Corporate Tax Watch

Congressional Hearing Highlights Problems with the Border Adjustment Tax

May 25, 2017 • By Richard Phillips

The debate over the so-called border adjustment tax (or BAT) took center stage this week when the House Ways and Means Committee held its first hearing on the topic. Despite strong support by the House Republican leadership and the Chairman of the Ways and Means Committee, Rep. Kevin Brady, the proposal faced an onslaught of criticism during the hearing from invited witnesses and members of both parties.

Tax Avoiding Companies Well Represented at Tax Reform Hearing

May 18, 2017 • By Richard Phillips

Today the House Ways and Means Committee will hold its first tax reform hearing of 2017, which marks the official opening of the tax reform debate in Congress. True tax reform, if the committee sought to achieve it, could create more jobs and ensure companies are paying their fair share by cracking down on the massive offshore tax avoidance that companies engage in. Unfortunately, the panel of witnesses for today’s hearing is largely made up of representatives of various major corporations that are beneficiaries of the loopholes in our current corporate tax laws. Given this, it seems likely that these…

3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015

April 27, 2017 • By Aidan Davis, Matthew Gardner, Richard Phillips

The trend is clear: states are experiencing a rapid decline in state corporate income tax revenue. Despite rebounding and even booming bottom lines for many corporations, this downward trend has become increasingly apparent in recent years. Since our last analysis of these data, in 2014, the state effective corporate tax rate paid by profitable Fortune 500 corporations has declined, dropping from 3.1 percent to 2.9 percent of their U.S. profits. A number of factors are driving this decline, including: a race to the bottom by states providing significant “incentives” for specific companies to relocate or stay put; blatant manipulation of…

President Trump’s Corporate Tax Outline: At Least He Didn’t Use a Napkin

April 27, 2017 • By Matthew Gardner

The most complimentary thing that can be said about the corporate tax changes outlined by President Trump earlier this week is that they weren’t scribbled on a napkin. Unlike supply-side architect Arthur Laffer, who infamously sketched out his explanation for why tax cuts can somehow pay for themselves in this manner, the Trump Administration took […]

States are experiencing a rapid decline in state corporate income tax revenue, and the downward trend has become increasingly pronounced in recent years. Despite rebounding bottom lines for many corporations, a new ITEP report, 3 Percent and Dropping: State Corporate Tax Avoidance in the Fortune 500, 2008 to 2015,finds that effective tax rates paid by […]

Does a 15 Percent Corporate Tax Rate Sound Low? For Dozens of Major Corporations, Maybe Not

April 25, 2017 • By Matthew Gardner

President Donald Trump has promised to release new details Wednesday on what he says could be “the biggest tax cut we’ve ever had.” While much is unclear about the shape this plan will take, the Wall Street Journal reported yesterday that it will include a 15 percent tax rate on corporate profits, less than half […]

Profitable Fortune 500 companies in a range of economic sectors have been remarkably successful in manipulating the tax system to avoid paying even a dime in tax on billions of dollars in U.S. profits. This ITEP report examines a select, diverse group of 15 corporations' tax situations to shed light on the widespread nature of corporate tax avoidance. As a group, these companies paid no federal income tax on $21 billion in profits in 2016, and they paid almost no federal income tax on $111 billion in profits over the past five years. All but one received federal tax rebates…

New Analysis Compares Tax Rates Paid by Companies Lobbying for/against Border Adjustment Tax

March 31, 2017 • By Matthew Gardner

An Institute on Taxation and Economic Policy analysis finds that, on average, companies that are opposed to the Border Adjustment Tax pay higher tax rates than a coalition of companies lobbying against the tax. The Border Adjustment Tax or BAT is being proposed as part of a broader GOP plan to overhaul the corporate tax […]

A Comparative Analysis: Tax Rates Paid by Companies for and Against the Border Adjustment Tax

March 30, 2017 • By Richard Phillips

It’s often noted that corporate tax reform is difficult, in part, because it creates so many winners and losers. As Congress turns its attention to federal corporate tax reform, the House GOP’s proposed border adjustment tax, which is intended to raise enough revenue to justify cutting the corporate tax rate from 35 to 20 percent, […]

