Although lawmakers in some states continue to push for expensive and regressive tax cuts that would primarily benefit wealthy households, worsen economic and racial injustices, and undermine funding for key public services, this week’s state fiscal news is dominated by efforts to do the opposite. Leaders in the District of Columbia, Maine, Nebraska, New York, Washington, and Wyoming made recent headlines by advocating for policies that improve on upside-down tax codes and generate needed funding for shared priorities like schools and health care.

Major State Tax Proposals and Developments

- A coalition of policy experts, advocates, and lawmakers in MAINE call for increasing taxes on wealthy Mainers and corporations to address growing inequality. In particular, the focus is on rolling back the income tax cuts on the wealthiest Mainers (which passed by referendum in 2016 only to be undone by lawmakers and the former Gov. Paul LePage), taxing capital gains and stock dividends at a higher rate, ending corporate offshore tax breaks, and imposing a new tax on corporations with profits exceeding $3.5 million. – AIDAN DAVIS

- MARYLAND lawmakers passed a bill to extend the state’s EITC, including recently enacted temporary enhancements, to immigrant workers who file taxes using an ITIN. Gov. Larry Hogan did not support the measure but has signaled he will let it go into law without his signature. Maryland joins California and Colorado in making its EITC more immigrant inclusive. – DYLAN GRUNDMAN O’NEILL

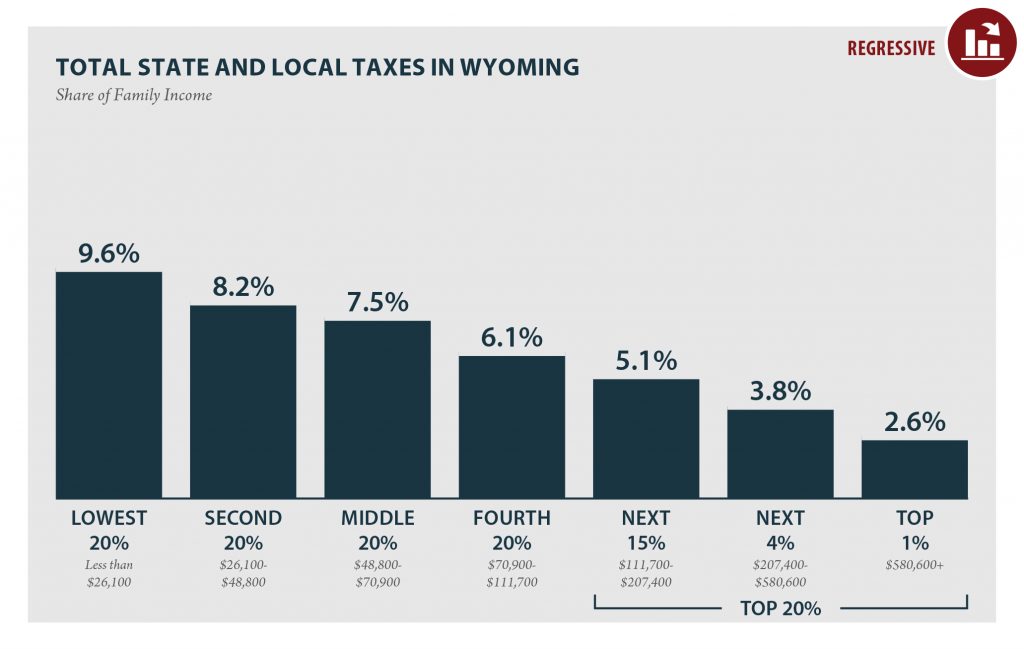

- Several WYOMING lawmakers have sponsored a bill that would impose a 4 percent tax on unearned income over $200,000 to help provide funding for K-12 education. This is notable because Wyoming does not levy a personal income tax and has one of the most upside down tax structures in the country. – MARCO GUZMAN

- Most governors have now introduced their budgets and given their annual addresses. A full list of previous and scheduled addresses with links is available here.

State Roundup

- DISTRICT OF COLUMBIA leaders are exploring ways of raising taxes on the district’s wealthiest households through the budget process.

- A GEORGIA bill that will increase the state’s standard deduction passed unanimously out of the House and will soon be considered by the Senate.

- Lawmakers in KENTUCKY have proposed a gas tax increase to fund long-overdue infrastructure projects.

- MISSISSIPPI’s Lt. Gov. Delbert Hosemann says that the Senate will carefully examine and consider House Bill 1439 that would, among other things, phase out the state’s personal income tax, cut the grocery tax, and increase consumption and excise taxes. Meanwhile, the House backed away from a proposal for a statewide election on increasing gasoline and diesel fuel taxes to fund infrastructure improvements.

- Tax debates are picking up in NEBRASKA, where lawmakers are considering bills to tax high-income households for early childhood education funding, improve reporting on business tax subsidies, cap property taxes, increase the existing income tax exemption for most Social Security benefits to fully exempt them, raise tobacco taxes, and expand the sales tax base to candy and soda.

- A new coalition composed of teachers, school administrators, and faith leaders has formed to encourage NEVADA lawmakers to raise needed revenue for the state’s underfunded school system. The state’s revenue struggles are likely to force deep cuts to its higher education system as well.

- Proposals to improve tax fairness by taxing rich NEW YORK residents are being given serious consideration by lawmakers awakening to the state’s stark inequalities, regressive tax system, and revenue losses expected to continue long past the Covid-19 pandemic.

- An OKLAHOMA bill that would give a one-time payment of $1,000 to parents of school-aged children enrolled in public school is gaining bipartisan support as it moves through the legislature.

- The OREGON House held a landmark hearing on Tax Policy Through a Racial Equity Lens featuring testimony from local and national experts.

- Late last week in a unanimous vote, the VERMONT Senate passed a sales tax exemption for menstrual products. The bill now moves to the House for consideration.

- Advocates for fair and adequate taxation in WASHINGTON are keeping the pressure up to enact an excise tax on capital gains transactions that would bring some much-needed progressivity and revenue to the state’s tax system.

What We’re Reading

- Two public finance experts explain in Governing why arguments against federal aid to states and localities are flawed. The Center on Budget and Policy Priorities weighs in as well.

- The New York Times also digs into the complex dynamics affecting state budgets during the pandemic.

- Marketplace explores why states with progressive income taxes are faring better in the current downturn than others.

- The OREGON House held a landmark hearing on Tax Policy Through a Racial Equity Lens featuring testimony from local and national experts.

- The TaxProf Blog summarizes recent research out of Villanova University into how denying pandemic relief to incarcerated people exacerbates racial injustices.

- With talk of a federal wealth tax heating up again, Inequality.org points out that wealth taxes already exist for most people via state and local property taxes, but that the system is vastly inequitable because it taxes the primary assets of low- and middle-income families (homes) while leaving out the financial assets that make up most of the wealth of the rich.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.