While the conversations on the debt ceiling heat up in the nation’s capital, debates on state tax policy also continue to unfold in capitol buildings across the nation. One thing that is not up for debate, however, is the continued momentum around states seeking to improve their refundable tax credits. New York can be added to the list of states enhancing its state Child Tax Credit, as lawmakers agreed to begin offering the credit to children under the age of 4. Across the country, lawmakers in Hawaii have agreed to bolster their Earned Income Tax Credit and Food/Excise Tax Credit and more than doubled the state’s Child and Dependent Care Credit. Governors in both states will need to sign off on these changes. Though, there are signs that not all the debates will lead to similar, productive results. In Florida, lawmakers passed a tax cut that would further chip away at the state’s sales tax – and overall revenue – base, while in Indiana, the legislature is looking to speed up cuts to their income tax and expand school vouchers to high earners at the expense of key public investments, including high-quality public education.

Major State Tax Proposals and Developments

- The FLORIDA House has passed a $1.4 billion tax cut package that includes a sales tax exemption on baby products, gas stoves, and multiple back-to-school sales tax holidays. In addition to sales tax changes, the bill would reduce the business rent tax and freeze the local communications services tax rate for three years. With the legislative session ending at the end of the week, the Senate must now hash out the differences between their respective plan and the House plan under a tight deadline. – NEVA BUTKUS

- The HAWAII Senate and House negotiators agreed to a tax package that includes doubling the state EITC and Food/Excise Tax Credit, and more than doubling the Child and Dependent Care Credit. The agreement does not include some changes made by Gov. Josh Green – including adjustments to the state’s income tax brackets, standard deductions, and exemptions. – BRAKEYSHIA SAMMS

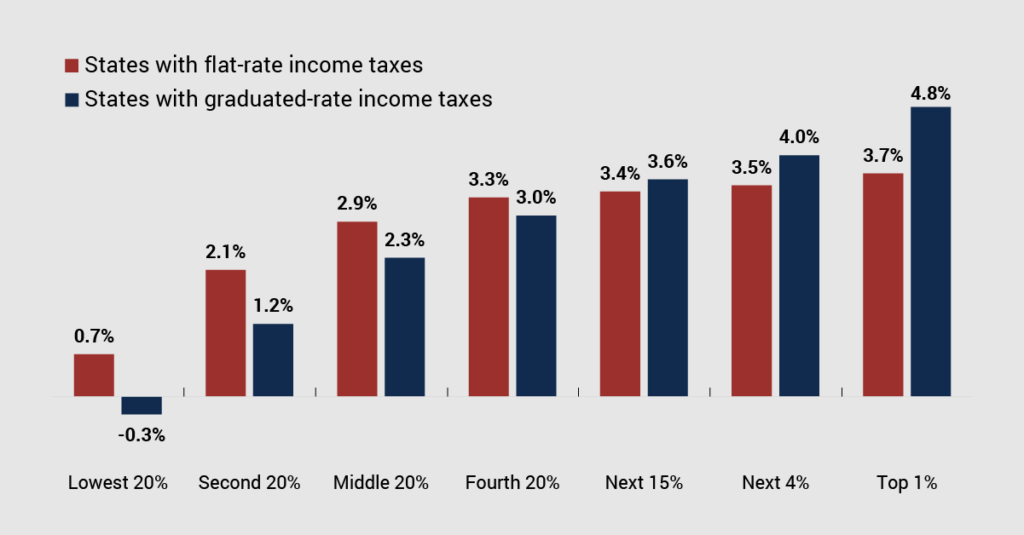

- INDIANA’s legislature is considering a final state budget that would accelerate their graduated income tax cut that was passed last year, resulting in a flat tax of 2.9 percent in 2025 as opposed to 2027. The final budget would also expand school vouchers to higher-income households. – NEVA BUTKUS

- Building on this year’s notable momentum around Child Tax Credits, NEW YORK lawmakers have agreed to expand the state’s Child Tax Credit – known as the Empire State Child Credit – to families with children under the age of 4 who were previously excluded from the benefit. – NEVA BUTKUS

State Roundup

- A bill to reduce the sales tax on groceries from 4 to 2 percent in ALABAMA is cosponsored by all 35 members of the Senate.

- The CALIFORNIA Senate released their budget proposal, which rejects many cuts proposed by Gov. Newsom and proposes multiple changes to the state’s tax code. These include: additional Low-Income Housing Tax credits; expanding the renter’s tax credit and making it refundable; expanding the California EITC; funding the already authorized Worker’s Tax Fairness Tax Credit; raising the corporate tax rate from 6.63 percent to 10.99 percent for income above $1.5 million and cutting it to 6.63 percent for income below $1.5 million; and automatically suspending Net Operating Loss credits while making the suspended credits both refundable and transferable. On net, the Senate estimates the tax changes will generate $2.8 billion in ongoing additional revenue.

- COLORADO Gov. Jared Polis along with Democrats in the state introduced a plan to cut property taxes for up to 10 years. The plan, which is one of three proposals, will have to first be approved by voters in November before going into effect.

- Republicans in CONNECTICUT released their first budget proposal since 2017, as a counter to Gov. Ned Lamont’s recent plan. The proposal would cut taxes by $700 million a year, compared to the governor’s $500 million plan. It would cut the rates of the bottom two income tax brackets, create a new child deduction, expand business tax cuts, and repeal the highway tax on commercial trucks.

- The Republican controlled House in LOUISIANA is proposing cuts to early childhood programs and healthcare programs for Louisianans living with disabilities to avoid raising the state’s constitutional spending cap. Meanwhile, lawmakers continue to weigh personal income and corporate tax cuts, as well as an increase to the state’s Earned Income Tax Credit.

- The MISSOURI legislature is continuing to negotiate the state’s budget as the state’s constitutional deadline of Friday May5th approaches. So far, Senate Majority Leader Hough has held firm on not passing the House’s substantial tax cuts, arguing that the state’s last round of cuts have yet to take effect.

- Senators in MINNESOTA have passed their tax proposal, containing $4 billion in tax cuts including a one-time rebate, new child tax credit, and expanded Social Security exemption. Lawmakers will now work through differences between the various proposals.

- SOUTH DAKOTA voters could possibly decide in 2024 to repeal the state’s sales tax on groceries after supporters received approval to begin collecting petition signatures for the measure. Repealing the tax was a priority for Gov. Kristie Noem, but the legislature rejected the proposal and instead passed legislation that reduced the general sales tax rate from 4.5 percent to 4.2 percent through July 2027.

What We’re Reading

- In case you missed it, ITEP’s Brakeyshia Samms wrote last week about the attempted veto override in Kansas and how the state ultimately avoided a flat tax proposal.

- The Arkansas Times blog published a piece that demonstrates how the years of consecutive income tax cuts passed by Arkansas lawmakers did little-to-nothing for low- and moderate-income Arkansans despite lawmakers’ claims.

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Aidan Davis at [email protected]. Click here to sign up to receive the Rundown via email.