Estate Tax

How the Wealthy Exploit the Tax Code: Q&A with Professor Ray Madoff, Author of ‘The Second Estate’

January 26, 2026 • By Brakeyshia Samms

Her timely book, The Second Estate: How the Tax Code Made an American Aristocracy, walks readers through federal tax policy history and the modern-day legal maneuvers the wealthy use to pay little to no taxes

This country’s biggest historical challenge has been delivering this progress to all Americans, but Republicans have cut it back for everyone, retreating from many 20th century achievements in ways that will slam doors, rather than opening them, for the next generation.

Trump Megabill Will Encourage Dynastic Wealth Hoarding by Further Weakening the Estate Tax

May 15, 2025 • By Jon Whiten

The tax and spending megabill signed into law by President Trump on July 4 will cut nearly $200 billion from food assistance, affecting tens of millions adults and children, while providing an estate tax cut costing roughly the same amount to a few thousand people who will leave behind more than $7 million to their heirs.

The Estate Tax Should Help to Level the Playing Field. Instead it’s Letting the Rich Get Richer.

March 26, 2024 • By Amy Hanauer

The federal estate tax should ensure that family dynasties who’ve amassed enormous fortunes pay their fair share in taxes. But because policymakers have repeatedly doubled and tripled the immense sums that can be passed on before the tax kicks in, the estate tax today affects almost no one.

The Estate Tax is Irrelevant to More Than 99 Percent of Americans

December 7, 2023 • By Steve Wamhoff

The federal estate tax has reached historic lows. In 2019, only 8 of every 10,000 people who died left an estate large enough to trigger the tax. Legislative changes under presidents of both parties have increased the basic exemption from the estate tax over the past 20 years. This has cut the share of adults leaving behind taxable estates down from more than 2 percent to well under 1 percent.

Paying The Estate Tax Shouldn’t Be Optional for the Super Rich

November 9, 2021 • By Carl Davis

ProPublica this year released multiple exposés revealing how the nation’s wealthiest individuals and families avoid taxes on an unimaginable scale. Most recently, it uncovered Republican and Democratic elected officials and political appointees who used complex strategies to avoid taxes. Richard Painter, a White House ethics lawyer under George W. Bush, said these revelations should be “troubling […]

