Who Pays?

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

March 6, 2019 • By ITEP Staff

There is significant room for improvement in state and local tax codes. State tax codes are filled with top-heavy exemptions and deductions and often fail to tax higher incomes at higher rates. States and localities have come to rely too heavily on regressive sales taxes that fail to reflect the modern economy. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. These types of shortcomings provide compelling reason to pursue state and local tax reforms to make these systems more equitable, adequate, and sustainable.

New and returning policymakers have a tremendous opportunity to improve their constituents’ lives and their states’ economies through tax policy. This report distills the findings of “Who Pays?” into policy recommendations that can serve as a guide to new lawmakers, advocates, and others seeking to improve their state’s tax codes. It explains the importance of favoring taxes on income and wealth over taxes on consumption, the value of certain targeted tax benefits for families living in poverty, the need to abandon ineffective, unnecessary tax subsidies for high-income households, and the promise of bold new options for improving the regressive distributional…

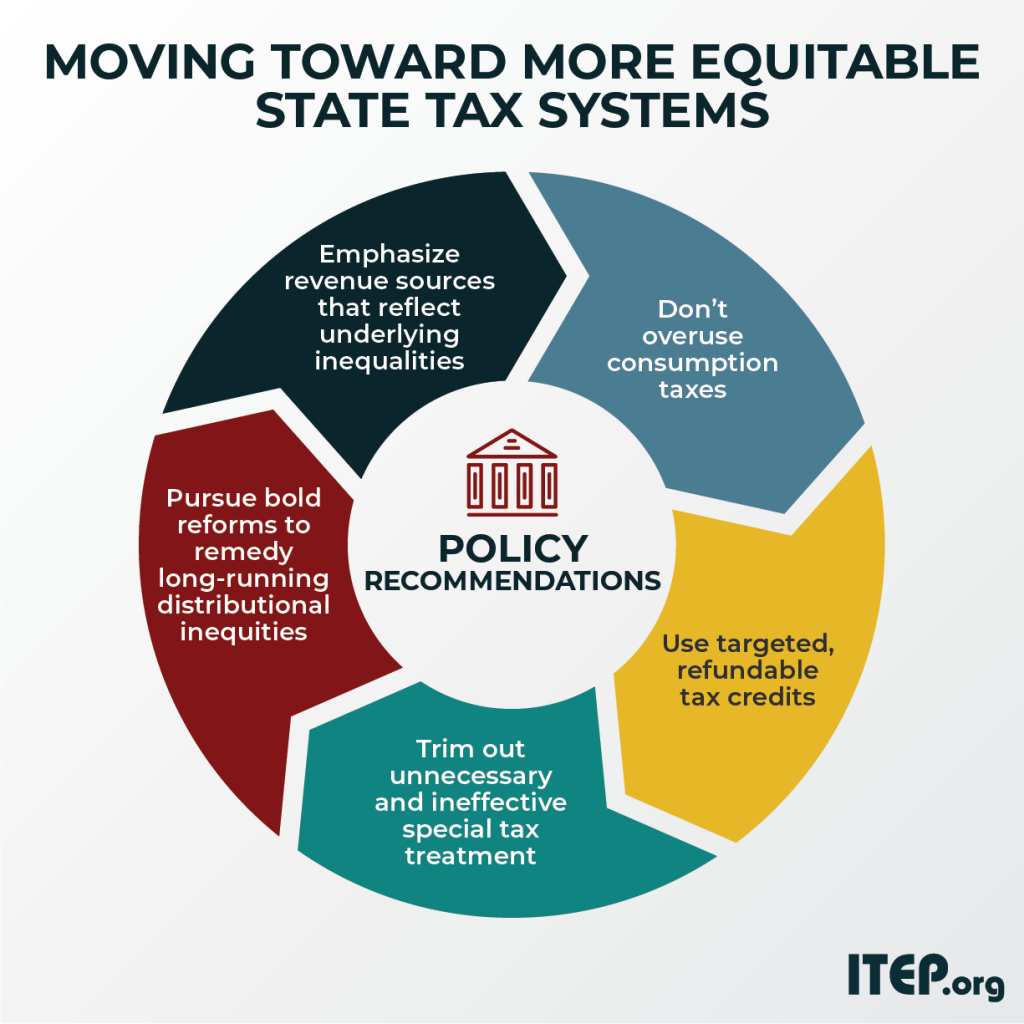

For those looking to start improving on these inequitable tax systems today, we now also offer a helpful companion to “Who Pays?” called "Moving Toward More Equitable State Tax Systems." This new report distills the findings of “Who Pays?” into a set of policy recommendations – from the foundational to the aspirational – that residents of every state can draw from and start work on now.

