The purpose of state corporate income taxes is to tax the profit, or net income, an incorporated business earns in each state. Ascertaining the state where profits are earned is, however, complicated for companies that conduct business in multiple jurisdictions.

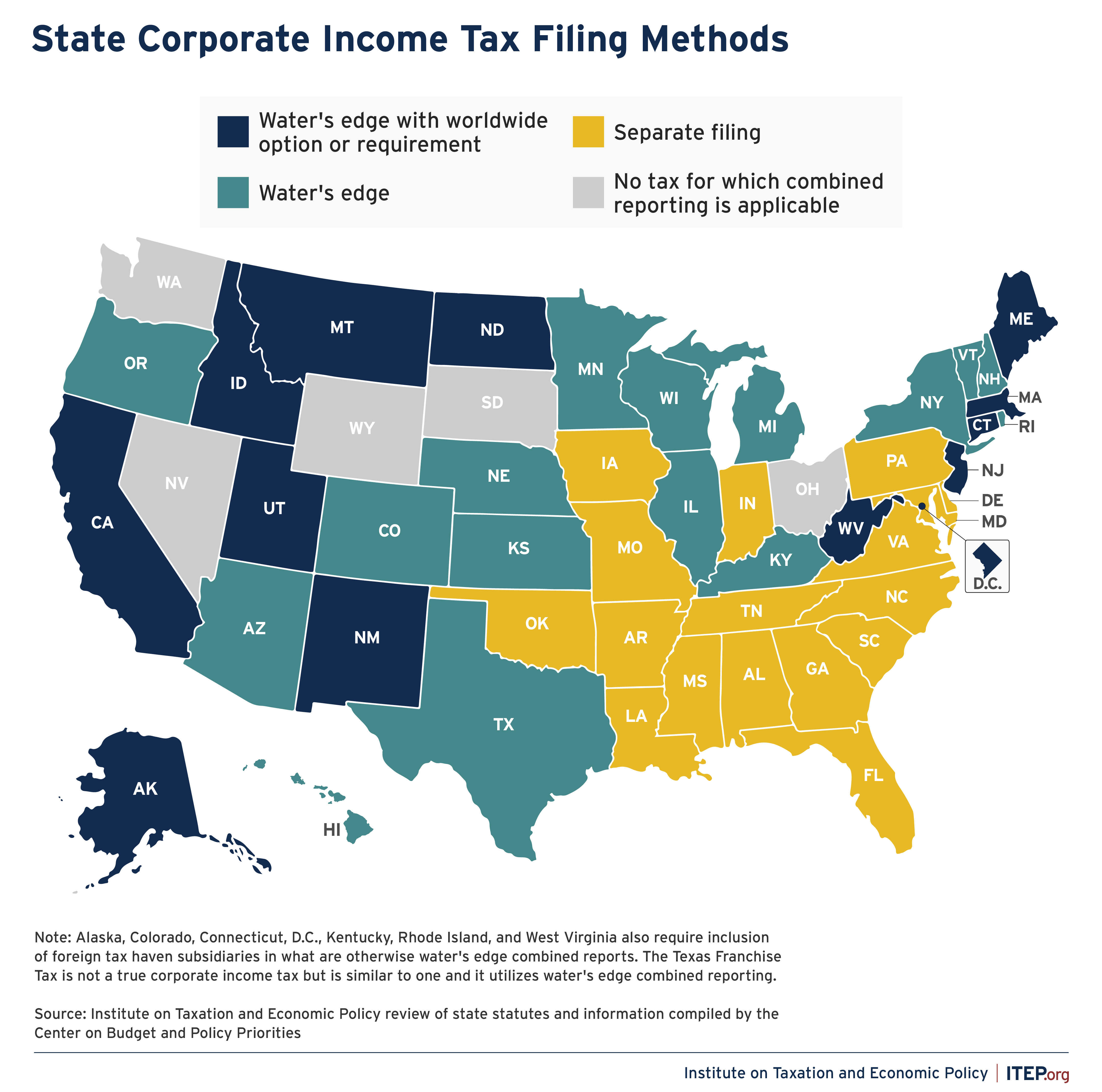

Twenty-eight states plus D.C. now require a limited version of combined reporting called “water’s edge” combined reporting. Under water’s edge combined reporting laws, a corporation’s subsidiaries included in the combined report are only those located in the U.S. While this approach is effective in neutralizing domestic profit-shifting strategies, it does little to prevent the well-documented problem of multinational corporations shifting their income to offshore tax havens.

Many state tax codes today include voluntary elections to file on a worldwide combined basis or, in Alaska, the requirement to do so for the oil and gas companies responsible for most of the state’s corporate income tax revenue. Under the comprehensive approach of worldwide combined reporting, it does not matter whether a company chooses to house its income-generating activities in its headquarters state or in a post-office box in Delaware or the Cayman Islands. Either way, the income of all the corporation’s unitary U.S. entities will be included in a single tally of the corporation’s apportionable income

The other 17 states with corporate income taxes use what is known as the “separate filing” method. This approach offers corporations far greater latitude to shift profits to other states and countries.

The map below shows the corporate income tax filing methods in every state.