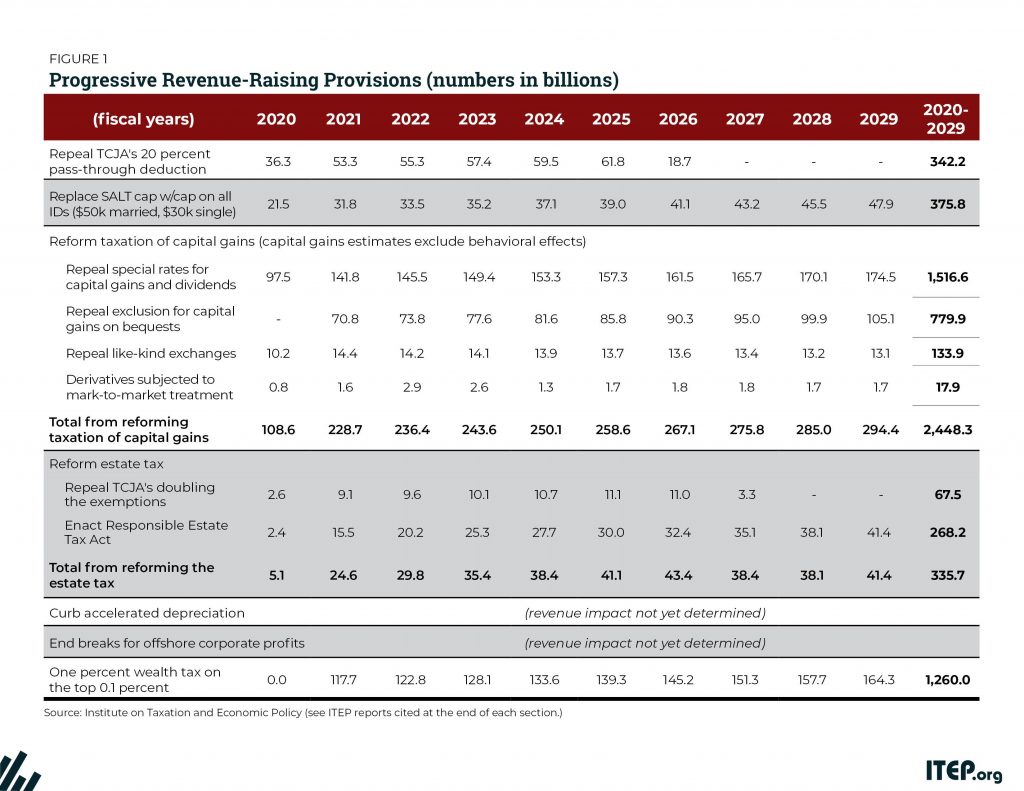

How Democratic Presidential Candidates Would Raise Revenue

February 19, 2020 • By Steve Wamhoff

One of the biggest problems with the U.S. tax code in terms of fairness is that investment income, which mostly flows to the rich, is taxed less than the earned income that makes up all or almost all of the income that working people live on.

The nation’s tax policies and their role in economic inequality are front and center during this election cycle. For those interested in how the nation can move toward a fairer tax system and or more detailed information about progressive tax policy ideas, ITEP created this quick guide.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

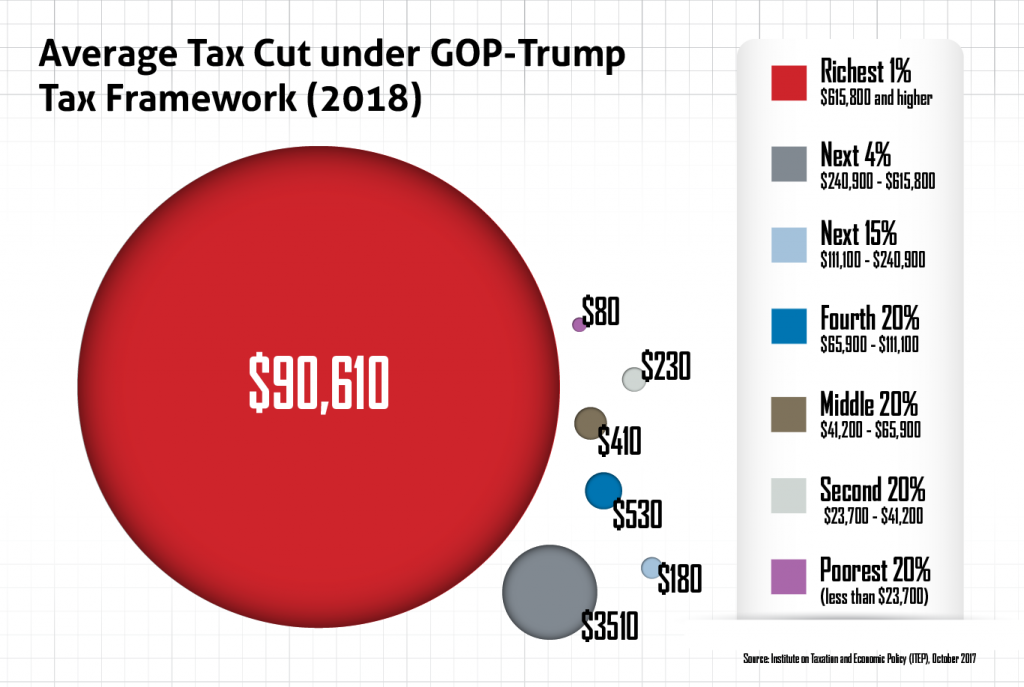

America has long needed a more equitable tax code that raises enough revenue to invest in building shared prosperity. The Tax Cuts and Jobs Act (TCJA), enacted at the end of 2017, moved the federal tax code in the opposite direction, reducing revenue by $1.9 trillion over a decade, opening new loopholes, and providing its most significant benefits to the well-off. The law cut taxes on the wealthy directly by reducing their personal income taxes and estate taxes, and indirectly by reducing corporate taxes.