Idaho Press: Economic Study Finds That Poor Idahoans Pay More State and Local Taxes Than Rich Ones

November 3, 2018

The biggest drivers of the inequality in Idaho are the sales and property taxes. In every bracket of income measured by the Institute’s report, the amount that families paid in state and excise taxes went down as their total income increased. The lowest-earning 20 percent spent twice as much of their annual income on property taxes as the highest 20 percent, with an average of 3.3 percent paid on their property compared to 1.6 percent.

The New Orleans Advocate: James Gill: Louisiana’s Tax System Isn’t the Most Unfair in the Nation, But It’s not for Lack of Trying

November 3, 2018

According to a study just released by the Institute on Taxation and Economic Policy in Washington, Washington State sets the regressive standard, while we rank 14th. If your income is $17,100 or less in Louisiana, you'll pay 11.9 percent of it in taxes. That number shrinks the further you go up on the income scale and is roughly halved by the time you reach fat-cat territory. Sales and excise taxes take 9.2 percent from the poorest, and 1.2 percent from the richest.

Cherokee Tribune & Ledger-News: Financial Watchdog: Pritzker’s Spending Promises Would Raise Taxes on Middle Class

November 1, 2018

The Institute on Taxation and Economic Policy says Illinois has one of the most regressive taxes in the nation, largely due to its flat income tax. In its annual “Who pays?” report, the institute said the poorest 20 percent of Illinois households pay 14 percent of their income in taxes because of the flat tax in addition to high sales and property taxes.

NJ Spotlight: GOP Leaders Call on NJ Democrats to Reconsider Middle-class Tax Cuts

October 29, 2018

The related tax-cut bills — and another that would shield most retirement-savings contributions from state income taxes — were introduced at the start of the year but have not been posted for votes by the Democratic leaders who control the Assembly’s agenda. Bucco suggested a report released earlier this month by the left-leaning Institute on Taxation and Economic Policy that found middle-income taxpayers in New Jersey pay a higher effective tax rate than any other group — including the top 1 percent of earners — as a reason to begin prioritizing adoption of the GOP bills.

Massachusetts Budget and Policy Center: Who Pays? Low and Middle Earners in Massachusetts Pay Larger Share of their Incomes in Taxes

October 25, 2018

Taxes are the main way communities pay for the things we do together. Taxes pay for essential programs and infrastructure we take for granted, like fire protection, public education, and health inspectors; roads, bridges, and public transit; and the support for people facing hard times. Examining how much people at different income levels pay in taxes is important when considering the fairness of tax policy.

News and Tribune: In Indiana and Illinois, Taxes Hit Low-earners Hard

October 25, 2018

TERRE HAUTE -- Low-earning residents of Indiana and Illinois pay a greater share of state and local taxes than those in all other Midwestern states, and those in most states nationally, according to a new study by a non-partisan think tank.

The Garden Island: Gap Keeps Growing Between Rich, Poor

October 25, 2018

The study finds that those in the bottom fifth of the income spectrum in Hawaii pay 15 percent of their income in state and local taxes, while those in the top 1 percent pay only 8.9 percent, “which exacerbates inequality in our state,” according to a press release about the study.

Real Change: Study: Washington Bottoms Out on US Tax Assessment

October 24, 2018

Guess what? Washington state’s taxation system continues to be one of the most regressive in the country. This news comes from the Institute on Taxation and Economic Policy (ITEP), which did a deep dive into the taxation policies of all 50 states.

