North Carolina

Uncertainty abounds in state tax debates lately...

Many state legislative sessions are wrapping up...

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

April 11, 2024 • By ITEP Staff

State and local tax codes can do a lot to reduce inequality. But they add to the nation’s growing income inequality problem when they capture a greater share of income from low- or moderate-income taxpayers. These regressive tax codes also result in higher tax rates on communities of color, further worsening racial income and wealth divides.

Governors and legislative leaders in a dozen states have made calls to fully eliminate their taxes on personal or corporate income, after many states already deeply slashed them over the past few years. The public deserves to know the true impact of these plans, which would inevitably result in an outsized windfall to states’ richest taxpayers, more power in the hands of wealthy households and corporations, extreme cuts to basic public services, and more deeply inequitable state tax codes.

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

Audio: ITEP’s Carl Davis Discusses North Carolina’s Upside-Down Tax Code

January 23, 2024

Ever since Republicans took control of the North Carolina legislature in 2011, they’ve passed income tax cut after income tax cut and bragged repeatedly of the supposed enormous benefits this has afforded to average North Carolinians

North Carolina: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

North Carolina Download PDF All figures and charts show 2024 tax law in North Carolina, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.7 percent) state and local tax revenue collected in North Carolina. These figures depict North Carolina’s 2024 flat income tax […]

Even as revenue collections slow in many states, some are starting the push for 2024 tax cuts early. For instance, policymakers in Georgia and Utah are already making the case for deeper income tax cuts. Meanwhile, Arizona lawmakers are now facing a significant deficit, the consequence of their recent top-heavy tax cuts. There is another […]

North Carolina Budget & Tax Center: NC Leaders Are Shirking Their Responsibilities To Our Children, Our State by Revisiting Leandro Lawsuit

November 17, 2023

The announcement that the NC Supreme Court will rehear the court case that affirmed children’s constitutional right to a sound, basic education is just another way in which North Carolina’s legislative leaders are attempting to rewrite the rules to further their agenda rather than the well-being of children. Read more.

America Used to Have a Wealth Tax: The Forgotten History of the General Property Tax

November 2, 2023 • By Carl Davis, Eli Byerly-Duke

Over time, broad wealth taxes were whittled away to become the narrower property taxes we have today. These selective wealth taxes apply to the kinds of wealth that make up a large share of middle-class families’ net worth (like homes and cars), but usually exempt most of the net worth of the wealthy (like business equity, bonds, and pooled investment funds).The rationale for this pared-back approach to wealth taxation has grown weaker in recent decades as inequality has worsened, the share of wealth held outside of real estate has increased, and the tools needed to administer a broad wealth tax…

State Rundown 9/27: Some States are Looking to Paint the Budgets Red

September 27, 2023 • By ITEP Staff

When it comes to investments, state lawmakers across the country are positioning their states to be in the red as they pass or debate further tax cuts that will overwhelmingly benefit the wealthy – and some states are now adding an additional coat of red paint...

State Rundown 8/10: Pump the ‘Breaks’ on Sales Tax Holiday Celebrations

August 10, 2023 • By ITEP Staff

August is here, school is starting, and with that comes back to school shopping...

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 2, 2023 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2023, and these suspensions will cost nearly $1.6 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Overall, the benefits of sales tax holidays are minimal while their downsides are significant.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe. There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and […]

North Carolina Budget & Tax Center: Tax Changes in NC Senate Budget Plan Benefit Richest, Worsen Racial Inequities

May 25, 2023

The NC Senate tax plan will double down on the path to zero income tax — keeping in place the elimination of the corporate income tax and reducing the personal income tax to 2.49 percent after 2029 — to benefit the very wealthy and profitable corporations. Read more.

State Rundown 5/25: The North Star State Leads the Way on Tax Fairness

May 24, 2023 • By ITEP Staff

As we approach the midpoint of 2023, it’s a good time to look back at the progress states have made in the name of tax fairness and equity...

This past week, in statehouses around the country, tax policy decisions are moving fast as budgets were signed and budget plans were released and passed...

