Warming temperatures in many parts of the country this week seem to be thawing out state fiscal debates as well. Multiple states including California, Colorado, Maryland, and New Jersey saw movement on efforts to improve tax credits for low- and middle-income families. Mississippi House lawmakers suddenly rushed through a dangerous bill to eliminate the state’s income tax and shift those taxes onto lower-income households. Montana senators also approved regressive income tax cuts and South Dakota legislators advanced an anti-tax constitutional amendment, while lawmakers in Hawaii, Rhode Island, and Washington made progress on improving the progressivity of their tax codes. Gas tax increases were also discussed in Kentucky, Mississippi, North Dakota, and Wyoming.

Governors’ Budget Proposals and Annual Addresses

- COLORADO Gov. Jared Polis announced, in his 2021 State of the State address last week, that he wants to eliminate the business personal property tax, double the Earned Income Tax Credit (EITC), and provide up to $600 in tax credits via the Colorado Child Tax Credit. –MARCO GUZMAN

- NEW JERSEY Gov. Phil Murphy’s budget proposal does not include any new tax increases but is able to fund an impressive set of investments and supports, even without counting on additional federal aid, thanks in part to the millionaires tax enacted last year. These include expanding the state EITC to low-paid senior workers currently excluded from the credit, enhancing the Child Tax Credit to make it fully refundable and reach families with incomes up to $150,000, make the state’s first full pension payment since 1996, and achieving universal health coverage for all children. – DYLAN GRUNDMAN O’NEILL

- Most governors have now introduced their budgets and given their annual addresses. A full list of previous and scheduled addresses with links is available here.

Major State Tax Proposals and Developments

- With recent improvements to their state EITC, MARYLAND lawmakers have now enacted possibly the most robust version of this vital support for low- to middle-income families in the country who are working and documented. But work still remains, as leaders in the state are now pushing to end the exclusion of undocumented taxpaying families from the credit. – DYLAN GRUNDMAN O’NEILL

- The MISSISSIPPI House passed a bill yesterday that would result in a massive tax shift that asks more of the state’s lowest-income taxpayers while provide a tax cut to the state’s richest. House Bill 1439 gradually eliminates the state’s personal income tax, increases the sales tax rate (lowering it for groceries), expands the sales tax base, and increases excise taxes. The bill flew through the House Ways and Means Committee and the full House despite lacking an official score of what the proposal would cost the state over time. — AIDAN DAVIS

- The MONTANA Senate approved three income tax cut bills that would reduce the top marginal tax rate from 6.9 percent to 6.75 percent, impose a mechanism that would reduce the top rate further depending upon budget revenues, and exempt taxpayers from capital gains tax on stock owned in local businesses. — MARCO GUZMAN

- The SOUTH DAKOTA House approved a resolution that would amend the state constitution to require a 60 percent vote to approve certain ballot measures that impose taxes, fees, or appropriates funds over a specific threshold. –MARCO GUZMAN

State Roundup

- The ARKANSAS House passed a bill exempting state income tax on unemployment benefits.

- CALIFORNIA lawmakers have approved $600 Covid-19 relief payments for EITC recipients, additional aid for undocumented taxpayers overlooked in federal bills so far, and $2.1 billion in grants and waivers. They are also considering another $2 billion in tax breaks for businesses.

- A GEORGIA lawmaker is considering expanding the sales and use tax to digital products like Netflix, e-books, and video game downloads.

- Another lawmaker recently filed a bill that would increase the standard deduction by $800 for single filers, $1,100 for joint filers, and $1,300 for those over 65 or blind.

- The GEORGIA House Economic Development and Tourism Committee also approved a bill that would tax profits from sports betting at 20 percent.

- Lawmakers in HAWAII consider boosting income taxes on the state’s high-income residents and eliminating an existing loophole that provides preferential treatment on income from capital gains.

- The IDAHO House Revenue and Taxation Committee introduced a bill that would phase out the personal property tax over 10 years.

- INDIANA‘s House budget plan–which is now heading to the Senate for consideration–includes a 50-cent increase to the state’s cigarette tax for a new rate of $1.50 and a 10 percent tax on certain electronic cigarette products.

- A bill in KENTUCKY would increase the state’s gas tax and other fees to increase overall transportation funding.

- MISSISSIPPI lawmakers are also considering a gas tax increase. A recent bill would ask voters to decide whether to temporarily increase the state’s tax on motor fuels.

- Recent bills in MASSACHUSETTS would decriminalize drugs and tax soda and other sugary drinks. Taxing soda is also under discussion in RHODE ISLAND where a recent bill would have beverage distributors pay a 1.5-cent-per-ounce tax on bottled sugary drinks, syrups, or powders.