The Journal Record: Prosperity Policy: An Upside-down Tax System

October 24, 2018

A modestly progressive income tax slightly offsets our regressive sales taxes. But Oklahoma lawmakers cut our top income tax rate by nearly 25 percent since 2004, further tipping the scales to the wealthiest households. Then while grappling with massive budget shortfalls caused in part by these tax cuts, lawmakers took aim at measures that primarily benefit low- and middle-income working families by making the state Earned Income Tax Credit non-refundable and freezing the state standard deduction, while leaving cuts to the top income tax rate in place.

Hawaii Public Radio: Hawaii Tax System Places Larger Burden on Low Income Residents

October 24, 2018

Low-income residents in Hawaii are paying a higher share of their income in taxes than higher level earners. That is the conclusion of a recent report from the Institute on Taxation and Economic Policy titled Who Pays? The Hawaii tax system is considered highly regressive, due to heavy reliance on the General Excise Tax, or GET. This is despite a progressive, graded state income tax and the lowest property taxes in the nation.

Third and State: Pennsylvania’s Terrible Tax Code Asks More of You as You Make Less: Hitting Community’s of Color Especially Hard

October 23, 2018

The Commonwealth once again claims its spot in the “Terrible 10” most unfair tax structures in the nation. The lowest 20% of income earners in the state pays more than double (2.3 times) their share of family income on state and local taxes than the top 1%.

Hawai’i Budget & Policy Center: Hawaii’s Tax System Exacerbates Inequality

October 23, 2018

A new report out from the Institute on Taxation and Economic Policy (ITEP) provides the vital statistics for each state’s tax system. It lays out, in clear and compelling numbers, the sobering message that Hawaiʻi taxes—and those in the United States on average—increase inequality between rich and poor.

Florida Policy Institute: Amendment 5 Would Lock in the Regressive Policies and Abysmal Funding Levels that Perpetuate Inequality

October 23, 2018

Florida’s unfair tax system, which forces low-income residents to contribute the most as a share of their household incomes, along with the state’s worst-in-the-nation per-person investment in public services, would be locked in under Amendment 5.

Enid News & Eagle: A Low Tax State for Only Some Oklahomans

October 23, 2018

While Oklahoma has a reputation as a low tax state, poor and middle-income Oklahomans are actually paying a greater share of their income in taxes than the national average, while the richest 5 percent of households — with annual incomes of $194,500 or more — pay less.

