New Hampshire

State Rundown 5/13: States Get Federal Aid and Guidance as Many Sessions Wind Down

May 13, 2021 • By ITEP Staff

We had our noses buried in new American Rescue Plan guidance...when we heard the refreshing news that Missouri leaders are on the verge of modernizing their tax code, not only by becoming the final state to apply sales taxes to online purchases, but also by enacting an Earned Income Tax Credit (EITC)...Meanwhile, tax debates are also highly active in California, Colorado, Louisiana, Maine, and Nebraska. We also share some of our own reporting on recent efforts in Arizona and several other states to undermine voter-approved reforms and democratic institutions themselves.

This week’s state fiscal news brings a reminder that even though advocates for great economic and racial justice have won some major progressive victories recently, anti-tax zealots have been hard at work too. Lawmakers advanced or enacted troubling regressive tax cuts or shifts in Idaho, Kansas, and Montana, and are actively debating them in Iowa, […]

Just as a recent cold snap reminded us that spring has not fully sprung yet, this week’s news has been full of reminders that state fiscal debates aren’t quite finished either...

State Rundown 4/14: More Progressive Wins in the Headlines this Week, but Mind the Fine Print

April 14, 2021 • By ITEP Staff

Two significant victories headlined state tax debates in the past week, as New Mexico leaders improved existing targeted tax credits to give bigger boosts and reach more families in need, and West Virginia lawmakers unanimously shut down a destructive effort to eliminate the state’s progressive income tax. These developments follow last week’s major wins for progressive taxation and targeted assistance in New York, and more good news is likely soon as Washington legislators continue to advance their own targeted credit for working families. Not all the news is positive though, as costly and/or regressive tax cuts remain on the table…

State Rundown 4/7: Tax Justice Advocates Applaud New York Budget Deal

April 7, 2021 • By ITEP Staff

New York lawmakers stole the spotlight this week as they were able to agree on—and convince reluctant Gov. Andrew Cuomo to support—strong progressive tax increases on the highest-income households and corporations in the state to fund shared priorities like K-12 education and pandemic recovery efforts. Minnesota leaders are attempting a similar performance off Broadway with progressive reforms of their own, while Kansas legislators are getting poor reviews for cutting a number of taxes and worsening their budget situation. Thankfully major tax changes stayed backstage as sessions concluded in Georgia and Mississippi.

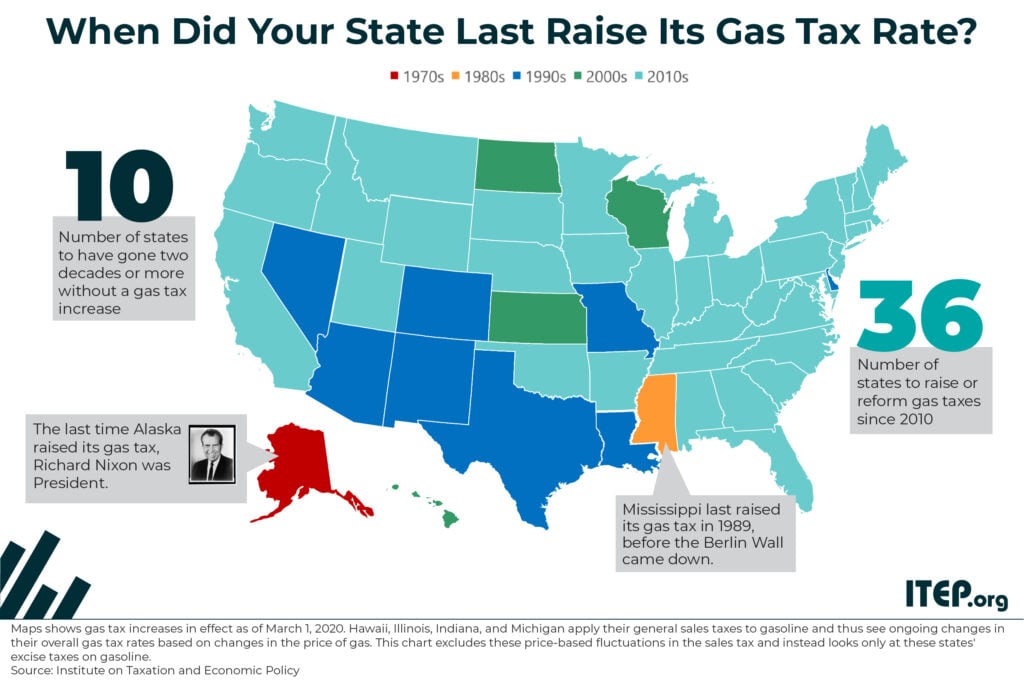

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

State Rundown 2/11: Legalizing and Taxing Cannabis Becoming Increasingly Mainstream

February 11, 2021 • By ITEP Staff

This week, the governors of New Hampshire and West Virginia proposed to eliminate their states’ most progressive revenue sources and shift taxes even more heavily onto the middle- and low-income families who already pay the highest rates in both states. It was also a big week for proponents of legalizing recreational cannabis, as that movement made progress in Hawaii, Virginia, and Wisconsin.

