More than three billion dollars could be raised under a major progressive tax plan proposed by Illinois Gov. J.B. Pritzker this week, the point being to simultaneously improve the state’s upside-down tax code and address its notorious budget gap issues. One state, Utah, may already be looking at a special session to revisit the sales tax reform debate that ended this week without resolution, in contrast to Alabama and Arkansas, where leaders finally resolved years-long debates over gas taxes and infrastructure funding. And lawmakers in four states – California, Florida, Minnesota, and North Carolina – introduced legislation to expand or enact Earned Income Tax Credits (EITCs).

— MEG WIEHE, ITEP Deputy Director, @megwiehe

Major State Tax Proposals and Developments

- ILLINOIS Gov. J.B. Pritzker has released details for his Fair Tax proposal–a plan that most notably calls for enacting a graduated income tax in the state. The plan would create new income tax rates and brackets for taxable income above $250,000 and tax all income of millionaires at the top rate of 7.95 percent. The plan also proposes a $100 nonrefundable Child Tax Credit, raising the corporate income tax rate to 7.95 percent, and raising the state’s Property Tax Credit from 5 to 6 percent. If enacted, the plan would bring in $3.4 billion new dollars in revenue to help stabilize the state’s budget and address its longstanding structural deficit. ITEP analysis shows that this plan would help increase tax fairness in the state by asking the top 1% to pay more, but leaves work to do in lowering the taxes of low-income residents who currently pay almost twice the taxes as a share of their income compared to the top 1 percent. — Lisa Christensen Gee

- The major sales tax reform effort in UTAH will not move forward during the regular legislative session in response to mounting opposition and public pressure to slow the effort. Sales tax modernization continues to be a top priority and Gov. Gary Herbert has indicated that he intends to call the legislature back into special session to address it. In the meantime, the legislature got past a budget impasse, the resolution of which includes setting aside $75 million for a future tax cut. Before the legislature reconvenes, a 20-member legislative task force will meet to discuss issues concerns about the state’ revenue base and potential reform measures. — Lisa Christensen Gee

- ALABAMA lawmakers have updated their gas tax after more than a quarter-century of seeing the tax decline due to inflation and roads deteriorate due to inadequate funding for construction and maintenance. And the law does more than just patch the funding hole with a temporary fix: it will raise the tax 6 cents per gallon this year and another 4 cents over the following two years; and then, crucially, it will be adjusted annually using a highway construction cost index, helping to ensure the tax and the transportation system continue to perform over time. ARKANSAS has also increased fuel taxes and fees to address longstanding deficits in transportation funding.

State Roundup

- Sales tax bills to fund public education have been introduced in the ARIZONA Opponents point to the regressive nature of consumption taxes and argue that these changes are not a permanent funding solution. Also, filers in the state may receive extra time to file their taxes this year as the Legislature and Governor continue to weigh their reaction to federal conformity.

- Lawmakers in COLORADO may soon consider a series of legislation that if passed would fundamentally shift the tax structure in the state. The bills seek to change property tax limitations imposed by the Gallagher amendment, eliminate the TABOR tax refund, and change the state’s school finance formula.

- An alternative to FLORIDA Gov. Ron DeSantis’s budget has been proposed, featuring a state EITC for low- and middle-income working families, to be paid for by closing loopholes for offshore tax havens, as we have written about here.

- HAWAII legislators are moving bills to increase the state’s Child and Dependent Care Tax Credit (CDCTC).

- KANSAS lawmakers in the House have passed a tax package that in addition to addressing changes in response to TCJA would lower the sales tax on food by 1 percentage point and address collecting sales taxes from online retailers. The bill faces an uncertain fate as Gov. Laura Kelly has indicated that she doesn’t believe that now is the time for tax cuts but rather to address the inadequacy of the state’s investments in K-12 education.

- Three bills filed in the MINNESOTA House propose to expand the state’s Working Family Tax Credit (or EITC). The proposed expansions include enacting higher credit values for families with three or more children, increasing the value of the credit for workers without children in the home, and raising the overall credit rates, maximum credit value, and phaseout thresholds.

- MISSOURI legislators are trying again to update the state’s gas tax to raise badly needed road and highway funding.

- The NEW MEXICO House passed cannabis legalization New revenue is earmarked for research, public education campaigns, workforce training, substance abuse, and mental health treatment.

- NEVADA lawmakers are coming face-to-face with the reality that they cannot fix their education system without new revenue, and may eventually be sued over their underfunded schools.

- NEW JERSEY leaders continue to weigh the merits of millionaires’ taxes, business tax subsidies, cannabis taxation, and allowing high-income residents to write off their charitable contributions.

- NEW YORK lawmakers are considering a pied-à-terre tax that would tax property valued over $5 million. It is expected that the tax would be paid by wealthy homeowners who maintain co-ops and condominiums in Manhattan, or homes that do not serve as the buyer’s primary residence. Meanwhile, Gov. Cuomo is pushing to make the state’s property tax cap permanent in budget dealings.