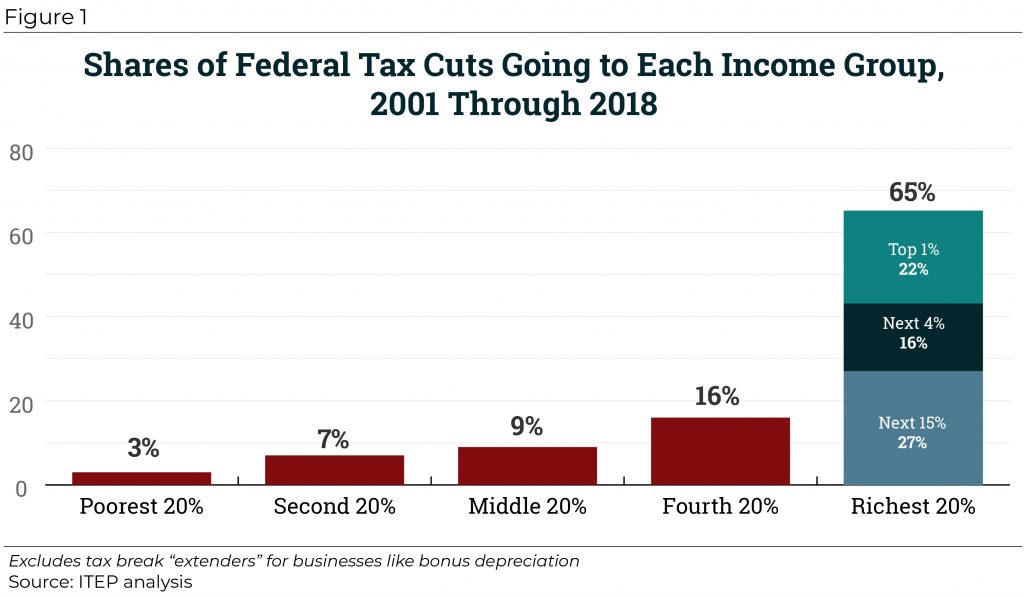

Since 2000, tax cuts have reduced federal revenue by trillions of dollars and disproportionately benefited well-off households. From 2001 through 2018, significant federal tax changes have reduced revenue by $5.1 trillion, with nearly two-thirds of that flowing to the richest fifth of Americans.

Middle-Income More Likely Than the Rich to Pay More Under Trump-GOP Tax Plan

October 11, 2017 • By Jenice Robinson

The Trump Administration and GOP leaders continue to wrap their multi-trillion tax cut gift to the wealthy in easily refutable rhetoric about boosting the nation’s middle class. Later today, trucks and truck drivers will serve as a backdrop for a Pennsylvania speech in which Trump is anticipated to talk about how proposed tax changes that […]

The Federal Estate Tax: A Critical and Highly Progressive Revenue Source

December 7, 2016 • By Richard Phillips

For years, wealth and income inequality have been widening at a troubling pace. A recent study estimated that the wealthiest 1 percent of Americans held 42 percent of the nation's wealth in 2012, up from 28 percent in 1989. Public policies have exacerbated this trend by taxing income earned from investments at a lower rate than income from an ordinary job and by dramatically cutting taxes on inherited wealth. Further, lawmakers have done little to stop aggressive accounting schemes designed to avoid the estate tax altogether.

The federal estate tax is one of our most progressive sources of revenue and a critical tool in the fight against rising wealth inequality. Congressional legislation has significantly eroded the tax over the years, and now it is levied on only the wealthiest 0.2% of estates, meaning that 99.8% of estates will have no federal estate tax liability. The estate tax should be not only preserved but restored to a historical level to increase revenues and ensure more progressivity in the tax system.