North Dakota

State Tax Watch 2026

February 2, 2026 • By ITEP Staff

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

State Rundown 1/14: New Year Brings New Resolutions for Funding Key Priorities

January 14, 2026 • By ITEP Staff

State governors are beginning to lay out their top priorities as legislatures reconvene in statehouses around the country.

Linking to Tipped and Overtime Income Deductions Would Worsen State Shortfalls, Do Little to Help Workers

December 8, 2025 • By Neva Butkus, Galen Hendricks

State deductions for tips and overtime are not only ineffective at supporting working-class people, it will come at a substantial cost to state budgets.

The Wealth Proceeds Tax: A Simple Way for States to Tax the Wealthy

October 30, 2025 • By Sarah Austin, Carl Davis

Taxing the proceeds generated by wealth through a new Wealth Proceeds Tax is a simple way for states to raise billions in new revenue and improve the fairness of their tax systems.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

States Should Move Quickly to Chart Their Own Course on SALT Deductions

July 17, 2025 • By Dylan Grundman O'Neill, Nick Johnson

While a federal SALT cap is hotly debated, capping deductibility at $10,000 was an unambiguously good idea at the state level. States would be smart to stick with the current cap or, better yet, go even farther and repeal SALT deductions outright. Going along with a higher federal SALT cap would double down on a regressive tax cut that will mostly benefit a small number of relatively wealthy state residents and cost states significant revenue.

How Much Would Every Family in Every State Get if the Megabill’s Tax Cuts Given to the Rich Had Instead Been Evenly Divided?

July 14, 2025 • By Michael Ettlinger

If instead of giving $117 billion to the richest 1 percent, that money had been evenly divided among all Americans, we'd each get $343 - or nearly $1,400 for a family of four.

Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates

July 7, 2025 • By Steve Wamhoff, Carl Davis, Joe Hughes, Jessica Vela

President Trump has signed into law the tax and spending “megabill” that largely favors the richest taxpayers and provides working-class Americans with relatively small tax cuts that will in many cases be more than offset by Trump's tariffs.

As federal aid ends and economic uncertainty grows, local governments face tough budget choices. Now is the time for localities to protect vulnerable residents and build stronger, more equitable fiscal foundations.

Trump Megabill Will Give $117 Billion in Tax Cuts to the Top 1% in 2026. How Much In Your State?

June 30, 2025 • By Michael Ettlinger

The predominant feature of the tax and spending bill working its way through Congress is a massive tax cut for the richest 1 percent — a $114 billion benefit to the wealthiest people in the country in 2026 alone.

How Much Do the Top 1% in Each State Get from the Trump Megabill?

June 30, 2025 • By Carl Davis

The Senate tax bill under debate right now would bring very large tax cuts to very high-income people. In total, the richest 1 percent would receive $114 billion in tax cuts next year alone. That would amount to nearly $61,000 for each of these affluent households.

Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

May 22, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

The poorest fifth of Americans would receive 1 percent of the House reconciliation bill's net tax cuts in 2026 while the richest fifth of Americans would receive two-thirds of the tax cuts. The richest 5 percent alone would receive a little less than half of the net tax cuts that year.

State Rundown 5/7: As Budget Season Heats Up, Tax Proposals Are Getting Serious

May 7, 2025 • By ITEP Staff

With spring in full bloom ,many state lawmakers are reaching tax policy agreements. Out west, lawmakers in North Dakota and Texas have moved major property tax cuts. Meanwhile, in the east and south, Vermont appears likely to pass an expansion to its Child Tax Credit and Earned Income Tax Credit, and South Carolina lawmakers are aiming to make deep, drastic cuts to the state’s income tax.

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

State Rundown 5/1: State Tax Debates Wrapping Up, and Just Beginning

May 1, 2025 • By ITEP Staff

The rampant uncertainty this year extends far beyond the national economy and federal policy, as many state legislatures are declaring their tax and budget debates finished, and just getting started, sometimes in the same breath.

State Rundown 4/24: States Push Tax Cuts Despite Fiscal Uncertainty

April 24, 2025 • By ITEP Staff

While some states are preparing for uncertainty – slowing revenue growth, chaos from unpredictable tariffs, cuts to federal programs, etc. – others continue to move forward with plans for deep tax cuts. For instance, Georgia Gov. Brian Kemp signed legislation accelerating the cut to the personal income tax rate, which is currently phasing down. […]

IRS Cooperation with ICE Will Damage Public Trust, Putting Tax Revenues in Jeopardy

April 10, 2025 • By Marco Guzman

Attempts by the Department of Homeland Security to secure private information from the IRS on people who file taxes with an Individual Taxpayer Identification Number is a violation of federal privacy laws that protect taxpayers. It is also a change that could seriously damage public trust in the IRS, which could jeopardize billions of dollars in tax payments by hardworking immigrant families.