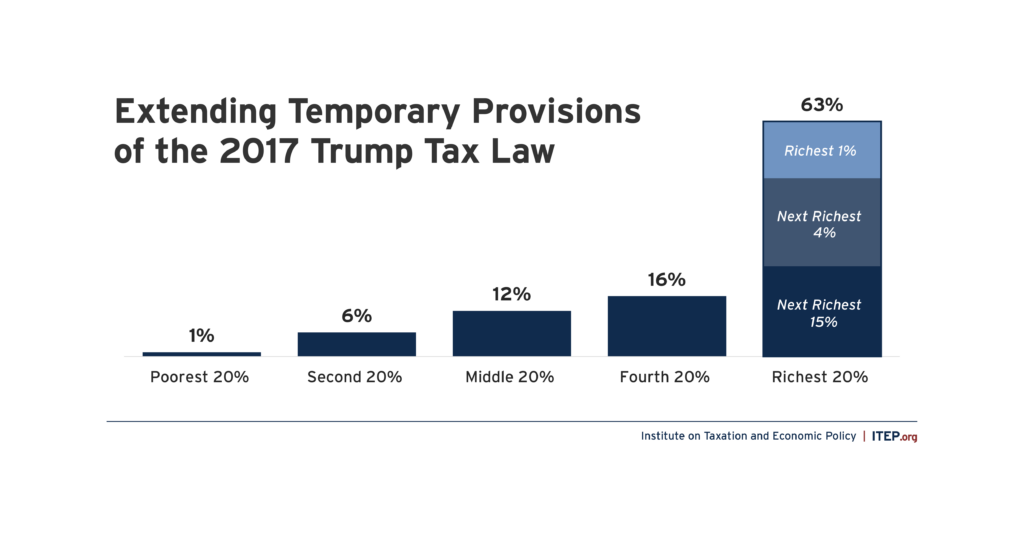

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

Racial Justice Requires Tax Justice: Our Analysis Helps Deliver Both

April 24, 2023 • By Amy Hanauer

ITEP’s analytical approach, our comprehensive microsimulation model, and our unique state-level capacities enable us to do pioneering analyses that enrich the debate on racial justice in tax policy that no other entity can do.

This week, a bill out of Arkansas that would cut the top personal income tax rate and the corporate income tax rate found its way to the governor’s desk...

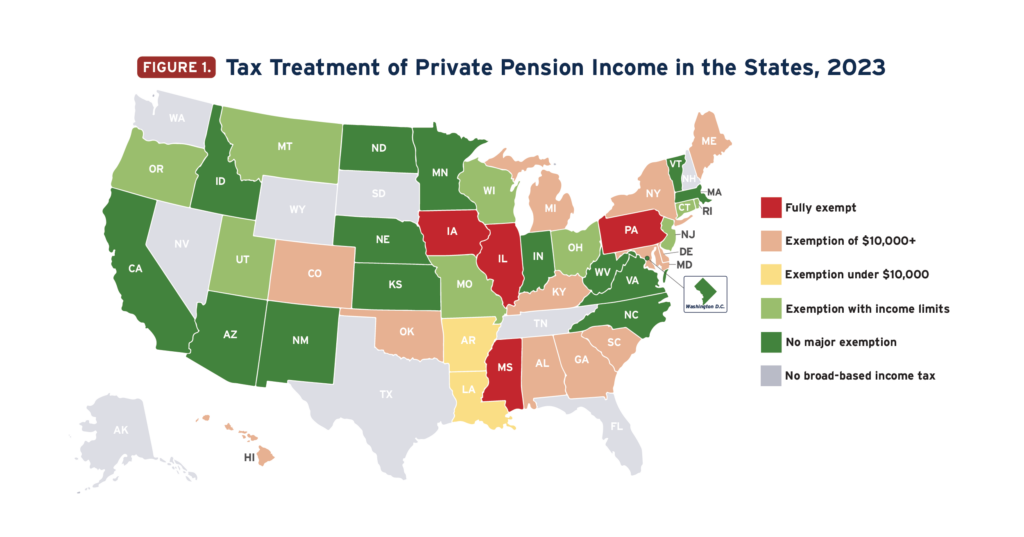

States Prioritize Old Over Young in Push for Larger Senior Tax Subsidies

March 23, 2023 • By Carl Davis, Eli Byerly-Duke

Under a well-designed income tax based on ability to pay, it is simply not necessary to offer special tax subsidies to older adults but not younger families. At the end of the day, your income tax bill should depend on what you can afford to pay, not the year you were born. It’s really as simple as that.

Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities

March 22, 2023 • By ITEP Staff

Contact: Jon Whiten – [email protected] Costly and Poorly Targeted Senior Tax Subsidies Widen Economic, Racial, and Generational Inequalities State lawmakers should focus on improving overall tax fairness, not creating special carveouts based on age Lawmakers in several states are currently considering tax subsidies for senior citizens, even though these breaks are costly and poorly targeted. […]

It’s March and state lawmakers are showing why the Madness isn’t only reserved for the basketball court...

State Rundown 3/9: The Whirlwind 2023 Legislative Session Continues

March 9, 2023 • By ITEP Staff

State 2023 legislative sessions are proving to be eventful ones. With many states eager to make use of their budget surpluses, major tax changes are still being proposed and others signed into law. Michigan residents will soon see an increase to their state Earned Income Tax Credit (from 6 percent to 30 percent) after the […]