Washington Examiner: Think tank: Texas Isn’t a Low-tax State if You’re Poor

October 23, 2018

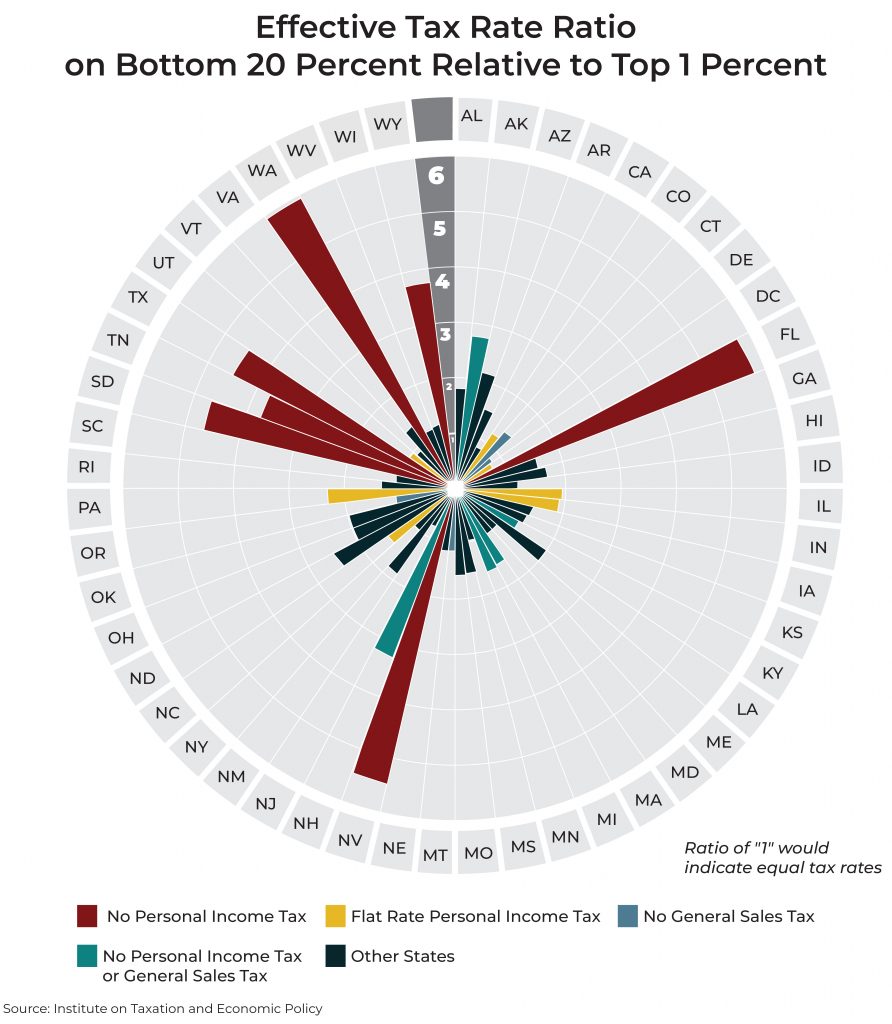

Carl Davis for the Institute on Taxation and Economic Policy: [ M]any states traditionally considered to be “low-tax states” are actually high-tax for their poorest residents. The “low tax” label is typically assigned to states that either lack a personal income tax or that collect a comparatively low amount of tax revenue overall. But a focus on these measures can cause lawmakers to overlook the fact that state tax systems impact different taxpayers in very different ways, and that low-income taxpayers in particular often do not experience these states as being even remotely “low tax.”

Beacon Journal/Ohio.Com Editorial Board: A Taxing Matter Goes Missing in the Governor’s Race

October 22, 2018

It follows that low- and middle-income Ohioans pay a higher share than the national average, and wealthy Ohioans pay a lower share. To a degree, that is expected in view of the vastly larger incomes of wealthy Ohioans. At the same time, the state would be well served by altering the shares to make the state and local system more fair, to reflect how new income in recent years, even decades, has flowed largely to households at the highest income rungs.

NorthJersey.com: 2018 Elections: Candidates Taking Wait-and-See Approach to SALT Deductions

October 22, 2018

A study by the Institute on Taxation and Economic Policy, a non-partisan think tank, found that a majority of New Jersey taxpayers in every income group will pay less taxes next year than they did in 2017 as a result of last year’s federal tax-code overhaul. The cap is expected to affect those in high-income brackets the most. Thousands of New Jersey homeowners rushed to prepay their 2018 taxes in December to take advantage of bigger deductions on their 2017 returns before the cap took effect.

NC Policy Watch: North Carolina’s Tax Code Isn’t Helping the State’s Growing Inequality

October 22, 2018

Despite claims by the architects of North Carolina’s failed tax-cut experiment, policy choices since 2013 have not ensured that middle and low-income taxpayers are paying lower shares of their income in state and local taxes. Instead the richest taxpayers—whose average income is more than $1 million—continue to pay 33 percent less in state and local taxes as a share of their income than taxpayers who have averages incomes annually of $11,000, a threshold that aligns with deep poverty.

Idaho Statesman: Poor Idahoans Pay Largest Share of Taxes, Study Finds

October 22, 2018

Low-income Idahoans were hit hardest by property and sales taxes, ITEP reported. The lowest-earning segment spent 3.3 percent of income on property tax and 6 percent of income on sales and excise taxes (the latter are sometimes known as “sin taxes”).

Tulsa World: Political Notebook: Report Says Oklahoma’s State and Local Taxes Among the Most Regressive in the Nation

October 21, 2018

Oklahoma’s state and local taxes are among the most regressive in the country, according to a report released last week by the Institute on Taxation and Policy.

KTVB: Idaho Tax Analysis

October 20, 2018

Study finds lower income Idahoans paying higher tax rates than those with higher incomes.

CPPP: The Staggering Unfairness of Our State Tax System

October 19, 2018

Here’s one way to think about it: Families at the top of the income ladder receive 20 percent of all personal income in Texas, but pay only 8.5 percent of all state and local taxes. Families at the bottom of the scale receive only three percent of all income, but pay 5.7 percent of all taxes.