State Rundown 3/26: Lawmakers Navigate Shortfalls, Potholes, and Pitfalls

March 26, 2025 • By ITEP Staff

State lawmakers around the country are navigating a range of potential hazards this week. Leaders in Maryland and Washington are facing budget holes but are smartly working to get out of them through progressive taxes on those with the most ability to pay. Both North Dakota and Washington state are looking to fill literal potholes […]

March Madness kicks off today and the pressure is on as many states’ legislative sessions are nearing the final buzzer. Some state lawmakers are seemingly competing for the title of most regressive state tax policies while others are looking to lift up best practices for more equitable outcomes. The Mississippi legislature landed on a […]

Circuit Breakers Are a Better Option for Property Tax Relief

March 13, 2025 • By Brakeyshia Samms

To curb the impact of property taxes on working families, lawmakers should improve or implement a property tax circuit breaker program. The program works like this: when families are overloaded with their property taxes, the circuit breaker kicks in and helps alleviate the pressure these taxes put on family budgets.

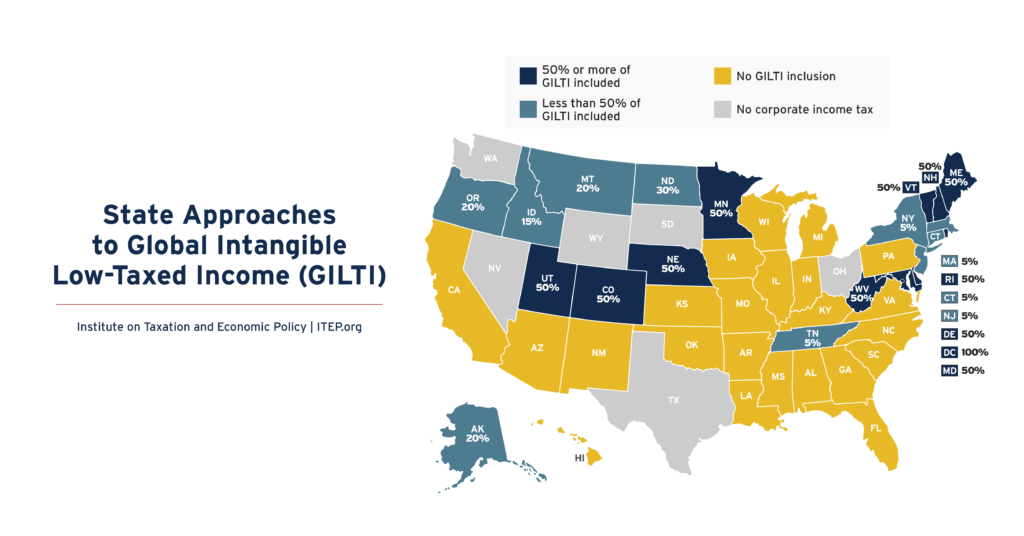

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.

State Rundown 3/6: In the Shadow of Chaotic Federal Policymaking States Seek to Tax the Top, Cut Taxes

March 6, 2025 • By ITEP Staff

Proposals from governors in both New Jersey and Wisconsin include provisions to tax high-income earners. Meanwhile, several major tax proposals are advancing in the great plains, with Iowa considering a major cut to unemployment taxes, North Dakota advancing new benefits for private schools, and Wyoming cutting property taxes. The District of Columbia is facing a more than a $1 billion revenue shortfall over the next three years, compared to previous estimates, and a mild recession due in large part to the layoffs of federal workers.

Below is a list of tax expenditure reports published in the states.

Learn from Prop 13 History to Avoid Repeating Past Mistakes

February 26, 2025 • By Rita Jefferson

Worries about housing costs and property tax bills are leading people to check the history books for solutions, but there’s a danger that they’ll repeat past mistakes. If anti-tax lawmakers carelessly weaken property taxes as they did in the 1970s, as they did with California’s Proposition 13, they will undercut public finances, making municipalities, school districts, and other special districts worse off.

In the face of immense uncertainty around looming federal tax and budget decisions, many of which could threaten state budgets, state lawmakers have an opportunity to show up for their constituents by raising and protecting the revenue needed to fund shared priorities. Lawmakers have a choice: advance tax policies that improve equity and help communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for most families to get ahead.