State tax and budget debates have arrived in a big way, with proposals from every part of the country and everywhere on the spectrum from good to bad tax policy. Just look to ARIZONA for a microcosm of nationwide debates, where education advocates have a plan to raise progressive taxes for school needs, Gov. Doug Ducey has his own regressive plan to slash them, and lawmakers are proposing both increases and cuts as well. Or compare IOWA and SOUTH CAROLINA, whose governors are seeking to cut income taxes on their richest residents, to HAWAII and RHODE ISLAND, whose governors are both seeking Earned Income Tax Credit (EITC) improvements to help working families make ends meet. Read on for details on all these developments and many more!

— MEG WIEHE, ITEP Deputy Director, @megwiehe

Major State Tax Proposals and Developments

- ARIZONA education leaders and advocates are back with a new ballot measure that would raise nearly $1 billion for education. The initiative would ask more of the state’s wealthiest residents by enacting a tax surcharge on earnings over $250,000 single/$500,000 married. — AIDAN DAVIS

- HAWAII’s Gov. David Ige and leaders from both chambers announced a deal this week that would result in an increase to the state’s minimum wage, a package of middle-class tax cuts, and a refundable Earned Income Tax Credit (EITC). — AIDAN DAVIS

Governors’ Budget Proposals and State of the State Speeches

- While education advocates in the state continue to fight to raise funds to restore cuts made during the Great Recession, ARIZONA’s Gov. Doug Ducey announced in his State of the State address that he will propose another round of tax cuts. The state’s individual income tax appears to be a likely target.

- CALIFORNIA Gov. Gavin Newsom presented his budget plan last Friday, including plans for significant investments in housing and homelessness, K-12 education, wildfire prevention and mitigation, as well as continuing to invest in the state’s Rainy Day fund and pay down pension liability debts.

- COLORADO Gov. Jared Polis delivered his 2020 State of the State address touching on priorities such as creating a public health insurance option, creating a paid family medical leave plan, achieving universal preschool by the end of his first term, partially eliminating student debt for qualifying graduates, strengthening water and air quality monitoring and violations, and delivering plans for an income tax cut by the end of his first term.

- IOWA Gov. Kim Reynolds used her address to present her plans to raise the regressive sales tax by one cent and use much of the revenue to slash income taxes even further than they are already scheduled to go down—a clear recipe for shifting taxes off of wealthy households and onto low- and middle-income families. She also proposes for the state to start paying 70 percent of mental health care costs, which are currently completely funded through county property taxes.

- KENTUCKY Gov. Andy Beshear delivered his first State of the State address, in which he identified teacher pay, state public pension obligations and health care coverage as key priorities.

- NEW JERSEY Gov. Phil Murphy has been very busy, signing a “SALT workaround” bill to help certain business owners deduct their state income taxes on their federal tax returns, vetoing a bill to allow school districts to exceed an existing property tax growth cap (saying the funding should come from wealthy households, not middle-class property tax payers), re-iterating in his State of the State Address that he’ll continue to fight for a millionaires tax to help fix the state’s fiscal situation and upside-down tax code, and creating a new task force to study economic disparities in the state.

- Gov. Gina Raimondo of RHODE ISLAND outlined priorities for the year in her recent address. Regarding taxes, she committed to cutting the car tax again this year, cutting taxes for small businesses, and continuing to cut unemployment insurance taxes. She also mentioned an expansion to the state’s EITC, making the case that “no one who works full time should live in poverty.”

- SOUTH CAROLINA Gov. Henry McMaster proposed in his budget plan to rebate $250 million of income taxes on a pro-rated basis, rewarding high-income households with checks for hundreds of thousands of dollars while sending $50 each to lower-income families. He also proposes to reduce the state’s top income tax rate from 7 percent to 6 percent over five years, again handing out much larger tax cuts to higher-income people who need them least.

- Gov. Gary Herbert of UTAH released his final budget proposal last week, with very similar emphases as last year on education, social service programs (including funds needed to support newly approved Medicaid expansion in the state), the state’s transportation systems, and air quality improvement.

- VERMONT’s Gov. Phil Scott laid out a number of priorities in his address, including a new universal afterschool network. Additional information and specific details are expected to be provided in the Governor’s budget expected later this month.

- WEST VIRGINIA’s Gov. Jim Justice delivered his State of the State address last week. His address outlined a more conservative budget for the Mountain State.

- More addresses are scheduled this week in INDIANA, KANSAS, MISSOURI, NEBRASKA, SOUTH DAKOTA, and WASHINGTON, and next week in DELAWARE, HAWAII, MASSACHUSETTS, NEW MEXICO, SOUTH CAROLINA, and WISCONSIN.

State Roundup

- Broad-based taxes are back up for discussion in ALASKA as lawmakers brace for a $1.5 billion deficit. The debate remains over whether they should reinstate a personal income tax, introduce a statewide sales tax, and/or revisit the state’s Permanent Fund dividend.

- Also in ALASKA, an oil tax initiative now has enough signatures to move to the ballot. The initiative would raise the minimum tax, eliminate oil tax credits for the state’s largest legacy fields, and require companies to publicly report their revenues and costs from those fields.

