North Carolina

The great women’s philosopher, Pat Benatar, once said “love is a battlefield,” and there’s no greater test of our love for state tax policy than following the ups and downs of state legislative sessions...

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

North Carolina Budget & Tax Center: Missing the Mark for North Carolina

September 28, 2022

Inflation isn’t just a pocketbook problem, it’s a budget problem as well. Governments feel the pinch of gas prices climbing higher, food becoming more expensive, and increased competition from private sector employers as well as most of the impacts of inflation that affect consumers and businesses. Unfortunately, the 2022-23 budget allows inflation to undermine the […]

Do you remember/the big tax news innn September? Well, if not, we at ITEP got you covered...

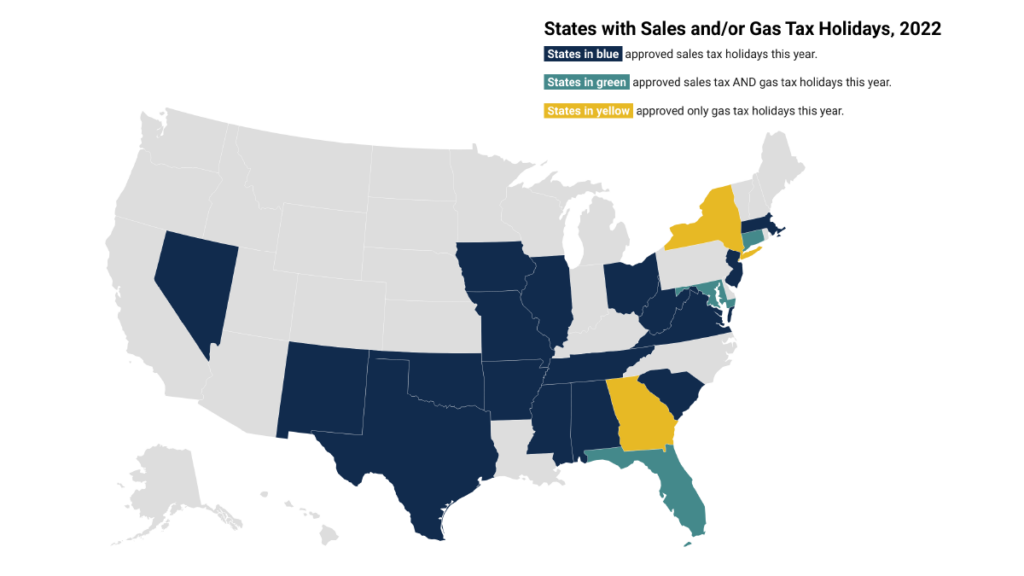

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

From the Bay State to the Golden State, lawmakers across the nation are making deals and negotiating budgets with major tax implications...

With many state legislative sessions wrapped or wrapping up, we at ITEP want to take a moment to direct your attention south, and specifically, to the American South...

Creating Racially and Economically Equitable Tax Policy in the South

June 21, 2022 • By Kamolika Das

The South's negative outcomes on measures of wellbeing are the result of a century and a half of policy choices. Lawmakers have many options available to make concrete improvements to tax policy that would raise more revenue, do so equitably, and generate resources that could improve schools, healthcare, social services, infrastructure, and other public resources.

State Rundown 2/16: Spending Priorities Emerge as the Votes Are Counted

February 16, 2022 • By ITEP Staff

State lawmakers have been busy working out deals and negotiating how best to use excess revenues, and as the votes are beginning to come in, spending priorities are becoming clearer...

State Rundown 1/13: The Tax Cuts Cometh, But There Is a Better Way

January 13, 2022 • By ITEP Staff

As expected, with the start of many new legislative sessions around the country, lawmakers have introduced a slew of tax cut plans following better-than-expected budget outlooks that have, so far, weathered the impact of the pandemic...

The New Trend: Short-Sighted Tax Cuts for the Rich Will Not Grow State Economies

January 10, 2022 • By Neva Butkus

The same legislators who touted tax cuts for the rich as solution to our problems before the pandemic are also saying tax cuts for the rich are a solution during the pandemic. Tax cuts cannot be a solution to everything, especially at a time when the richest Americans are amassing more wealth than ever.

Rather than resorting to tax cuts, which can eventually create revenue shortfalls, lawmakers should determine whether they have adequately invested in people and communities. There are better ways to leverage tax systems to help those who need it most.

Bloomberg: SALT Debate Forces Rich Americans to Confront Widening Tax Gap

December 10, 2021

Lawmakers in Arizona, Arkansas, Idaho, Iowa, Louisiana, Missouri, Montana, North Carolina, Ohio and Oklahoma have also approved cuts to their top personal income tax going into effect either this year or in future years. “There are states moving in different directions,” said Carl Davis, research director at the left-leaning Institute on Taxation and Economic Policy. […]

State Rundown 11/10: It’s Beginning to Look a Lot Like…Election Season?!

November 10, 2021 • By ITEP Staff

If the leaves are turning colors and you find yourself walking out of the office into pitch-black darkness, it only means that time of the year is upon us—and no, I'm not talking about the holiday season. Before that, it’s the equally important election season...

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes

October 4, 2021 • By Carl Davis, Jessica Schieder, Marco Guzman

10 state personal income tax reforms that offer the most promising routes toward narrowing racial income and wealth gaps through the tax code.

Summer is quickly (and sadly) coming to an end and if you’ve been away enjoying the great outdoors or off the grid, we’re here to help keep you up to date on what’s been happening on the tax front around the country...

