New Jersey avoided a second consecutive shutdown and proved that even against staunch opposition, progressive solutions to states’ fiscal issues are attainable, and Arizona voters will likely have a chance to solve their education funding crisis in a similar way. Budget and tax debates remain to be resolved, however, in Maine and Massachusetts. Meanwhile, voters are gaining a clearer picture of what questions they will be asked on ballots this fall as signature drives conclude in several states.

— Meg Wiehe, ITEP Deputy Director, @megwiehe

Major State Tax Proposals/Developments:

- Narrowly averting a government shutdown, New Jersey lawmakers and Gov. Phil Murphy reached agreement on a budget last Tuesday night. The deal raises income taxes on individuals with income over $5 million per year, adds a two percent surtax on large corporations, requires “combined reporting” for multi-state corporations, increases the state Earned Income Tax Credit (EITC), creates a new credit for low-income families with children, and improves funding for education, infrastructure, and the state’s underfunded pension system.

- Last week, Arizona’s Invest in Education campaign submitted more than 270,000 signatures to place a tax on high-income earners on the ballot. The signatures are now being verified. Meanwhile, lawmakers are debating which taxes to cut in response to the possibility of an online sales tax windfall.

- North Carolina lawmakers gave final approval to a measure that will send a constitutional amendment referendum to North Carolinians for a vote. The measure would limit the state’s ability to raise additional revenue, likely at the expense of key public services, by lowering the constitutional cap on personal income tax rates from 10 to 7 percent.

- Massachusetts lawmakers have yet to pass a permanent state budget for FY19. An interim budget agreement will serve in its place until an agreement is reached.

- California is facing two major tax showdowns. With the gas tax repeal initiative qualifying for the November 2018 ballot, Republicans are seeking to use the initiative to shape Congressional outcomes, but construction companies, labor groups, and civic organizations are fighting back. And after lawmakers were strong-armed into banning local soda taxes for the next 12 years, a coalition led by the state’s major medical organizations has announced its plans to fight back with a statewide soda tax initiative to take to voters in November 2020.

Further State Fiscal News:

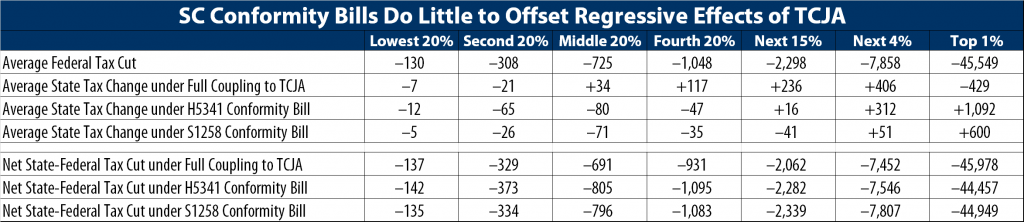

- South Carolina leaders decided to adjourn without taking any action on federal tax conformity, leaving the debate to next year. Multiple proposals had been floated but none were agreed to.

- Louisiana avoided further downgrading of its credit rating with enactment of the 0.45 sales tax increase and passage of a balanced budget.

- The anti-tax group seeking to roll back Oklahoma’s recent tax increases dropped their effort when the state Supreme Court ruled that the description of the proposal was insufficient and the ballot title misleading, which would have required another round of signatures by mid-July.

- The ballot lineup in Oregon has become clearer, featuring two anti-tax measures that would exempt food from sales taxes and require a three-fifths majority vote to approve any tax measure that would result in increased state revenues. Not featured is an initiative to improve corporate tax disclosures, which unions have just agreed to drop to focus efforts on defeating the anti-tax petitions. Another initiative of note will appear on the ballot in Portland, where voters will be asked to consider a surcharge on large retailers to fund environmental projects.

- Delaware lawmakers are cutting taxes on casinos to try to keep them afloat.

- One Missouri legislator is filing a lawsuit to challenge a gas tax increase that is supposed to go before state voters this fall.

- Washington state voters may have an opportunity to revisit the question of adopting a carbon tax via ballot this November. The state initiative is not surprisingly not popular among the big oil companies. And the beverage industry is hard at work to secure another statewide soda tax ban on the west coast, hoping to cap via ballot initiative existing soda taxes (in Seattle) and prevent other localities from adopting new soda taxes.

- Nevada cannabis tax revenues have been exceeding projections all year, and have now officially beaten the yearly forecast in only 10 months.

- North Dakota oil revenues are exceeding forecasts but not likely by enough to restore recent funding cuts.

What We’re Reading…

- Ohio Policy Matters released a plan to rebalance the state’s income tax. The report points to the impact of tax cuts in Ohio since 2005 and makes the case for greater investment.

- The Economic Progress Institute published highlights from the state’s 2018 session, including detail on the enacted budget and legislation.

- Route Fifty reports on states and localities seeking and trying ways to combat rising inequality.

- The Associated Press and Route Fifty review some of the paths states may take in the wake of the Supreme Court’s Wayfair decision allowing them to collect online sales taxes. Some state leaders are unsurprisingly already calling for new tax cuts.

- The Center on Budget and Policy Priorities recently wrote about how K-12 funding cuts have affected basic school construction and renovation around the country.

- The Washington Post reports on anti-tax state legislators’ fears of being ousted from office and their attempts to entrench their viewpoints in law through constitutional amendments that require special supermajority votes to raise taxes, including in Florida, Oregon, and North Carolina.

- The fight over revenues needed for core public services has reached the pages of Playboy, which writes that “[t]he public, it seems, has woken up to a stark reality regardless of political affiliation: education, and other key government services that make for a functioning society, need money to run—and the coffers are empty.”

If you like what you are seeing in the Rundown (or even if you don’t) please send any feedback or tips for future posts to Meg Wiehe at [email protected]. Click here to sign up to receive the Rundown via email.