elective basis, meaning that companies can choose to file in this manner. Officials at the Multistate Tax Commission have confirmed that companies in at least some of these states are already using the WWCR system in their tax filings.

• Research by the Center on Budget and Policy Priorities indicates that six states and D.C. mandate that profits booked in certain tax haven countries must be included in a company’s state tax filings. This amounts to a partial step toward complete WWCR and, given the ubiquity of tax haven subsidiaries among multinational companies, means that many companies are already accustomed to including some of their foreign subsidiaries’ profits in state corporate income tax filings. Previous ITEP research revealed that three quarters of Fortune 500 companies operate one or more subsidiaries in a tax haven country.

• The Alaska corporate income tax already functions primarily as a worldwide combined tax. Our review of state tax data going back to 1991 finds that almost three quarters (74 percent) of Alaska’s corporate income tax collections have come from the oil and gas sectors, which have long been subject to mandatory WWCR. Data provided by the Alaska Department of Revenue further reveal that in Fiscal Year 2023, every dollar of state corporate tax paid by these sectors came from companies with foreign subsidiaries filing worldwide combined returns.

Background

One of the most encouraging developments in the critically important, and highly popular, campaign against corporate tax avoidance in recent years has been the flurry of interest in fixing a multi-billion-dollar blind spot in state corporate tax law through mandating a comprehensive worldwide combined filing system.[1] Worldwide combined reporting (WWCR), sometimes called “complete reporting,” is the simplest and most effective means of neutralizing an endless, evolving string of tax avoidance techniques that allow corporations to misrepresent their business to state tax authorities such that they appear to be earning an outsized share of their profits in tax haven countries.[2]

Under WWCR, the corporate tax calculation begins from a comprehensive and difficult to manipulate measure of all profits being earned worldwide. From there, a formula based on business fundamentals, rather than accounting fiction, is used to determine the portion of those profits that should be subject to a given state’s corporate income tax.[3] This system is preferable to the less comprehensive water’s edge filing system where companies generally report only those profits associated with U.S. subsidiaries, enabling some profits to remain hidden from taxation. With that approach, companies can claim that profits were earned by foreign subsidiaries and even if that is not true, it can be extremely difficult for states to understand exactly what was earned or how to tax it.

WWCR offers the simplest path for any state that is serious about administering its corporate income tax in a manner that is not intensely vulnerable to profit shifting. Seeking to prevent such avoidance through one-off loophole closures and litigation is a far more difficult and less fruitful approach. As Don Griswold, former Executive Tax Counsel at Berkshire Hathaway, explained in Tax Notes:

Planners hope that auditors will stop once they find the ‘low hanging fruit.’ The more sophisticated (and recent) the strategy, the more likely it is to be hidden in a series of complex and obscure intercompany relationships among multiple obscure entities that are designed, quite simply, to tire out the state’s audit team or run out the clock on the audit… Not one of the [state policy] antidotes currently in use comes close in effectiveness to [worldwide combined reporting].[4]

In response to growing interest in worldwide combined reporting, multinational businesses and the organizations they fund have launched an aggressive campaign against the idea. One feature of that campaign has been a tendency to overlook or understate the degree to which WWCR, or partial versions of it, is already being used in the states. Fourteen states and the District of Columbia (D.C.) either allow, or require, companies to file returns that include at least some profits booked in foreign countries. In other words, many companies are already filing state corporate tax returns that reflect some, or all, of the profits they claim to have earned abroad. Mandatory worldwide combination would represent a logical and highly principled extension of this already routine practice.

Elective Worldwide Combination

Ten states and D.C. currently allow companies the option of filing on a worldwide combined basis.[5] This is a diverse group of states along economic, geographic, and ideological lines: California, Connecticut, D.C., Idaho, Massachusetts, Montana, New Jersey, New Mexico, North Dakota, Utah, and West Virginia.[6]

Our conversations with officials at the Multistate Tax Commission have confirmed that the WWCR option is, in fact, being used by companies in at least some of these states. Undoubtedly, other companies have considered using WWCR, and have done at least some of the work necessary to file in this manner, but opted against it because it would require them to pay more. The key point, however, is that WWCR is already being used by some companies.

The existence of this filing option is a nod to the fact that worldwide combined filing can produce a fair and accurate measure of taxable profits—indeed, one that is even better than what is yielded by water’s edge reporting. And the fact that WWCR returns are currently being filed indicates that compliance with this kind of system is not overly complex. Some corporations—especially those that are not engaging in aggressive profit shifting—have no qualms with filing a worldwide combined return when doing so results in a lower tax bill.

