State and local policymakers will be preoccupied for a short time with celebrating and deciphering the federal pandemic relief package approved today, but ultimately the federal aid should free them to focus on even bigger concerns such as tax codes that often fail to adequately fund core priorities even in good years and exacerbate the economic and racial inequities that this pandemic has laid bare. Lawmakers in Hawaii and Washington, for example, have their eyes on long-term structural changes to improve their upside-down tax codes. Unfortunately leaders in West Virginia and some other states must first defeat proposals to double-down on trickle-down tax cut proposals before they can move on to real reforms to benefit their states.

Major State Tax Proposals and Developments

- The HAWAII Senate passed a bill (SB 56) bills that would make the state’s tax code more progressive, ensuring the higher-income taxpayers pay more and that the state can maintain essential services during and as the state recovers from the pandemic. The proposal would increase the state’s top income tax rate, the tax on capital gains, corporate taxes, and taxes on high-end real estate sales. Other progressive revenue bills will also continue into the second half of session. – AIDAN DAVIS

- WEST VIRGINIA’s Gov. Jim Justice has officially introduced his tax proposal. It includes a substantial cut to the state’s personal income tax, while raising a variety of sales and other taxes. While the ultimate goal of income tax elimination remains, the proposal would initially cut income taxes on “earned” income (from wages and salaries, pensions, annuities, IRAs, Social Security and unemployment) by 60 percent. Despite a sales tax rebate to blunt some of the regressive effects of slashing the income tax, the overall impact results in a tax shift that asks more of low- and middle-income West Virginians. The average taxpayer in the bottom 60 percent of households (making less than $55,000 a year) would experience a net tax increase while the average taxpayer in the top 40 percent would experience a net tax cut. – AIDAN DAVIS

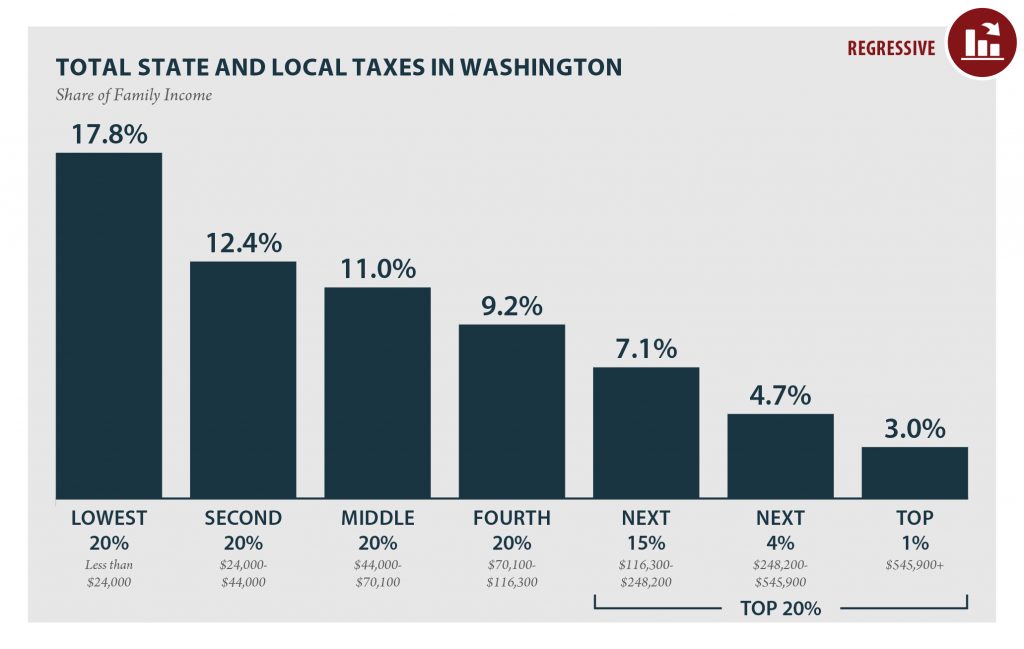

- WASHINGTON leaders moved two steps closer to bringing some much-needed revenue and progressivity to the nation’s most upside-down tax code, as an excise tax on certain capital gains-generating transactions has passed the Senate and now moves to the House, and a bill to fund and improve the state’s Working Families Tax Exemption (based on the federal Earned Income Tax Credit) advanced from the House to the Senate. – DYLAN GRUNDMAN O’NEILL

- Most governors have now introduced their budgets and given their annual addresses. A full list of previous and scheduled addresses with links is available here.

State Roundup

- A report from a local ALABAMA university sheds light on the impact of local tax breaks given to large corporations for their relocation, finding that the lack of tax revenue leaves communities with less to spend on public services in exchange for lower quality jobs for residents.

- CONNNECTICUT lawmakers are the latest to attempt to tax tech giants through a tax on digital advertising.

- An IOWA Senate subcommittee has advanced legislation to phase out the state inheritance tax over three years and fast-forward tax cuts enacted two years ago by eliminating revenue “triggers” that were intended to ensure the cuts wouldn’t take effect until the state could afford them.

- In a recent legislative hearing, MAINE residents spoke on the need for the legislature to pass two revenue bills that ensure that the wealthy pay their fair share and help those Mainers hardest hit by the pandemic and recession. The bills would increase the state’s top corporate income tax rate and reauthorize the 3 percent surcharge on income over $200,000, which was approved by voters in 2016 and subsequently repealed by former-Gov. Paul LePage.

- State workers in MARYLAND are not impressed by Gov. Larry Hogan’s proposal to give them $1,000 bonuses after attempting to cut their pay and budgets repeatedly in recent years.

- An odd proposal to raise MISSOURI’s gas tax and then fully refund the increase for anyone who applies was stopped in the state Senate. Prospects are unclear for a separate bill that would finally apply the state sales tax to online purchases but would cancel out the revenue gain and shift taxes off of high-income households by cutting the top income tax rate.

- The NEBRASKA Revenue Committee chair is readying a big push to shift taxes onto middle- and low-income Nebraskans by cutting income tax rates and expanding the sales tax base, with full details likely coming soon.

- Senate leaders in RHODE ISLAND have introduced a bill to tax recreational cannabis. Under the proposal, consumers would pay the 3 percent municipal tax and the existing 7 percent sales tax rate plus an additional 10 percent tax. The result would be price-based tax of 20 percent on cannabis products.

What We’re Reading

- Route Fifty reports on what is known about state and local aid in the federal Covid-19 relief bill and how use of the funds will be restricted.

- The Aspen Institute will hold a virtual event March 24th corresponding with the launch of Dorothy A. Brown’s important upcoming book, “The Whiteness of Wealth: How the Tax System Impoverishes Black Americans—and How We Can Fix It.”

- Route Fifty writes about the overlooked importance of coordination between the local, state, and federal levels of government for vaccine delivery and many other issues.

- Pew’s State Fiscal Health Initiative recommends ways states can proactively foresee fiscal issues in their early stages.

- The Center on Budget and Policy Priorities has a new report out on the value of Earned Income Tax Credits to communities and state economies.

- The Georgia Budget & Policy Institute published a helpful explainer on school vouchers to help separate facts from myths—which is especially important as the House recently voted to increase the limit on contributions to the state tax credit program for private school.

- The Louisiana Budget Project released a report making a compelling argument for the Strong Families Tax Credit, which help close the economic gap between wealthy and lower-income families as well as increase racial equity.

- The Off the Charts blog reports that some state lawmakers, notably those in Mississippi and West Virginia, are unfortunately attempting regressive tax cuts despite revenue shortfalls and struggling families that would be further harmed as a result.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.