- Meanwhile in ARIZONA, a Republican senator has proposed an additional $300 million in tax cuts. These would include property tax cuts for businesses and homeowners, repeal of the state’s highway safety fee, increasing the amount families could claim per dependent child, and doubling the state’s capital gains subtraction. Curiously, other Republican lawmakers are making the claim that the state needs additional revenue by seeking a sales tax hike to better fund public education.

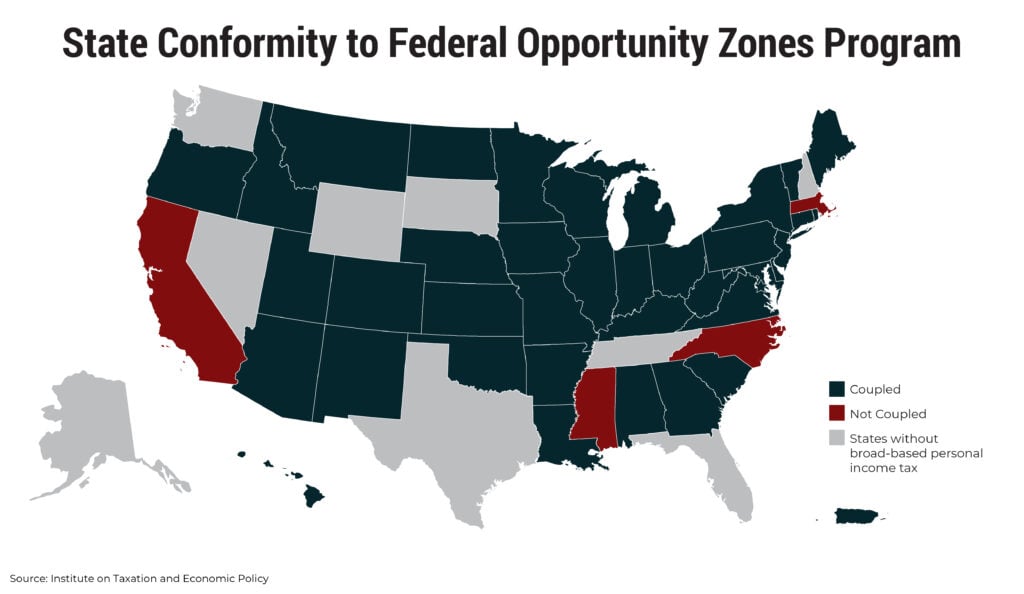

- Although not included in his budget plans released Friday, CALIFORNIA Gov. Gavin Newsom is pressing lawmakers to enact state-level tax breaks for investors of the federal opportunity zone program, a policy move that would be ill-advised.

- Advocates in COLORADO have taken the first steps towards getting a ballot initiative that would raise funding for preschool statewide through a higher tobacco and a new vaping tax.

- GEORGIA lawmakers have a situation on their hands with revenues sputtering and shortsighted income tax cuts from previous years still scheduled to take effect.

- KANSAS lawmakers returned to session this past week with agendas that include big ticket items such as a bipartisan bill to enact Medicaid expansion (which some lawmakers have vowed to vehemently oppose) and a third attempt to enact tax cuts following passage of Trump’s tax law in December 2017.

- MARYLAND lawmakers will consider a new tax on digital advertising and a carbon tax this year, intriguing proposals that are nonetheless driven by an unnecessary self-imposed pledge to fund major education reforms without any major tax reforms to the state’s upside-down tax code.

- Add MISSOURI to the list of states considering sales tax exemptions for feminine hygiene products and diapers. Gov. Mike Parson is also proposing an extension of a small cost-sharing program to help localities pay for infrastructure that is deteriorating in the absence of a needed gas tax update.

- NEBRASKA Revenue Committee members have fast-tracked a bill to lower property taxes by increasing state school aid, though it could lose momentum quickly if projected revenues aren’t enough to fund the aid increase, requiring tax increases or funding cuts elsewhere. Lawmakers are also considering proposals to expand the sales tax base to more services while bringing down the rate, give companies tax breaks for hiring felons, and exempt half of military retirement income.

- Teachers in the Las Vegas, NEVADA, area announced a ballot initiative campaign to raise taxes on the powerful gambling industry to improve K-12 schools. A second initiative is forthcoming, with an overall goal to raise $1.4 billion for the state’s “chronically underfunded” education system.

- After a day-long session, NORTH CAROLINA lawmakers continue their budget stalemate. The Senate failed in their attempt to override Gov. Roy Cooper’s veto of a teacher pay raise bill, that the administration said did not raise enough money. Lawmakers will return to Raleigh in the spring.

- VIRGINIA’s Commonwealth Institute reviews tax policy options currently on the table that can help improve tax fairness and adequacy.

What We’re Reading

- The New York Times explains the strengths and shortcomings of the current federal Child Tax Credit, which states can shore up themselves in absence of congressional will.

- Route Fifty reports on new research providing further evidence that state business tax subsidies don’t deliver the broad economic benefits their supporters claim. The Outline covers this development too.

- Governing explores several issues to watch in state policy debates in 2020.

- The Tax Policy Center weighs in on continued disappointing trends in IRS funding.

- Bloomberg Tax sets the stage for many states’ revenue positions in 2020, which includes for many new monies from new sources like online sales and recreational cannabis.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.