- Lawmakers in NORTH CAROLINA are considering bills to reinstate the state’s EITC, which was allowed to expire in 2013.

- The OHIO House passed a 10.7-cent/gallon gas tax increase, 7.3-cents/gallon lower than Gov. Mike DeWine’s proposal, along with a 20-cent/gallon increase to the diesel tax over three years. The state Senate is expected to take up the debate next week.

- The first draft of SOUTH CAROLINA’s budget includes 4 percent teacher pay raises, which would just be the first step in a five-year process to bring their pay up to the national average.

- As the SOUTH DAKOTA legislative session wraps up, lawmakers are close to final deals on the budget and online sales taxes. Having enacted a previous law calling for sales tax rate cuts in response to the Supreme Court decision authorizing states to collect online sales taxes, legislators may guarantee those cuts using an automatic trigger or may grant more discretion to future legislatures.

- WASHINGTON lawmakers are taking another look at increasing the gas tax and instituting a fee on carbon as ways to fund infrastructure improvements while reducing pollution.

- The WEST VIRGINIA legislature passed an income tax cut on Social Security income. This version includes a 3-year phase-in and applies only to taxpayers with income under $50,000 (single)/$100,000 (married).

What We’re Reading

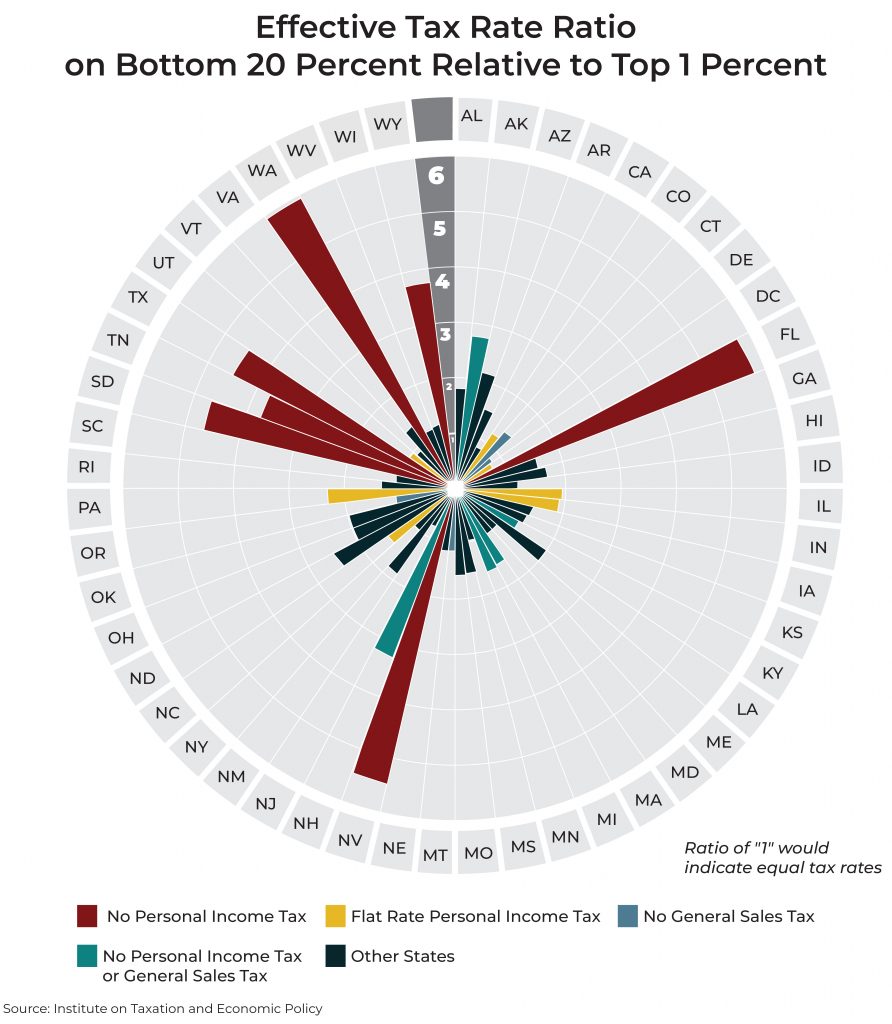

- GQ reports on how state and local taxes increase income inequality, as demonstrated in our Fairness Matters chart book.

- Governing picked up on new research from the Center on Budget and Policy Priorities showing that education funding has improved as a result of recent teacher protests, but in many cases remains lower than it was a decade ago.

- The Center on Budget and Policy Priorities also has helpful new information on how much states can benefit from enacting or increasing state EITCs, the relatively modest cost of doing so, and how EITCS work hand-in-hand with minimum wage increases to boost communities and state economies.

- The CALIFORNIA Budget & Policy Center is out with a new chartbook that illustrates how an expanded CalEITC is a smart investment to broaden economic security in the state.

- Pew reminds states how they can more effectively weigh and design tax incentives.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.