For 45 years, the federal Earned Income Tax Credit (EITC) has benefited low- and moderate-income workers. Serving as one of the nation’s most significant and effective anti-poverty programs, the EITC helps to offset federal income and payroll taxes and supplements the earnings of low-wage workers across the country. This, in turn, not only helps them meet their basic needs in the short-run but bolsters their long-run economic security as well.

Yet, throughout its history, the EITC has provided little or no benefit to workers without children in the home—a group that includes noncustodial parents whose children live the majority of the year with another parent. For these childless adults (as we will refer to them in this report), aged 25 through 64, the maximum credit is small and the income limits are restrictive. For instance, in 2020 a single qualifying childless adult who earns between $7,030 and $8,790 can receive a maximum federal credit of just $538. Above those levels, the credit is gradually phased out and disappears once earnings reach $15,820.

The maximum credit is seven times more generous for adults with one child, 11 times more generous for recipients with two children, and more than 12 times more generous for larger families with three or more children.[i] The federal EITC’s meager benefits for childless adults leads to an inequitable outcome: the federal income tax system–which is ostensibly based on ability-to-pay–taxes some impoverished, childless adults deeper into poverty.[ii]

But, perhaps even more astounding, is the impact on childless adults under 25 and older than 65. Both young workers (between 18 and 24) just getting a foothold in the job market and older adults (65 and older) working well beyond the traditional retirement age are left out of the federal EITC as it is currently designed.

Immediate Steps for State Lawmakers to Consider

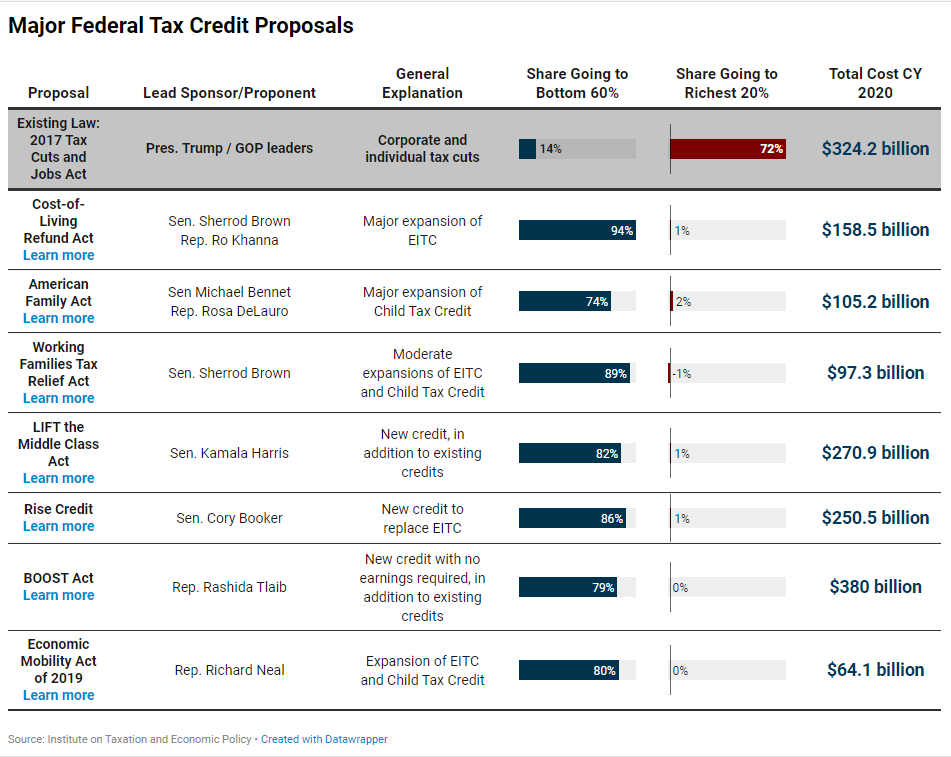

Many federal policymakers have recognized a need for reform in this area. Numerous pieces of legislation have been proposed to improve the existing EITC, many providing greater benefits to childless adults through boosting the maximum credit, increasing income eligibility limits, and/or expanding the age cutoffs to include both younger and older childless adults.[iii]

But states do not have to wait for the federal government to begin making progress in this area.

Currently, the federal government’s limited scope of the EITC for childless adults creates challenges at the state level where policymakers have typically designed EITCs as a fixed percentage of the meager federal credit. In a state offering a credit calculated at 30 percent of the federal level, for example, that credit will be much more substantial for families with children than for childless adults.

The tables in this report outline the benefits of relaxing age requirements under state EITCs to include both young and older childless adults. They also identify the impact of bringing existing state EITCs for that population up to 100 percent of the federal credit to help counteract shortcomings in the federal credit’s design.

More specifically, the following tables show the state cost and the number of adults who would be affected by:

- expanding age eligibility to include childless 18-to-24-year-old workers;

- expanding age eligibility to the 65 and over working population; and

- the total impact of expanding existing state credits to 100 percent of the federal credit for all childless adults while also expanding age eligibility.

The appendix of this report also includes the federal impact of expanding age eligibility to young and older childless adults.

States are Already Leading the Way

Earned Income Tax Credit enhancements for childless adults have already taken place in a handful of states. The District of Columbia led the charge in 2014 by offering 100 percent of the federal credit to childless workers while also expanding income eligibility beyond the federal limits. Maine followed suit in 2019 by expanding its state EITC for childless workers to 25 percent of the federal credit, above their existing 12 percent credit for families with children.

California, Minnesota, Maine, and Maryland have expanded age eligibility under their state EITCs. California now allows childless adults between ages 18 and 24, as well as eligible recipients 65 and over, to benefit from the state’s EITC. Maryland and Maine extended their state credits to childless adults 18 to 24 years old, and Minnesota to those 21 to 24 years old. Meanwhile, the momentum for similar improvements is continuing across the country during states’ 2020 legislative sessions.

The EITC lifts millions out of poverty, allows them to better meet their most basic needs, and helps to position them for long-run economic security. Childless workers, specifically those 18 to 24 years old and over age 65, have for too long been denied this essential support. State lawmakers can work to correct this inequity and greatly benefit childless adults in their states by enacting reforms that would expand age eligibility and increase the credit for this population that has historically been left behind.

[i] Maximum credits for the federal EITC in 2020 are as follows: $538 for childless adults, $3,584 for recipients with one child, $5,920 for recipients with two children, and $6,660 for recipients with 3 or more children. Income limits also increase with the number of children in the home. Details available here: https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/earned-income-tax-credit-income-limits-and-maximum-credit-amounts

[ii] Marr, Chuck and Yixuan Huang. “Childless Adults Are Lone Group Taxed Into Poverty: EITC Expansion Could Address Problem,” Center on Budget and Policy Priorities. June 10, 2019. https://www.cbpp.org/research/federal-tax/childless-adults-are-lone-group-taxed-into-poverty

This group’s federal tax liability is also noticeably impacted by the fact that they do not receive the Child Tax Credit (CTC).

[iii] “Major Federal Tax Credit Proposals,” Institute on Taxation and Economic Policy (ITEP). September 10, 2019. https://itep.org/taxcreditproposals/