As states kick off their 2021 legislative sessions, it’s clear that many governors and lawmakers are attempting to “take a mulligan” on the last year and recycle tax-slashing ideas that were already bad in 2020 and are even worse now as states try to recover from the Covid-19 pandemic and accompanying downturn...On a brighter note, Illinois leaders showed they did learn from the events of 2020, passing a major criminal justice reform bill and payday loan protections intended to reduce racial inequities.

State Rundown 10/21: States Preparing Ingredients for 2021 Fiscal Debates

October 21, 2020 • By ITEP Staff

State lawmakers around the nation are already looking well past the upcoming election to the legislative debates they’ll be cooking up in 2021. In Iowa and Nebraska, anti-tax groups are thawing out regressive tax shift ideas they had put on ice earlier in the pandemic. In Delaware, a lawsuit and recent settlement have put educational and property tax inequities on the menu for the upcoming session. Meanwhile New Jersey and New York are both looking to add stock to their revenue mixes with progressive taxes on stock trades.

State Rundown 9/23: Tax Justice Advanced in New Jersey, On the Ballot in Illinois

September 23, 2020 • By ITEP Staff

New Jersey leaders grabbed the biggest headlines of the week by finally agreeing to implement a much-needed and long-discussed millionaires tax to shore up the budget and improve tax fairness. And Illinois residents can begin voting tomorrow to enact a graduated income tax there. Relatedly, ITEP Research Director Carl Davis updated our research debunking the myth that progressive taxes interfere with economic growth. Cannabis legalization and taxation was a hot topic as well, as lawmakers in Vermont reached an agreement to move forward on the matter and others in Connecticut, Kansas, and New Hampshire worked toward the same.

State Rundown 9/11: Benefits of Progressive Taxation Getting Well-Deserved Attention

September 11, 2020 • By ITEP Staff

Readers may want to start with our “What We’re Reading” section this week, which is full of good reading on how progressive taxation is needed to fund vital public services, helpful for state and local economic growth, and popular among voters as well. In that spirit, leaders in both New Jersey and New York are looking at small taxes on stock trades to help improve their budgets and tax codes. These last couple of weeks have also featured more state fiscal action than is typical this time of year, for example in North Carolina, where lawmakers decided to use federal…

State Rundown 8/26: Progressive Revenue Ideas Featured in Many States’ Fiscal Debates

August 26, 2020 • By ITEP Staff

Voters could significantly change the tax landscape through ballot measures this November regarding oil taxes in Alaska and a high-income surcharge for education funding in Arizona. Legislators are doing their part to bring progressive tax ideas to the fore as well, including a possible wealth tax in California, a millionaires tax in New Jersey, and a pied-a-terre proposal in New York. And Nebraska lawmakers reached a property tax and business tax subsidy compromise before closing out their session, but did not identify progressive revenue sources to fund it and will likely be back at the bargaining table before long.

State Rundown 8/12: States Find Themselves in New Unemployment Pickle

August 12, 2020 • By ITEP Staff

Even in statehouses, many eyes remained on Congress and President Trump this week as state lawmakers advocated for needed federal fiscal relief and debated whether they can afford to join in on the president’s executive order requiring states to partially fund a new version of enhanced unemployment benefits that have otherwise expired.

With tax day finally coming at the federal level and in many states this week, policymakers in Nevada and New Jersey began to talk about revenue solutions to their revenue shortfalls, even if they fell well short of wholeheartedly backing needed reforms. Like their counterparts in most states, they remain primarily focused on temporary solutions to their short-term emergencies. Still, advocates in these and other states continue to push for more fundamental fixes to their inadequate and upside-down tax codes, including a new campaign for better tax policy in Massachusetts and efforts to rein in tax subsidies and loopholes in…

State Rundown 7/8: Many State Legislatures Reconvene for Special or Resumed Sessions

July 8, 2020 • By ITEP Staff

Local leaders in the District of Columbia and Seattle, Washington, approved progressive tax changes to raise needed funding this week for priorities such as coronavirus relief, affordable housing, and mental health. Arizona advocates submitted signatures to place a high-income surcharge on the ballot for November. And as a number of states made decisions on how to use federal Coronavirus Aid, Relief, and Economic Security (CARES) Act funds, North Carolina decoupled from costly business tax cuts contained in the act and Nebraska started discussing doing the same.

State Rundown 6/26: States Take Varying Fiscal Approaches While Awaiting Federal Action

June 26, 2020 • By ITEP Staff

State policymakers this week took a variety of approaches to their fiscal situations amid the COVID-19 pandemic. Tennessee lawmakers chose to balance their budget through $1.5 billion in cuts to public services, but not before adding to those cuts by going forward with planned tax cuts. California legislators also passed a budget but relied on a number of temporary measures and delays to do so. Their counterparts in Massachusetts, New Jersey, and Rhode Island opted for interim budgets to tide them over for a few months while they continue to look for lasting solutions. Meanwhile, many states are debating whether…

State Rundown 4/29: State Responses and Federal Aid Could Be Among “May Flowers” to Come

April 29, 2020 • By ITEP Staff

April has brought relentless showers of troublesome tax and budget news as the COVID-19 pandemic wreaked havoc on communities and the public services and institutions that both support and depend on them. There is hope, however, that these troubles have opened the eyes of policymakers and that May will bring more clarity and strong action in the form of federal fiscal relief as well as home-grown state and local responses.