For years, the number one tax policy talking point from corporate lobbyists has been the claim that the United States has the highest corporate tax rate in the world. The story then goes that this high tax rate is driving away business and Congress should move to dramatically lower it. A new study by the […]

Profitable corporations are subject to a 35 percent federal income tax rate on their U.S. profits. But many corporations pay far less, or nothing at all, because of the many tax loopholes and special breaks they enjoy. This report documents just how successful many Fortune 500 corporations have been at using loopholes and special breaks over the past eight years. As lawmakers look to reform the corporate tax code, this report shows that the focus of any overhaul should be on closing loopholes rather than on cutting tax rates.

The Border Adjustment Tax Creates More Problems Than It Solves

February 22, 2017 • By Richard Phillips

In recent weeks, the Republican congressional leadership’s effort to introduce a comprehensive tax reform bill has increasingly faced opposition from major business groups and skeptical lawmakers from across the aisle. The primary source of dissent thus far is that the most prominent tax framework, the House GOP’s “Better Way” tax blueprint, contains a radical provision […]

Regressive and Loophole-Ridden: Issues with the House GOP Border Adjustment Tax Proposal

February 22, 2017 • By Matthew Gardner, Richard Phillips

In the summer of 2016, House Republicans released a blueprint for tax reform that is likely to be used as the starting point for major tax legislation in 2017.[1] One of the most radical provisions is a proposal to shift the corporate tax code from a residence-based to a destination-based system through applying a border adjustment on exports and imports. This proposal has major flaws that would make it a challenge to implement. Further, it is inherently regressive, rife with loopholes and would violate international agreements.

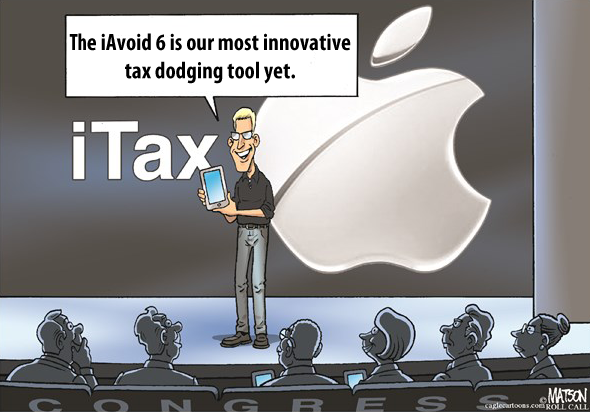

Tim Cook’s Disingenuous Argument to Justify Apple’s $215 Billion Offshore Cash Hoard

August 9, 2016 • By Jenice Robinson

Tim Cook is a persuasive CEO. In a wide-ranging interview published earlier this week in the Washington Post, he discussed his vision for the company, thoughts about leadership succession, and humbly admitted he has made mistakes. So it would be very easy to view as reasonable his declaration that Apple will not repatriate its offshore […]

Many of America's Most Profitable Corporations Pay Little or No Federal Income Taxes; Multinationals Pay Higher Rates Abroad Than in the U.S.

Earlier this year, Berkshire Hathaway Chairman Warren Buffett made headlines by publicly decrying the stark inequity between his own effective federal tax rate (about 17 percent, by his estimate) and that of his secretary (about 30 percent). The resulting media firestorm has drawn welcome attention to unfair tax breaks that allow the richest Americans to […]

Massey Pays One-Sixth of 35% Federal Tax Rate, Little in State Income Tax

April 15, 2010 • By Matthew Gardner

A new analysis shows that Massey Energy, which owned the Upper Big Branch mine where 29 West Virginia miners were killed last week, paid an average of 5.6 percent of its profits in federal income taxes over the last three years—despite having large profits in each year. This is less than one-sixth of the statutory […]

This study details which companies have benefitted the most from the decline in corporate taxes over the past three years, and which have been less fortunate. It also measures the effects of loopholes in our corporate tax laws that predated the George W. Bush administration. Specifically, the study looks at the federal income taxes paid […]