- The RHODE ISLAND coalition Revenue for Rhode Island reupped its campaign to raise revenue for the state by increasing taxes on the state’s top 1 percent of earners. The proposal would add a new top bracket, taxed at 8.99 percent, for earners with incomes above $475,000.

- A forward-thinking lawmaker in NEW YORK is proposing a new tax on companies that collect and sell the personal information of her state’s residents. The tax would apply only to companies collecting such data on at least one million New Yorkers per month, and start at 5 cents per individual surveilled, rising up to 50 cents per individual for companies collecting data on more than 10 million New Yorkers. It is considered to be a thoughtful and legally robust approach to taxing this ever-growing and highly profitable activity.

- Also in NEW YORK, 24 different organizations have banded together to encourage lawmakers to decouple from the federal Opportunity Zones program that mostly benefits wealthy developers.

- NORTH DAKOTA‘s House recently passed two bills to legalize and tax the use of recreational cannabis. HB 1501 would impose a 15 percent gross receipts tax on sales and a 10 percent excise tax on sales from manufacturers to dispensaries in the state.

- The NORTH DAKOTA House also voted to increase the state gas tax by 3 cents per gallon, which would bring the tax to 26 cents.

- An OREGON lawmaker is proposing to earmark cannabis tax dollars to advance social and racial equity by repairing harm to communities caused by the substance’s criminalization over the years.

- A batch of three tax bills working their way through the UTAH legislature would restore the dependent exemption and eliminate income tax on military retirement pay and Social Security income.

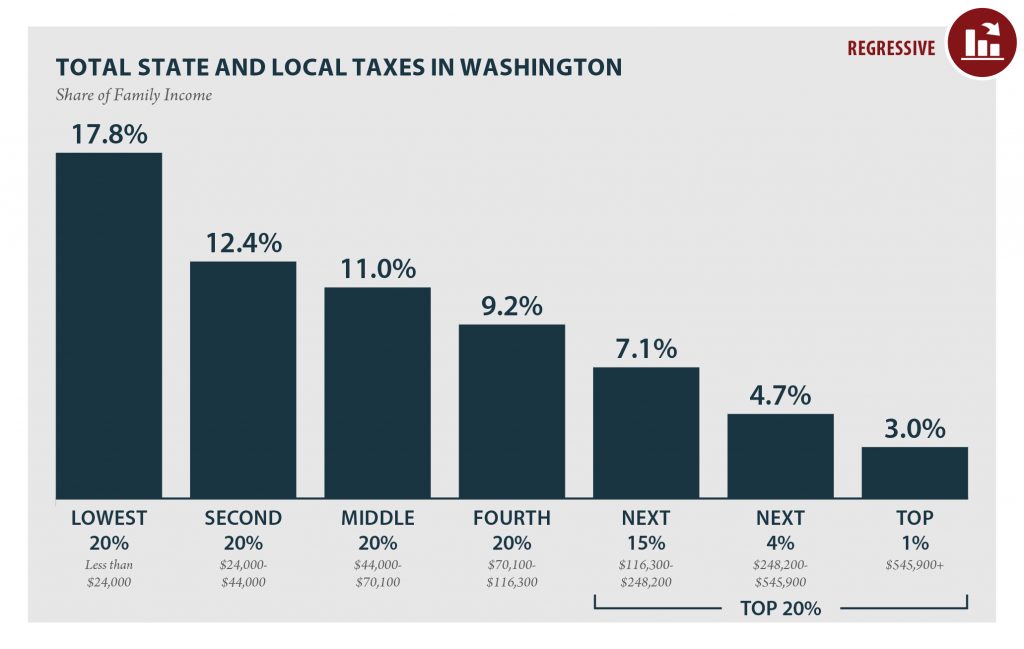

- WASHINGTON leaders have advanced a bill to apply an excise tax to capital gains-generating sales that exceed a $250,000 threshold, which would add a welcome dose of progressivity to the nation’s most upside-down tax code.

- A WYOMING bill that would increase the fuel tax by 9 cents passed out of committee recently.

What We’re Reading

- The Center on Budget and Policy Priorities covers some of the ways states can craft forward-looking, antiracist policy coming out of this recession that will promote thriving communities and economies – by targeting aid to those who need it most, focusing on structural inequities, and shoring up state finances.

- Route Fifty argues that current and future economic recovery efforts will benefit from greater appreciation for the lessons of the New Deal and the crucial role of local-level policies.

- Pew’s State Fiscal Health initiative has a new report out on the historic decline in state tax revenues caused by the Covid-19 pandemic.

- Pew also reports on current record levels of spending on local jails.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.