State Rundown 4/15: Tax Day Delayed but Other Important Work Accelerated

April 15, 2020 • By ITEP Staff

April 15 is traditionally the day federal and state income taxes are due, but like so much else, Tax Day is on hold for the time being. Meanwhile the pandemic’s disastrous and uneven effects on communities and shared institutions are decidedly not suspended. But nor are the efforts of individuals, advocates, and policymakers to develop solutions to respond to the immediate crisis while also building better systems going forward. ITEP’s recommendations for state tax policy responses are now available here, and this week’s Rundown includes experiences and perspectives on paths forward from around the country.

State Rundown 3/4: Sun Shining on Progressive Tax Efforts This Week

March 4, 2020 • By ITEP Staff

Wisconsin’s expansion of a capital gains tax break for high-income households represents a dark spot on this week’s state fiscal news, and the growing threat of COVID-19 is casting an ominous shadow over all of it, but otherwise the picture is pleasantly sunny, featuring small steps forward for sound, progressive tax policy. An initiative to create a graduated income tax in Illinois, for example, got a vote of confidence from a major ratings agency, while a similar effort went public in Michigan and two progressive income tax improvements were debated in Rhode Island. Gas tax updates made encouraging progress in…

State Rundown 2/20: Property Taxes and School Finance Take Center Stage

February 20, 2020 • By ITEP Staff

Property taxes and education funding are a major focus in state fiscal debates this week. California voters will soon vote on borrowing billions of dollars to fill just part of the funding hole created in large part by 1978’s anti-property-tax Proposition 13. Nebraska lawmakers are debating major school finance changes that some fear will create similar long-term fiscal issues. And Idaho and South Dakota leaders are looking to avoid that fate by reducing property taxes in ways that will target the families who most need the help. Meanwhile, Arkansas, Nevada, and New Hampshire are taking close looks at their transportation…

State Rundown 2/13: What’s Trendy in State Tax Debates This Year

February 13, 2020 • By ITEP Staff

We wrote earlier this week about Trends We’re Watching in 2020, and this week’s Rundown includes news on several of those trends. Maine lawmakers are considering a refundable credit for caregivers. Efforts to tax high-income households made news in Maryland, Oregon, and Washington. Grocery taxes are receiving scrutiny in Alabama, Idaho, and Tennessee. Tax cuts or shifts are being discussed in Arizona, Nebraska, and West Virginia. And Arizona, Maryland, and Nevada continue to seek funding solutions for K-12 education as Alaska and Virginia do the same for transportation infrastructure.

State Rundown 1/30: Flip-Flops and Steady Marches in State Tax Debates

January 30, 2020 • By ITEP Staff

State tax and budget debates can turn on a dime sometimes, as in Utah this past week, where lawmakers unanimously repealed a tax package they had just approved in a special session last month. Delaware lawmakers are hoping to avoid the similarly abrupt end to their last effort to improve their Earned Income Tax Credit (EITC) by crafting a bill that Gov. John Carney will have no reason to unexpectedly veto as he did two years ago. But at other times, these debates just can’t change fast enough, as in New Hampshire and Virginia, where leaders are searching for revenue to address long-standing transportation needs, and in Hawaii, Nebraska, and North Carolina, where education funding issues remain painfully unresolved.

State Rundown 9/26: Shady State Business Tax Subsidies Coming to Light

September 26, 2019 • By ITEP Staff

Lawmakers in Michigan and New Hampshire made progress toward enacting their state budgets, though Michigan may yet end up in a government shutdown. Leaders in Wyoming advanced a proposal to create a limited tax on large corporations to raise some revenue and add a progressive element to their state’s tax code. Georgia agencies are forced to recommend their own funding cuts amid state income tax cuts. And business tax subsidies are looking particularly bad in Maryland, where subsidy money has been handed out without verification that companies were creating jobs, and New Jersey, where a false threat to leave the…

State Rundown 9/12: Work Continues to Flip the Script on Backwards Tax Codes

September 12, 2019 • By ITEP Staff

Residents of several states are spending their palindrome week reading ballot initiatives forwards and backwards to decide whether or not to support them, including measures to improve education funding in California and Idaho, allow Alaska and Colorado to invest more in public services, and constitutionally prohibit income taxation in Texas. New Jersey lawmakers are giving the same thorough treatment to the state’s corporate tax subsidies. And advocates in Chicago, Illinois, have a bold proposal to flip the script on upside-down taxes there. But devotees of good policy and honest government in North Carolina won’t want to re-read yesterday’s news in…

OHIO legislators passed a budget with unfortunate income tax cuts for high-income households. Other states turned their attention to unconventional ideas during their legislative off-seasons, for better and for worse. And there are many gems to be found in our “What We’re Reading” section below, including new research on the racial inequities that continue to pervade our communities and schools.