Tax Haven Reporting

Another group of states mandates a partial version of worldwide combined filing by requiring the inclusion of profits booked in certain tax haven countries on state tax returns. Research by the Center on Budget and Policy Priorities indicates that six states and D.C. fall into this group. Those states are Alaska, Colorado, Connecticut, D.C., Kentucky, Rhode Island, and West Virginia.[7]

This approach falls short of the more comprehensive measure of profit made possible by worldwide combined filing. But it does represent a partial step in the direction of WWCR and, given the ubiquity of tax haven subsidiaries among multinational companies, it means that many companies are already accustomed to including at least some of their foreign subsidiaries’ profits in state corporate income tax filings. Previous ITEP research revealed that three quarters of Fortune 500 companies operate one or more subsidiaries in a tax haven country.[8]

Alaska Corporate Income Tax is Primarily a Worldwide Combined System

Also sometimes overlooked by opponents of worldwide combined reporting is the fact that Alaska has been administering its corporate income tax primarily on a worldwide combined basis for many decades. In Alaska, oil and gas companies have been required to file on a fully worldwide combined basis since 1981. Other companies previously filed using this method as well but in 1991 Alaska moved to a bifurcated system under which oil and gas companies file fully worldwide combined and other companies file only partially worldwide combined (mostly stopping at the water’s edge but including certain entities doing business in tax haven countries).

While it might be tempting to view mandatory WWCR that applies only to oil and gas companies as a relatively minor curiosity, this would be a mistake. Among companies paying more than $1 million in Alaska corporate income tax per year (i.e. large companies, which are more likely to have foreign subsidiaries that give WWCR any relevance), more than a third (37 percent) of all returns filed over a 20-year period came from companies in the oil and gas sectors.[9]

The significance of worldwide combination to the Alaska system is even more apparent when looking at the revenues generated by this tax. Our review of state tax data going back to 1991 reveals that almost three quarters (74 percent) of Alaska’s corporate income tax collections since implementation of this bifurcated system have come from the oil and gas sectors. Furthermore, data furnished to us by the Alaska Department of Revenue reveal that, in Fiscal Year 2023, every dollar of corporate income tax revenue paid by this sector came from companies with at least one foreign subsidiary—meaning from companies that filed worldwide combined returns. In other words, Alaska’s corporate income tax primarily functions as a worldwide combined system. This is made even clearer when considering that companies outside of the oil and gas sectors also file under a partial worldwide combination method that includes profits booked in tax haven countries.

State Corporate Taxes Already Look Beyond the Water’s Edge to a Substantial Extent

The building blocks for worldwide combined reporting are already present at the state level. More than a dozen states already allow or require some corporate tax returns to be filed in ways that include income that companies claim was earned beyond the water’s edge. Building on this system with worldwide combined reporting offers the most practical, efficient, and effective means of ensuring that multinational companies pay the appropriate amount of tax to the states in which they do business.

Endnotes

[1] Richard Phillips and Nathan Proctor, “A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens,” Institute on Taxation and Economic Policy, U.S. PIRG Education Fund, SalesFactor.org, and American Sustainable Business Council. January 2019. https://itep.org/a-simple-fix-for-a-17-billion-loophole/.

[2] Steve Wamhoff, ”The No Tax Breaks for Outsourcing Act is Needed More than Ever,” Institute on Taxation and Economic Policy, February 2023, https://itep.org/no-tax-breaks-for-outsourcing-act-offshore-corporate-tax-dodging/.

[3] Often that formula simply looks at where the firm is making its sales, though sometimes the location of the firm’s payroll and property is also taken into consideration. For Alaska oil and gas companies, the formula considers three factors: tariffs and sales, production, and property.

[4] Don Griswold, ”Innovation Principles for Multistate CIT Planning – Part 1,” Tax Notes State, May 2022.

[5] Michael Mazerov, “Minnesota Bill Marks Major Step Forward in Preventing Multinational Corporations from Shifting Profits Abroad,” Center on Budget and Policy Priorities, May 2023. https://www.cbpp.org/blog/minnesota-bill-marks-major-step-forward-in-preventing-multinational-corporations-from-shifting.

[6] Cal. Code Regs. Tit. 18, § 25113. Conn. Gen. Stat. § 12-218f. D.C. Code § 47–1810.07. Idaho Code Section 63-3027B. MA Title 830 CMR 63.32B.2. Montana Code Section 15-31-324. NM Statutes § 7-2A-8.3. NJ Stat. § 54:10A-4.11. N.D. Admin. Code 81-03-05.2-02. Utah Code Section 59-7-403. WV Code § 11-24-13f. DC

[7] Center on Budget and Policy Priorities, ”State Revenue Options for Advancing Equity and Prosperity,” Accessed October 2023. https://www.cbpp.org/node/25886#/policies/26.

[8] Richard Phillips, Matt Gardner, Alexandria Robins, and Michelle Surka, ”Offshore Shell Games 2017,” Institute on Taxation and Economic Policy and U.S. PIRG Education Fund, October 2017. https://itep.org/offshoreshellgames2017/.

[9] For purposes of this analysis, large companies are defined to include those with state corporate income tax liability above $1 million per year because this is the highest band reported in Alaska Department of Revenue reports. These companies were responsible for 90 percent of all state corporate income tax payments over the 20-year period for which we were able to obtain data: FY96 through FY14, plus FY23.