North Carolina Policy Watch: NC House Tax Plan Isn’t Good for Our State (And These Graphs Explain Why This Is the Case)

August 10, 2021

The House tax plan would deliver the greatest share of the net tax cut to the richest North Carolinians. Fifty-six percent of the net tax cut would go to the richest 20 percent in North Carolina. During the House Finance debate, proponents of the tax plan suggested that North Carolinians with poverty-level incomes would see […]

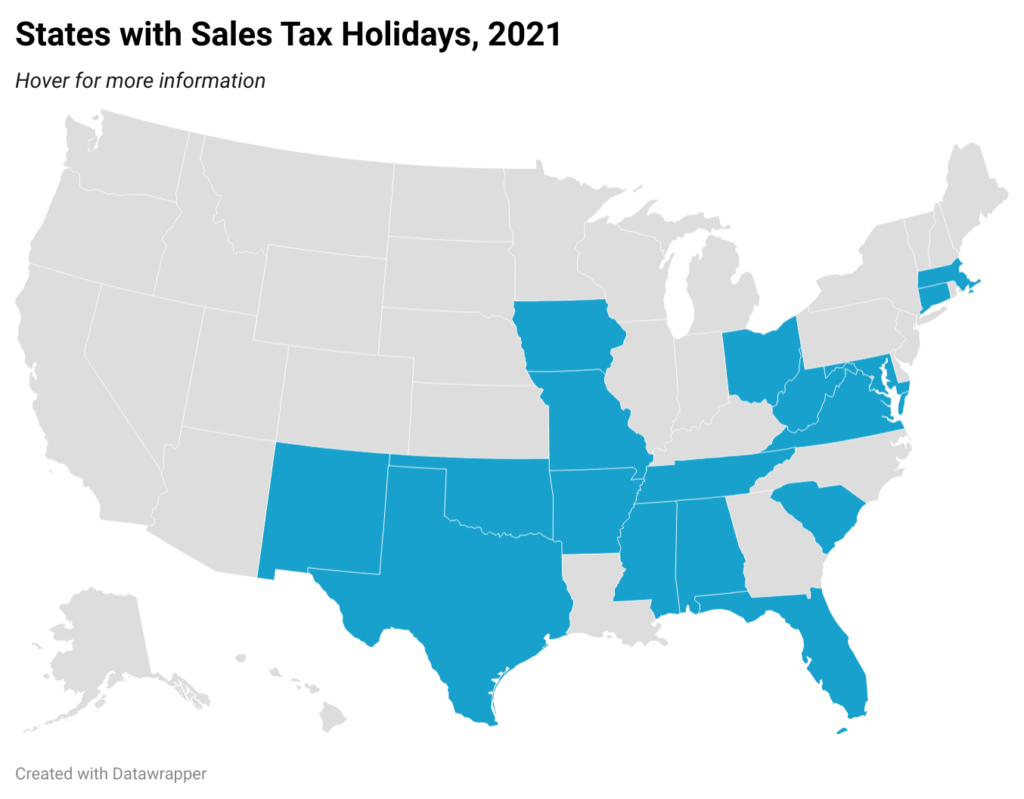

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

State Rundown 8/4: Tis the Season…for Unnecessary Sales Tax Holidays

August 4, 2021 • By ITEP Staff

It’s beginning to look a lot like that time of year again. That’s right, it’s sales tax holiday season and states across the country are doing their best to induce spending that would probably occur regardless...

North Carolina Policy Watch: NC’s Tax Code Reinforces Racial Exclusion; Senate’s Proposed Budget Would Make Matters Worse

July 30, 2021

When one applies a unique tool developed by the Institute on Taxation and Economic Policy to assess the racial and ethnic impact of the budget proposal approved by the state Senate in June (SB 105), it becomes clear that the proposed income tax reductions will worsen the state’s exclusionary tax code. This analysis should serve […]

State Rundown 7/21: States Go for Tax Policy Gold This Olympics Season

July 21, 2021 • By ITEP Staff

It’s Olympics season! As countries around the globe battle for first place in a plethora of sports and contests it’s as good a time as any to look around America to see which states deserve a gold medal in the ‘Equitable Tax Policy’ event...

State Rundown 7/7: The New Fiscal Year Starts off With a Bang, And Not Just Fireworks

July 7, 2021 • By ITEP Staff

States were busy over the past week despite the Fourth of July holiday. Many are gearing up for upcoming tax and budget clashes that could shape their futures for some time...

In Drive to Cut Taxes, States Blow an Opportunity to Invest in Underfunded Services

July 7, 2021 • By Marco Guzman

Many states find themselves in a peculiar fiscal situation right now: federal pandemic relief money has been dispersed to states and revenue projections have exceeded expectations set during the pandemic. Meanwhile, more and more workers are returning to jobs as vaccines roll out and typical economic activity resumes. Some states, however, have decided to squander their unexpected fiscal strength on tax cuts.

State Rundown 6/30: Resolutions Are in Order for the New Fiscal Year

June 30, 2021 • By ITEP Staff

Today is the last day of the fiscal year in many states, and some lawmakers might want to take the opportunity to make some new fiscal year resolutions. Legislators in Arizona, New Hampshire, Ohio, North Carolina, and Wisconsin, for example, should really cut back on the trickle-down tax-cut Kool-Aid, which may make parties with rich donors more fun but tends to be both harmful and habit-forming...

State Rundown 6/24: Late June State Fiscal Debates Unusually Active

June 24, 2021 • By ITEP Staff

Delayed legislative sessions and protracted federal aid debates have made for a busier June than normal for state fiscal debates. Arizona, New Hampshire, and North Carolina legislators, for example, are still pushing for expensive and regressive tax cuts in their states while they remain in session...